💨 Wind Energy + Southeast Asia Climate Tech 50

The Wind Energy sector has seen impressive growth over the last few years, having added 69GW of installed capacity in 2023. However, high interest rates, inflation, and supply chain disruptions dampened performance in 2023.

Happy Monday 👋

The Wind Energy sector has seen impressive growth over the last few years, having added 69GW of installed capacity in 2023 despite tough economic conditions. This week, we also focus on the 2023 Southeast Asia Climate Tech 50, which spotlights the region's most promising startups in the climate technology sector.

This Week's Topics

- 💨 Wind Energy. Mapping 100+ global players across core categories

- 📊 Charts Spotlight. Installed wind power capacity has exceeded 900GW

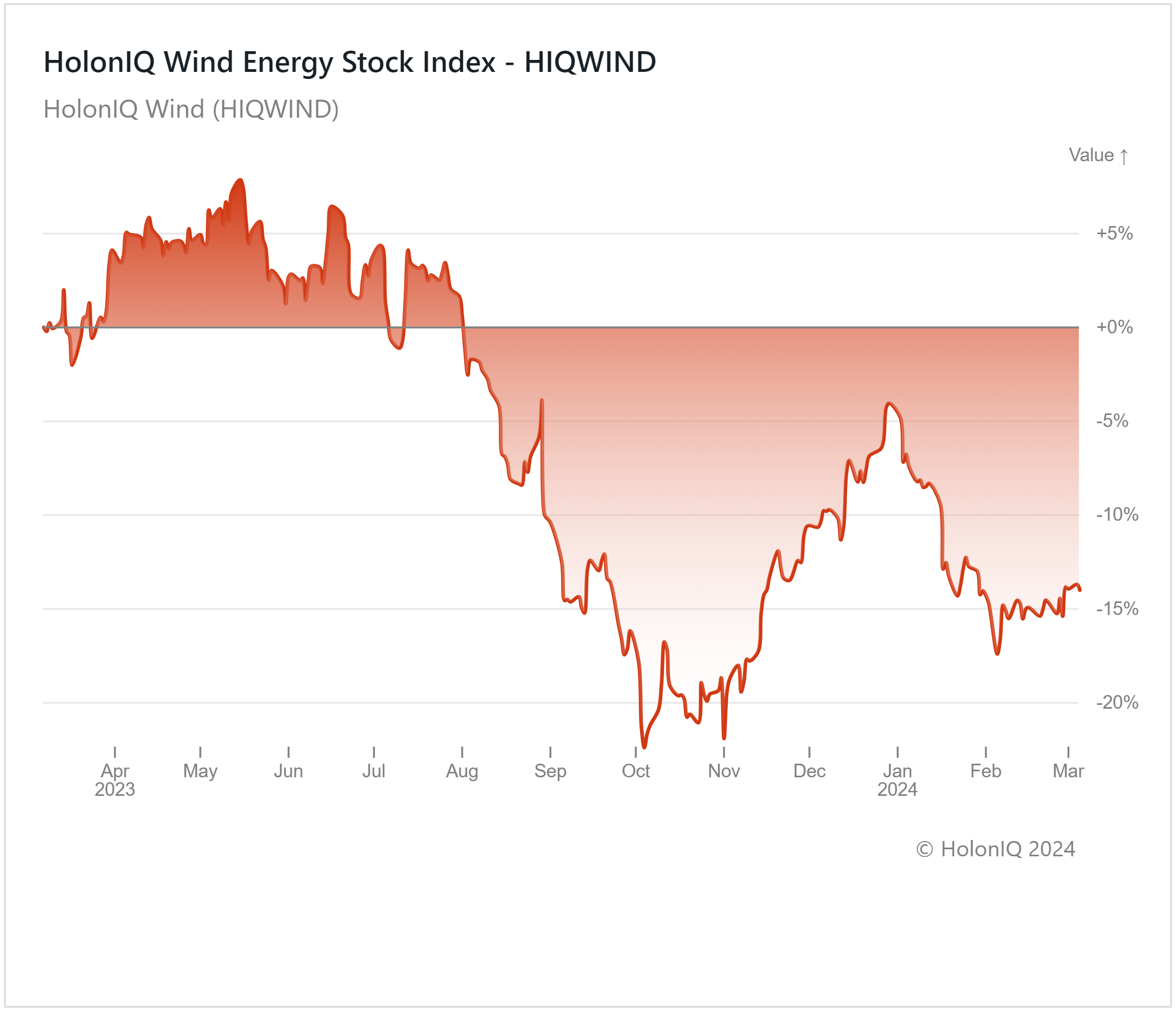

- 📈 Wind Energy Stock Index. High inflation and interest rates push the Wind Energy index down

- 🏆 Southeast Asia Climate Tech 50. Southeast Asia's most promising startups working in clean energy, zero-emission mobility, and sustainability

- 📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

- 💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

💨 Wind Energy Landscape

Once used to mill grain, generating energy using the power of wind has come a long way. Over the last five years, the world has seen an accelerated transition in the deployment of wind power as an energy generation source. Global cumulative installed wind power capacity has increased 220% since 2012, reaching approximately 975 GW in 2023. 2022 was the best year for wind energy installations, as the world collectively added new capacity worth 78 GW. While the sector saw strong performance in the first half of 2023, the combination of high-interest rates, inflation, and supply chain disruptions pushed up financing costs for project developers, which led to many projects being paused or canceled. Large developers like Ørsted and Eversource recorded millions lost in impairments. This resulted in the year ending with an installed capacity of 69GW, 10GW less than in 2022.

Setting up a wind farm is considerably more expensive than setting up a solar farm and is more susceptible to economic conditions. However, as global economies begin to recover, the outlook for the wind industry looks favorable. Most of the major economies are exploring new on-shore and off-shore sites for installations as part of their energy mix. China will continue to play a leading role in the deployment of wind power, as it was one of the few growth markets for wind in 2023 as a major component manufacturer for the wind sector. The US, UK, Germany, and other European countries are actively addressing regulatory red tape to make the approval process faster and are investing in grid upgrades to accommodate additional wind energy sources.

💨 Wind Energy - Market Map

📊 Charts Spotlight - Installed Wind Power Capacity Has Exceeded 900GW

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact of the economy, from climate tech to education and healthcare.

The cumulative installed wind power capacity is inching closer to reaching 1TW. By 2022, the world had installed 906GW of wind power, and 2023 saw approximately 69GW being installed of which China accounted for 84%. China added about 58GW of installed capacity to its energy mix, bringing its total installed wind capacity to almost 400GW. Contrastingly, the US, which had also seen high growth in wind additions, saw its slowest year yet, as increased costs led to many projects being halted and new tenders seeing subdued interest. The outlook for the sector is, however, positive. Project developers anticipate improved returns following a decline in interest rates, while advancements in technology, specifically off-shore wind, are driving costs down.

📈 Capital Markets - Wind Energy Index

HolonIQ tracks thousands of listed climate tech companies worldwide along with acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

In the second half of 2023, returns experienced a notable decline, attributed to heightened setup costs linked to wind farms. High-capital expenditure projects in wind and solar energy were impacted by rising interest rates in major economies during this period. The Wind Index witnessed a decrease of 15% in returns over the past 12 months.

In 2023, the leading wind turbine manufacturer, Vestas Wind Systems A/S ($29B MCap), announced that their new prototype V236 turbine achieved a global milestone by generating the highest power output within 24 hours. This marked the culmination of several years of efforts by the Danish company to create the world's largest wind turbine. However, towards the end of 2023, notable negative developments were noted, coinciding with a decline of more than 20% observed in the index. Ørsted ($24B MCap), the global leader in offshore wind power, canceled two offshore wind energy projects off the New Jersey coast due to increasing interest rates and inflation, coupled with concerns about potential impacts on marine life and tourism.

Nevertheless, the positive outlook for the broader renewable energy sector bodes well for wind energy companies. The industry's trajectory is being shaped by technological progress, including modular wind systems, AI-driven predictive maintenance, the deployment of floating wind turbines, and the expansion of offshore wind energy.

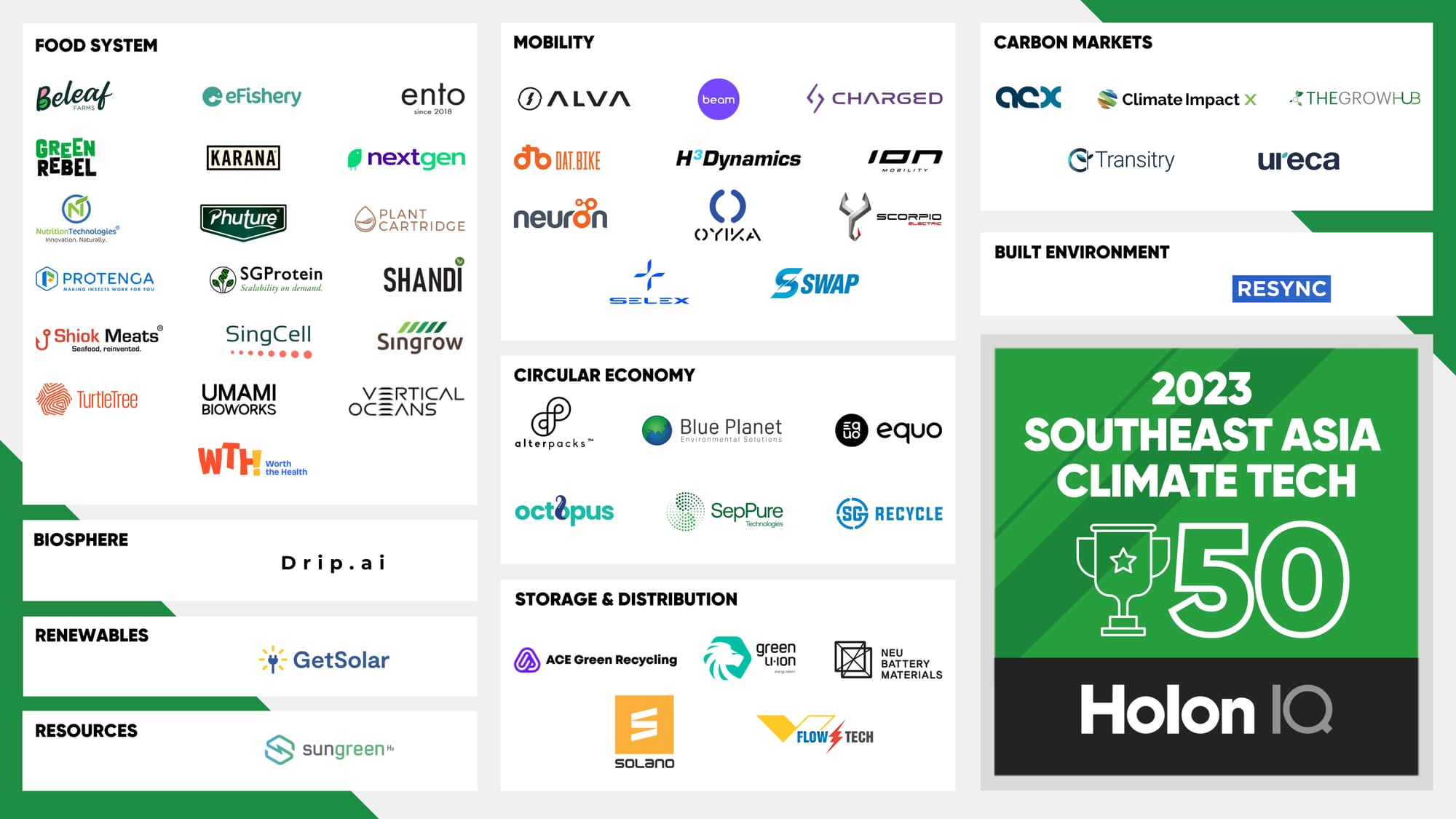

🏆 Southeast Asia Climate Tech 50

The Southeast Asia Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

The Southeast Asian region raised a total of $725M in VC funding in 2023, with Indonesia accounting for 67.4% of this total. Smart Farming emerged as the leading cluster, underscoring the region's growth in this domain. Startups in the Food System sub-sector took the lead in the Southeast Asia Climate Tech 50, followed closely by Mobility. Subsequent sub-sectors included Carbon Markets and Storage & Distribution, with both having an equal number of startups and a significant representation gap. Within Food System and Mobility, Plant-based alternatives for Meat & Seafood and Micro Mobility took the lead, collectively representing over 40% of the list, while regionally, Singapore dominated the overall list.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🚗 iM Motors, a Chinese electric vehicles manufacturer, raised a $1.1B Series B from Bank of China Financial Assets Investment. The funding will be used

to develop new models and expand market channels.

🌿 Sunfire, a German manufacturer of electrolyzers, raised a $233M Series E to scale up its green hydrogen production technology.

🚗 Zelos Technology, a China-based autonomous vehicle company raised a $100M Series A to advance autonomous driving technology.

⚡ HData, an Alabama-based startup specializing in regulatory compliance & business intelligence for the energy sector, raised a $10M Series A from Buoyant Ventures to accelerate the expansion of its platform.

🌱 Cyclize, a German climate-tech startup, raised a $5.25M Seed from UVC Partners to scale its technology.

M&A

⛽ Talos Energy Inc., a US-based oil and gas company, acquired QuarterNorth Energy Inc., a deepwater oil production company, for $1.3B. The acquisition is expected to enhance Talos’ deep-water asset portfolio in the US Gulf of Mexico.

🏭 BlackRock, a US-based asset management company, signed an agreement to acquire Portland Natural Gas Transmission System (PNGTS) for $1.1B.

☀️ 1komma5°, a German solar tech developer, acquired Arkana Energy Group, an Australian solar energy company that offers solar solutions for commercial and residential sectors.

🌬️ AFRY, a Swedish engineering services company, Carelin Oy, agreed to acquire a Finnish company that offers services to the wind power industry.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com