💊 $259M Biopharma Funding. EV Index Up 30%.

Impact Capital Markets #45 looks at our Electric Vehicles stock index, major impact deals, M&A, and upcoming economic releases.

Hola 💃

📉 Today's Global Economic Update: Australia's Balance of Trade data reveals a trade surplus of $7B in January 2024. Exports surged to a 10-month high of $31B, while imports climbed to $24B, driven by non-industrial transport equipment.

💊 Deal of the Day: Alumis, a clinical-stage biopharmaceutical company, raised a $259M Series C to advance its pipeline of immune dysfunction therapies.

What's New?

- 🚗 Electric Vehicles. Electric Vehicles index up 30%

- 💰 Funding. Biopharma, cryptography, asset management and more

- 💼 M&A. Medical technology and energy consultancy

- 📅 Economics. Employment data, UK GDP, US inflation + more

For unlimited access to more deals and economic updates, request a demo

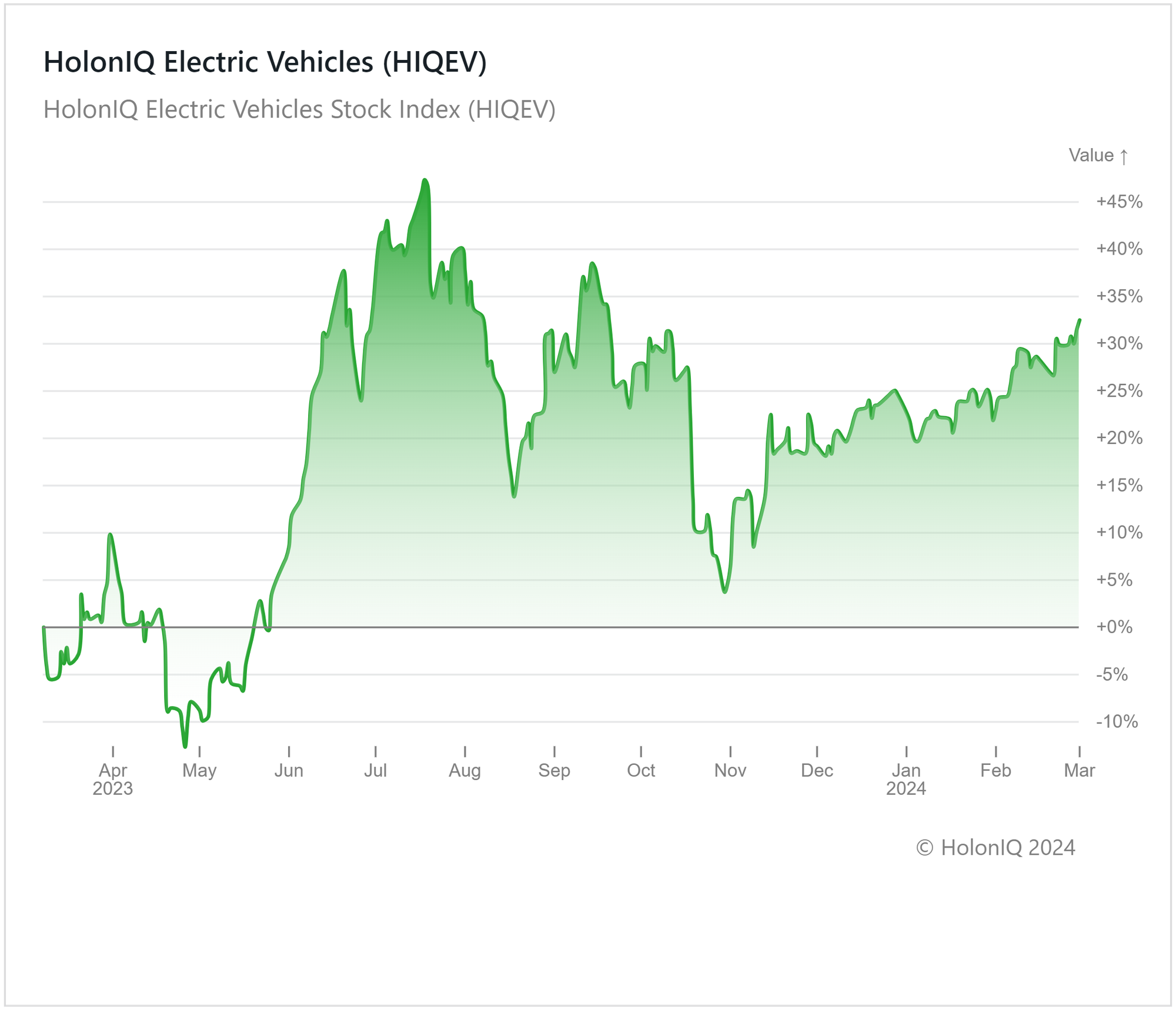

🚗 Electric Vehicles Index Up 30%

HolonIQ's Electric Vehicles Index bounced back from a dip in May, to increase by about 30% compared to a year ago. Major stocks in the index, such as Toyota Motor Corp ($399B MCap) and Stellantis NV ($87B MCap), have experienced significant growth, with increases of 75% and 49% respectively. However, Tesla ($560B MCap) showed a decline, attributed to shrinking profit margins, increased competition, and uncertainties surrounding pricing and demand in the market. The electric vehicle industry overall has seen slow sales stemming from low demand and an oversupply of inventory in China, the largest EV market in the world.

However, the EV market is poised for substantial growth driven by global initiatives to phase out fossil fuels and the growing demand for sustainable transportation solutions. Advancements in battery technologies and the growth in demand for hybrid vehicles are expected to contribute to the overall growth of the market as well.

💰 Funding

💊 Alumis, a California-based clinical-stage biopharmaceutical company, raised a $259M Series C from Foresite Capital to support a pipeline of oral therapies designed to tackle immune dysfunction.

🔬 Rakuten Medical, a California-based biotechnology company, raised a $119M Series E to advance clinical trials and develop new medical devices.

🔐 Zama, a Paris-based cryptography company, raised a $72.9M Series A from Multicoin Capital and Protocol Labs to expand its team and develop a new class of Fully Homomorphic Encryption (FHE) applications.

💼 FitLab, a California-based asset management company, raised $65M from Atlas Credit Partners to acquire a fitness equipment manufacturer.

🌐 T0dyl, a Denver-based security and network company, raised a $50M Series B from Base10 Partners to expand offices worldwide and speed up platform developments.

🛡️ Defense Unicorns, a Colorado-based defense tech company, raised a $35M Series A from Sapphire Ventures and Ansa Capital to expand its operations.

🏗️ Maybell Quantum, a Denver-based quantum infrastructure company, raised a $25M Series A from an affiliate of Cerberus Capital Management to scale up manufacturing and open a new production facility in 2024.

🧠 BrainCheck, a Texas-based digital health provider, raised $15M from Next Coast Ventures to scale operations.

🧬 Wobble Genomics, an Edinburgh-based genomics company, raised a $10.8M Seed from Mercia Ventures and BGF for tech developments.

🏥 Fijoya, an Israeli platform for employer-sponsored health and wellness services, raised a $8.3M Seed from the venture-creation fund of Team8 to fuel development initiatives.

📊 Sonarverse, a California-based data & analytics provider delivering crypto insights, raised a $7M Seed from BlockTower Capital to speed up product developments and boost usage of the platform.

📱 Cosmology, a California-based toolkit for creating innovative internet apps, raised a $5M Seed from Galileo and Lemniscap to support the growth of interchain and simplify app development.

🚀 Kurs Orbital, an Italian space tech company, raised a $4M Seed from OTB Ventures to complete its first flight model and expand its team.

💼 M&A

🏥 Nightingale Health, a Finnish biotechnology company, signed an agreement to acquire Welltus, a Japanese medical technology company.

🔧 Rejlers, a Swedish engineering consultancy company, signed an agreement to acquire Solvina, a Swedish consultancy company in the electric power space.

📅 Economic Calendar

Employment Data, UK GDP, US Inflation + More

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

🇺🇸 US Unemployment Data, February

Tuesday, March 12th 2024

🇦🇺 Australia NAB Business Confidence, February

🇬🇧 UK Unemployment Data, January

🇺🇸 US Core Inflation Data, February

🇺🇸 US Inflation Data, February

Wednesday, March 13th 2024

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment (Preliminary), March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com