⌚ Wearables + Europe Health Tech 200

Happy Monday 👋

This week we are spotlighting wearables. Don't forget to check out the 2024 Global Health Outlook, and sign up for our new Daily Newsletters - 'Chart of the Day' and 'Impact Capital Markets'.

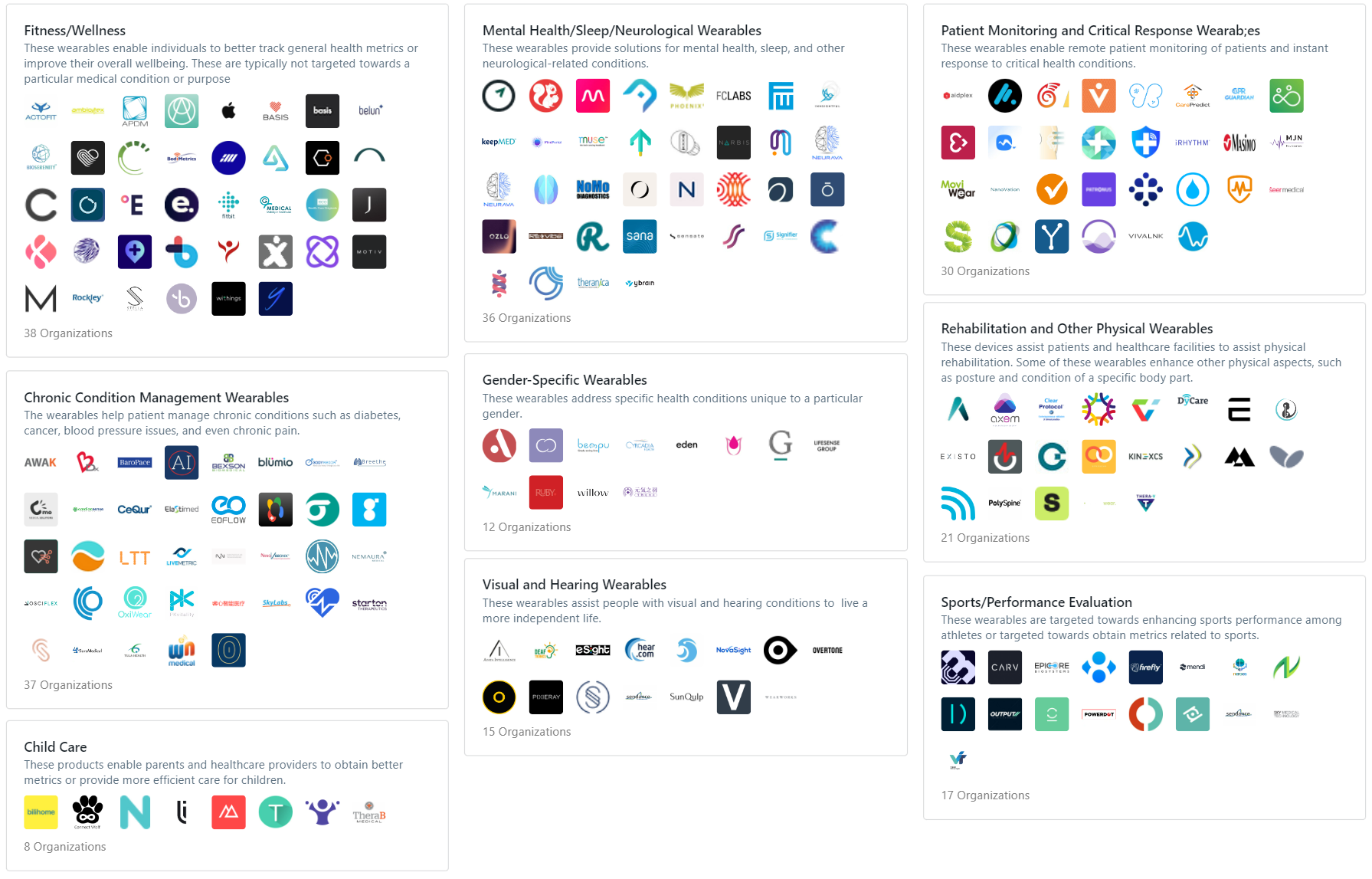

⌚ Wearable Technology Landscape

Wearables have seen a markable increase in interest over the past few years. For instance, Apple Watches have seen a dramatic increase in sales, from just over 8 million units sold in 2015 to nearly 54 million units in 2022. Wearables are changing healthcare by letting people track their health data, from steps and sleep to heart rate and blood sugar. This helps people manage chronic conditions and even get early treatment. Advanced wearables can even deliver medicine or treat conditions like neurological problems. Wearables are making healthcare more convenient, personalized, and preventive. The future of healthcare is on our wrists, fingers, and even in our clothes.

There is a considerable amount of industry activity surrounding wearables over the recent week. Apple's appeal against the ban on Apple Watch Series 9 and Ultra 2 with blood oxygen features was denied. Starting Jan 18th, these models will be sold in the US without the feature, while previous owners and international models retain it. This was a result of a patent violation by Apple on a patent owned by Masimo on the blood oxygen feature.

HolonIQ is tracking hundreds of health companies in this area around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you. By region, revenue, age, category and more with sub categorization on any dimension in one click. Stay tuned for the launch!

HolonIQ Market Map - Wearables

📊 2024 Global Health Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Health Technology. Just a few weeks ago, we launched the 2024 Global Health Tech Outlook, HolonIQ's annual analysis of the health landscape, presenting over 190 pages of detailed market data, investment & analysis, strategic shifts and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Climate Tech Outlook or Global Education Outlook.

We have a jam packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward thinking institutions, governments and organizations worldwide as they navigate the challenges and opportunities ahead. Purchase the Outlook or Download the Extract.

🏆 Europe Health Tech 200

The Europe Health Tech 200 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery and analytics.

Market Map - 2023 Europe Health Tech 200

📊 Charts, Charts and more Charts.

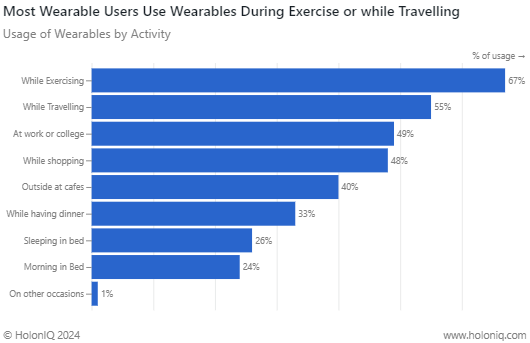

Subscribe to HolonIQ's newsletter 'Chart of the Day,' providing a daily chart that helps explain the global impact economy - from education to healthcare and climate technology.

Utilizing wearables during exercise and travel is common, with users leveraging performance metrics to gain insights into their health and progress towards fitness goals. This data-driven approach can enhance workout efficiency. Additionally, a significant portion of users (around 25%) incorporate wearables into their sleep routines, suggesting a focus on monitoring sleep health. Given the widespread prevalence of sleep disorders and sleep deprivation (affecting over a third of adults and 20-30% of children, respectively), wearables offer a potential solution for many individuals. Studies have shown their effectiveness in reducing sleep disturbances and improving sleep quality, especially for those struggling with insomnia, which affects 15% of the population with a higher incidence in women (40% more likely to develop the condition).

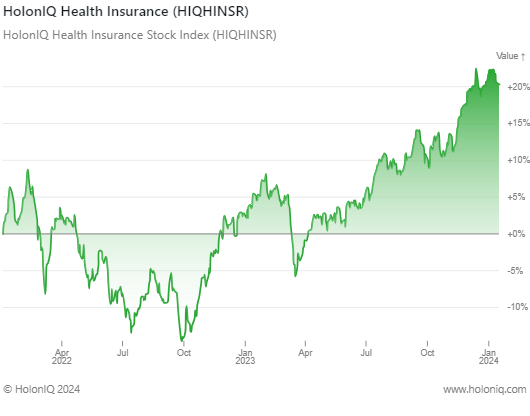

📈 Health Tech Capital Markets

HolonIQ tracks over multiple listed companies in health around the world and thousands of acquisitions and investments each year. Soon we will launch a range of Stock Indices to track the daily performance of over 10 indices across Health Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

💰 Top Deals This Week

Funding

🔬⚗️LegoChem Bioscience: has acquired $411 million from Orion, a candy manufacturer, to increase the scope of its pipeline for the development of antibody-drug conjugates (ADCs). To quicken its pipeline with an emphasis on ADCs.

🩺🔍Cleveland Diagnostics: collected $75 million in a financing round headed by Novo Holdings, with credit from Symbiotic Capital in addition to current investors. The money will help expand IsoPSA's infrastructure, expedite its commercial strategy, and increase the geographic reach of its prostate cancer tests.

🧩💙Forta: has completed a Series A fundraising round headed by Insight Partners, raising $55 million. The money will go toward developing clinical algorithms, growing Forta's family-powered autism therapy practice, and enhancing patient results through the application of AI and massive language models.

Acquisitions

🏥PureHealth: purchased Circle Health Group For $1.3 billion,, an independent hospital operator. With this acquisition, PureHealth is taking a big step toward its goals of becoming a global healthcare platform and strengthening Abu Dhabi's standing in the industry globally.

Demergers

🏥Aster DM Healthcare: plans to distribute 70%-80% of the $903 million it will receive from selling its Gulf business to shareholders. The decision follows a proxy advisory firm's advice to vote against the deal, citing unclear use of the sale proceeds. The proceeds will be used to pay shareholders dividends, with Aster initially intending to use the demerger proceeds for an expansion in India.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com