🔋Batteries + East Asia Climate Tech 100.

This week we look at our new Market Maps, preview Batteries, and spotlight the 2023 East Asia Climate Tech 100. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our new Daily Newsletters Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 📊 Annual Outlook. 230 pages of trends, insights and data

- 🔋 Battery Energy Storage Landscape. Market Map+

- 📊 Global Battery Demand & Lithium-Ion Battery Demand for EVs

- 🏆 East Asia Climate Tech 100. Top 100 Climate Tech's in East Asia

- 🦄 2024 Global Climate Tech Unicorn List. 35 new Unicorns. $350B total value

- 📈 Battery Tech & Lithium Stock Index. Up and Up

- 💰Climate Tech Top Deals of the Week

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

📊 2024 Global Climate Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Climate Technology. Just a few weeks ago, we launched the 2024 Global Climate Tech Outlook, HolonIQ's annual analysis of the new climate economy, presenting over 230 pages of detailed market data, investment & analysis, strategic shifts, and trends in energy, the environment, infrastructure, and mobility. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Health Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations worldwide as they navigate the challenges and opportunities ahead.

🔋Battery Energy Storage Landscape

Batteries, the foot soldiers of the clean energy revolution, are on track for accelerated growth in the coming decades. As electric vehicles replace conventional vehicles and energy storage systems become mainstream, the demand for this critical technology is surging. While lithium-ion is the leader in battery technology, research into lighter and cheaper battery types such as solid-state, sodium-ion, and flow batteries has shown promising results that could solve some of the technical limitations of lithium-ion. Lighter batteries would also mean increased energy density, which would result in a longer range and higher efficiency of EVs. Advancements in safety, management systems, and innovative technologies are key. Prologium's $1.6 billion gigafactory in France and Toyota's 2030 solid-state target are testaments to this quest.

These breakthroughs will not only extend battery capabilities but also bring down costs, a critical factor in the clean energy transition. With the 97% drop in lithium-ion cell prices since 1991, from $7500 per kilowatt-hour to just $139, batteries have become more accessible than ever. As alternative and improved lithium-ion options join the fray, market forces will continue to nudge prices towards more accessibility for clean energy solutions.

HolonIQ is tracking hundreds of players across the Battery Energy Storage landscape around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you, by region, revenue, age, category, and more with subcategorization on any dimension in one click. Stay tuned for the launch!

Market Map - Battery Energy Storage

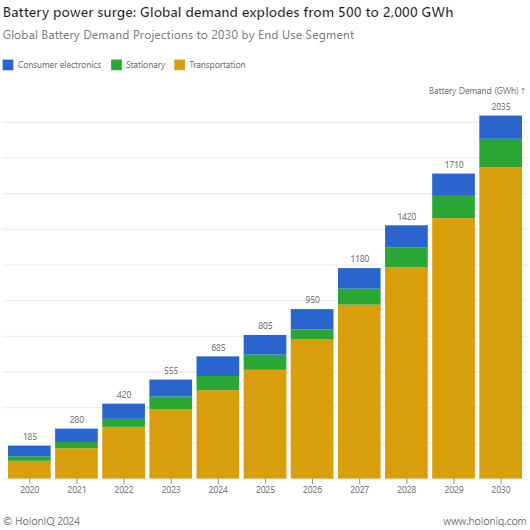

📊 Charts Spotlight - Projection of Global Battery Demand and Lithium-Ion Battery Demand for EVs

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact economy - from climate tech to education and healthcare. Subscribe to Chart of the Day for data-driven insights on sustainable and inclusive growth.

Global battery demand is forecast to increase exponentially leading up to 2030, with demand increasing to 2035 GWh from 555 GWh in 2023. The transportation sector is the largest end-user segment, driving this demand as the adoption of EVs accelerates across the globe. Approximately 23 countries have passed a critical EV tipping point of EVs surpassing 5% of total car sales, while many others are approaching this number. This threshold signals the start of mass adoption when technological preferences rapidly flip. This has also led to battery prices declining with lithium battery prices seeing an 82% decrease over the last 10 years. In 2013, a lithium-ion battery cost $780/kWh, while in 2023 it stood at about $139/kWh. Studies have indicated that battery pack prices need to fall below $100/kWh for electric vehicles to reach price parity with fossil fuel-burning vehicles.

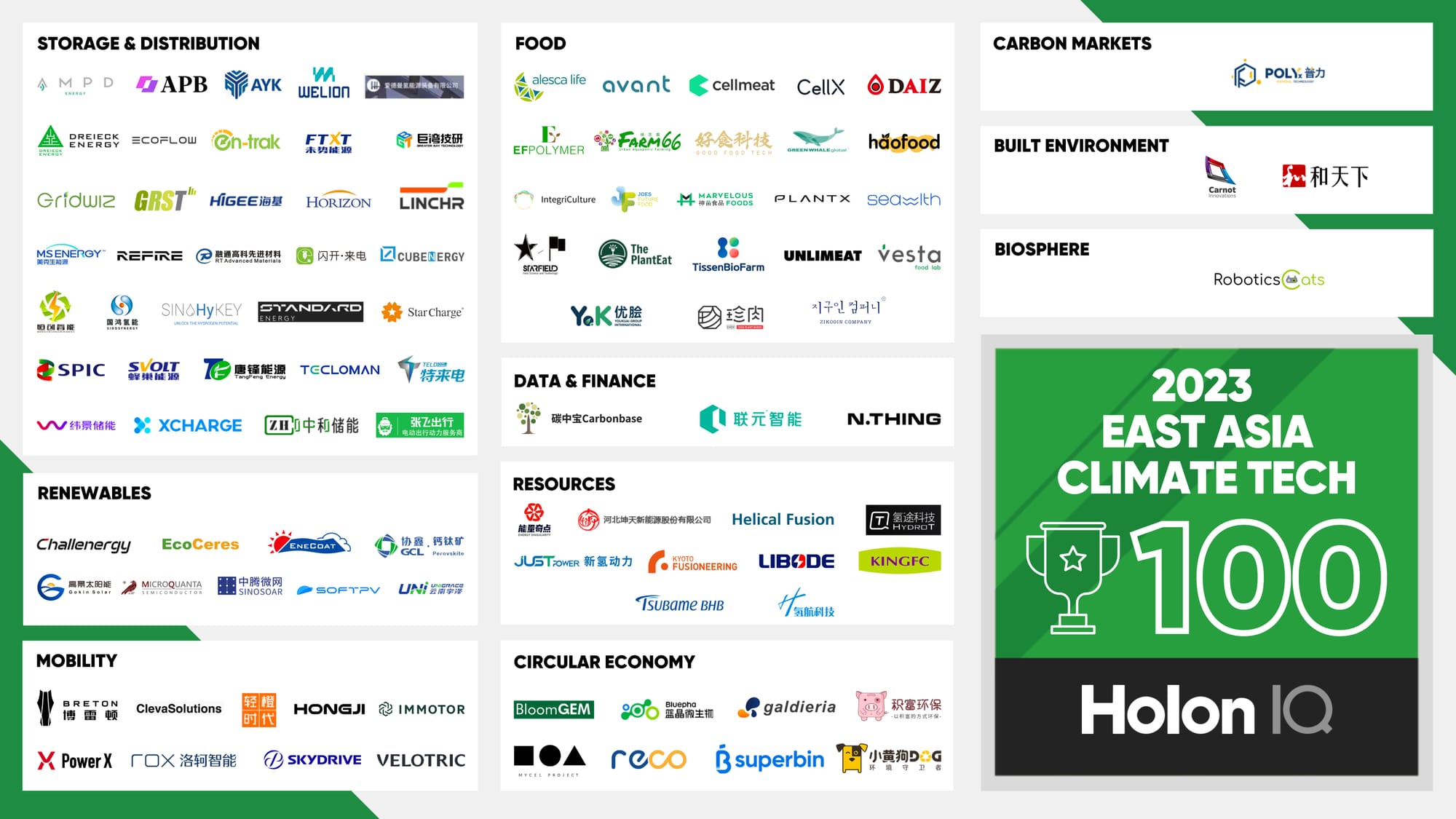

🏆 East Asia Climate Tech 100

The East Asia Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Chinese startups led the East Asian region, securing 83.8% of the total VC funding in the region's climate tech landscape, where EVs were the leading cluster that contributed to China’s significant position in the global climate tech landscape, followed by Solar Energy. Storage & Distribution is a key sub-sector in the region, specifically fueled by Battery Energy Storage, highlighting China and South Korea’s dominant position as the largest global battery suppliers.

2024 Global Climate Tech Unicorn List

This week HolonIQ has updated the Global Climate Tech Unicorn List for 2024, with 35 new companies joining the exclusive list of private companies valued at $1B or more. These companies, combined, are worth close to $320B.

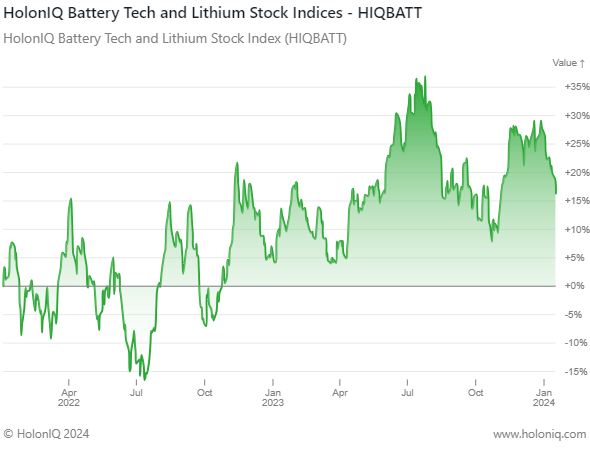

📈Capital Markets - Battery Tech, Battery Minerals Stocks.

HolonIQ's Battery Tech and Battery Mineral indices cover close to 100 of the best-performing stocks in the market and are actively monitoring the global economy and its impact on our indexes. Lithium and Batteries have a crucial and multifaceted relationship, with lithium playing a key role in the functioning of rechargeable batteries, particularly the ubiquitous lithium-ion batteries powering almost all modern electronics.

Subscribe to Impact Capital Markets newsletter for data-driven insights on capital powering impact. HolonIQ tracks over 60 impact stock indices, including climate tech, emerging economies, education technology and healthcare innovation.

HolonIQ Battery Tech and Lithium Index. During 2023, 12-month returns peaked in August, with the Lithium and Battery Tech index increasing by almost 25%. Index performance declined in 1H 2023 due to a slowdown in China after companies were hit by sluggish demand conditions alongside an increase in raw material stockpiles.

CATL (Market Cap: US$ 95B) and LG Energy Solutions (Market Cap: US$ 74B), two prominent players in the battery manufacturing industry from China and South Korea, respectively, experienced significant developments over the past year. The index rose steadily amid CATL’s announcement in July 2023 of the development of new materials for lithium-ion batteries that would improve the efficiency of electric vehicle charging. In addition, CATL saw a surge in revenue after it secured a new deal to supply 950 containerized liquid-cooling battery systems and 232 inverters to the government of Western Australia for a $700M energy storage project. In August 2023, LG Energy Solutions produced its first battery recycling joint venture to oversee the construction of two new battery recycling plants in China.

💰Climate Tech Top Deals of the Week

HolonIQ actively monitors and tracks deals that take place in the Climate Tech landscape, spanning all regions of the world. Subscribe to our Daily Capital Markets newsletter for a feed of top deals for each day.

💰 Funding

🔋 Northvolt, a Swedish lithium-ion battery producer, raised $5B in the largest green loan in the largest green loan in Europe seeking to expand its battery factory in northern Sweden.

🔋 Calpine secured over $1B in debt financing in debt financing to finance a 680 MW battery energy storage project in California. The funding, secured through a syndicated loan, will be used for the development and construction of a battery complex in Menifee, set to become one of the largest facilities of its kind in the US.

⚡ Electra, a France-based EV charging company, raised $333M Series B from PGGM Investments and will likely use the funds to expedite the expansion of its charging infrastructure in Europe.

💡 Aira, a Sweden-based clean energy-tech company, raised $158.2M Series B from Altor to continue market expansion across Italy, Germany, and the UK.

🔋 Ineratec, a Germany-based e-Fuel company, raised over $129M Series B from Piva Capital to start the mass production of its industrial-scale Power-to-X plants worldwide and advance the production of e-Fuels made from recycled CO2 and renewable energy.

💼 Acquisitions

🏦 BlackRock acquired Global Infrastructure Partners, a NY-based infrastructure investing firm that invests in the energy, transportation, water, and waste sectors for $12.5B.

🪙 Alamos Gold (NYSE: AGI), a Canadian-based intermediate gold producer, entered into a definitive agreement to acquire Toronto-based junior miner Orford Mining (TSXV: ORM).

💉 Renesas Electronics Corporation (TYO:6723), a Tokyo-based semiconductor manufacturer, entered into a definitive agreement to acquire Transphorm a Goleta, CA-based semiconductor company that produces gallium nitride-based solutions for high-voltage power conversion applications.

💧 Atlas-SSI, a Minnesota-based leader in water screening solutions that protect mission-critical assets and water ecosystems, acquired ABASCO, a Texas-based prominent provider of containment barriers and service.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com