🎯 Chronic Disease Management + LATAM Health Tech 50

Happy Monday 👋

This week we are exploring "Targeted Chronic Disease Management". Don't forget to check out the 2024 Global Health Outlook, and sign up for our new Daily Newsletters - 'Chart of the Day' and 'Impact Capital Markets'. For unlimited access to over one million charts, request a demo.

This Week's Topics:

🎯 Targeted Chronic Disease Management Landscape

📊 2024 Global Health Tech Outlook

🏆 East Asia Health Tech 200

📊 Charts, Charts and more Charts

📈 Health Tech Capital Markets

💰 Top Deals This Week

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

🎯 Targeted Chronic Disease Management Landscape

Chronic diseases pose a significant global challenge, exemplified by their rising prevalence, mortality rates, and economic burden. With over 74% of global deaths attributed to chronic conditions, including premature fatalities from heart disease, effective management strategies are crucial. This analysis explores recent advancements and promising avenues in targeted chronic disease management, particularly in diabetes and obesity, fueled by innovations in pharmaceuticals, biotechnology, and artificial intelligence. These advancements offer hope for not only managing, but potentially even curing, these prevalent and costly conditions.

Diabetes/obesity drug space buzzes with activity. Novo Nordisk expanded their portfolio through the EraCal investment in January, while Eli Lilly eyes European expansion for Mounjaro. Pfizer remains committed despite setbacks, reflecting a persistent interest to enter the space by the company. Drug pricing remains a hurdle, with affordability concerns surrounding Ozempic and Mounjaro.

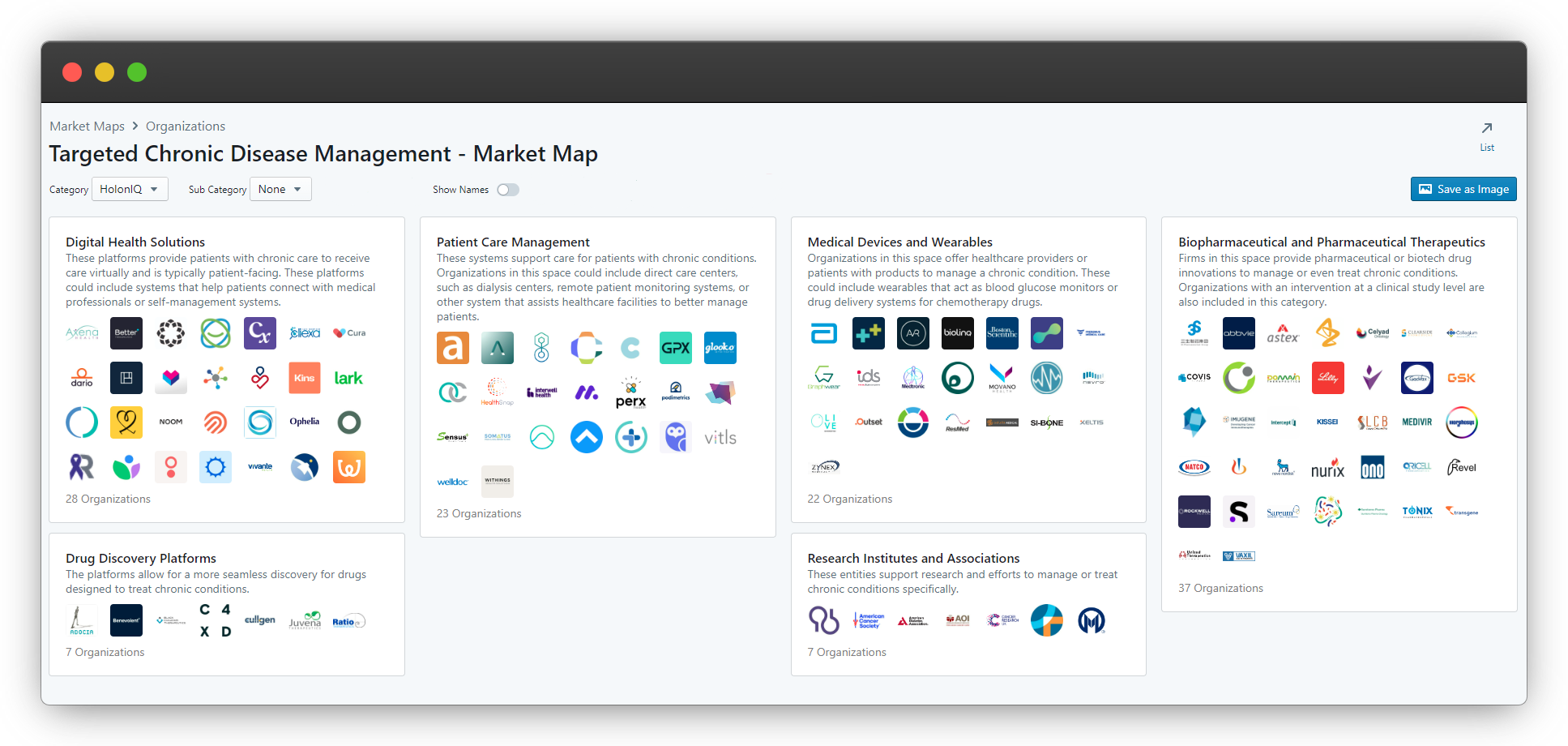

HolonIQ is tracking hundreds of health com panies in this area around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you. By region, revenue, age, category and more with sub categorization on any dimension in one click. Stay tuned for the launch!

HolonIQ Market Map - Targeted Chronic Disease Management

📊 2024 Global Health Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Health Technology. Just a few weeks ago, we launched the 2024 Global Health Tech Outlook, HolonIQ's annual analysis of the health landscape, presenting over 190 pages of detailed market data, investment & analysis, strategic shifts and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Climate Tech Outlook or Global Education Outlook.

We have a jam packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward thinking institutions, governments and organizations worldwide as they navigate the challenges and opportunities ahead. Purchase the Outlook or Download the Extract.

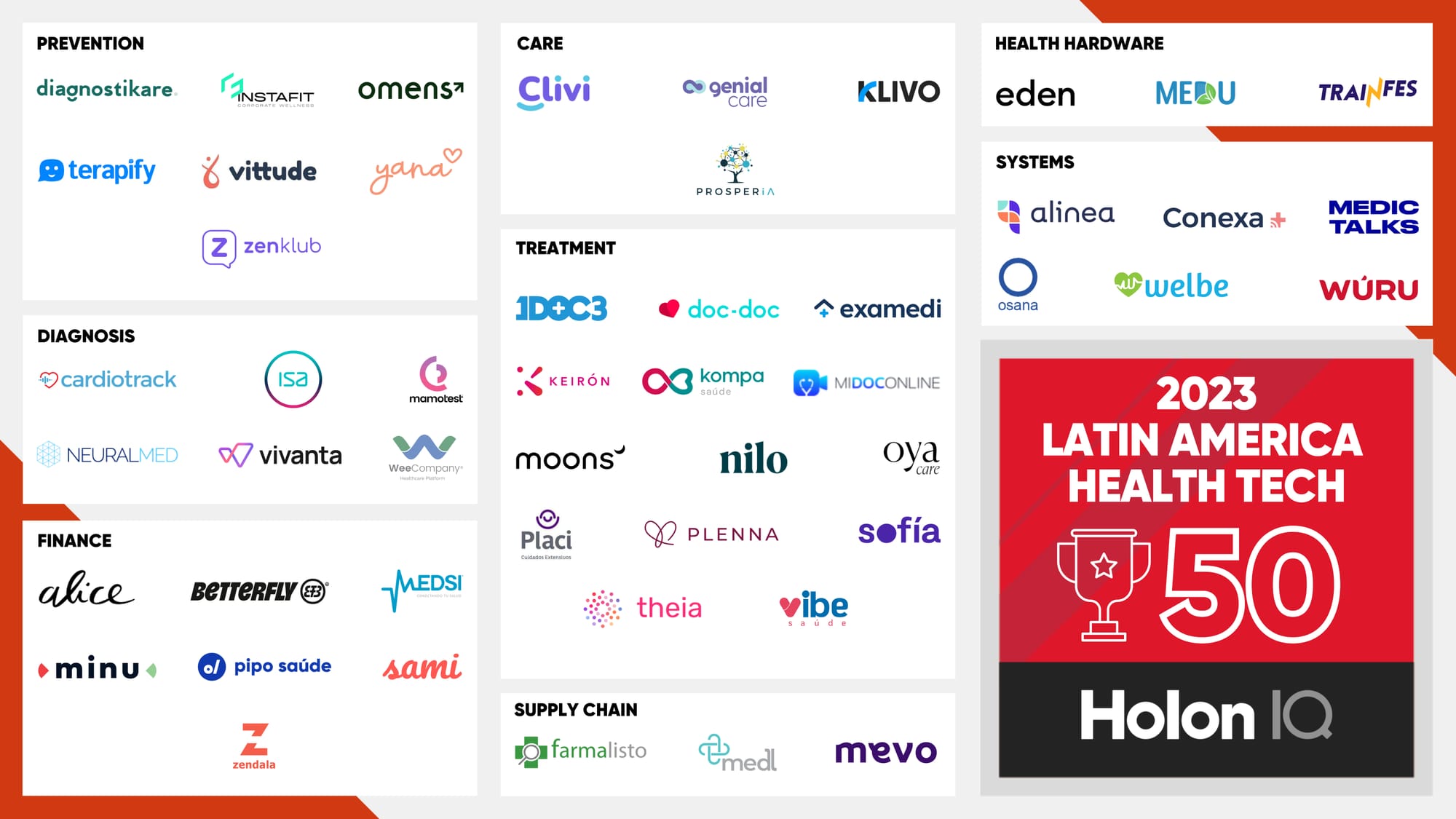

🏆 Latin America Health Tech 50

The Latin America Health Tech 50 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery and analytics.

The regional activities of Conexa Saúde in Brazil, one of the members of our cohort, provides an excellent example of this ongoing interest. Vivo's (Telefônica Brasil) venture capital arm invested $5 million in the startup. In addition, Conexa Saúde and Zenklub, a different cohort member offering a digital platform for exercise and well-being, have started talking about merging their businesses at the start of 2024.

📊 Charts, Charts and more Charts.

Subscribe to HolonIQ's newsletter 'Chart of the Day,' providing a daily chart that helps explain the global impact economy - from education to healthcare and climate technology.

With 74% percent of all deaths being attributed to chronic diseases, better care and management is an absolute must to address. Moreover, women tend to hold a higher percentage of deaths by chronic diseases across most regions. Women hold twice the likelihood of encountering a heart attack and have a greater probability in contracting Alzheimer's Disease or an autoimmune condition. Regardless, research into health inequalities with how chronic diseases affect women have yet to be evened out three decades after the National Institutes for Health (NIH) declared that clinical trials should include equal portions of women. Many conditions that solely or mostly impact women have yet to be addressed.

While nearly 59% of participants in NIH trials are female, significant gaps remain. Pregnant, minority, and older women are underrepresented, despite comprising large demographics. Even trials designed for women, like weight-loss studies, miss key questions about sex-specific responses. This gap stems from historical exclusion and outdated assumptions about women's availability and biology. Women, even as the majority population, still face limited access to potentially life-saving research, including for common conditions like heart disease. Addressing this bias requires proactive inclusion strategies and acknowledging the limitations of male-centric research models.

Source: HolonIQ, WHO

📈 Health Tech Capital Markets

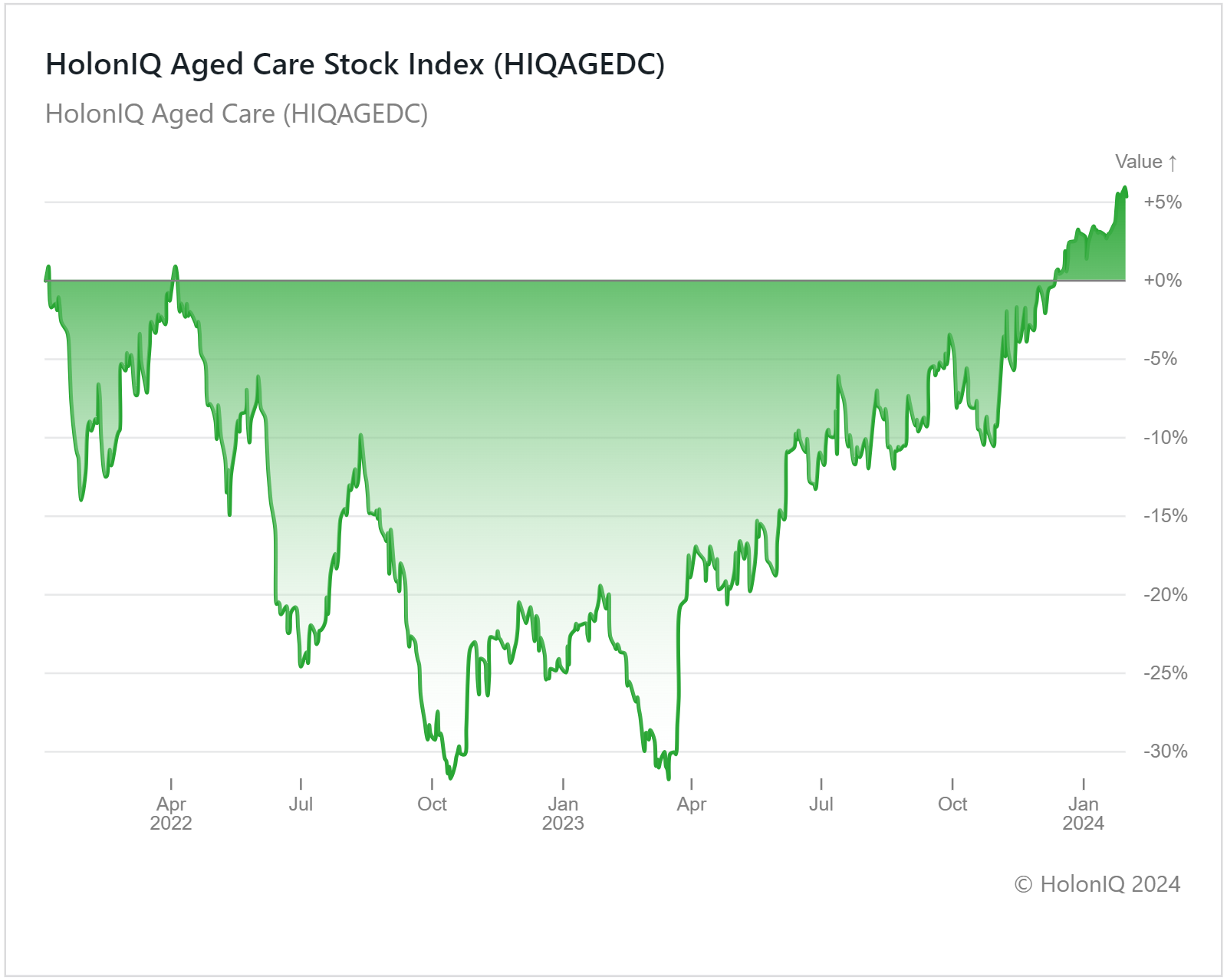

HolonIQ tracks over multiple listed companies in health around the world and thousands of acquisitions and investments each year. Soon we will launch a range of Stock Indices to track the daily performance of over 10 indices across Health Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

💰 Top Deals This Week

Funding:

🩹🔍 Cour Pharmaceuticals: has secured $105M in funding from Roche, Pfizer, and Bristol Myers Squibb to advance its portfolio of autoimmune diseases medicines using nanoparticle drugs to reprogram immune systems.

🫁💨 Enterprise Therapeutics: secured a $33M Series B follow-on financing round, led by Panakes Partners, to support the Phase 2a clinical trial of ETD001, a novel compound for cystic fibrosis treatment, and expand clinical activities into Italy.

Acquisitions

🧬🔬 Gilead Sciences: invested $225M in Arcus Biosciences, increasing its stake from 20% to an unspecified larger share. The deal expands collaboration and provides Arcus with an extra year of funding, extending its cash runway into 2027.

🚺💡 Dubai Investments: acquired around 34% stake in Global Fertility Partners (GFP), a prominent Middle Eastern fertility network, and secured $60M in equity financing to expand its fertility and women's health centers.

IPOs

🩸🔥 Fractyl Health: plans to raise $132 million in its US IPO, aiming for a market valuation of $762 million. The company, backed by Mithril Capital and General Catalyst, is developing disease-modifying therapies for metabolic diseases like type-2 diabetes and obesity.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com