🌱 Green Hydrogen + MENA Climate Tech 50

This week we look at our new Market Maps, preview Green Hydrogen, and spotlight the 2023 Middle East and North Africa Climate Tech 100. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our new Daily Newsletters Chart of the Day and Impact Capital Markets.

This week we look at our new Market Maps, preview Green Hydrogen, and spotlight the 2023 Middle East and North Africa Climate Tech 50. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our new Daily Newsletters Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 📊 Annual Outlook. 230 pages of trends, insights, and data

- 🌱 Green Hydrogen. Market Map+

- 📊 Global Hydrogen Production and Electrolyzer Capacity.

- 🦄 2024 Global Climate Tech Unicorn List. 35 new Unicorns. $350B total value. New Unicorn Entrant.

- 📈 Hydrogen Stock Index.

- 💰 Climate Tech Top Deals of the Week

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

📊 2024 Global Climate Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Climate Technology. Just a few weeks ago, we launched the 2024 Global Climate Tech Outlook, HolonIQ's annual analysis of the new climate economy, presenting over 230 pages of detailed market data, investment & analysis, strategic shifts, and trends in energy, the environment, infrastructure, and mobility. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Health Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations worldwide as they navigate the challenges and opportunities ahead.

🌱 Green Hydrogen Landscape

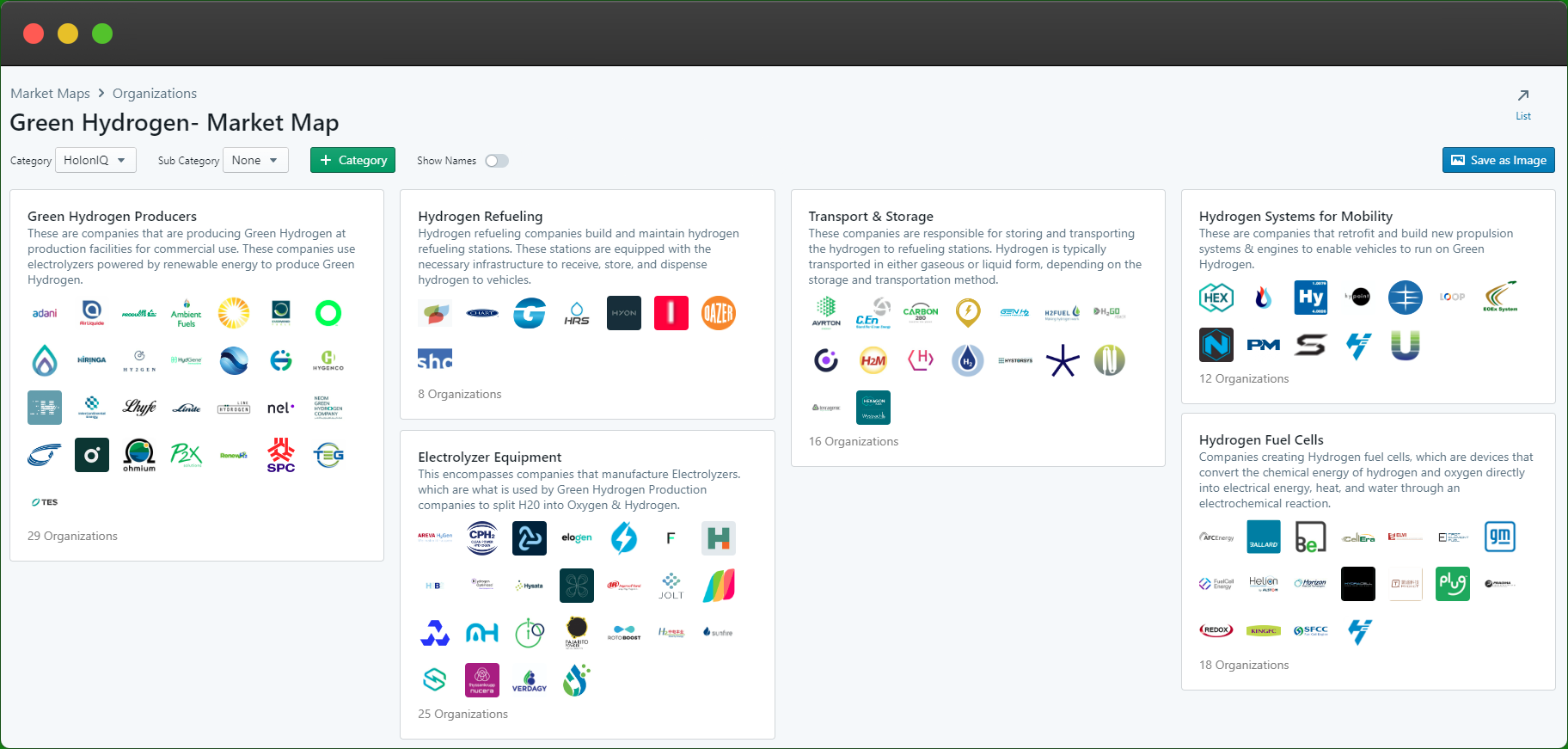

Green hydrogen, lauded for its clean burn and versatility in powering vehicles, heavy industries, and storing renewable energy, is attracting billions in investments from governments and companies worldwide.

2023 saw the US announcing a $7B Bipartisan Infrastructure Law initiative charged with concurrently developing clean hydrogen production, transport, storage & use, Saudi Arabia developing the world’s largest green hydrogen production facility worth $8.4B, Oman signing 2 contracts worth $10B for a green hydrogen project while the Netherlands allocated ~$11B in subsidies to establish 4GW of green hydrogen capacity in operation by 2030 & 8GW by 2032.

However, there are significant hurdles for this sector to overcome such as the costs involved, scaling up production in sustainable ways, and its current limitations and applicability. Transporting and storing green hydrogen is a crucial problem that governments & companies need to address for it to replace fossil fuels.

🌱 Green Hydrogen - Market Map

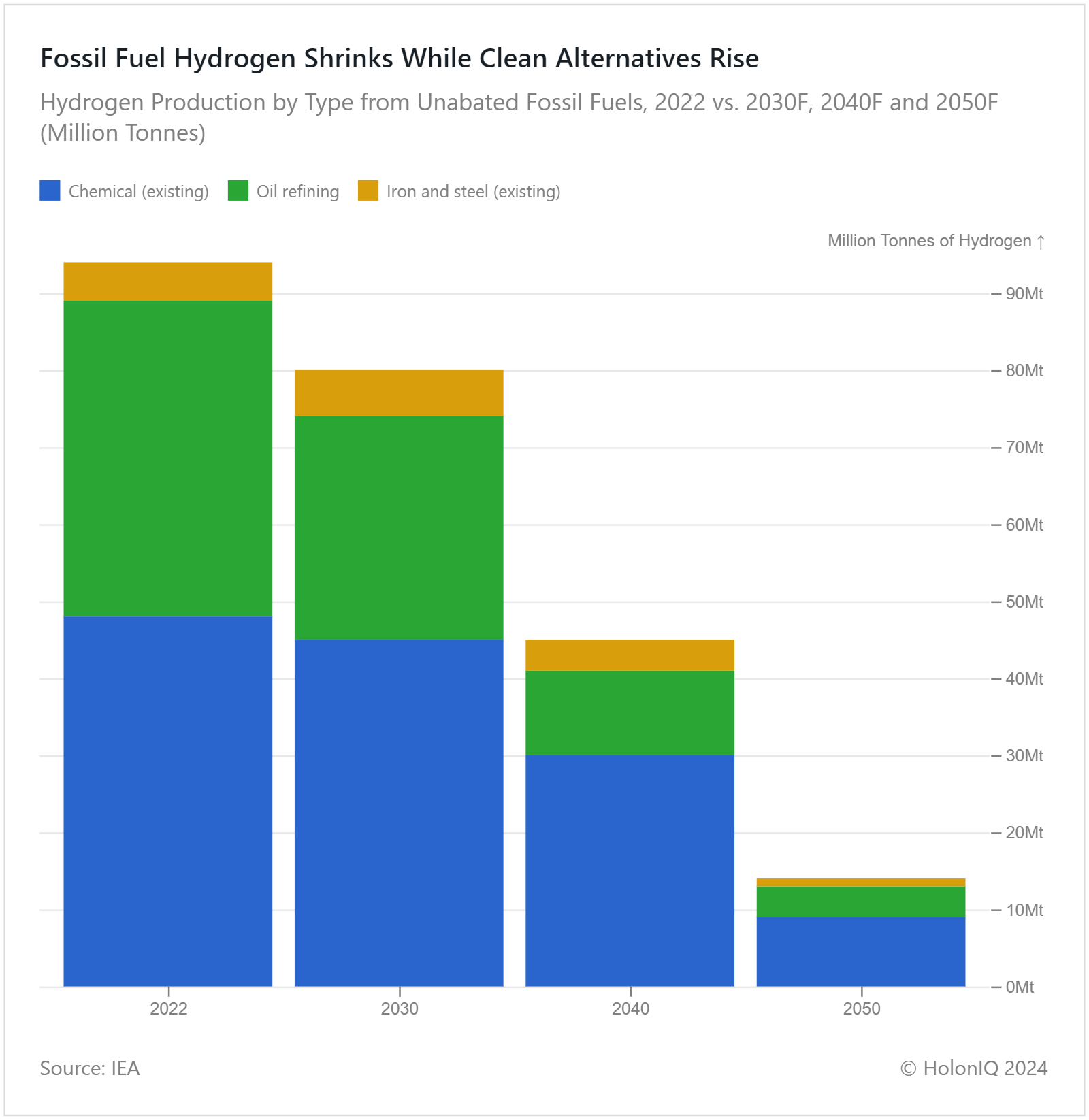

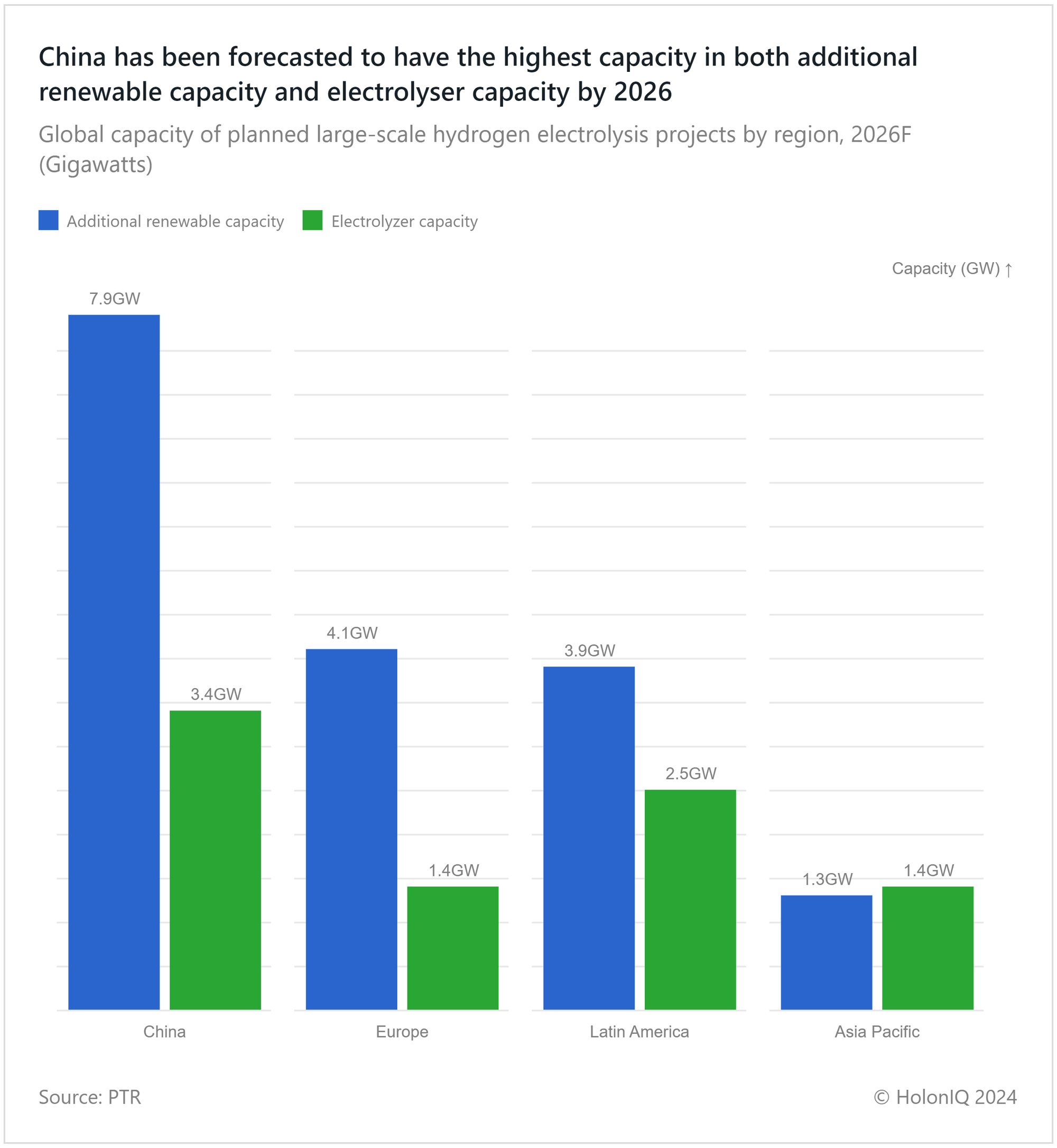

📊 Charts Spotlight - Hydrogen Production by Type and Global Electrolyzer Capacity.

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact economy - from climate tech to education and healthcare. Subscribe to Chart of the Day for data-driven insights on sustainable and inclusive growth.

Green Hydrogen, produced from renewable energy is considered to be the fuel of the future, with carbon emissions decreased across the entire value chain. In alignment with global pledges to meet net zero, the production of hydrogen from unabated fossil fuels is expected to decrease leading up to 2050. As the global electrolyzer capacity along with the global renewable energy capacity increases, the ability to scale up the production of green hydrogen increases exponentially. Currently, as is the case with most clean energy hardware, China has an indomitable hold on the market. The country's renewable capacity dwarfs the rest of the world and over the last few years, they have been ramping up electrolyzer capacity as well.

🏆 MENA Climate Tech 50

The MENA Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

The MENA region secured over $631M in VC funding within the climate tech landscape, with funding primarily concentrated in Israel, the UAE, and Saudi Arabia. Interestingly, in the Middle East and North Africa Climate Tech 50, the above concentration shifted to Israel, the UAE, and Egypt, where Food Systems and Circular Economy led the list, followed by the Built Environment subsector which accounted for just 8%. Food Systems and Circular Economy collectively represented 60% of the startups and the majority of the startups in the list were from Israel, followed by the UAE.

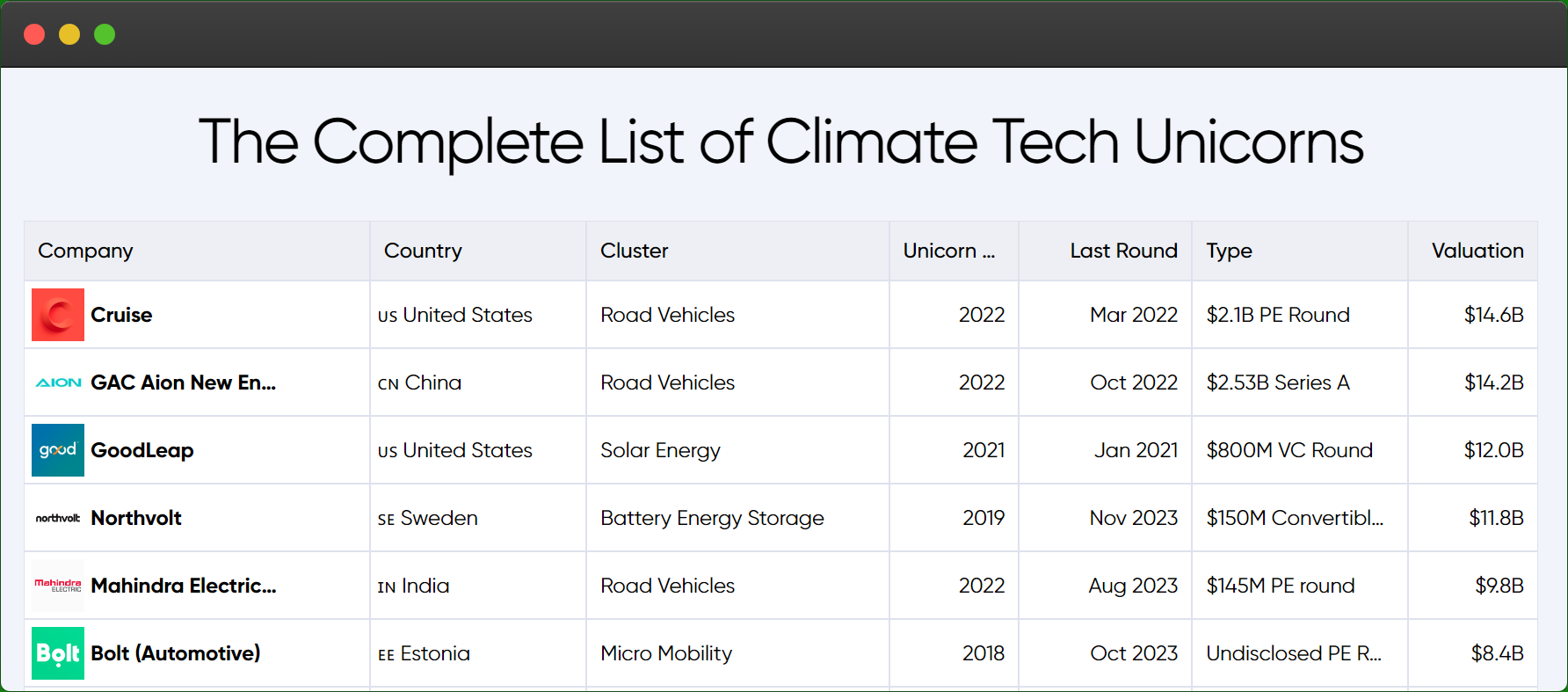

🦄 2024 Global Climate Tech Unicorn List

This week HolonIQ has updated the Global Climate Tech Unicorn List for 2024, with 35 new companies joining the exclusive list of private companies valued at $1B or more. These companies, combined, are worth close to $320B.

- This week saw Zum, a California-based modern student transportation provider raise $140 million in Series E funding. This round values Zum at $1.3B and raises the total funding to $350 million. Zum will use the new capital to accelerate the expansion of its AI-driven technology platform, which decarbonizes the school bus industry and bolsters the fight against climate change.

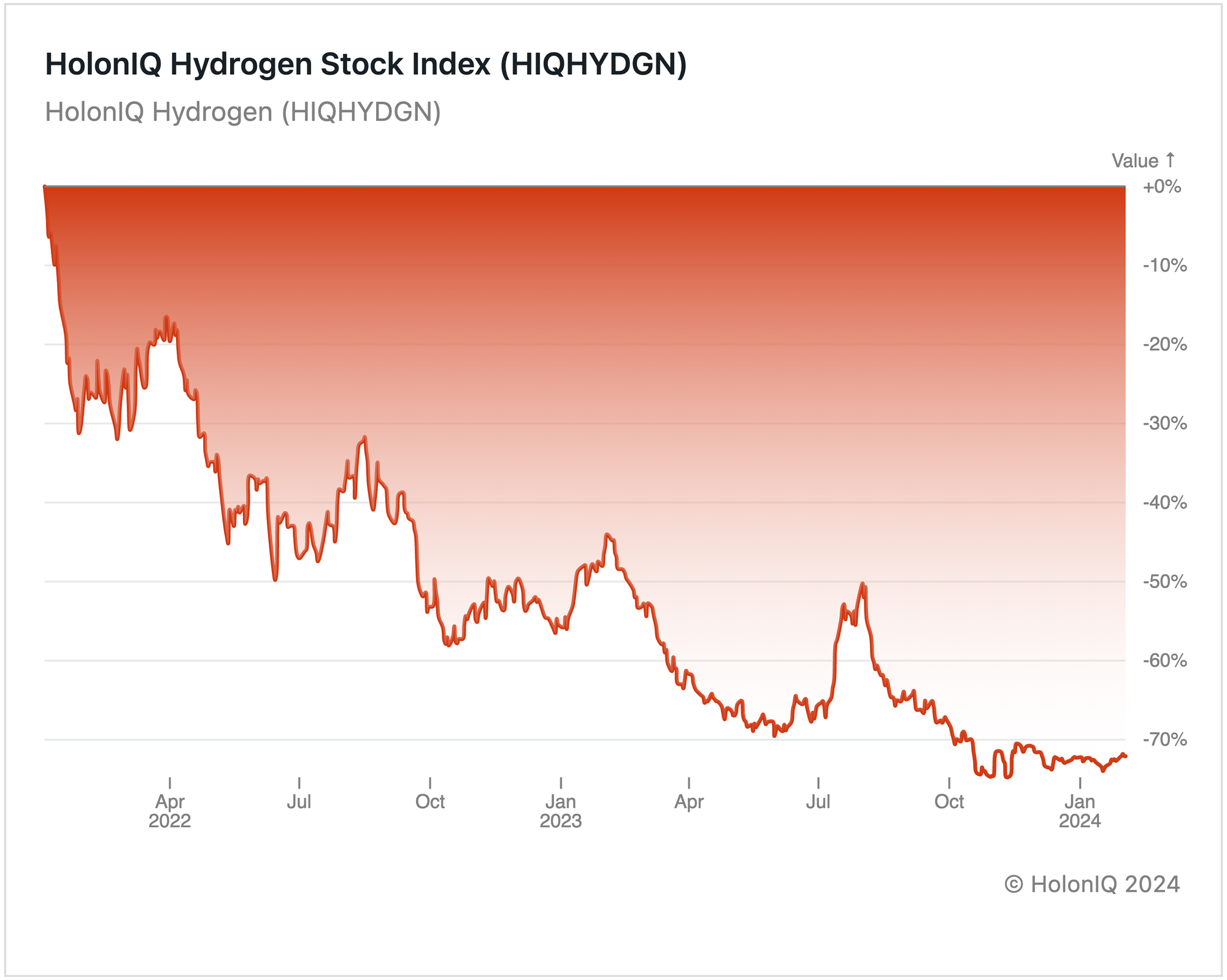

📈Capital Markets - Green Hydrogen Stocks.

💰Climate Tech Top Deals of the Week

HolonIQ actively monitors and tracks deals that take place in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Top deals this week include,

💰 Funding

🌱 Generate Capital, a California-based investment firm focused on sustainability and infrastructure, raised $1.5B in Private Equity from preeminent global institutional investors. The funds will boost General's platform, fast-tracking sustainable power projects, expanding renewable energy, and advancing clean transportation initiatives.

🚐 Zum, a California-based provider of student transportation solutions, raised a $140M Series E from GIC to accelerate the expansion of its AI-driven technology platform.

🚗 BluSmart Mobility, an Indian-based EV ride-hailing service and EV charging hub infrastructure operator raised $25M from Responsability investments to expand its EV charging infrastructure across India.

⚛️ Transmutex SA, a Switzerland-based nuclear engineering company, raised $23M Series A from Union Square Ventures & Steel Atlas to further develop and commercialize its subcritical nuclear energy system.

🏭 Boston Metal, a Massachusetts-based metals technology solution company, raised a $20M Series C from Marunouchi Innovation Partners to enlarge their Asian presence, accelerate commercialization, and fuel growth.

🔄 Paques Biomaterials, a Netherlands-based circular Polymer Technology Company, raised $15.2M from Invest-NL and NOM. The funds will construct a Caleyda Extraction Facility in Emmen for extracting the biopolymer named Caleyda, valued for its 100% biodegradability and microplastic elimination.

💼 Acquisitions

☀️ Qualitas Energy, a Madrid-based renewable energy investment company, has signed a definitive agreement to acquire Heelstone Renewable Energy, a North Carolina-based power producer and solar developer.

🏠 5M Group, an Illinois-based real estate firm, acquired Cox Interior, a Kentucky-based company crafting superior wood building products, including crown moldings, mantels, and stair parts, with a focus on design and manufacturing.

💡 Facility Solutions Group, a Texas-based company that offers lighting, electrical, and energy management services, acquired Greenleaf Energy Solutions, a UK-based company that offers energy solutions and LED lighting.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com