🗺️ Nordic-Baltic Climate Tech 100 + Climate Tech Women Leaders

In this week's Climate Tech Newsletter, we preview Climate Tech Women Leaders and spotlight the 2023 Nordic-Baltic Climate Tech 100. We also look at the Global Climate Tech Unicorn list for 2024, and top deals that took place this week.

Happy Monday 👋

This week we preview Climate Tech Women Leaders and spotlight the 2023 Nordic-Baltic Climate Tech 100. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our Daily Newsletters Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 📊 Annual Outlook. 230 pages of trends, insights, and data

- 🌱 Climate Tech Women Leaders. People Map+

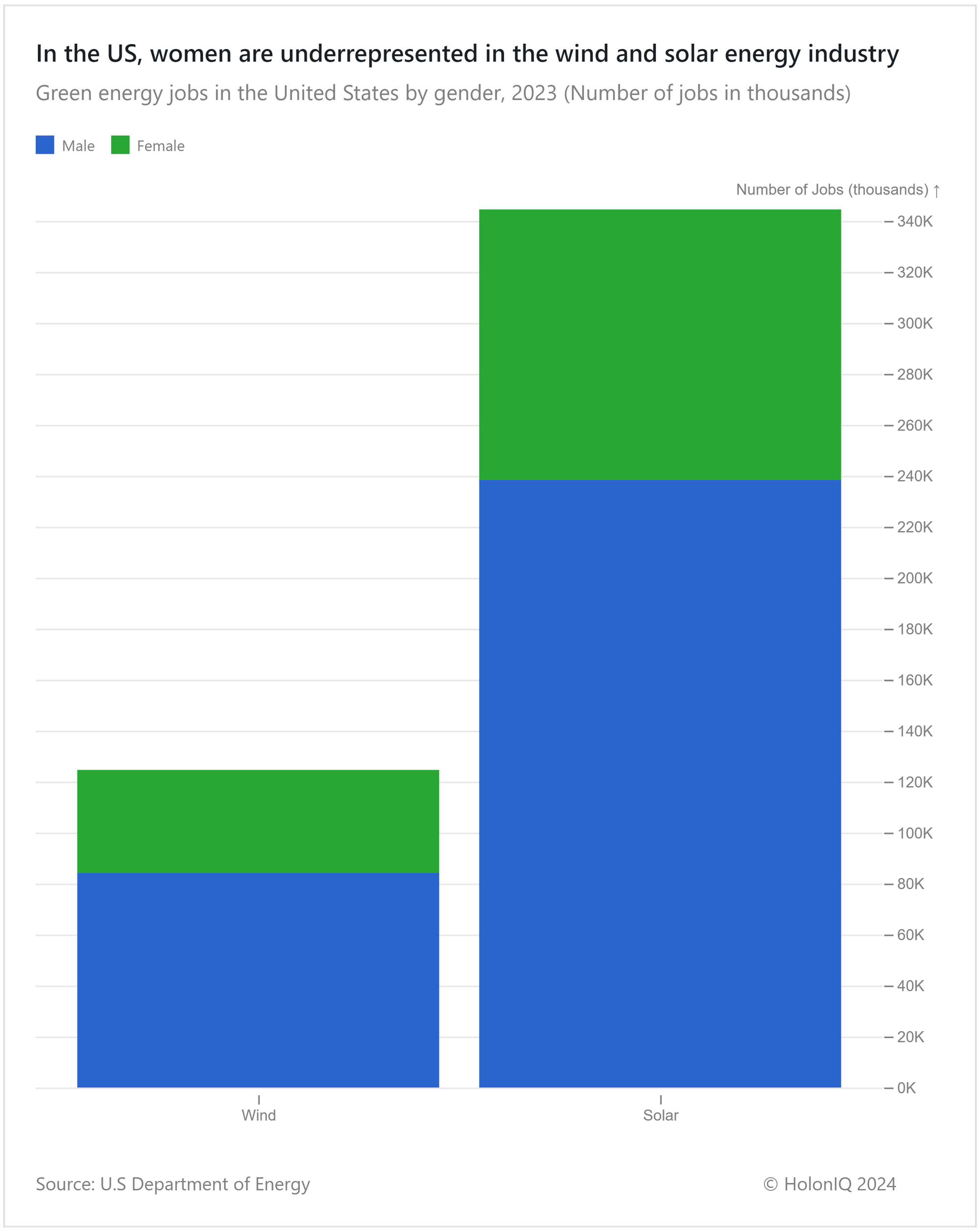

- 📊 Green Energy Jobs by Gender and Women's Upward Mobility in Green Energy.

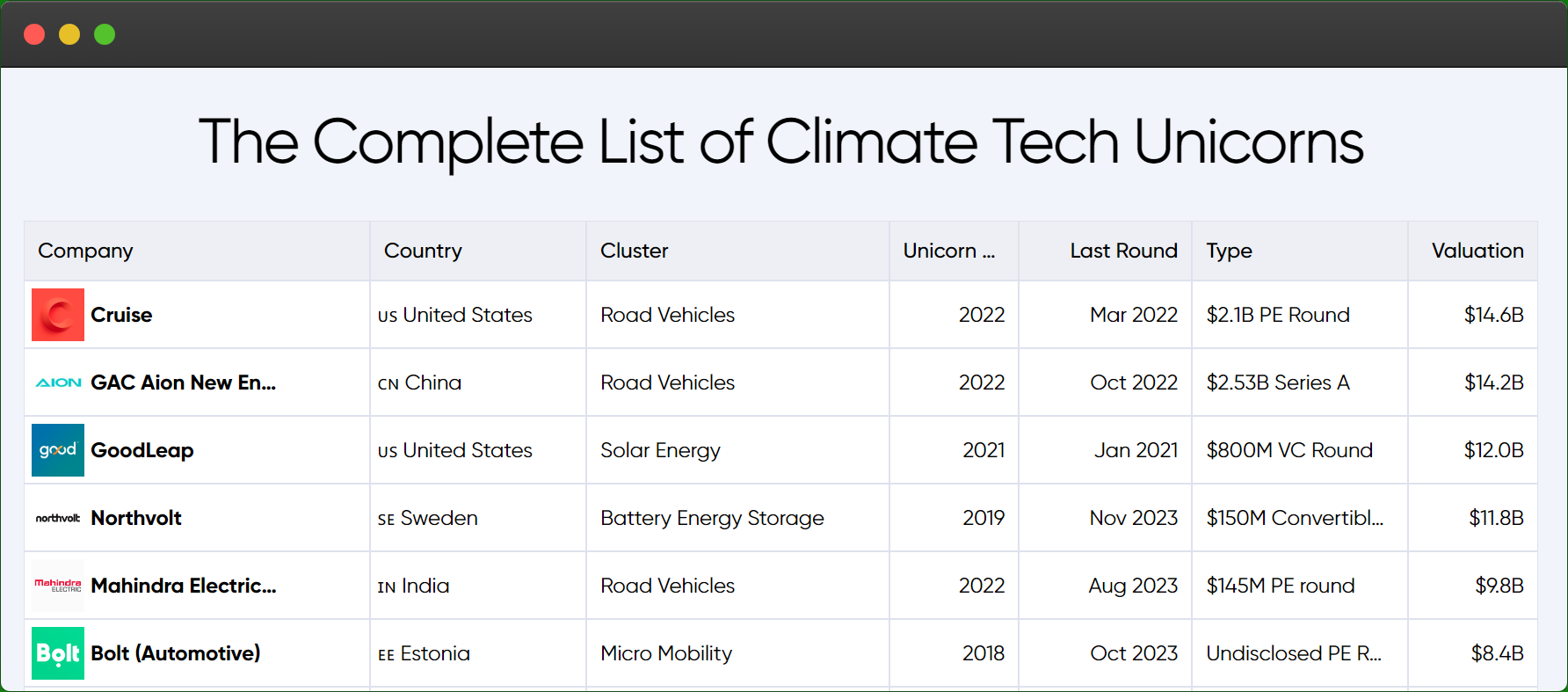

- 🦄 2024 Global Climate Tech Unicorn List. 35 new Unicorns. $350B total value. January New Entrants.

- 📈 Ag-Tech and Smart Farming Stock Volatility.

- 💰 Climate Tech Top Deals of the Week

📊 2024 Global Climate Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Climate Technology. Just a few weeks ago, we launched the 2024 Global Climate Tech Outlook, HolonIQ's annual analysis of the new climate economy, presenting over 230 pages of detailed market data, investment & analysis, strategic shifts, and trends in energy, the environment, infrastructure, and mobility. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Health Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations worldwide as they navigate the challenges and opportunities ahead.

🗺️ People Map - 2023 HolonIQ Climate Tech 1000 Women Leaders

This week, we look at our People Map examining the representation of women leaders in HolonIQ's Climate Tech 1000 list. The People Map includes 86 women leaders across the globe. Notably, 29.4% of the women leaders are from the Europe and Central Asia region, followed by the North American region (26.5%). The East Asia and Pacific region comprises 25%, while the Sub-Saharan Africa region is represented by 5.9% on the map. The Middle East and North Africa, South Asia, and Latin America and Caribbean regions each have 4 women leaders in the cohort of 86 globally, exhibiting the smallest representation on the map.

📊 Charts Spotlight - Green Energy Jobs by Gender and Women's Upward Mobility in Green Energy.

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact economy - from climate tech to education and healthcare. Subscribe to Chart of the Day for data-driven insights on sustainable and inclusive growth.

The energy sector has experienced an unprecedented surge in growth over the last few years, with close to $1.8 trillion in funding invested in the sector in 2023. While the number of start-ups in this area has increased exponentially, particularly over the past three years, there remains a significant under representation of women in the clean energy sector. The gender gap is more or less even across both solar and wind in percentage terms, but is more evident in solar by virtue of there being 3x more jobs relative to wind.

According to a report by the International Renewable Energy Agency, the number of people employed in the global renewable energy sector was 12.7 million in 2023, a number that will grow rapidly as more countries increase their energy transition efforts. This would be an opportunity for governments to address systemic issues with female labor force participation.

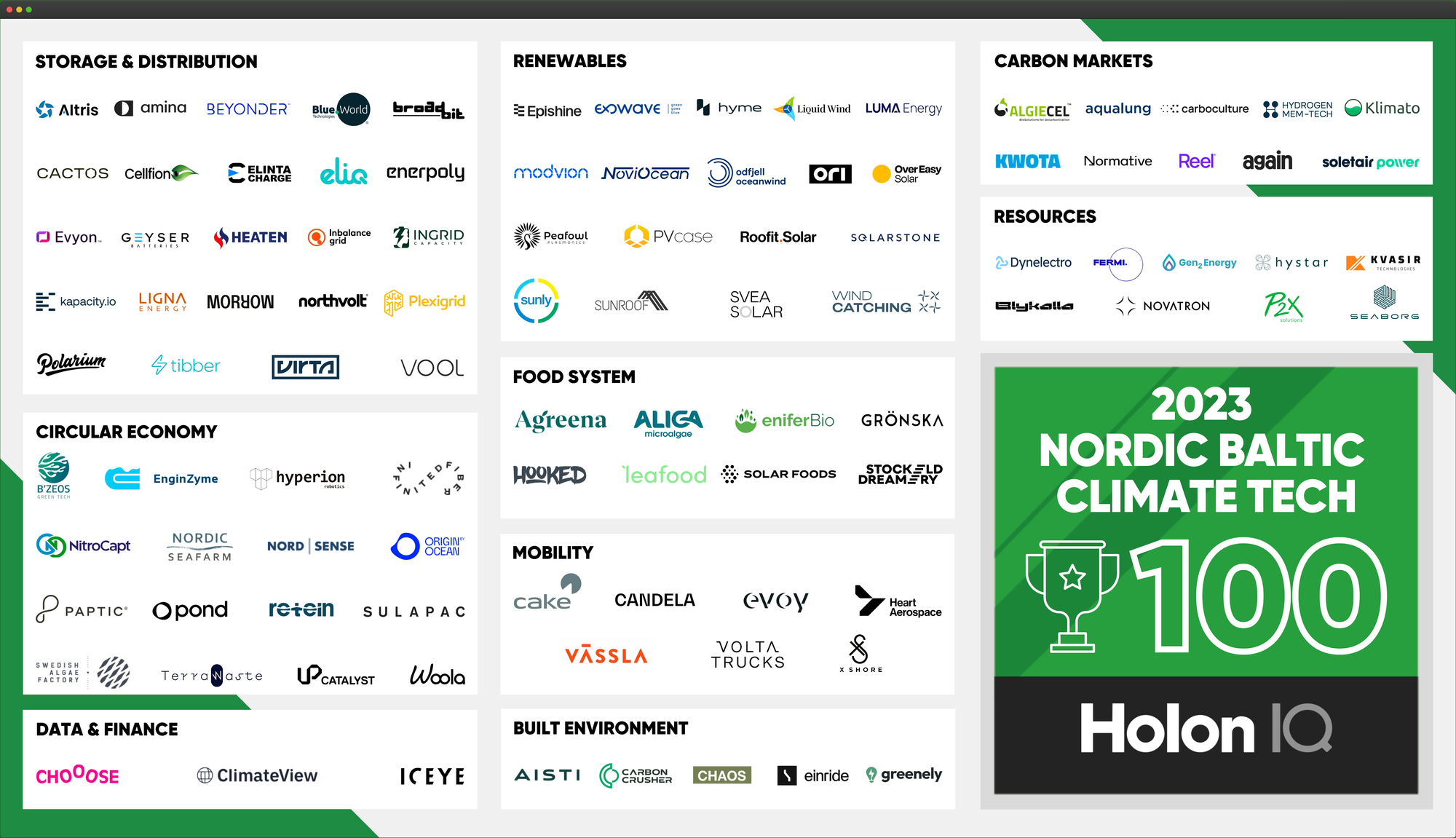

🏆 Nordic-Baltic Climate Tech 100

The Nordic-Baltic Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Similar to last year, the Nordic-Baltic Climate Tech 100 list encompasses almost all sectors and is represented across 90% of the subsectors. Nordic and European lists proved to be similar in terms of subsectors, although with minor differences, where the Nordic-Baltic Climate Tech 100 list was primarily led by Storage & Distribution and Renewables, closely followed by the Circular Economy Sector. Sweden and Finland jointly represented more than half of the list.

The cohort has seen positive funding news over the past several weeks. Northvolt, who is one of Europe's largest battery manufacturers raised $5 billion in the form of the largest green loan raised in Europe as it seeks to expand its battery factory in northern Sweden. Heart Aerospace, a Sweden-based hybrid-electric airplane maker, raised $107M in Series B funding.

🦄 2024 Global Climate Tech Unicorn List

In January, HolonIQ updated the Global Climate Tech Unicorn List for 2024, with 35 new companies joining the exclusive list of private companies valued at $1B or more. These companies, combined, are worth close to $320B.

January saw 2 companies join the exclusive $1B club.

🔋Qiyuan Green Power, a green energy solutions provider closed a $211.2m funding round to reach the unicorn valuation of over $1b.

🚌 Zum, a California-based modern student transportation provider raised $140 million in Series E funding, valuing the company at $1.3B.

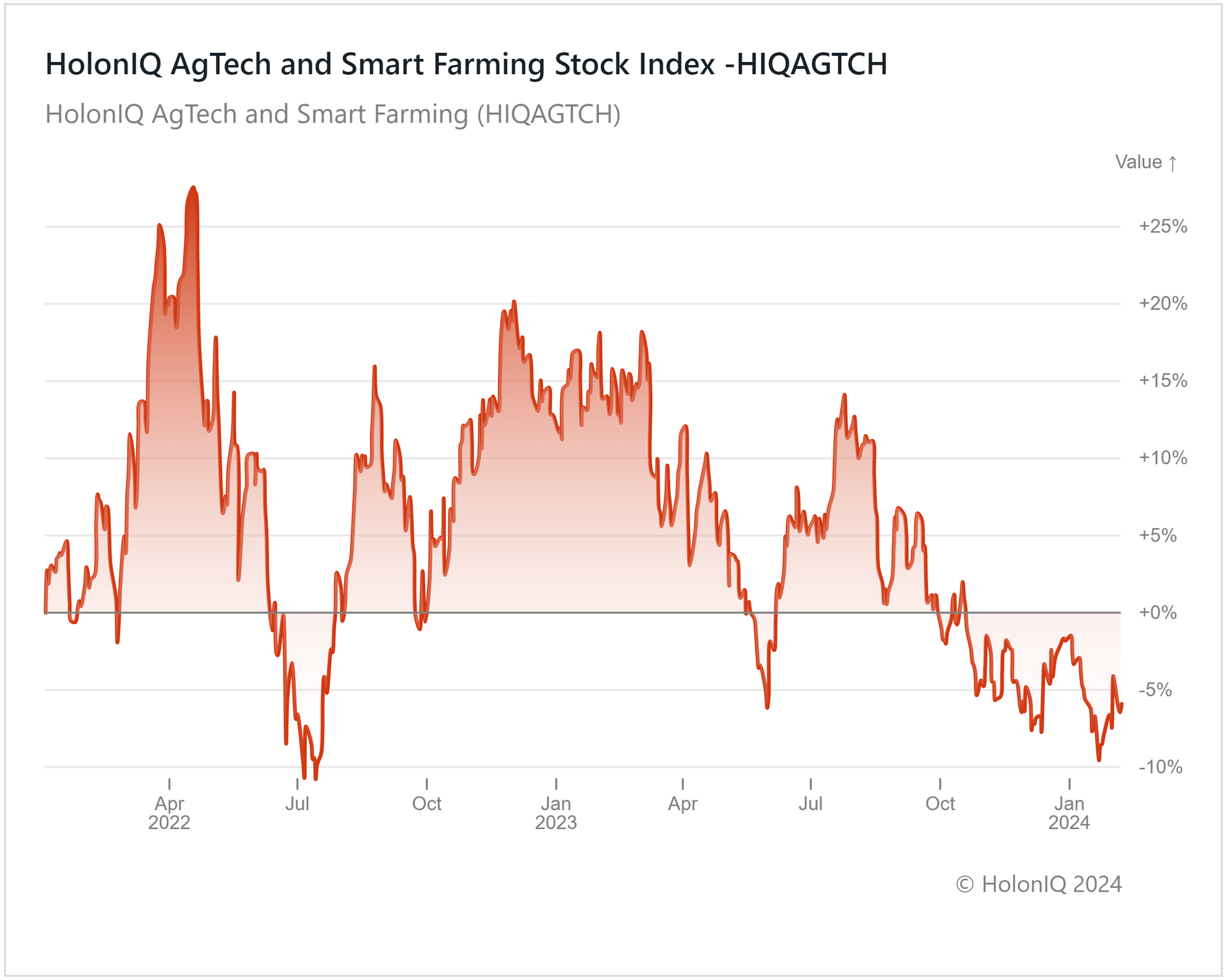

📈 Capital Markets - AgTech And Smart Farming Stock Volatility

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking education technology and healthcare innovation.

Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

An 18% decline over the past year was seen as global supply chain disruptions and the Russia-Ukraine conflict weighed on investor sentiment. The index, reflecting the cyclical nature of agriculture, has also acted as a barometer of economic worries in 2023. The short-lived recovery around mid-2023 can be linked to encouraging economic data releases from the US, a major catalyst for global growth. This, coupled with an outlook for falling steel and iron ore prices (vital for agricultural machinery companies), helped improve industry sentiment, but worries about 2024's economic prospects took root again in the third quarter.

Two firms that were once considered pioneers in the industry, AeroFarms, and Future Crops, were forced to shut down operations in 2023. Major stocks in the index such as Deere & Co. witnessed a year of declining volumes. Corteva Inc. another major constituent, also reported lower revenues in 4Q23 and saw its prices sink 13%. A rebound in global food demand and prices will likely help agribusiness stocks bounce back. However, the UN’s FAO Food Price Index saw a decline for the sixth consecutive month in January 2024, so whether a rise in price is on the cards for 2024 remains uncertain.

💰 Climate Tech Top Deals of the Week

HolonIQ actively monitors and tracks deals that take place in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

💰 Funding

🍔 Heura Foods, a Spanish plant-based meat company, raised a $43M Series B. The funds will fuel innovation, expand the patent portfolio, and drive global expansion.

🚗 River, an India-based electric vehicle (EV) start-up, raised a $40M Series B nationwide from Yamaha Motor to scale the distribution and service network nationwide and invest further in R&D.

🌱 ProducePay, a California-based AgTech finance platform, raised a $38M Series D from Syngenta Ventures to support the company’s expansion into Europe, Asia, Africa, and Australia.

🌍 Avnos, a California-based company developing novel Hybrid Direct Air Capture (HDAC) technology for carbon dioxide removal, raised a $36M Series A from NextEra Energy to expand HDAC™ technology.

🚗 Aptera Motors, a California-based solar EV developer, raised $33M in a crowdfunding round to support the initial production phases of its three-wheeled solar electric vehicle.

💼 M&A

⚡ Franklin Energy, a Wisconsin-based energy solutions company, acquired Snugg Home, a Colorado-based leading SaaS energy efficiency company.

❄️ Comfort Systems USA, a Texas-based national heating, ventilation, and cooling (HVAC) company, acquired J & S Mechanical Contractors, a Utah-based company that provides mechanical construction services.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com