📱 Telehealth + Southeast Asia Health Tech 50

In this week's Health Newsletter, we explore Telehealth, a field that has seen several new developments. We also look at funding news from promising startups in the Southeast Asia Health Tech 50 list, and top deals that took place this week.

Happy Monday 👋

This week we are exploring Telehealth which has seen many new developments. Don't forget to check out the 2024 Global Health Outlook, and sign up for our new Daily Newsletters - 'Chart of the Day' and 'Impact Capital Markets'. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 📱 Telehealth Landscape.

- 📊 2024 Global Health Tech Outlook.

- 🏆 Southeast Asia Health Tech 50. Most promising Health Tech's

- 📊 Charts Spotlight. Malaria Cases On The Decline

- 📈 Health Tech Capital Markets.

- 💰 Top Deals This Week.

📱 Telehealth Landscape

The Telehealth landscape has been filled with activity, with a diverse array of companies harnessing remote technologies to deliver cutting-edge healthcare solutions. Core telemedicine platforms offer digital structures for virtual consultations, diagnoses, and even treatments, democratizing access to care and elevating patient convenience.

This past week, the Telehealth field saw many developments. Vodaphone and eConsult Health joined forces to improve patient access to care in the UK. Apple's unveiling of the Vision Pro opens exciting new possibilities for Telehealth. Additionally, Cedars-Sinai's pioneering innovation employs the new Apple device for AI-powered therapy. These advancements prompted HolonIQ to delve deeper into this dynamic landscape this week.

HolonIQ is tracking hundreds of health companies in this area around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you. By region, revenue, age, category and more with sub categorization on any dimension in one click. Stay tuned for the launch!

HolonIQ Market Map - Telehealth

📊 2024 Global Health Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Health Technology. Just a few weeks ago, we launched the 2024 Global Health Tech Outlook, HolonIQ's annual analysis of the health landscape, presenting over 190 pages of detailed market data, investment & analysis, strategic shifts and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Climate Tech Outlook or Global Education Outlook.

We have a jam packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward thinking institutions, governments and organizations worldwide as they navigate the challenges and opportunities ahead. Purchase the Outlook or Download the Extract.

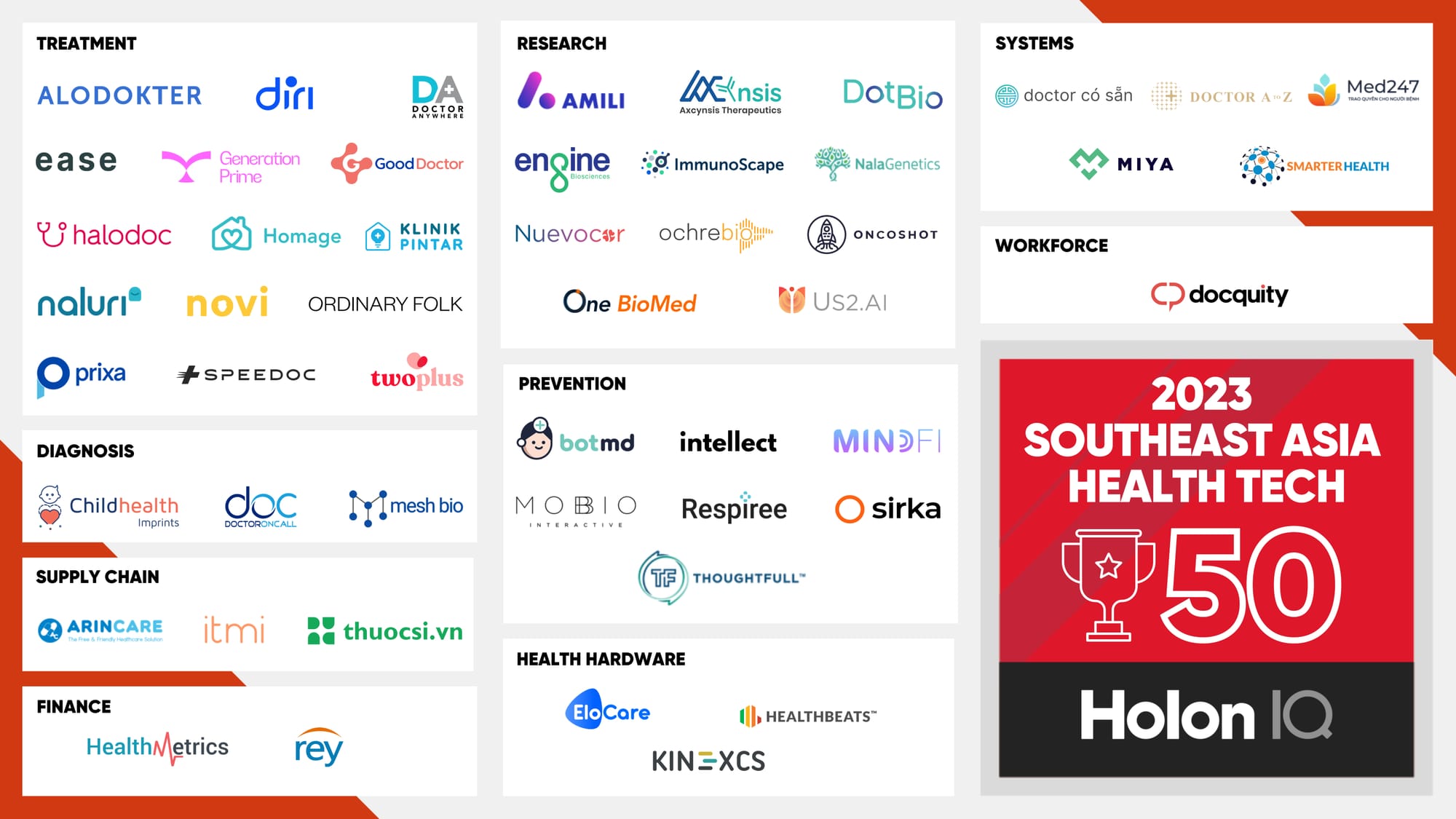

🏆 Southeast Asia Health Tech 50

The Southeast Asia Health Tech 50 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery and analytics.

The cohort has seen positive funding news over the past several weeks. Mesh Bio (a Singapore-based biotech firm) raised $3.5M in series A funding in January 2024. Klinik Pintar (an Indonesian hybrid health firm) raised $5M through a Series A round in December 2024. The 2023 cohort continue to form vital partnerships with global players to better advance their cause. Us2.ai formed a partnership with Duke University to develop AI tools that can provide early detection for heart conditions.

📊 Charts Spotlight - Malaria Cases On The Decline

Subscribe to HolonIQ's newsletter 'Chart of the Day,' providing a daily chart that helps explain the global impact economy - from education to healthcare and climate technology.

Southeast Asia presents a compelling case study in successful malaria control. Malaria incidents have plummeted 70% across the region between 2012 and 2021, showcasing the impact of sustained governmental efforts. This significant decline, in a region historically recording the second-highest global malaria burden, signifies positive momentum towards achieving broader control.

📈 Health Tech Capital Markets

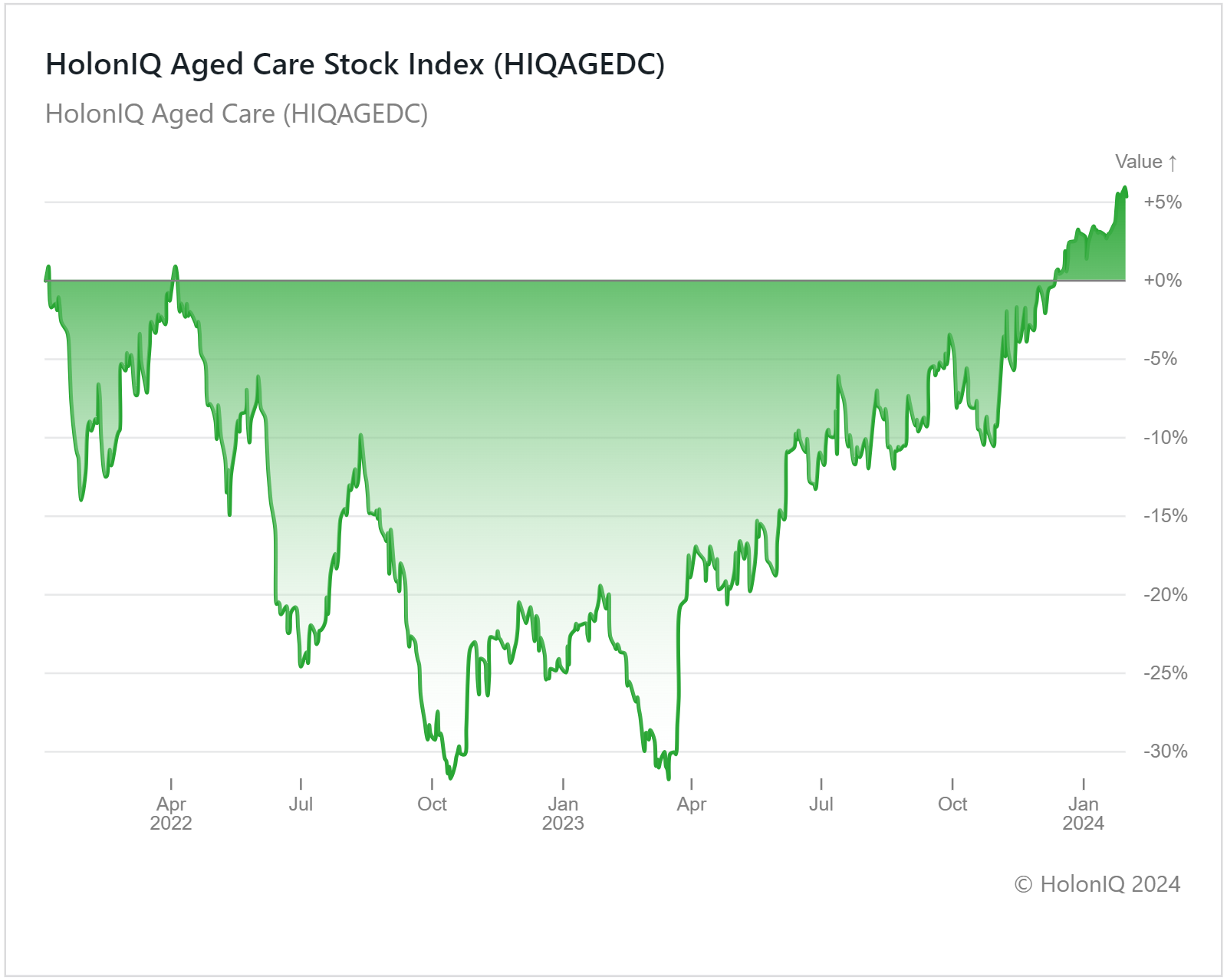

HolonIQ tracks thousands of listed health companies around the world and several acquisitions and investments each year. Soon we will launch a range of Stock Indices to track the daily performance of over 10 indices across Health Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

💰 Top Deals This Week

M&A

🩹 MorphoSys: plans to sell itself in two deals, with most assets handed to Novartis and one of its marketed medicines to Incyte. Novartis will acquire MorphoSys for $2.9B.

🏥 Tenet Healthcare: has sold three South Carolina hospitals to Novant Health for $2.4B, aiming to reduce leverage and improve financial stability. The deal also included affiliated physician practices. Tenet also sold four California hospitals to UCI Health for $975M.

💊 Zuellig Pharma: acquired Cialis and Alimta brands from Eli Lilly, encompassing several ASEAN territories. Zanovex has also been granted the manufacturing information license for these products.

IPOs

🏢 American Healthcare REIT: plans to raise $756M through an IPO on the New York Stock Exchange, offering 56 million shares at a $12-15 price range. The proceeds will be used to pay off $1.8B in outstanding debt.

🧠 Alto Neuroscience: raised $129M in its IPO, marking its third venture this year. The biotechnology company focuses on developing central nervous system drugs using biomarkers.

Funding

🩹 Scion Life Sciences: exceeded expectations and raised $310M. The firm is focused on promising medicines research and large-molecule development projects.

Closures This Week

🧬 NanoString Technologies: has initiated a Chapter 11 bankruptcy plan and is exploring a potential sale following a loss in a patent infringement case against 10X Genomics

⚕️ InVivo Therapeutics: filed for Chapter 11 bankruptcy protection in Delaware after failed clinical trials for its Neuro-Spinal Scaffold device treatment.

🏥 Cano Health: is set to delist its Class A common stock and suspend trading after filing voluntary relief petitions under Chapter 11 Bankruptcy.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com