🌴 Indonesia Stock Index Up 5%. $345M+ VC Funding.

Impact Capital Markets #110 looks at our Indonesia Stock Index, major impact deals, M&A, and upcoming economic releases.

Tashi delek 🏞️

Today's Global Economic Update: Germany's trade surplus was little changed, at EUR 22.1B in April compared to EUR 22.2B in March, coming in below forecasts. Exports increased 1.6%, while imports increased by 2.0%. Despite the growth in exports, a decline in industrial production in April points to a slow recovery in Germany's manufacturing sector.

☢️ Deal of the Day: ITM, a German radiopharmaceutical biotech company, raised $204.4M to develop its radiopharmaceutical pipeline.

What's New?

🌴 Indonesia. Indonesia stock index up 5%

💰 Funding. Biotech, pharmaceuticals, workforce management + more

💼 M&A. Health tech and health diagnostics

📅 Economics. Fed rate decision, BoJ interest rate, inflation, + more

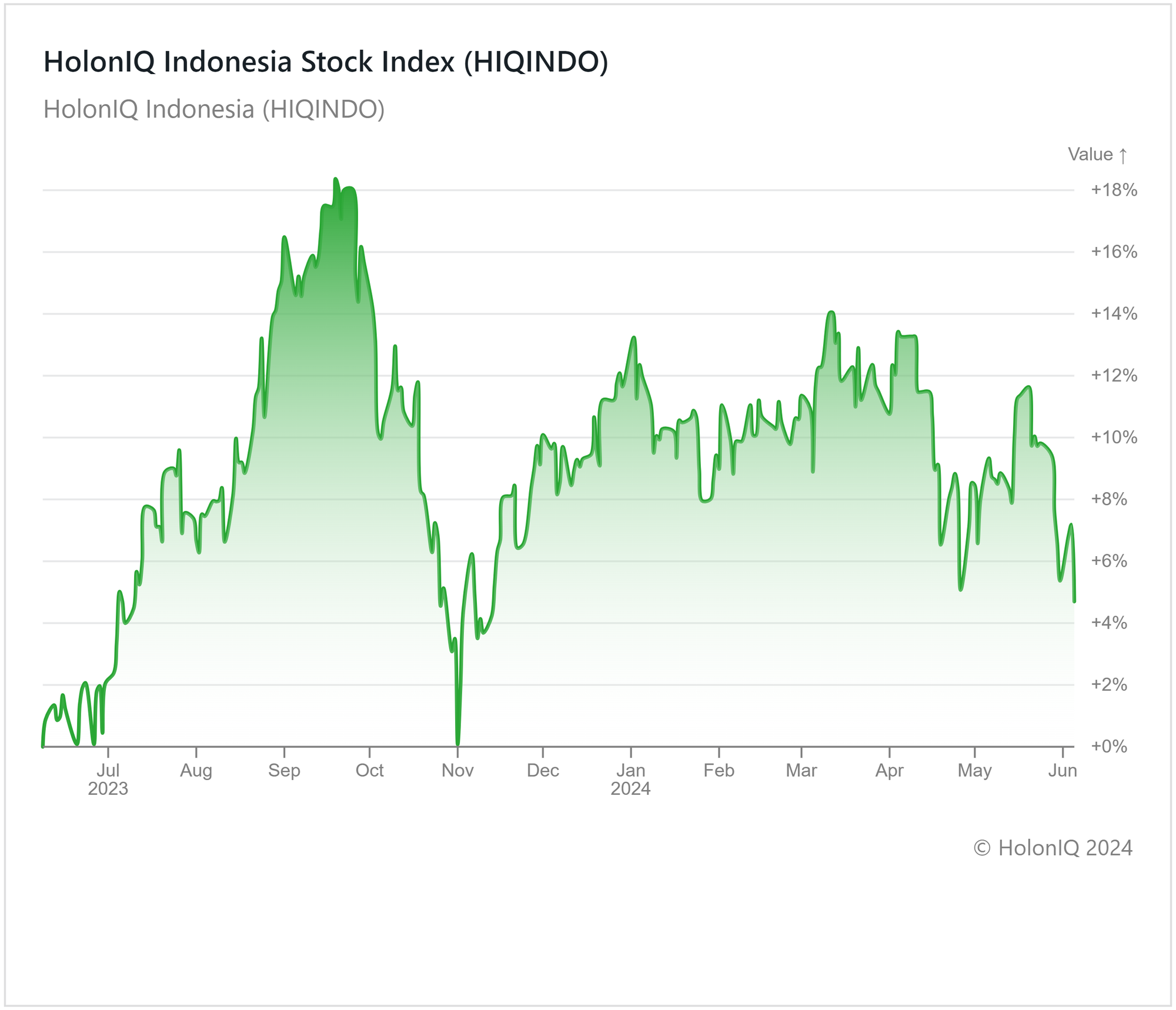

🌴 Indonesia Stock Index Up 5%

HolonIQ’s Indonesia Index has seen a 7% decrease over the past three months. Despite relatively stable inflation, an unexpected 25 bps interest rate hike in April aimed at stabilizing the Rupiah caused uncertainties, leading to a decline in stock prices, and negatively impacting the index. Geopolitical tensions, global economic changes, and lingering COVID-19 effects have weakened the Indonesian Rupiah to over 16,000 IDR per USD. Perry Warjiyo, Governor of Bank Indonesia, indicated that the currency is expected to stabilize within the range of 15,300 to 15,700 per dollar next year. Despite the challenges posed by high interest rates, potential stabilization of the currency and ongoing efforts to bolster Indonesia's commodities sector are expected to enhance investor confidence, likely leading to growth in the index in the future.

💰 Funding

☢️ ITM, a German radiopharmaceutical biotech company, raised $204.4M from Temasek to develop its radiopharmaceutical pipeline.

📊 Cube, a California-based universal data layer provider, raised $25M from Databricks Ventures to enhance its cloud with new AI features.

💼 Indico Data, a Massachusetts-based workforce management company, raised $19M from .406 ventures to expand operations and development efforts.

🪙 Fhenix, an Israeli confidential Ethereum solutions company, raised a $15M Series A from Hack VC to scale its operations.

💳 Fizz, a New York-based student payment solutions provider, raised a $14.4M Seed from Kleiner Perkins to expand its workforce.

💊 GPN Vaccines, an Australian pharmaceutical company, raised a $11.9M Series B from Forepont Capital Partners and Michael Gregg to develop new vaccines.

💼 M&A

🏥 Health Catalyst, a Utah-based health tech platform, acquired Carevive Systems, a Florida-based health tech company focusing on care management.

🔬 Premier Biotech, a Minnesota-based health and diagnostic company, acquired Desert Tox, an Arizona-based company providing mental health and substance abuse care.

📅 Economic Calendar

Fed Rate Decision, BoJ Interest Rate, Inflation, + More

Friday, June 7th 2024

🇩🇪 Germany Balance of Trade Data, April

🇨🇦 Canada Balance of Trade Data, April

🇨🇦 Canada Employment Data, May

🇺🇸 US Employment Data, May

Monday, June 10th 2024

🇦🇺 NAB Business Confidence, May

Tuesday, June 11th 2024

🇬🇧 UK Employment Data, April

🇨🇳 China Inflation Data, May

Wednesday, June 12th 2024

🇬🇧 UK GDP, April

🇺🇸 US Core Inflation Data, May

🇺🇸 US Inflation Data, May

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

🇺🇸 US Fed Press Conference

Thursday, June 13th 2024

🇺🇸 US PPI, May

Friday, June 14th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇺🇸 Michigan Consumer Sentiment (Preliminary), June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com