🌐 Digital Infrastructure Index Up 17%.$420M+ VC Funding.

Impact Capital Markets #58 looks at our Data Centers & Digital Infrastructure stock index, major impact deals, M&A, and upcoming economic releases.

Aloha 🌺

📉 Today's Global Economic Update: Germany's GfK Consumer Climate data forecasts a rise to -27.4 in April 2024 from -28.8 a month earlier, its highest level this year. The increase is driven by improvements in income expectations and economic prospects.

🧬 Deal of the Day: Avenzo Therapeutics, a clinical biotechnology company, raised a $150M Series A to support the development of its portfolio of oncology treatments.

What's New?

- 📊 Data Centers & Digital Infrastructure. Data centers & digital infrastructure index up 17%

- 💰 Funding. Biotechnology, digital ecosystem, smart machinery & more

- 💼 M&A. Air purification and education

- 📅 Economics. Inflation, US GDP, personal income & spending + more

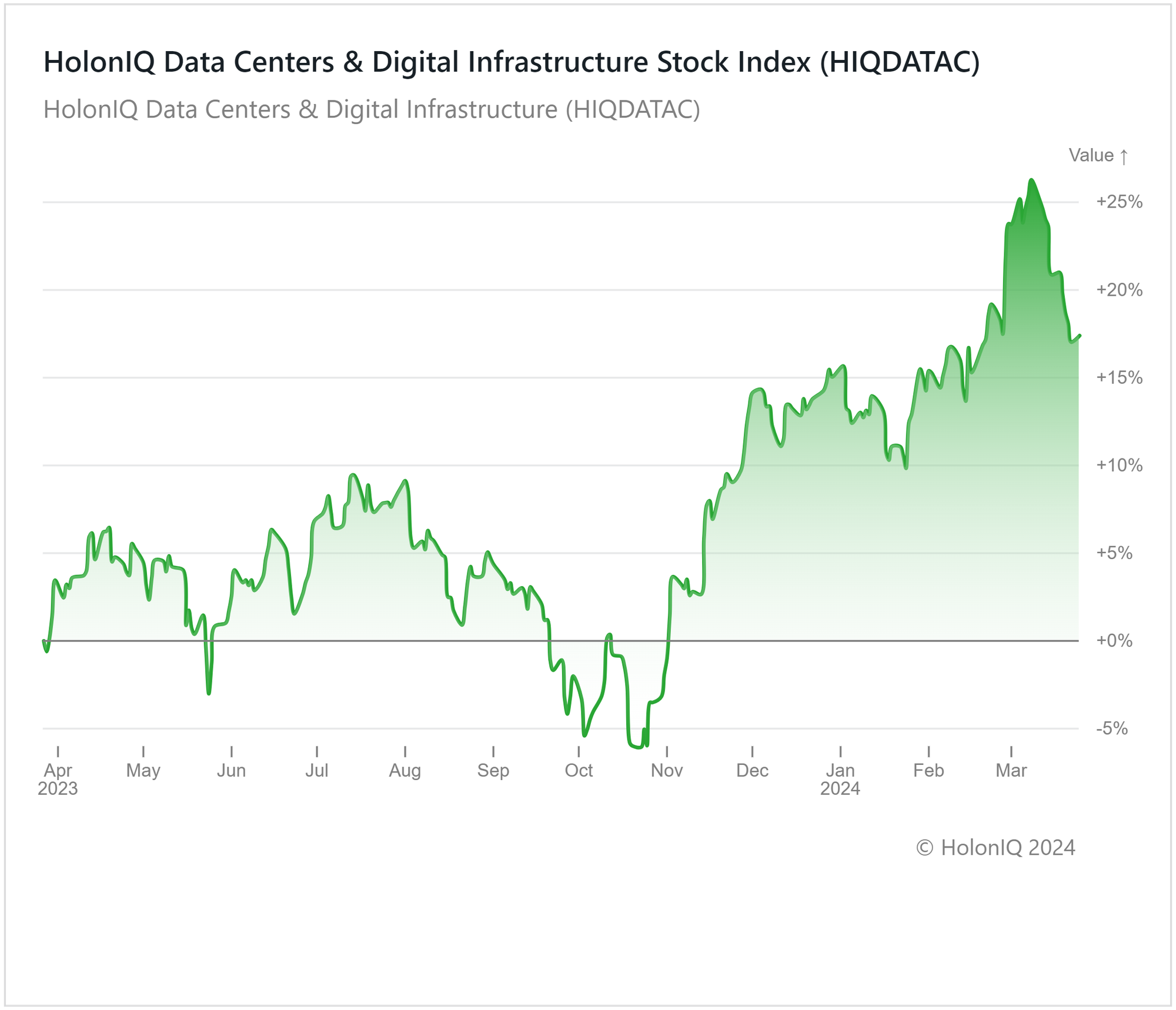

📊 Data Centers & Digital Infrastructure Up 17%

HolonIQ's Data Centers and Digital Infrastructure Index has increased by 17% over the past year. This growth reflects the escalating demand for IT services worldwide as businesses increasingly rely on digital technologies for their operations. Various industries are undergoing digital transformation beyond traditional IT domains, such as telecoms embracing network virtualization, manufacturing integrating IT with operational technology (OT), and retail shifting towards e-commerce and digital in-store experiences. Governments worldwide are enacting new laws to address concerns about data protection and sovereignty, leading to the establishment of local data centers to serve domestic markets. Incentives, tax breaks, and streamlined approval processes introduced by governments to boost the digital infrastructure industry are further propelling this growth.

Major stocks in the index, including Equinix, Inc. ($76B MCap) and Nextdc Ltd ($6B MCap), represent the ongoing trend in the digital infrastructure landscape, with YoY increases of 16% and 71% respectively.

💰 Funding

🧬 Avenzo Therapeutics, a California-based clinical biotechnology company, raised a $150M Series A to support the development of Avenzo's growing portfolio of oncology treatments, with a particular focus on advancing the lead candidate, AVZO-021.

🏡 PipeDreams, a California-based tech-powered home services provider, raised a $25.5M Series A from Canvas Ventures to expand their business.

🚀 TCab Tech, a Shanghai-based company creating a zero-emission airborne ridesharing app for the public, raised a $20M Series A to launch the air-taxi app within the Middle East region.

💉 Protembis, a German cardiovascular medical device start-up, raised a $32.5M Series B to support the enrolment of participants in its medical device trial.

🏥 Tonic app, a Portugal-based digital health startup, raised an $11.8M Series A to support the company's expansion into new areas and expand its senior team.

🌿 900.care, a French company that offers eco-friendly, refillable bathroom products, raised $22.7M from Lombard Odier to accelerate its product development.

🤖 Fieldguide, a California-based AI platform for advisory and audit services, raised a $30M Series B from Bessemer Venture Partners to add new features to its platform, such as fraud and forensic services.

🏥 Tennr, a NYC-based healthcare startup automating manual tasks, raised a $18M Series A from a16z to expand its team and scale operations.

🤖 Viam, a NYC-based tech platform for smart machinery, raised a $45M Series B from Union Square Ventures and Battery Ventures for commercial innovation and platform advancement.

💻 Uzum, a Uzbekistan-based digital services company, raised a $52M Series A from FinSight Ventures to assist in the development of the country's IT and logistics infrastructure.

💸 Zayzoon, an Arizona-based provider of Earned Wage Access (EWA) services for small to mid-sized enterprises, raised a $15M Series B from Viola Fintech to support its expansion.

🚌 Ember, a UK-based company specializing in electric bus networks, raised a $13.9M Series A to speed up the rollout of its electric bus service and improve its online services platform.

💼 M&A

🌺 Aroma360, a Florida-based expert in scent-based branding and marketing, acquired NextScent, which provides indoor air purification services.

🌍 Keystone Education Group, an Oslo-based company assisting students in discovering suitable educational paths, acquired Edunation, a company offering education and career services.

📅 Economic Calendar

Inflation, US GDP, Personal Income & Spending + More

Thursday, March 28th 2024

🇺🇸 US Core PCE Price Index Data, February

🇺🇸 US GDP Growth Data, Q4

Friday, March 29th 2024

🇫🇷 France Inflation Data (Preliminary), March

🇮🇹 Italy Inflation Data (Preliminary), March

🇺🇸 US Personal Income & Spending Data, February

Monday, April 1st 2024

🇯🇵 Japan Tankan Large Manufacturers Index, Q1

🇨🇳 China Caixin Manufacturing PMI, March

🇺🇸 US ISM Manufacturing PMI, March

Tuesday, April 2nd 2024

🇦🇺 Australia RBA Meeting Minutes

🇩🇪 Germany Inflation Data (Preliminary), March

🇺🇸 US JOLTs Job Openings, February

Wednesday, April 3rd 2024

🇪🇦 Euro Area Inflation Data, March

🇺🇸 US ISM Services PMI, March

Friday, April 5th 2024

🇦🇺 Australia Balance of Trade Data, February

🇨🇦 Canada Balance of Trade Data, February

🇨🇦 Canada Employment Data, March

🇺🇸 US Employment Data, March

🇨🇦 Canada Ivey PMI, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com