⚕️Health Diagnostics & Testing Up 4%. $870M+ VC Funding.

Impact Capital Markets #90 looks at our Health Diagnostics & Testing Stock Index, major impact deals, M&A, and upcoming economic releases.

Zdravo 🍷

📉 Today's Global Economic Update: The Bank of England decided to maintain its policy interest rate at 5.25% at yesterday's monetary policy meeting. As inflation cools, current market expectations are projecting a rate cut from the BoE sometime in the third quarter of this year.

🧬 Deal of the Day: Zenas BioPharma, a biopharmaceutical company, raised a $200M Series C to advance its ongoing clinical trials.

What's New?

⚕️Health Diagnostics & Testing. Health diagnostics & testing recovers from April dip

💰 Funding. Biopharmaceutical, green hydrogen, medical device + more

💼 M&A. Cubic acquires Reg-Room

📅 Economics. US inflation, balance of trade, retail sales + more

⚕️Health Diagnostics & Testing Recovers From April Dip

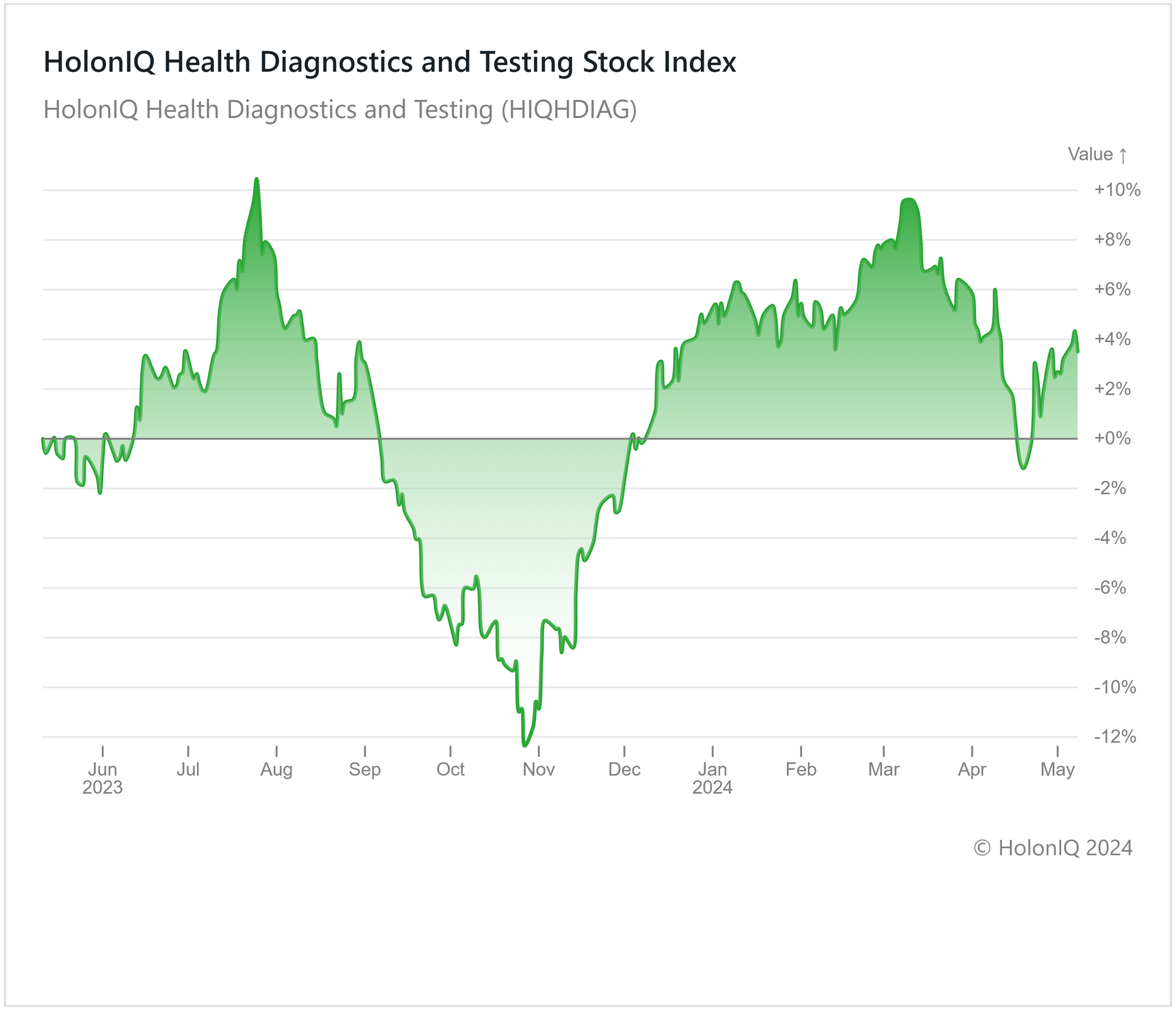

HolonIQ’s Health Diagnostics and Testing Index recorded a growth of 4% rise over the past year. The index dipped in November as Thermo Fisher ($220B MCap) cut its profit outlook on slowing demand and loss of Covid-related sales, impacting other stocks in the sector as well. The index has recovered since then as long-term prospects remain intact, with 6M performance showing a strong 12% return.

Over the last three months, the index has registered a decline of 1% with the dip in mid-April aligning with earnings results announcements, which were generally below expectations. Roche Holding AG ($198 B MCap) experienced a 5% decline attributed to challenges in overcoming a decline in COVID-19 product demand and a drop in sales of established cancer drugs. Abbott Laboratories ($182 B MCap), despite surpassing profit estimates driven by strong medical device sales, made a slight downward revision to the current quarter’s EPS estimate due to the continuing decline in COVID-related products. Overall annual guidance remains unchanged.

Industry-wide challenges, such as supply chain disruptions exacerbated by the pandemic, have contributed to a downturn over the last two years. The declining demand for COVID-related products and services is continuing to affect industry performance, although the impact of this is now waning. Looking ahead, the diagnostic testing market is set to advance with the increasing adoption of decentralized testing and integration of artificial intelligence (AI), promising more accessible and efficient testing methods. These trends signify a shift towards streamlined and effective diagnostic processes, driven by AI-driven algorithms enhancing accuracy and convenience.

💰 Funding

🧬 Zenas BioPharma, a Massachusetts-based biopharmaceutical company, raised a $200M Series C to advance its ongoing clinical trials.

💊 Bluejay Therapeutics, a California-based biopharmaceutical company, raised a $182M Series C from Frazier Life Sciences to accelerate its ongoing clinical developments.

⚡ Hysata, an Australian green hydrogen company, raised a $111M Series B from bp Ventures and Templewater to expand production capacity.

🔬 Attovia Therapeutics, a California-based biotherapeutics company, raised a $105M Series B from Goldman Sachs Asset Management to advance Attovia’s lead programs through initial clinical readouts.

💉 R3 Vascular, a California-based medical device company, raised a $87M Series B from Deerfield Management to support R&D, regulatory submissions, manufacturing scale-up, and commercialization.

💊 Aardvark Therapeutics, a California-based obesity-focused therapeutics, raised a $85M Series C from Decheng Capital to advance its pipeline.

🔋 Li Industries, a Virginia-based lithium-ion battery recycling technology, raised a $36M Series B from Bosch Ventures to scale up its next-generation lithium-ion battery recycling technologies.

🌾 ArkeaBio, a Massachusetts-based agricultural biotech startup, raised a $26.5M Series A from Breakthrough Energy Ventures to support vaccine research.

🏥 Sift Healthcare, a Wisconsin-based healthcare payment analytics company, raised a $20M Series B from B Capital to focus on team expansion.

💼 M&A

📊 Cube, a UK-based FP&A platform, acquired Reg-Room, a New York-based regulatory intelligence for finance.

📅 Economic Calendar

US Inflation, Balance of Trade, Retail Sales + more

Friday, May 10th 2024

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Tuesday, May 14th 2024

🇬🇧 UK Employment Data, March

🇩🇪 Germany ZEW Economic Sentiment Index, May

🇺🇸 US PPI, April

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com