☢️ Uranium Index up 12%. $200M+ VC Funding.

Impact Capital Markets #89 looks at our Uranium stock index, major impact deals, M&A, and upcoming economic releases.

Marhaba 🐪

📉 Today's Global Economic Update: In May, the Reserve Bank of Australia decided to keep its base interest rate at 4.35%, staying consistent with previous decisions. They emphasized the importance of closely watching global economic trends, local demand, inflation, and job market conditions, while also maintaining interest rates on Exchange Settlement balances at 4.25%.

📊 Deal of the Day: Atlan, a data and AI governance company, raised a $105M Series C to expand its platform's capabilities.

What's New?

☢️ Uranium. Uranium index up 12%

💰 Funding. AI, ecosystem, satellite services + more

💼 M&A. Clinical research, medical equipment supplier, health care + more

📅 Economics. UK GDP data, US inflation, balance of trade + more

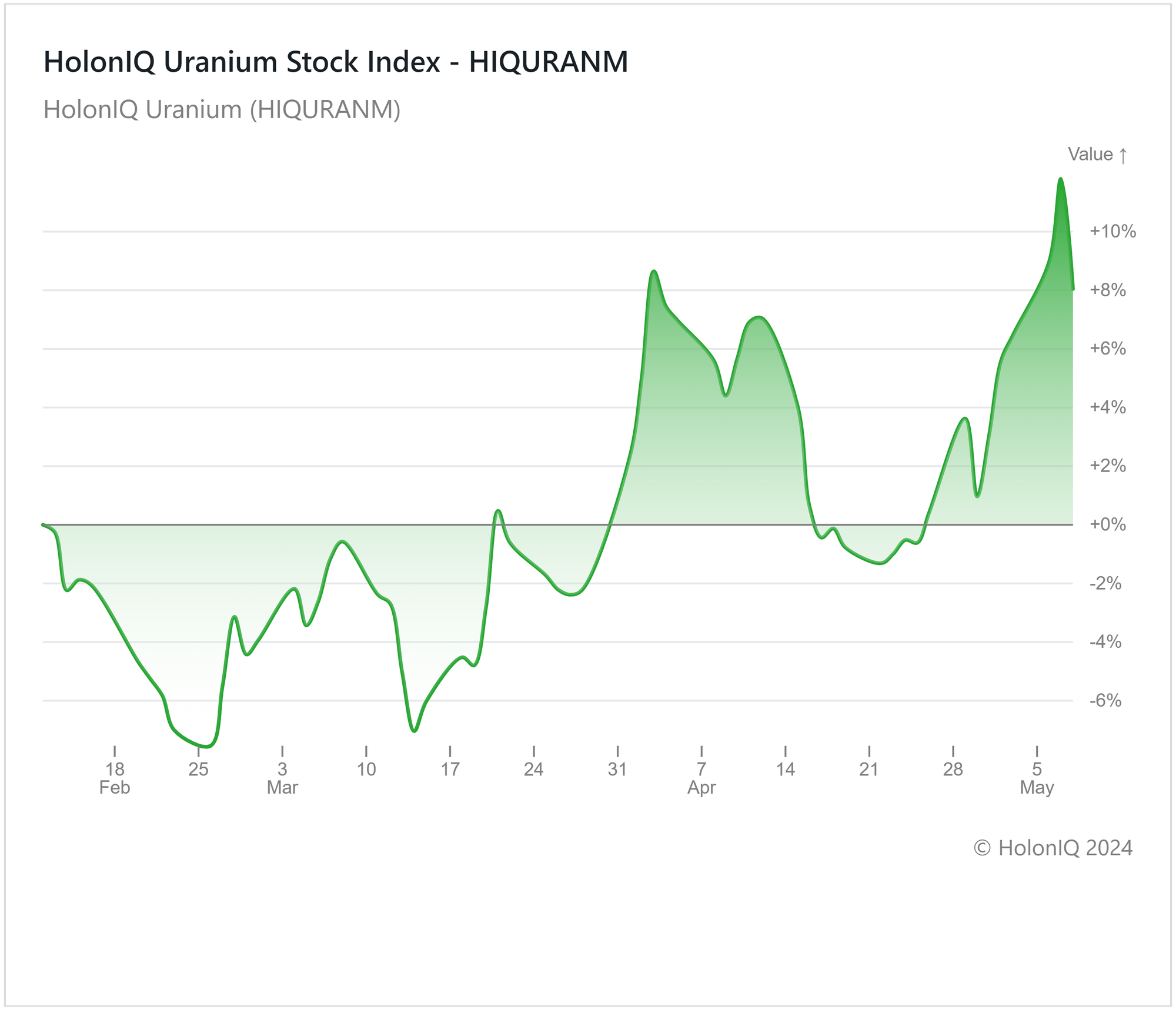

☢️ Uranium Index Up 12%

HolonIQ’s uranium index has shown substantial growth over the past year, recording 90%, 35%, and 12% for the past 12M, 6M, and 3M periods, respectively. On April 30th, the U.S. Senate voted to approve legislation that bans the import of enriched uranium from Russia, effectively opening up 25% of the country's supply to domestic suppliers. Following this announcement, uranium mining stocks such as NexGen Energy, Uranium Energy, and Cameco rallied in pre-market trading. In Europe, the EU parliament formally recognized the role of nuclear energy towards achieving climate goals, which potentially opens up additional future demand for uranium fuel. During COP28 in December, 22 countries pledged to triple nuclear energy production by 2050, & about 30 countries are now considering, planning, or starting nuclear power programs, including Bangladesh, Egypt, and Turkey, which are constructing their first nuclear power plants, adding to future uranium demand.

Key stocks within the index, such as Cameco ($21B MCap) & NexGen Energy have shown 3M returns of 29% and 13%, respectively. Kazatomprom’s ($11B MCap) has registered YoY returns of 47%. Recently, Kazatomprom announced a reduction in uranium output to 80% due to construction delays and sulfuric acid shortages. They produce roughly 20% of the world's uranium. This reduction could lead to further shortages and an increase in uranium prices. Cameco's acquisition of 49% of Westinghouse last November, a nuclear service giant worth $7 billion, will boost Cameco's role in the nuclear fuel cycle as well. Given the limited supply, estimated to be 20% less than demand from western nations, the competitive market environment, and rising demand, the index is anticipated to experience continuous positive growth.

💰 Funding

📊 Atlan, a California-based data and AI governance company, raised a $105M Series C from GIC to expand its platform's capabilities.

📝 Sesame, a Spanish human resource management company, raised $24.8M from GP Bullhound funds to enhance its software and expand globally.

🔬 Insempra, a German bio-based product company, raised a $20M Series A to advance biological manufacturing processes.

🚀 Xona Space Systems, a California-based firm satellite services provider for intelligent systems, raised a $19M Series A from Future Ventures and Seraphim Space to speed up their Low Earth Orbit (LEO) satellite network for commercialization.

🌱 Dendra Systems, a UK-based ecosystem restoration platform, raised a $15.76M Series B from Zouk Capital to promote global ecosystem restoration initiatives.

💰 Panax, a New York-based AI cash flow management company, raised $15M to grow sales and support teams.

💻 Optix, a Chinese XR tech startup, raised $15M from Primavera Venture Partners to scale its operations.

💼 M&A

🔍 American Clinical Research Services (ACRS), a Texas-based clinical research company, acquired Elixia, a Florida-based clinical research network.

💉 SG Homecare, a California-based medical equipment supplier, acquired Western Drug, a California-based medical equipment firm.

⚕️ Samsung Medision, a South Korean healthcare company, acquired Sonio for $92.4M, an AI-based healthcare platform.

📅 Economic Calendar

UK GDP Data, US Inflation, Balance of Trade + more

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Tuesday, May 14th 2024

🇬🇧 UK Employment Data, March

🇩🇪 Germany ZEW Economic Sentiment Index, May

🇺🇸 US PPI, April

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com