💰 China Energy Rebounds 9%. Glean Raises $200M.

Impact Capital Markets #38 looks at our China Energy stock index, major impact deals, M&A, and upcoming economic releases.

Lumela🌾

📉 Today's Global Economic Update: US Durable Goods Orders for January 2024, indicated a 6.1% monthly drop, the largest fall in almost 4 years. The drop was primarily attributed to a 16.2% reduction in orders for transportation equipment.

🤖 Deal of the Day: Glean, an AI-powered work assistant provider, raised $200M in a Series D funding round to support growth efforts.

What's New?

- 🔋 China Energy. China's energy index rebounds to 9%

- 💰 Funding. AI work assistant, logistics, biotech & more

- 💼 M&A. Health tech company Veradigm to acquire ScienceIO

- 📅 Economics. Europe inflation data, balance of trade, US GDP + more

For unlimited access to more deals and economic updates, request a demo

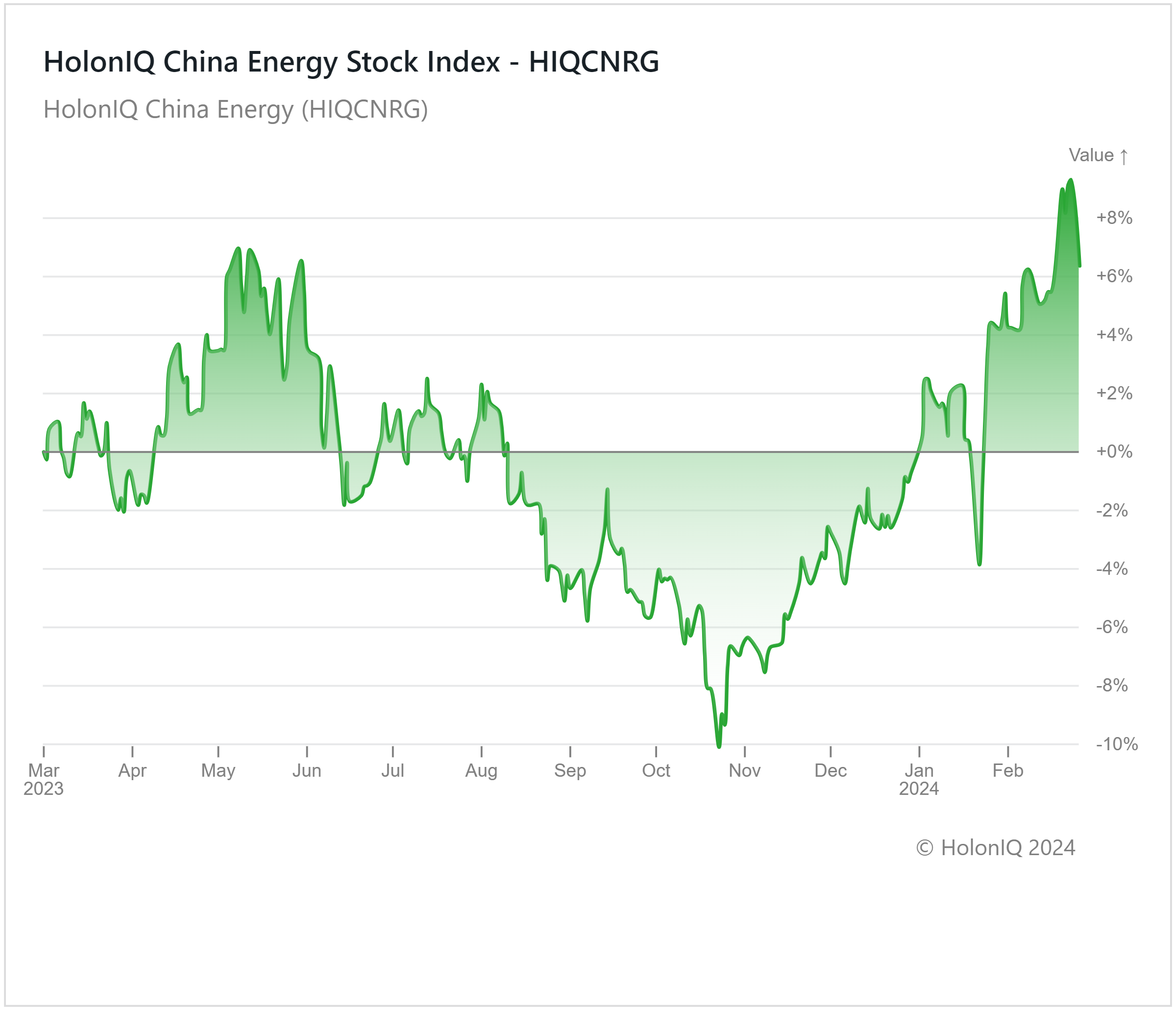

🔋 China's Energy Index Rebounds to 9%

HolonIQ’s China Energy Index has rebounded to a 9% growth in February after registering a 10% decline in 4Q23. Major stocks in the index rose, with China Yangtze Power ($84B MCap) gaining 14%, CGN Power Co. ($23B MCap) 34%, and Huaneng Lancang River Hydropower ($23B MCap) 26%. China Three Gorges Renewables ($18B MCap) was an exception, recording a -21% return.

Despite China’s economic woes, its clean energy sector, which accounted for 40% of China’s GDP growth in 2023, is experiencing rapid growth. While spending in other areas shrank, clean-energy investment rose 40% YoY, with solar power, EVs, and batteries receiving the most focus. The shift towards renewable energy is not just a part of China’s energy and climate efforts but also its broader industrial policy due to its competitive advantages in the renewable sector.

Overcapacity poses a major challenge in the domestic sector, alongside concerns about potential resistance in China's export markets for renewable energy to protect local manufacturers. Ongoing discussions on raising US tariffs on Chinese EVs and an EU anti-subsidy investigation into imported battery electric vehicles add to the risks. The growing supply of electric machinery, a significant investment driver, exceeds domestic demand, potentially hurting players in China's energy industry and risking a reversal in investment commitments.

💰 Funding

🤖 Glean, a California-based AI-powered work assistant provider, raised a $200M Series D from Kleiner Perkins and Lightspeed Venture Partners to accelerate growth.

🚚 Shadowfax, a logistic network in India, raised a $100M Series E from TPG to expand instant delivery services.

🌊 Unseenlabs, a French maritime surveillance company, raised a $92M Series C from Supernova Invest & ISALT to accelerate technological innovations.

🧬 Curve Therapeutics, a UK-based biotechnology company, raised a $51.3M Series A from Pfizer Ventures to enhance its clinical development efforts.

🏥 Aktiia, a Swiss producer of blood pressure monitoring devices, raised a $30M Series A from Redalpine to speed up product development.

🌱 Vegetarian Express, a vegetarian & vegan food service distributor in the UK, raised $19M from NVM Private Equity to expand services into Ireland.

💊 Pelage Pharmaceuticals, a California-based biotechnology company, raised $16.75M Series A from Google Ventures to advance treatment for alopecia.

💼 M&A

🏥 Veradigm, an Illinois-based healthcare IT solutions provider is to acquire ScienceIO, a healthcare language model company.

📅 Economic Calendar

Europe Inflation Data, Balance of Trade, US GDP Growth Data + More

Wednesday, February 28th 2024

Thursday, February 29th 2024

🇫🇷 France Inflation Data (Preliminary), February

🇮🇳 India GDP Data, Q4

🇩🇪 Germany Inflation Data (Preliminary), February

🇨🇦 Canada GDP Data, Q4

🇺🇸 US Core PCE Price Index Data, January

🇺🇸 US Personal Income & Spending Data, January

Friday, March 01st 2024

🇨🇳 China NBS & Caixin Manufacturing PMI (Preliminary), February

🇯🇵 Japan Consumer Confidence, February

🇪🇦 Euro Area Inflation Data (Flash), February

🇮🇹 Italy GDP Data, 2024

🇮🇹 Italy Inflation Data (Preliminary), February

🇮🇹 Italy Government Budget, 2023

🇺🇸 US ISM Manufacturing PMI (Preliminary), February

Tuesday, March 5th 2024

🇺🇸 US ISM Services PMI, February

Wednesday, March 6th 2024

🇦🇺 Australia GDP Growth Data, Q4

🇩🇪 Germany Balance of Trade, January

🇨🇦 Canada BoC Interest Rate Decision

🇨🇦 Canada Ivey PMI, February

🇺🇸 US JOLTs Job Openings, January

Thursday, March 7th 2024

🇦🇺 Australia Balance of Trade, January

🇨🇳 China Balance of Trade, Jan-Feb

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇨🇦 Canada Balance of Trade, January

🇪🇦 Euro Area ECB Press Conference

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

🇺🇸 US Unemployment Data, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com