♻️ Waste & Recycling Index Up 23%. $110M+ VC Funding.

Impact Capital Markets #37 looks at our Waste and Recycling stock index, major impact deals, M&A, and upcoming economic releases.

Sannu🌿

📉 Today's Global Economic Update: Japan's inflation rate fell to 2.2% in January 2024 from 2.6% in February, marking its lowest level since March 2022. The latest data is raising speculation that Japan could be ending its negative interest rates in the coming months.

🏥 Deal of the Day: b.well Connected Health raised $40M in Series A funding to expand its operations.

What's New?

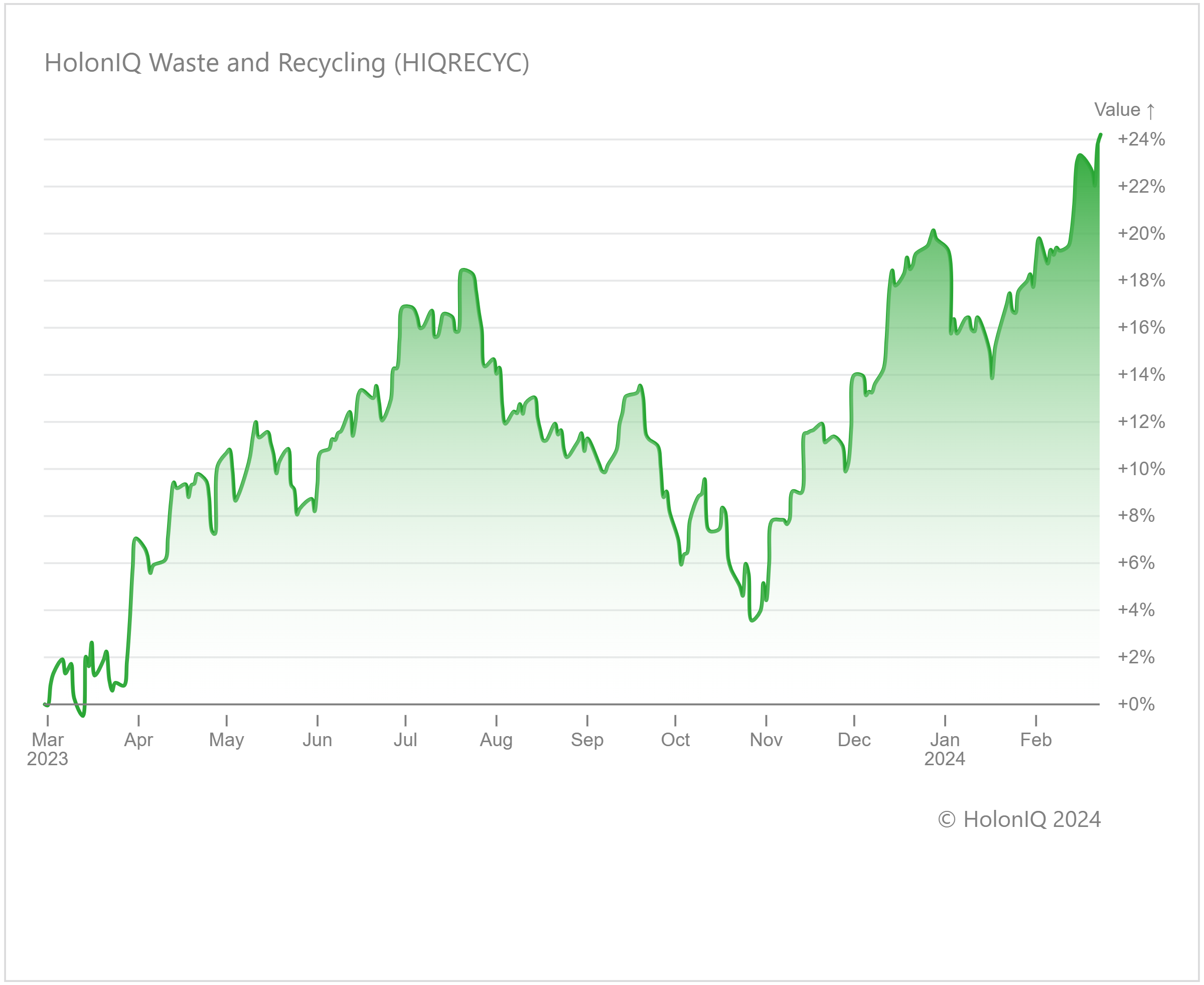

- ♻️ Waste and Recycling. Waste and recycling index up 23%

- 💰 Funding. Healthcare ecosystems, vaccines, clinical trials & more

- 💼 M&A. Atena Equity acquires 51% of Redshift Group

- 📅 Economics. Europe inflation data, US GDP, balance of trade + more

For unlimited access to more deals and economic updates, request a demo

♻️ Waste and Recycling Index Up 23%

HolonIQ’s Waste and Recycling Index has risen by 23% over the last year. Major stocks in the index have seen significant increases, with Waste Management, Inc. (MCap: $84B) increasing by 38%, Republic Services Inc. (MCap: $58B) by 43%, and Waste Connections, Inc. (MCap: $44B) by 25%. The market is experiencing a positive push due to heightened government regulations on waste management, growing consumer consciousness about environmental preservation, and the adoption of smart waste technology. Technologies like smart sensors, AI-enabled cameras, and hyperspectral cameras are expediting automated waste sorting, presenting growth opportunities for the industry. As industrialization and commercial activities increase, the need for waste management is also on the rise.

Despite the positive momentum, challenges include substantial capital investment, limited disposal infrastructure in emerging markets, and high costs related to recycling electronic devices. Nevertheless, ongoing technological advancements are driving innovative solutions, and the industry is expected to maintain its positive momentum.

💰 Funding

🏥 b.well Connected Health, a Maryland-based company providing platform-based healthcare ecosystems, raised a $40M Series A from Leavitt Equity Partners to expand operations and business reach.

💉 Baseimmune, a UK-based biotech startup integrating AI into vaccine development, raised a $11M Series A from Merck Global Health Innovation Fund & IQ Capital to accelerate the development of vaccines for swine fever, coronavirus, and malaria.

🔬 Power, a California-based marketplace for active clinical trials, raised a $12M Series A from Kin Ventures and Contrary to expand operations.

🏋️♂️ Cult.fit, an India-based health and fitness company, raised a $10M Series F from Valecha Investments to support its growth and operations.

👨💼 Interview Kickstart, a California-based online professional development platform, raised $10M from Blume Ventures to support its global expansion.

🧬 CellVoyant, a UK-based biotechnology company creating stem cell-based therapies, raised a $9.6M Seed from Octopus Ventures to scale its business.

💼 M&A

🔒 Atena Equity Partners, a Portugal-based private equity firm, acquired a 51% stake in the Redshift Group, a cybersecurity and information technology specialist in Portugal.

📅 Economic Calendar

Europe Inflation Data, Balance of Trade, US GDP + More

Tuesday, February 27th 2024

🇺🇸 US Durable Goods Orders Data, January

Wednesday, February 28th 2024

Thursday, February 29th 2024

🇫🇷 France Inflation Data (Preliminary), February

🇮🇳 India GDP Data, Q4

🇩🇪 Germany Inflation Data (Preliminary), February

🇨🇦 Canada GDP Data, Q4

🇺🇸 US Core PCE Price Index Data, January

🇺🇸 US Personal Income & Spending Data, January

Friday, March 01st 2024

🇨🇳 China NBS & Caixin Manufacturing PMI (Preliminary), February

🇯🇵 Japan Consumer Confidence, February

🇪🇦 Euro Area Inflation Data (Flash), February

🇮🇹 Italy GDP Data, 2024

🇮🇹 Italy Inflation Data (Preliminary), February

🇮🇹 Italy Government Budget, 2023

🇺🇸 US ISM Manufacturing PMI (Preliminary), February

Tuesday, March 5th 2024

🇺🇸 US ISM Services PMI, February

Wednesday, March 6th 2024

🇦🇺 Australia GDP Growth Data, Q4

🇩🇪 Germany Balance of Trade, January

🇨🇦 Canada BoC Interest Rate Decision

🇨🇦 Canada Ivey PMI, February

🇺🇸 US JOLTs Job Openings, January

Thursday, March 7th 2024

🇦🇺 Australia Balance of Trade, January

🇨🇳 China Balance of Trade, Jan-Feb

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇨🇦 Canada Balance of Trade, January

🇪🇦 Euro Area ECB Press Conference

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

🇺🇸 US Unemployment Data, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com