🌬️ Wind Index Declines 1%. $80M+ VC Funding.

Impact Capital Markets #76 looks at our Wind stock index, major impact deals, M&A, and upcoming economic releases.

Merhaba ☕

📉 Today's Global Economic Update: Retail sales in the UK remained flat in March 2024, failing to meet market expectations, despite a modest rise of 0.1% in February. Declines in food and non-store retailers offset notable increases in automotive fuel and non-food stores.

🔒 Deal of the Day: Anvilogic, a Security Information and Event Management (SIEM) provider raised a $45M Series C to expand its generative AI features.

What's New?

🌬️ Wind. Wind index declines 1%

💰 Funding. Security intelligence and revenue solutions

💼 M&A. Heating services & AI analytics

📅 Economics. US GDP Data, Japan inflation, retail sales, balance of trade + more

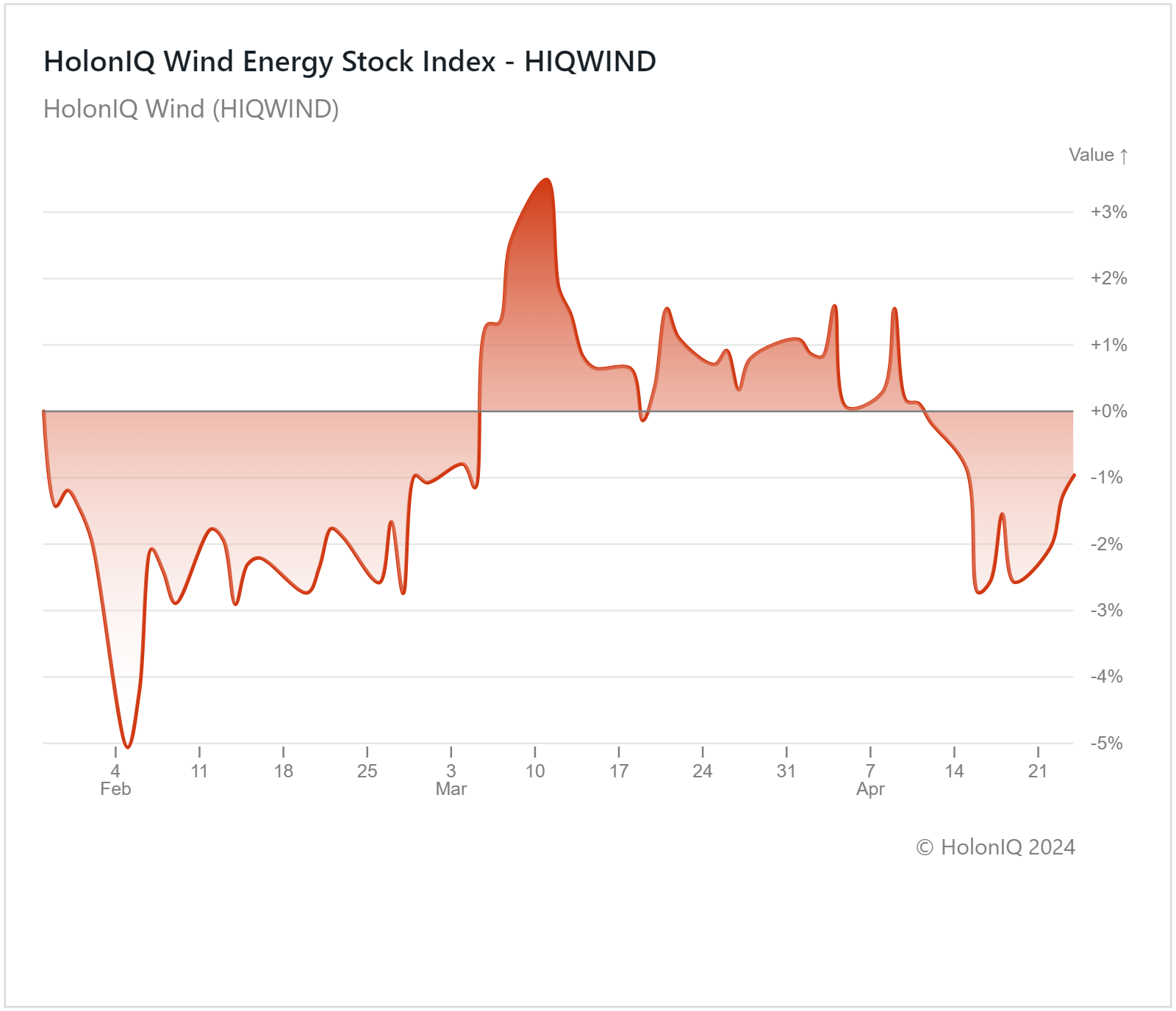

🌬️ Wind Index Declines 1%

HolonIQ’s Wind Index showed a decrease of 1% in the last three months. Wind project developers faced a turbulent 2023, as high interest rates resulted in project costs rising substantially, and companies like BP ($23B MCap) and Equinor ($82B MCap) had to write down approximately $2B+ in impairments. Elevated interest rates make it tougher for these projects to obtain funding, while inflation drives up operational expenses. These factors resulted in Vestas Wind Systems A/S ($25B MCap), Iberdrola SA ($77B MCap), and China Longyuan Power Group Corp. Ltd ($15B MCap) experiencing declines of 8%, 33%, and 7% respectively.

However, the index is positioned for potential growth as markets normalize and the economic fluctuations recede. In Q4 of 2023, orders recorded an increase of 2.5% and 12% YoY for the full year. China ordered approximately 100 GW in 2023, the largest annual order intake on record, while Western markets witnessed a record-breaking 55 GW in 2023. Propelled by conducive policies passed in 2023, such as the European Wind Power Action Plan, the UK's eased planning rules for onshore wind projects, and Germany’s 12-point action plan to expand onshore wind capacity to 157 GW by 2035, the industry is positioned for significant growth.

💰 Funding

🔒 Anvilogic, a California-based provider of a Security Information and Event Management platform, raised a $45M Series C from Evolution Equity Partners to expand its generative AI features.

🤖 Xfactor.io, a California-based developer of a corporate decision platform that uses AI to assist with strategy planning, raised a $16M Series A from Mike Carpenter to enhance its product.

🔍 VulnCheck, a Massachusetts-based cyber intelligence platform that delivers threat intelligence services to government organizations, raised a $7.9M Seed from Sorenson Capital to accelerate product innovation.

💼 M&A

❄️ Sila, a Pennsylvania-based home service company, acquired T-Mark Plumbing, Heating, Cooling & Electric (HVAC), a New York-based company offering plumbing, HVAC, and electrical services.

🏥 ABOUT, a Minnesota-based medical transfer technology company, acquired Edgility Inc., a Florida-based real-time AI analytics platform for operations management.

📅 Economic Calendar

US GDP Data, Japan Interest Rate, Balance of Trade + More

Tuesday, April 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), April

🇦🇺 Australia Inflation Data, Q1

Wednesday, April 24th 2024

🇩🇪 Germany Ifo Business Climate Index, April

🇺🇸 US Durable Goods Orders Data, March

Thursday, April 25th 2024

🇩🇪 Germany GfK Consumer Confidence Index, May

🇺🇸 US GDP Growth Data, Q1

🇯🇵 Japan BoJ Interest Rate Decision

Friday, April 26th 2024

🇺🇸 US Core PCE Price Index, March

🇺🇸 US Personal Income & Spending, March

Monday, April 29th 2024

🇩🇪 Germany Inflation Data (Preliminary), April

🇨🇳 China NBS Manufacturing PMI, April

🇨🇳 China Caixin Manufacturing PMI, April

Tuesday, April 30th 2024

🇫🇷 France GDP Growth Data (Preliminary), Q1

🇫🇷 France Inflation Data (Preliminary), April

🇩🇪 Germany GDP Growth Data Flash, Q1

🇮🇹 Italy GDP Growth Data, Q1

🇪🇦 Euro Area GDP Growth Data Flash, Q1

🇪🇦 Euro Area Inflation Data Flash, April

🇮🇹 Italy Inflation Data (Preliminary), April

Wednesday, May 1st 2024

🇯🇵 Japan Consumer Confidence Index, April

🇺🇸 US ISM Manufacturing PMI, April

🇺🇸 US Job Openings, March

🇺🇸 US Fed Interest Decision

🇦🇺 Australia Balance of Trade Data, March

Thursday, May 2nd 2024

🇨🇦 Canada Balance of Trade Data, March

Thursday, May 3rd 2024

🇺🇸 US Non-Farm Payrolls Data, April

🇺🇸 US Employment Data, April

🇺🇸 US ISM Services PMI, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com