💨 Wind Energy Stocks Drop 15%YoY. $140M more VC

Impact Capital Markets #16 looks at HolonIQ's Wind Stock Index, major impact deals and acquisitions, and upcoming economic releases.

Today's Topics

- 🍃 Wind. Wind Down 15% YOY, Following a Volatile Year

- 💰 Funding. $140M+ Funding in Regtech, LegalTech, Smart Contracts, Biotech & More

- 💼 Acquisitions. TraceGains acquires NutriCalc

- 📅 Economics. Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo.

🍃 Wind Down 15% YOY, Following a Volatile Year

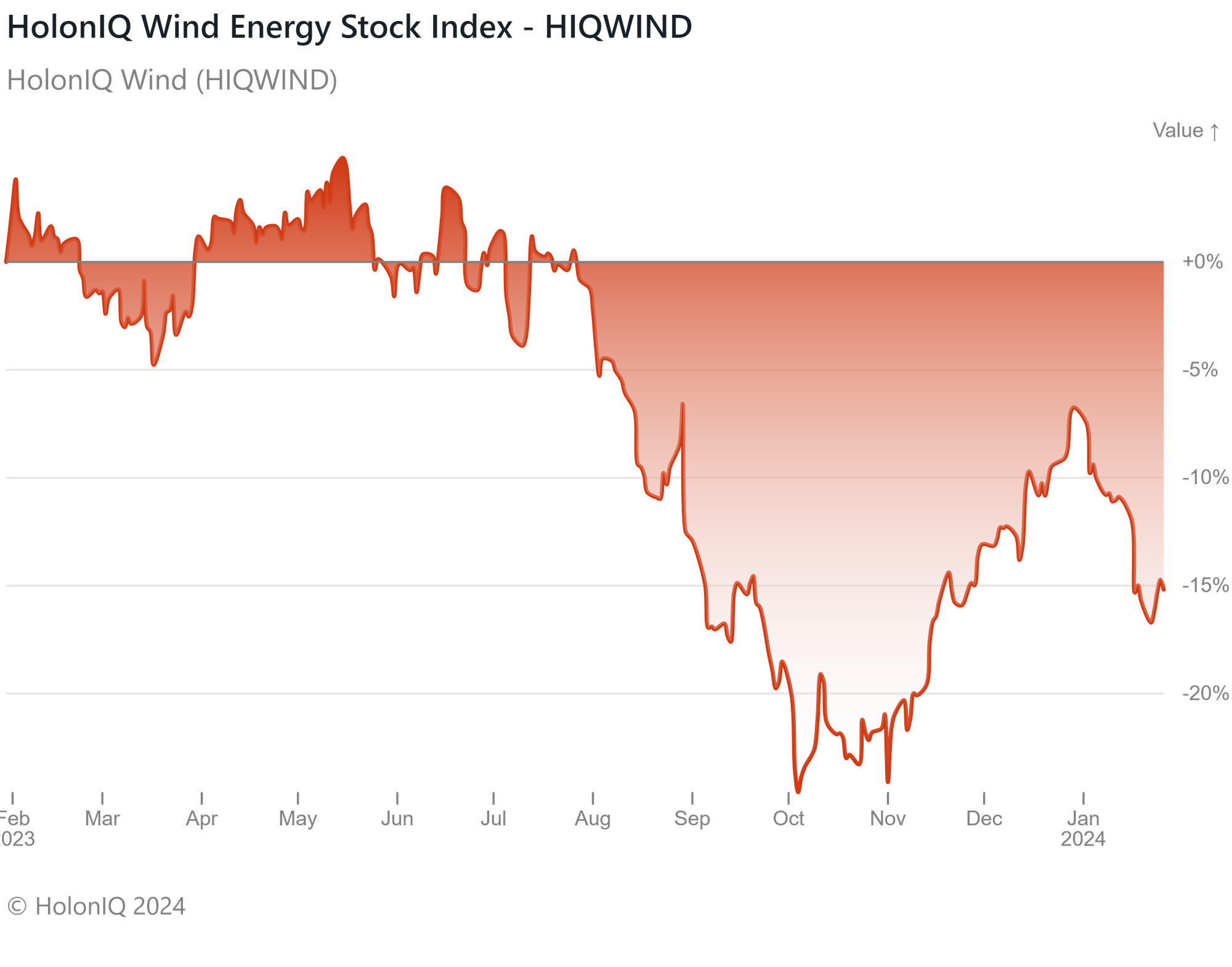

HolonIQ Wind (HIQWIND). Indexed returns (returns on the index relative to the level on January 29th 2023) declined significantly in 2H 2023 due to the comparatively elevated setup costs associated with wind farms in contrast to solar farms. By the second half of the year, most economies were plagued by high interest rates, rendering conditions unsuitable for projects with high capital costs. Year-on-Year returns on the Wind Index are down 15%.

In 2023, the leading wind turbine manufacturer, Vestas Wind Systems A/S (Market Cap: US$ 29B), announced that their new prototype V236 turbine achieved a global milestone by generating the highest power output within a 24-hour period.This marked the culmination of several years of efforts by the Danish company in creating the world's largest wind turbine.

However, towards the end of 2023, significant negative developments were observed as well, Including from Ørsted (Market Cap: US$ 24B), the global-leader in offshore wind power, which canceled two noteworthy offshore wind energy projects due to increasing interest rates and inflation, coupled with concerns about potential impacts on marine life and tourism.

Nevertheless, the positive outlook for the broader renewable energy sector bodes well for wind energy companies as well. The industry's trajectory is being shaped by technological progress, including modular wind systems, AI-driven predictive maintenance, the deployment of floating wind turbines, and the expansion of offshore wind energy.

💰 Funding

🔍 Thentia, an Oklahama-based Regulatory technology company, raised a $38M series B from First Ascent Ventures to extend operations and expand globally.

📜 Proof Technology, Inc., a Denver, CO-based legal tech platform, raised a $30.4M Series B from Long Ridge Equity Partners to drive growth, e-filing expansion, integrate with legal software and embrace AI efficiency.

🚀 Axiom, a New York-based startup that uses crypto proofs for smart contracts, raised a $20M Series A from Standard Crypto and Paradigm to expand its team, speed up its core smart contract platform development.

🧪 PRISM BioLab, a Tokyo-based discovery and development biotechnology company raised a $10.3M Series C from Eli Lilly and Company and Santec Holdings Corporation to expand biology and screening capacity and to advance its PPI inhibitor pipeline.

♻️ GreenSpark, a New York-based metal recycling software platform, raised $9.4M from Infinity Partners and Third Prime to grow its products, team, and boost profitability for metal recyclers.

💻 WealthKernel, a London-based digital investment solutions provider, raised a $7.6M Series A from ETFS Capital to expand across the European market.

🌱 Chunk Foods, plant-based space company from New York, raised a $7.5M Seed from Cheyenne Ventures to solidify its position in plant-based whole cuts.

🏡 Digs, a Vancouver-based AI collaboration platform for home builders & homeowners, raised a $7M Seed from Oregon Venture Fund and Legacy Capital Ventures to speed up its marketplace rollout and launch.

🤖 RagaAI, a California-based AI testing tech company, raised $4.7M from pi Ventures to expand operations and its Research and development sector.

🔗 TextQL, a California-based AI data connector, raised a $4.1M Pre-seed from Neo and DCM to expand its team with a focus on hiring software engineers and deployed engineers.

🌱 Cnergreen, a Calgary-based hydrocarbon company, raised a $2M Seed from Rhapsody Venture Partners to speed up field trials and commercialization of its project focused on improving CO2 enhanced oil recovery.

💼 Acquisitions

📊 TraceGains, a Colorado-based compliance software innovator acquired NutriCalc, a UK-based provider of nutritional calculation software.

📅 Economic Calendar

Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

Tuesday January 30th 2024

🇫🇷 France - GDP Data, Q4

🇮🇹 Italy - GDP Data, Q4

🇪🇦 Euro Area - GDP Data, Q4

🇺🇸 US - Employment Data, December

Wednesday January 31st 2024

🇦🇺 Australia - Inflation Data, Q4

🇨🇳 Canada - NBS Manufacturing PMI, January

🇯🇵 Japan - Consumer Confidence, January

🇫🇷 France - Inflation Data, January

🇩🇪 Germany - GDP Data, Q4

🇩🇪 Germany - Inflation Data, January

Thursday February 1st 2024

🇺🇸 US - Fed Interest Rate Decision

🇺🇸 US - Fed Press Conference

🇨🇳 Canada - Caixin Manufacturing PMI, January

🇪🇦 Euro Area - Inflation Data, January

🇮🇹 Italy - Inflation Data, January

🇬🇧 UK - BoE Interest Rate Decision

🇺🇸 US - ISM Manufacturing PMI, January

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Monday February 5th 2024

🇦🇺 Australia - Balance of Trade, December

🇩🇪 Germany - Balance of Trade, December

🇺🇸 US - SM Services PMI, January

Tuesday February 6th 2024

🇦🇺 Australia - RBA Interest Rate Decision

🇨🇦 Canada - Ivey PMI s.a , January

Wednesday February 7th 2024

🇨🇦 Canada - Balance of Trade , December

Thursday February 8th 2024

🇨🇳 China - Inflation Data, January

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com