☢️ Uranium Up 56%. $120M Biotherapeutic Funding.

Impact Capital Markets #26 looks at our Uranium Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Zdravstvuite 👋

📉 Today's Global Economic Update: Canada's unemployment data released last Friday reveals a surprising drop in the unemployment rate to 5.7% in January 2024, marking the first month-on-month decrease in over a year. Additionally, the economy added 37,300 jobs, showcasing resilience despite concerns of economic slowdown in the face of higher interest rates.

💉 Deal of the Day: Neurona Therapeutics secures $120M in Series E funding to advance its cell therapy pipeline.

What's New?

- ☢️ Uranium. Uranium Stock Index Up 56%

- 💰 Funding. Neurona Raises $120M, Orthopedic, Pharmaceutical, AI EdTech Deals + More

- 💼 M&A. Deals in Hospital, Social & Emotional Learning and Medical Devices

- 📅 Economics. Major Employment Data, Inflation Data, UK GDB Data + More

For unlimited access to more deals and economic updates, request a demo

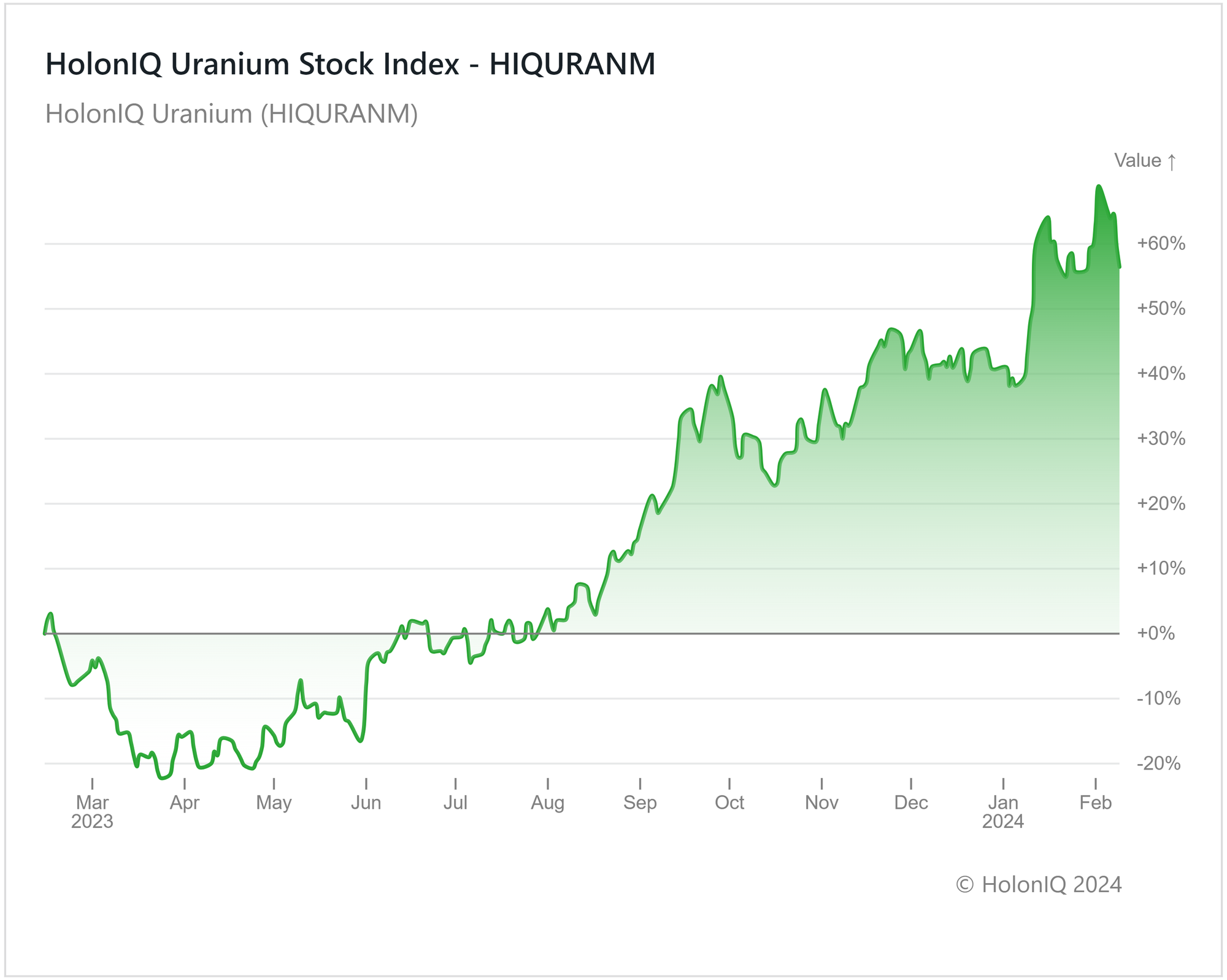

☢️ Uranium Index Up 56%

HolonIQ Uranium (HIQURANM)

HolonIQ’s Uranium Index rose 56% over the last year, as the transition towards clean energy accelerated. At COP28 in December 2023, 22 countries including US, Canada and Japan, pledged to triple nuclear energy production by 2050. Uranium, which is widely used as nuclear energy fuel, has seen upward pressure on its price, as a result of this shift. The index also has risen 20% since end-2023. Cameco (Market Cap: $19B), which is the world’s second-largest uranium miner, saw a 54% return YoY. Uranium Energy Corp. (Market Cap: $3B) and Paladin Energy Ltd. (Market Cap: $2.6B) also saw returns exceeding 70%.

Supply chain risks remain a challenge for the Uranium Industry. Cameco has forecasted lower production due to issues with equipment reliability, as well as labor shortages amongst other operational difficulties. Geopolitics also plays a part, with the US banning Uranium Imports from Russia. On the upside, the uncertainty that comes with sourcing uranium has led to a surge in long-term contracting activity, setting a positive outlook for the industry in the years to come.

💰 Funding

💉 Neurona Therapeutics, a California-based clinical-stage biotherapeutics company, raised a $120M Series E from Viking Global Investors and Cormorant Asset Management to advance its cell therapy pipeline.

🦴 Pixee Medical, a France-based company providing reality navigation technologies for orthopedic surgery, raised $15M. The funds will be used to grow in the US, launch augmented reality platforms and expand into Asia with a Singapore office.

🌐 Lilli, a UK-based SaaS company using a proactive lifestyle monitoring technology to revolutionize care, raised a $10.2M Series A from West Hill Capital, to empower vulnerable independent people to live longer within the safety of their homes.

🍄 Odyssey, a New Jersey-based functional mushroom-infused energy drink brand, raised $6M from Rocket Beverage Group to bolster sales, marketing, and inventory.

🤖 ConveGenius, an India-based AI EdTech, raised a $1.87M Series A from Searce to enhance its cloud services and accelerate its generative AI development.

💼 M&A

🏥 Max Healthcare, India’s largest private healthcare provider, acquired Alexis Hospital, a Nagpur-based Multi-Speciality Hospital for $49.7M.

📚 CentralReach, a Florida-based provider of Autism and IDD software, acquired Silas, a New Jersey-based social and emotional learning (SEL) solution for PreK-12 general, special, and transition vocational education programs.

🩺 Radcal, a California diagnostic X-ray measurement leader, has signed an agreement to acquire Ion Beam Applications. This Belgium-based company develops and manufactures medical devices and software solutions.

📅 Economic Calendar

Major Employment Data, Inflation Data, UK GDB Data + More

Tuesday , February 13th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, February

🇬🇧 UK Unemployment Rate, December

🇩🇪 Germany ZEW Economic Sentiment Index, February

🇺🇸 US Core Inflation Data, January

🇺🇸 US Inflation Data, January

Wednesday February 14th 2024

🇦🇺 Australia NAB Business Confidence, January

🇬🇧 UK Inflation Rate, January

Thursday February 15th 2024

🇯🇵 Japan GDP Data, Q4

🇬🇧 UK GDP Data , Q4

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data, January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Tuesday February 20th 2024

🇦🇺 Australia RBA Meeting Minutes

🇨🇦 Canada Inflation Data, January

Wednesday February 21st 2024

🇯🇵 Japan Balance of Trade, January

Thursday February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI Flash, February

Friday February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com