🔥 The EU Becomes #1 LNG Importer + East Asia 100

Europe surpassed China to claim the top spot as the biggest importer of liquefied natural gas (LNG) amid its transition away from Russian gas. Natural gas is crucial for heating and cooling in Eastern European nations, particularly due to unpredictable weather patterns.

Happy Monday 👋

Europe outpaced China to become the largest importer of liquified natural gas (LNG) as the bloc shifted away from Russian gas. This week, we also spotlight the 2023 East Asia Climate Tech 100, highlighting the region's most promising startups in the climate technology sector and how they are faring in 2024.

This Week's Topics

🔥 LNG Market. The EU is now the largest LNG importer in the world

📈 Wind Energy Index. Wind index drops 1% 3M, down 20% LTM

🏆 East Asia Climate Tech 100. 35M of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🔥 Europe Outpaces China To Become The Largest LNG Market

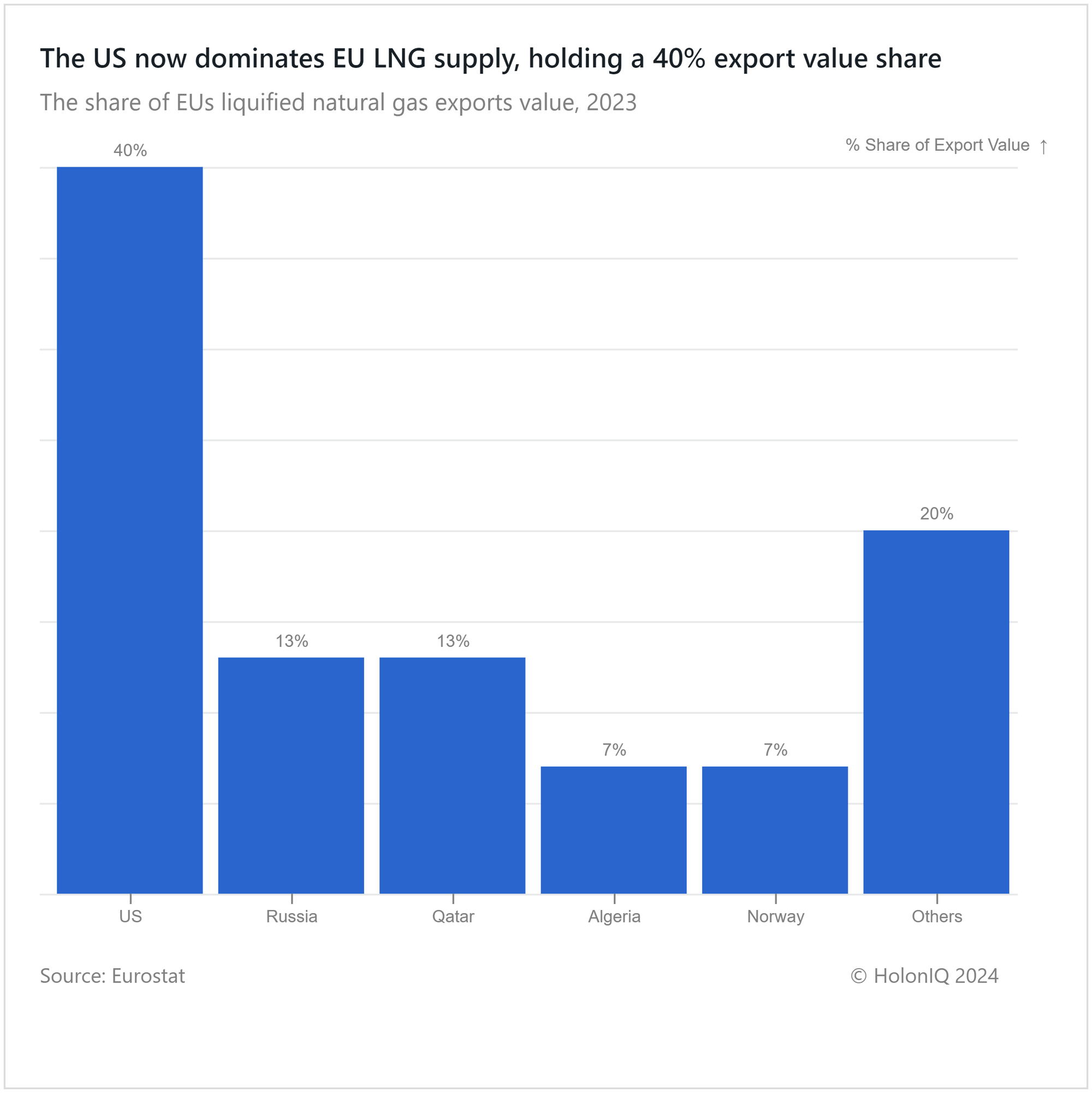

The EU became the largest importer of liquified natural gas (LNG) in 2023, outpacing China as the bloc shifted away from its reliance on Russian gas, increasing its imports of LNG from the US and other regions. This transition from Russian gas also prompted a large-scale expansion of LNG regasification capacity in the EU. The EU, UK, and Turkey saw a combined 60% year-on-year increase in imports in 2022, with 127.6 million mt (173 Bcm) of LNG delivered, and were marginally lower in 2023 with 125.5 million mt. The US accounted for 40% of exports to Europe in 2023.

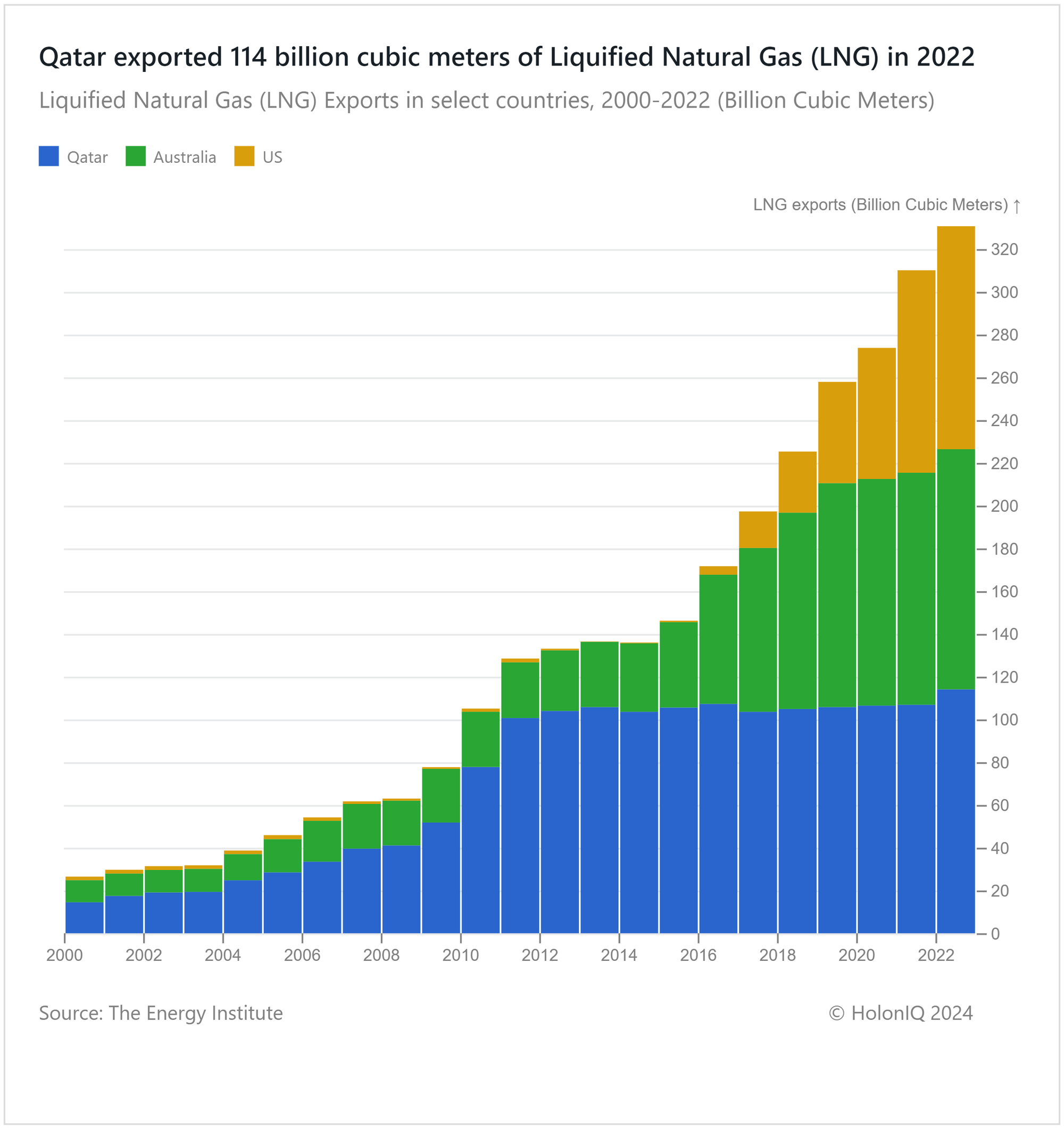

This trend is expected to continue in 2024, as per available data for the first four months of this year. During the first four months of 2024, Europe imported 54% of its LNG from the US, up from 46% for the same period in 2023. Within the EU, France, Spain, Netherlands, and Turkey were the largest LNG importers of US LNG. Increased demand from the EU pushed the US to become the largest exporter of LNG, surpassing Qatar and Australia in 2023.

🌬️ Wind Index Drops 1% 3M, Down 20% LTM

HolonIQ tracks thousands of listed climate tech companies worldwide, as well as acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten different sectors in Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

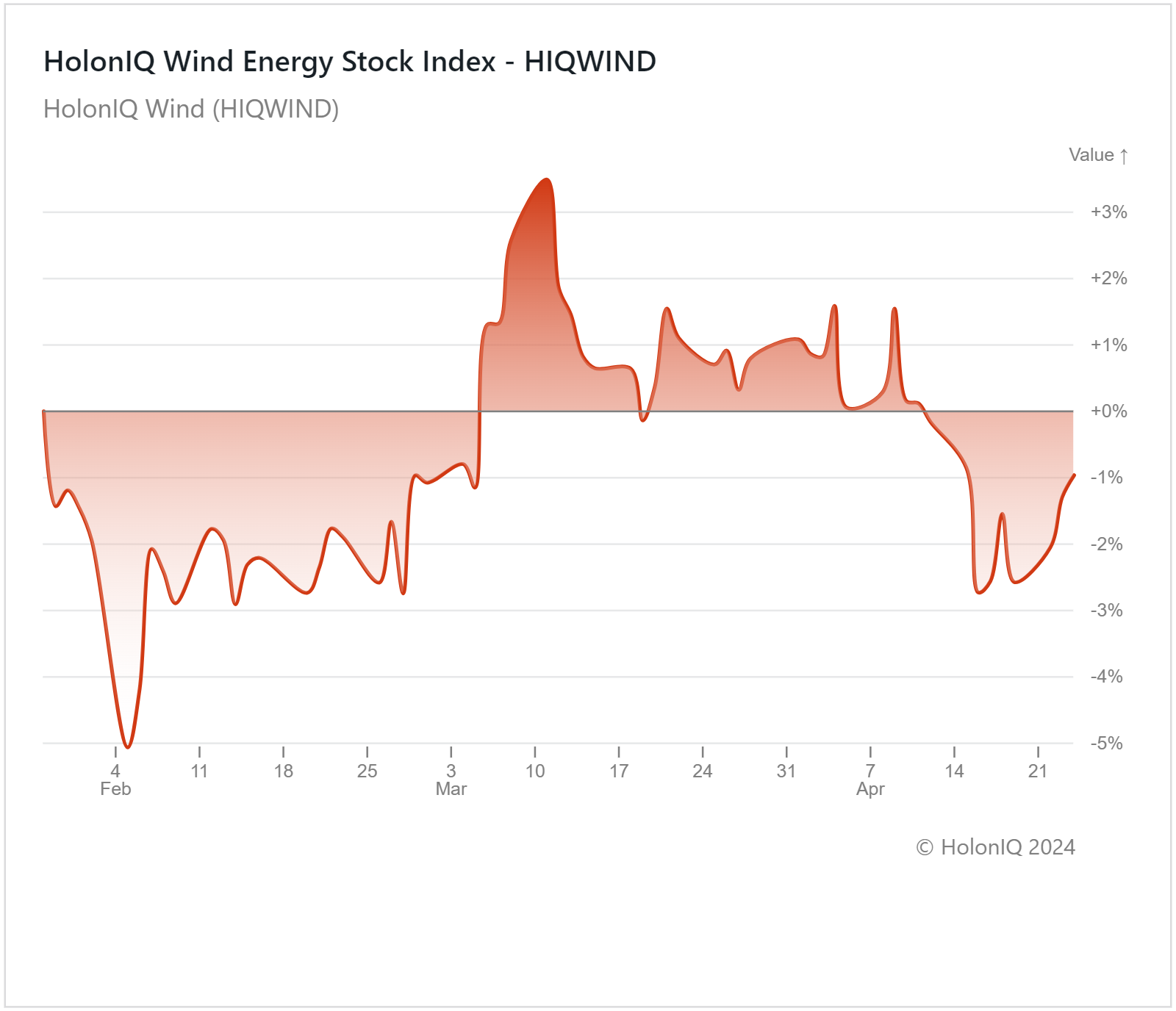

HolonIQ’s Wind Index showed a decrease of 1% in the last three months. Wind project developers faced a turbulent 2023, as high interest rates resulted in project costs rising substantially, and companies such as Orsted A/S, BP ($23B MCap), and Equinor ($82B MCap) had to write down approximately $2B+ in impairments. Elevated interest rates make it tougher for these projects to obtain funding, while inflation drives up operating costs. These factors resulted in Vestas Wind Systems A/S ($25B MCap), Iberdrola SA ($77B MCap), and China Longyuan Power Group Corp. Ltd ($15B MCap) experiencing declines.

However, the index is positioned for a potential recovery as markets normalize and economic conditions improve. In Q4 of 2023, orders recorded an increase of 2.5% and 12% YoY for the full year. China ordered approximately 100 GW in 2023, the largest annual order intake on record, while Western markets witnessed a record-breaking 55 GW in 2023. With conducive policies passed in 2023, such as the European Wind Power Action Plan, the UK's eased planning rules for onshore wind projects, and Germany’s 12-point action plan to expand onshore wind capacity to 157 GW by 2035, the industry is positioned for recovery.

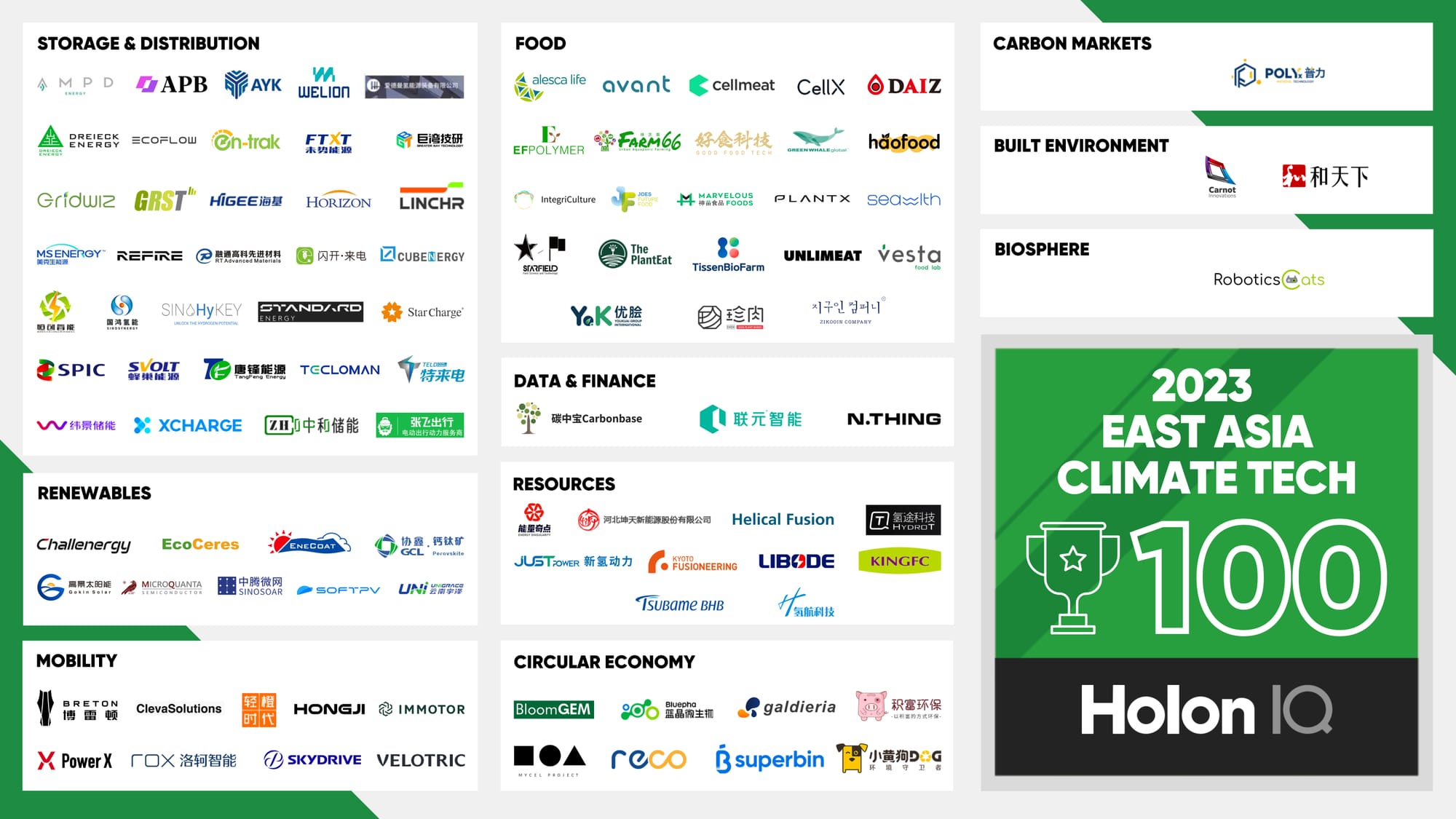

🏆 East Asia Climate Tech 100

The East Asia Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Companies in the East Asia Climate Tech 100 have not been as successful as they were last year in raising funds. In the same period in 2023, companies in the East Asia Climate Tech 100 raised $1.3B+. However, in 2024, funding by these companies dropped to $35M. However, this does not mean the region as a whole has been unsuccessful. In March 2024, IM Motors, a Chinese EV manufacturer, raised one of the largest private funding deals in the region, raising $1.1B to work on new smart car models and technologies. IM Motors' Series B round of equity financing was among the biggest investments into Chinese EV brands in the past two years, following Abu Dhabi-based CYVN's combined $3 billion investments into NIO.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🛬 Skyport, a UK-based drone manufacturer, secured $110M in funding to construct vertiports for electric Vertical Take-Off and Landing vehicles.

☀️ RayGen Resources Pty Ltd, an Australian-based solar and thermal storage technology provider, raised $32.2M in funding to expand its manufacturing and scale up the delivery of its projects.

🔌 Swtch Energy, a Canada-based EV charging company, raised a $27.2M Series B round to expand their EV chargers to apartments and condo buildings.

M&A

⛏️ Energy Fuels, a US-based uranium and rare earth producer, acquired Base Resources in a deal valued at $240M. The acquisition will establish Energy Fuels as the largest importer of liquified natural gas as the bloc shifts to a global leader in the critical minerals sector.

🌱 xFarm Technologies, a Swiss agritech startup, acquired Greenfield Technologies, a Spanish agriculture company conducting soil analysis and crop monitoring.

IPO

🤖 Serve Robotics Inc., a US-based developer of advanced, AI-powered, low-emissions sidewalk delivery robots, went public on the Nasdaq yesterday under the symbol “SERV,” opening at $4.75 and closing the day at $3.11. The company generated $40M in gross proceeds before underwriting discounts and offering expenses.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com