📞 Telecommunication Index Up 1.5%. $130M+ VC Funding.

Impact Capital Markets #72 looks at our Telecommunication stock index, major impact deals, M&A, and upcoming economic releases.

📉 Today's Global Economic Update: China's GDP data was released yesterday, revealing a 5.3% yearly increase in the first quarter of 2024, marking its highest growth since Q2 2023. Despite this positive momentum, March data showed industrial output and retail sales rising less than expected, indicating the need for further policy easing.

⚡️ Deal of the Day: NatPower, a renewable energy development company, raised $53M to expand its renewable energy projects in the United States.

What's New?

📞 Telecommunication. Telecommunication index up 1.5%

💰 Funding. Energy, materials science, insurance tech & AI legal platform

💼 M&A. Glanbia acquires Flavor Producers

📅 Economics. China GDP Data, inflation, retail sales, balance of trade + more

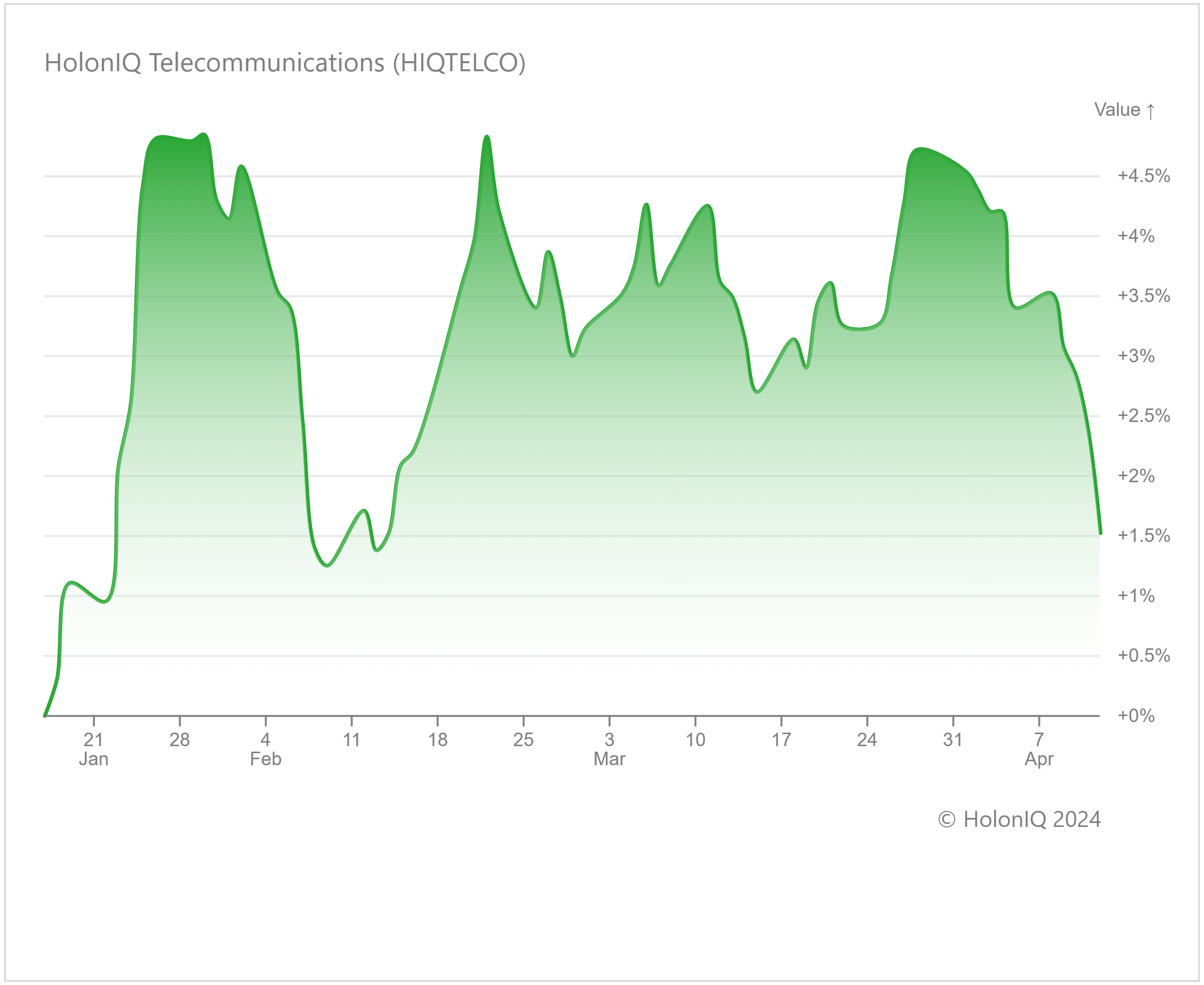

📞 Telecommunication Index Up 1.5%

Over the past quarter, the HolonIQ Telecommunication index witnessed fluctuations, reaching highs of around 4.8% in February and March, before settling at a 3-month return of 1.5%. Main stocks in the index such as China Mobile Ltd. ($191B MCap) grew by 4%, while T-Mobile US, Inc. ($189B MCap) and Comcast Corp. ($156B MCap) had more modest increases at 0.8% and 0.1% respectively. With telecom companies generally offering high payout ratios and retaining relatively smaller portions of their income for reinvestment, opportunities for substantial earnings growth may be limited. Underwhelming revenue growth from 5G wireless services is also holding back profit expansion.

Despite facing challenges, there's optimism about the telecom industry's future. While hurdles remain, like the low adoption of Fixed Wireless Access (FWA), a technology used to deliver 5G services, it has significant potential to bring internet to more places, especially in rural areas where deploying traditional wired infrastructure is impractical. Looking ahead to 2024, the telecom industry is rapidly digitizing and embracing AI. The industry's adaptability and innovation position it well for sustained growth.

💰 Funding

⚡️ NatPower, a Luxembourg-based independent renewable energy development company, raised $53M from VINCI to expand its renewable energy projects in the United States.

♻️ CleanFiber, a New York-based materials science company, raised a $28M Series B from Spring Lane Capital to enhance its growth and expand its product portfolio.

🛡️ Pula, a Kenyan insurance tech company, raised a $20M Series B from BlueOrchard to establish new partnerships, including for livestock covers.

⚖️ Lawhive, a UK-based AI legal platform, raised a $11.7M Seed to facilitate access to quality legal assistance for consumers and small businesses.

💼 M&A

🍽️ Glanbia, an Irish nutritional products developer, has signed an agreement to acquire Flavor Producers for $300M, a California-based custom flavors and extracts provider.

📅 Economic Calendar

China GDP Data, Inflation, Retail Sales, Balance of Trade + More

Tuesday, April 16th 2024

🇩🇪 Germany ZEW Economic Sentiment Index, April

🇨🇦 Canada Inflation Data, March

🇺🇸 US Building Permits (Preliminary), March

🇯🇵 Japan Balance of Trade Data, March

Wednesday, April 17th 2024

Thursday, April 18th 2024

🇯🇵 Japan Inflation Data, March

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Tuesday, April 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), April

🇦🇺 Australia Inflation Data, Q1

Wednesday, April 24th 2024

🇩🇪 Germany Ifo Business Climate Index, April

🇺🇸 US Durable Goods Orders Data, March

Thursday, April 25th 2024

🇩🇪 Germany GfK Consumer Confidence Index, May

🇺🇸 US GDP Growth Data, Q1

🇯🇵 Japan BoJ Interest Rate Decision

Friday, April 26th 2024

🇺🇸 US Core PCE Price Index, March

🇺🇸 US Personal Income & Spending, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com