📚 K12 Index Up 10%. $650M+ VC Funding.

Impact Capital Markets #73 looks at our K12 stock index, major impact deals, M&A, and upcoming economic releases.

Vanakkam 🙏

📉 Today's Global Economic Update: UK unemployment data released yesterday reveals a rise in the unemployment rate to 4.2% from December 2023 to February 2024, exceeding market expectations. The number of unemployed individuals increased by 85K to a total of $1.4M.

⚡️ Deal of the Day: Rivos, a secure server solutions provider, raised a $250M Series A for Silicon Launch.

What's New?

📚 K12. K12 index up 10%

💰 Funding. Data analytics, behavioral health + more

💼 M&A. Climate tech & security

📅 Economics. US GDP Data, inflation, retail sales, balance of trade + more

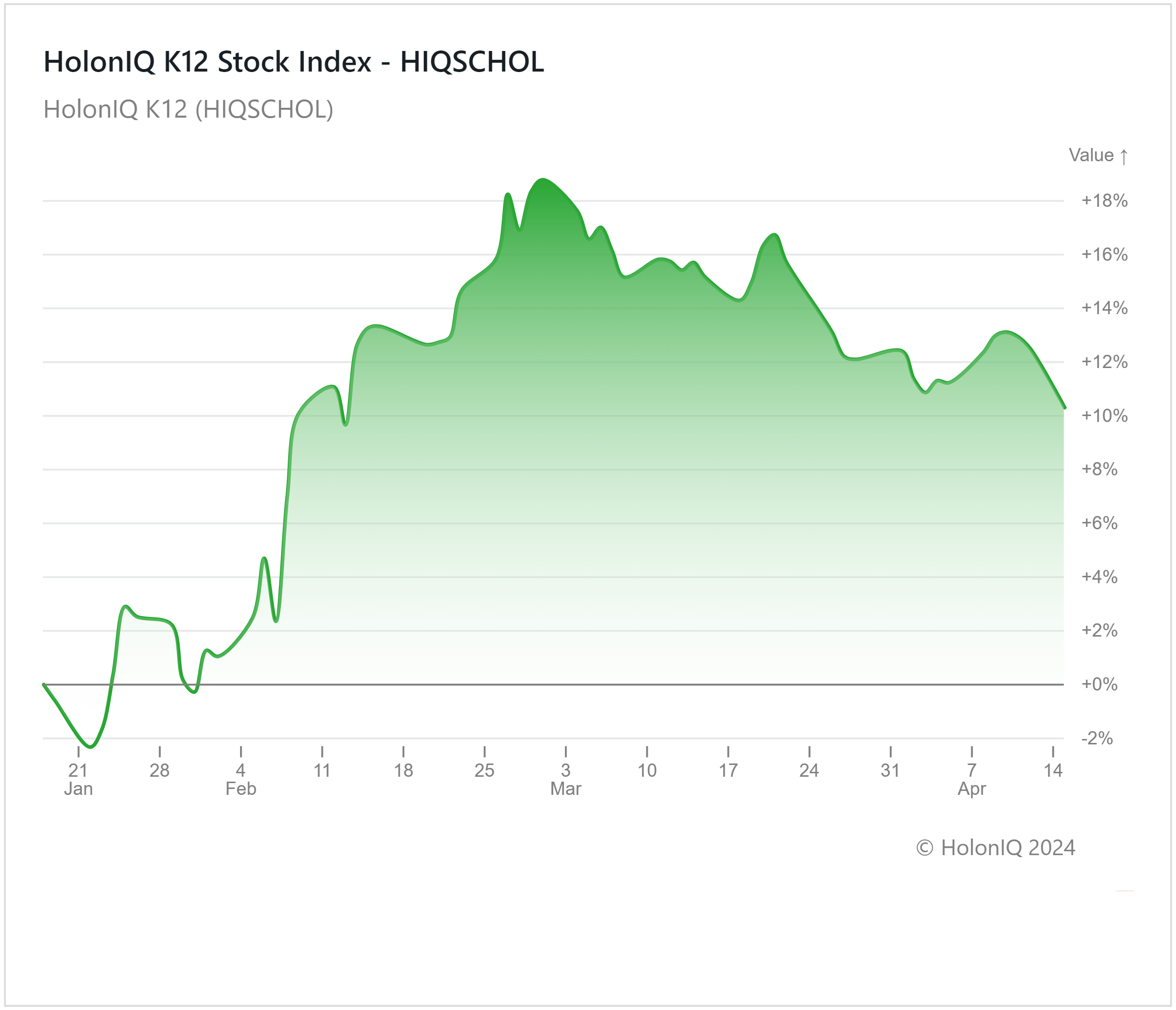

📚 K12 Index Up 10%

HolonIQ's K12 index registered a 10% growth over the last three months despite a mixed performance among major stocks in the index. New Oriental Education & Tech Group ($14B MCap) and TAL Education Group ($7B MCap) recorded growth of 16% and 4%, while Roblox Corp.($23B MCap) returns fell by 5% in the same period.

The K12 Index has seen a 40% growth in the past six months helped by supportive government policies and investments. Powerschool Holdings ($2.5B MCap) and and Nerdy ($280M MCap) were among the companies that saw noteworthy developments during the quarter. Nerdy's Varsity Tutors secured contracts with nearly 200 school districts and achieved an annual revenue growth of 32% in 2023. PowerSchool acquired Allovue, a US-based K12 financial planning platform that will aid in expanding the firm's abilities in financial management. The industry's positive momentum is expected to persist as governments worldwide adopt AI and digital solutions to improve outcomes for K12 students. There are some potential hurdles within the industry, however, particularly regarding China's ongoing implementation of a national regulatory framework for after-school tutoring, which could introduce uncertainty.

💰 Funding

📊 Rivos, a California-based secure server solutions provider, raised a $250M Series A from Matrix Capital Management to launch its first silicon product and to expand operations.

🧠 Two Chairs, a California-based behavioral health company, raised a $72M Series C from Fifth Down Capital and Amplo to expand its therapist network.

🤖 Upstage, a California-based AI company specializing in language models, raised a $72M Series B to speed up custom AI development for global companies.

⚡ GridBeyond, an Irish smart energy company, raised a $55.3M Series C from Klima to scale up its operations.

🌾 Bcomp, a Swiss natural fiber composites startup, raised a $40M Series C from EGS Beteiligungen to increase its production capacity.

🏠 Quilt, a California-based smart home solutions company, raised a $33M Series A from Galvanize Climate Solutions and Energy Impact Partners to expand its marketing efforts.

🔬 Evergreen Theragnostics, a New Jersey-based clinical-stage radiopharmaceutical company, raised $26M from Petrichor and LIFTT to support growth efforts and expand R&D and operations.

💼 M&A

🌍 Levelup, a Singapore-based climate tech company, acquired Zevero, a UK-based provider of a carbon intelligence platform.

🛡️ BeyondTrust, a Georgian intelligent identity solutions provider, acquired Entitle, an Israeli security company.

📅 Economic Calendar

US GDP Data, Inflation, Retail Sales, Balance of Trade + More

Thursday, April 18th 2024

🇯🇵 Japan Inflation Data, March

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Tuesday, April 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), April

🇦🇺 Australia Inflation Data, Q1

Wednesday, April 24th 2024

🇩🇪 Germany Ifo Business Climate Index, April

🇺🇸 US Durable Goods Orders Data, March

Thursday, April 25th 2024

🇩🇪 Germany GfK Consumer Confidence Index, May

🇺🇸 US GDP Growth Data, Q1

🇯🇵 Japan BoJ Interest Rate Decision

Friday, April 26th 2024

🇺🇸 US Core PCE Price Index, March

🇺🇸 US Personal Income & Spending, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com