📞 Telecom Gains 4%. $200M+ Funding.

Impact Capital Markets #14 looks at our Telecommunications Stock Index, major impact deals and acquisitions, and the upcoming big economic releases.

Today's Topics

- 📞 Telecommunications. Index Up 4% YoY Following Some Volatility

- 💰 Funding. $203M+ Funding in Lithium Battery, Pharmaceutical, Nutraceutical Biotechnology & More

- 💼 Acquisitions. MedTech, Agriculture, Fertility & More

- 📅 Economics. Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo.

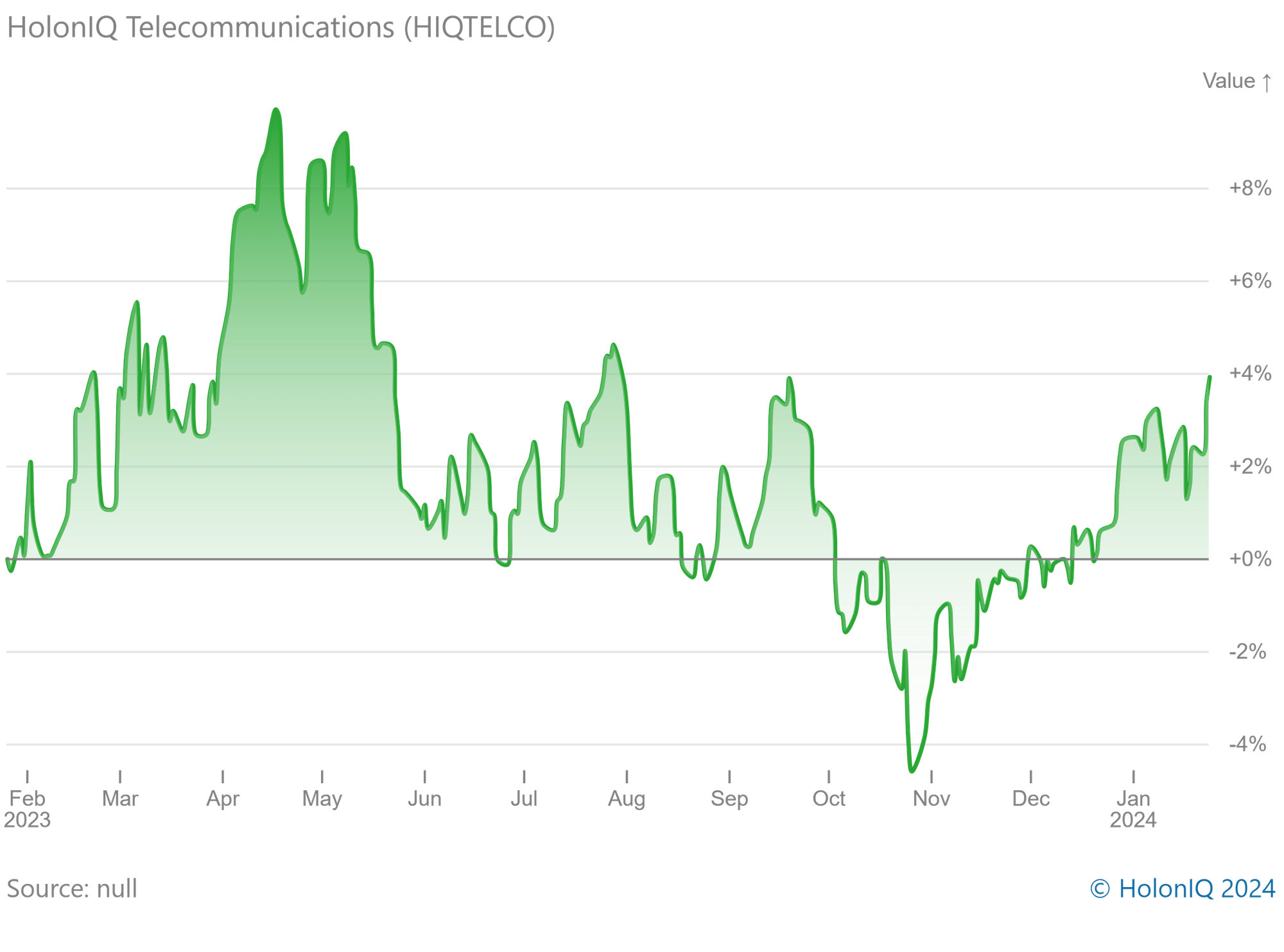

📞 Telecommunications Index - Up 4% YoY Following Some Volatility

HolonIQ Telecommunications (HIQTELCO). 12-month indexed returns (returns on the index relative to the level on January 26, 2023) exhibited notable volatility. Following a downward trend over much of the last 12 months, there was a subsequent upward shift in the last three months. As of January 2024, Year-on-Year returns stand at over 4% (S&P500: +23%YOY).

Telco giants such as Verizon, AT&T, and Sprint are competing with one another by focusing on providing value to consumers and corporate clients with bundled services and connection alternatives, including fiber and 5G access. Expansion on 5G networks is a key driver of growth, which would capture new business opportunities, although monetizing 5G services effectively remains a challenge.

In another industry development, in a move to shake up the UK mobile market, Vodafone (Market Cap: US$ 23.8B) and Three UK announced in June 2023 an agreement to merge, creating the country's largest operator. While Vodafone's shares saw a slight bump at the time of the announcement, the deal faces regulatory hurdles, with Vodafone expecting to complete the deal by end-2024.

💰 Funding

🔋 Sion Power, an Arizona-based lithium battery manufacturer, raised a $75M Series A from LG Energy Solution to establish a manufacturing line dedicated to producing lithium-metal cells.

♻️ CheckSammy, a Texas-based bulk waste and sustainability operator, raised $45M from I Squared Capital to enhance its ability to support the launch of the Veridiant SaaS Platform and its continued expansion.

🧬 Genetic Design and Manufacturing Corporation (GDMC), a Singapore-based pharmaceutical company that engages in manufacturing and designing genetic medicines, raised a $21M Series A from Celadon Partners.

🌱 Elo Life Systems, a North Carolina-based nutraceutical biotechnology company, raised a $20.5M Series A from Novo Holdings & DCVC Bio to get its monk fruit sweetener to market.

🧠 Motif Neurotech, a Texas-based neurotechnology company, raised $18.8M Series A from Arboretum Ventures. The funds will be used to progress Motif's lead product, the DOT microstimulator, a miniature brain pacemaker designed for precise brain stimulation to treat mental health disorders by restoring healthy circuit activity.

📦 Packmatic, a Germany-based digital product packaging platform, raised a $16.3M Series A from EQT Ventures. The fund will support Packmatic’s continued expansion in Europe, funding additional investment in software and the acquisition of top industry talent to help propel the business to its next growth stage.

💉 IMU Biosciences, a UK-based biotech company working in the field of immune-powered precision medicine, raised a $14.6M Series A from Molten Ventures. The funds will be used to expedite its roadmap, utilize the novel CytAtlas® platform, cultivate strategic partnerships, conduct immune research, and expand operations into the Boston/Cambridge, MA, area.

🔬 PRISM BioLab, a Japan-based discovery and development biotechnology company, raised a $10.1M Series C from Santé Holdings & Eli Lilly to refine PRISM's proprietary PepMetics® chemistry platform, expand biology and screening capabilities, and advance the internal pipeline of PPI inhibitors.

💊 ZWI Therapeutics, a Massachusetts-based pharmaceutical company, raised a $10M Series A from Sherpa Healthcare Partners & Cowin Venture. The funds will advance R&D, scale manufacturing, and support regulatory activities for their proprietary protein therapeutics technology.

💼 Acquisitions

🏥 Olympus, a Japan-based MedTech company, acquired TaeWoong Medical, a Korea-based manufacturer of medical devices such as gastrointestinal metallic stents.

🔄 Revolution Company, an Arkansas-based provider of ESG material solutions, acquired PolyAg Recycling, a Canadian mechanical recycler of agricultural films.

🍽 TraceGains, a Colorado-based software company specializing in food safety and quality assurance, acquired NutriCalc, a UK-based company that is renowned for its highly accurate nutritional calculation software.

💉 Rayner Surgical Group, a UK-based company that manufactures Intraocular lenses and associated instruments used in cataract surgery, acquired This AG, a Switzerland-based medical technology solutions provider.

👶 IBSA, a Swiss multinational pharmaceutical company actively involved in reproductive health, has acquired Aura Fertility, a UK-based app to improve the In Vitro Fertilization (IVF) experience.

⚡️ Mitsubishi HC Capital, a Japanese investment firm, acquired a 20% stake in European Energy, a Danish renewable energy developer.

📅 Economic Calendar

Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇪🇦 Euro Area - ECB Interest Rate Decision

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December

Tuesday January 30th 2024

🇫🇷 France - GDP Data, Q4

🇮🇹 Italy - GDP Data, Q4

🇪🇦 Euro Area - GDP Data, Q4

🇺🇸 US - Employment Data, December

Wednesday January 31st 2024

🇦🇺 Australia - Inflation Data, Q4

🇨🇳 Canada - NBS Manufacturing PMI, January

🇯🇵 Japan - Consumer Confidence, January

🇫🇷 France - Inflation Data, January

🇩🇪 Germany - GDP Data, Q4

🇩🇪 Germany - Inflation Data, January

Thursday February 1st 2024

🇺🇸 US - Fed Interest Rate Decision

🇺🇸 US - Fed Press Conference

🇨🇳 Canada - Caixin Manufacturing PMI, January

🇪🇦 Euro Area - Inflation Data, January

🇮🇹 Italy - Inflation Data, January

🇬🇧 UK - BoE Interest Rate Decision

🇺🇸 US - ISM Manufacturing PMI, January

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com