🛫 Aviation Drops 10%. $110M+ VC in BioTech, Wellness, Climate

Impact Capital Markets #15 looks at our Aviation Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Today's Topics

- 🛫 Aviation. Aviation Down 10%YoY Amid Challenges

- 💰 Funding. $110M+ Funding in Biotech, Wellness, Climate Tech, Digital Health & More

- 💼 Acquisitions. Child Care, Creator Education, Consumer Health & More

- 📅 Economics. Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo.

🛫 Aviation Down 10%YoY Amid Challenges

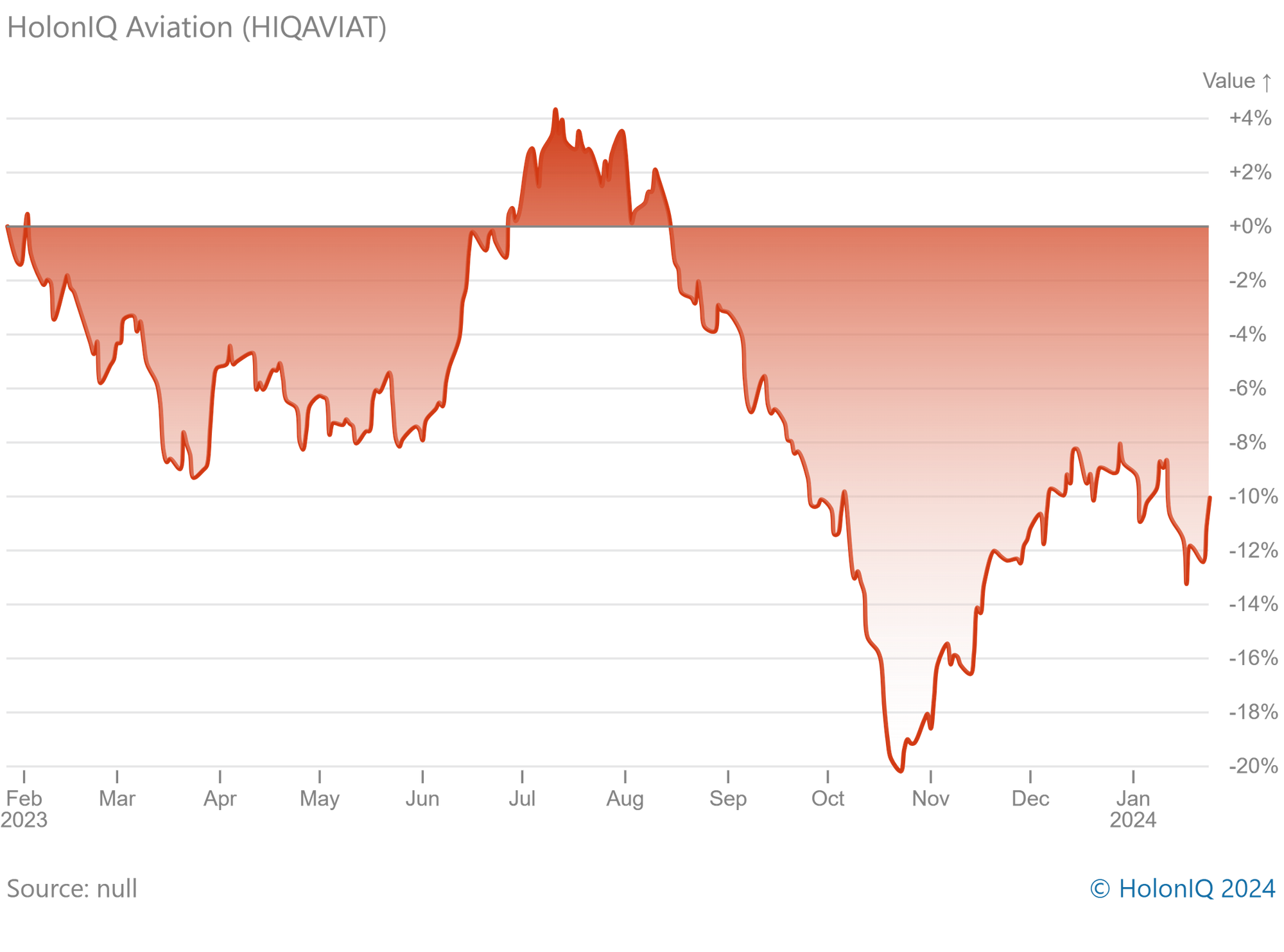

HolonIQ Aviation (HIQAVIAT). Indexed returns (returns on the index relative to the level on January 26, 2023) have mostly been negative over the last 12 months. Returns hit a low of 20% in October 2023 but have seen a gradual improvement since.

Aviation has been navigating through shifting tides over the last few years as demand recovered following the COVID-19 disruptions. Challenges persist, including labor shortages and ongoing disruptions causing issues for both airlines and passengers. Additionally, geopolitical and economic factors, such as increasing fuel prices and decreasing disposable incomes, pose potential threats to global travel volumes. However, there is optimism regarding the sustained recovery of demand for air travel, which could see aviation profits improve this year.

Addressing uncertainties related to climate change, United Airlines (MarketCap: US$ 13B), a prominent contender in the aviation space, has announced the adoption of sustainable aviation fuel. This alternative fuel, derived from non-petroleum feedstocks, aims to reduce emissions from air transportation. Southwest Airlines (MarketCap: US$ 18.5B) has also committed to investing in sustainable aviation fuel through its pilot project named ‘SAFFiRE1’, contributing to the industry's efforts to address environmental concerns.

💰 Funding

🔬 Infinite Roots, a Germany-based fungal biotech company, raised a $58M Series B from the European Innovation Council (EIC) and Dr Hans Riegel Holding to operationally ramp up production volumes and increase supply.

🏢 Sonder, an Australian-based Workplace wellness technology start-up, raised a $16M Series B from SEEK to fund the company’s growth in Australia and New Zealand. The funds will also aid a UK expansion, which is in the early stages but a key strategic market.

🌍 CEEZER, a Germany-based climate tech company, raised a $11.2M Series A from HV Capital to expand the startup’s presence in the US, strengthen its team, and introduce innovative carbon portfolio financing solutions.

💡 Vikran Engineering & Exim, an India-based engineering & construction company that provides services for power-related projects, raised $10M from Pantomath Capital and Ashish Kacholia. They intend to use the funds for expanding operations and preparing for an upcoming Initial Public Offering (IPO).

🏥 Swift Medical, a Canada-based digital health technology company, raised $8M from BDC Capital’s Women in Technology Venture Fund and funds managed by Virgo Investment Group. The funds will be used to accelerate the pace of technology enhancements.

🩺 Isaac Health, a New York-based digital health company, raised a $5.7M Seed from Meridian Street Capital and B Capital to redefine brain healthcare by leveraging cutting-edge technology and predictive machine learning.

🧘♂️ Being Health, a NYC-based psychiatrist-founded modern mental health practice provider, raised $5.4M from 18 Park and HDS Capital to expand operations and its business reach.

💼 Acquisitions

👶 Roper Technologies, a Florida-based radio frequency solutions Provider has signed a definitive agreement to acquire Procare Solutions, an Oregon-based provider of child care management solutions for a total enterprise value of $1.86B.

💻 HEALWELL AI, an Ontario-based healthcare technology company agreed to acquire Intrahealth, a British Columbia-based company that provides software and associated services for healthcare industries for a total consideration of $24.2M.

🌿 LMC Landscape Partners, a Texas-based commercial landscaping support services company, acquired Cutters Edge Total Landscape Solutions, a Florida-based company that provides professional services such as landscape maintenance, irrigation, and fertilization.

💻 VidIQ, a San Francisco-based provider of analytics suite for content creators, acquired Creator Now, a Los Angeles-based creator education platform.

🛍️ Suave, a New Jersey-based personal care essentials company, signed a binding offer to acquire ChapStick, a brand from Haleon, a global leader in consumer health.

🔬 Bruker Corporation, a Massachusetts-based manufacturer of analytical and medical instruments, signed a definitive agreement to acquire Chemspeed Technologies, a Swiss provider of vendor-agnostic automated laboratory R&D and QC workflow solutions.

📅 Economic Calendar

Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December

Tuesday January 30th 2024

🇫🇷 France - GDP Data, Q4

🇮🇹 Italy - GDP Data, Q4

🇪🇦 Euro Area - GDP Data, Q4

🇺🇸 US - Employment Data, December

Wednesday January 31st 2024

🇦🇺 Australia - Inflation Data, Q4

🇨🇳 Canada - NBS Manufacturing PMI, January

🇯🇵 Japan - Consumer Confidence, January

🇫🇷 France - Inflation Data, January

🇩🇪 Germany - GDP Data, Q4

🇩🇪 Germany - Inflation Data, January

Thursday February 1st 2024

🇺🇸 US - Fed Interest Rate Decision

🇺🇸 US - Fed Press Conference

🇨🇳 Canada - Caixin Manufacturing PMI, January

🇪🇦 Euro Area - Inflation Data, January

🇮🇹 Italy - Inflation Data, January

🇬🇧 UK - BoE Interest Rate Decision

🇺🇸 US - ISM Manufacturing PMI, January

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com