🌞 Solar Leads Renewables + South Asia Climate Tech 100

In this week's Climate Tech Newsletter, we preview Solar Energy and spotlight the 2023 South Asia Climate Tech 100. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our Daily Newsletters, Chart of the Day and Impact Capital Markets.

Happy Monday 👋

This week, we look across the Solar Energy market landscape and spotlight the 2023 South Asia Climate Tech 100. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our Daily Newsletters Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 🌞 Solar Energy. Mapping 100+ global players across the landscape

- 📊 Charts Spotlight. Installed Solar Capacity and Solar's Levelized Cost of Electricity

- 📈 Solar Stock Index. Stocks Slump Amidst Booming Sector

- 🏆 South Asia Climate Tech 100. South Asia's Most Promising Startups Working in Clean Energy, Zero-emission Mobility, and Sustainability

- 📊 Annual Climate Tech Outlook. 230 pages of Trends, Insights, and Data

- 💰 Climate Tech Deals of the Week. Funding, M&A and IPOs

🌞 Solar Energy Landscape

Power harnessed from the sun, more commonly known as Solar Energy is the most popular form of renewable energy across the world. While this concept has existed throughout human history, it was the discovery of the photovoltaic effect in 1839 that propelled the idea of harnessing solar energy to produce electricity into mainstream conversations. Photovoltaics (PV), in simple terms, is the process of converting energy from sunlight into electricity. The 2000s saw a resurgence in interest in solar power and has since seen exponential growth. Rooftop solar installations continue to gather momentum globally and were the biggest growth driver in the overall sector in 2023.

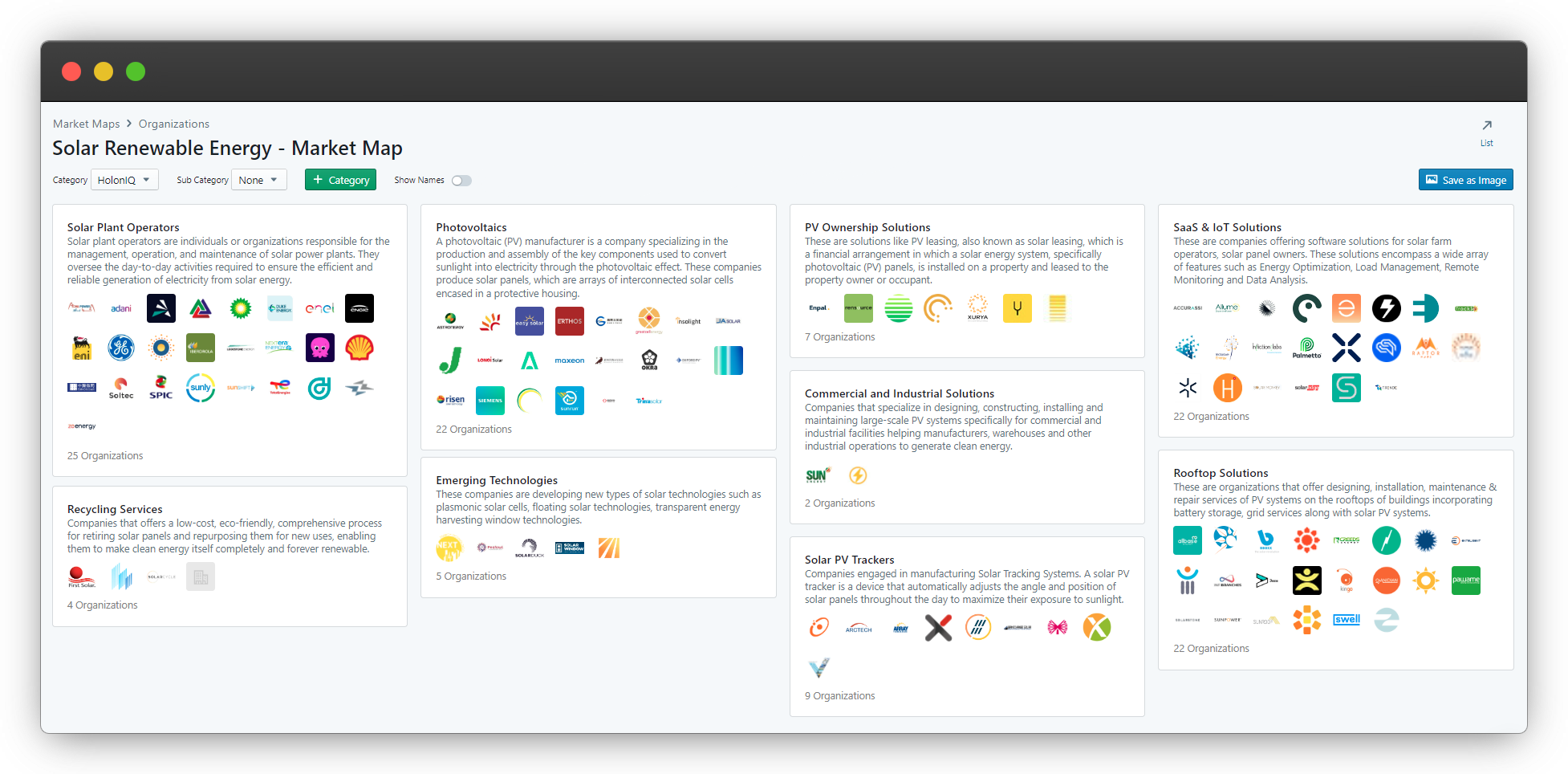

HolonIQ is tracking hundreds of players across the Solar Renewable Energy landscape around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you, by region, revenue, age, category, and more with subcategorization on any dimension in one click. Stay tuned for the launch!

🌞 Solar Renewable Energy - Market Map

📊 Charts Spotlight - Installed Solar Capacity and Solar's Levelized Cost of Electricity

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

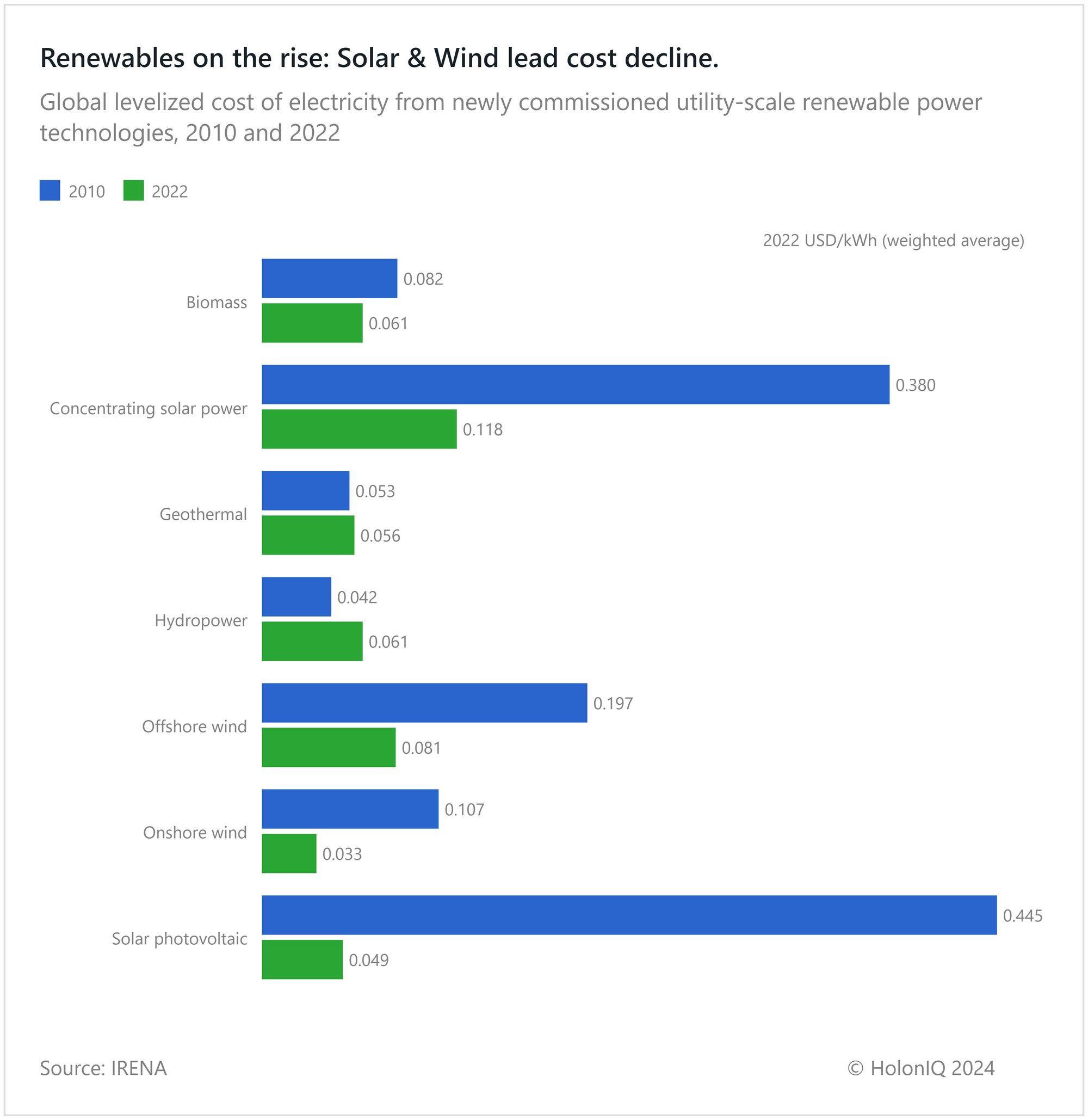

The rapid deployment of clean energy is primarily led by solar energy, as last year saw record additions led by rooftop installations and the deployment of giga-scale solar farms, especially in the UAE & Saudi Arabia. Solar energy has also seen the largest drop in levelized energy costs since 2010, which played a huge part in nations and developers alike embracing the technology. This also led to exponential growth in rooftop solar installations, especially in China & Europe. China's additions dwarfed those of all other countries, crossing 200GW while Europe added approximately 58GW. The US came in third with approximately 33GW. Furthermore, the sector also accounted for 60% or $1T of the $1.7T of clean energy investments in 2023. While activities in solar are set to cool in some European countries, the sector is set to see further growth in 2024, with Asia & the Middle East also expected to play a bigger role.

📈Capital Markets - Solar Energy Index

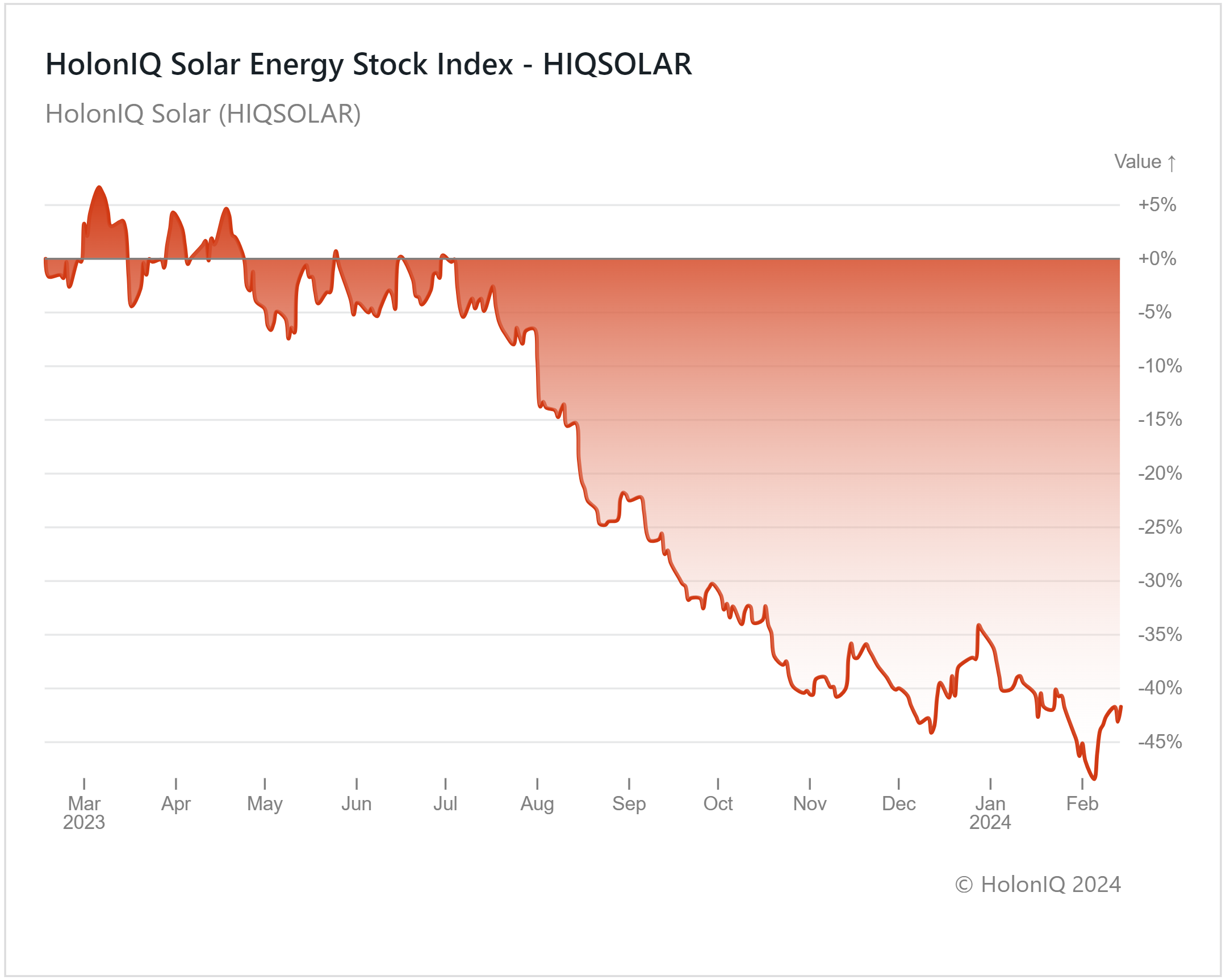

HolonIQ's Solar Energy index covers the best-performing stocks in the market and actively monitors the global economy and its impact on our indexes.

The solar energy sector saw record installations in 2023, dwarfing all other renewable energy sources. However, stocks in the sector performed poorly in comparison, primarily due to interest rate hikes that pushed up project financing for these companies, dampening profitability for solar energy developers. A 5% increase in interest rates increases the cost of electricity from wind and solar power by a third, while only marginally increasing the cost of electricity from natural gas plants. While most oil and gas facilities are part of an established infrastructure, the high-interest-rate economic environment will add to project costs and, as a result, dampen investor appetite.

Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

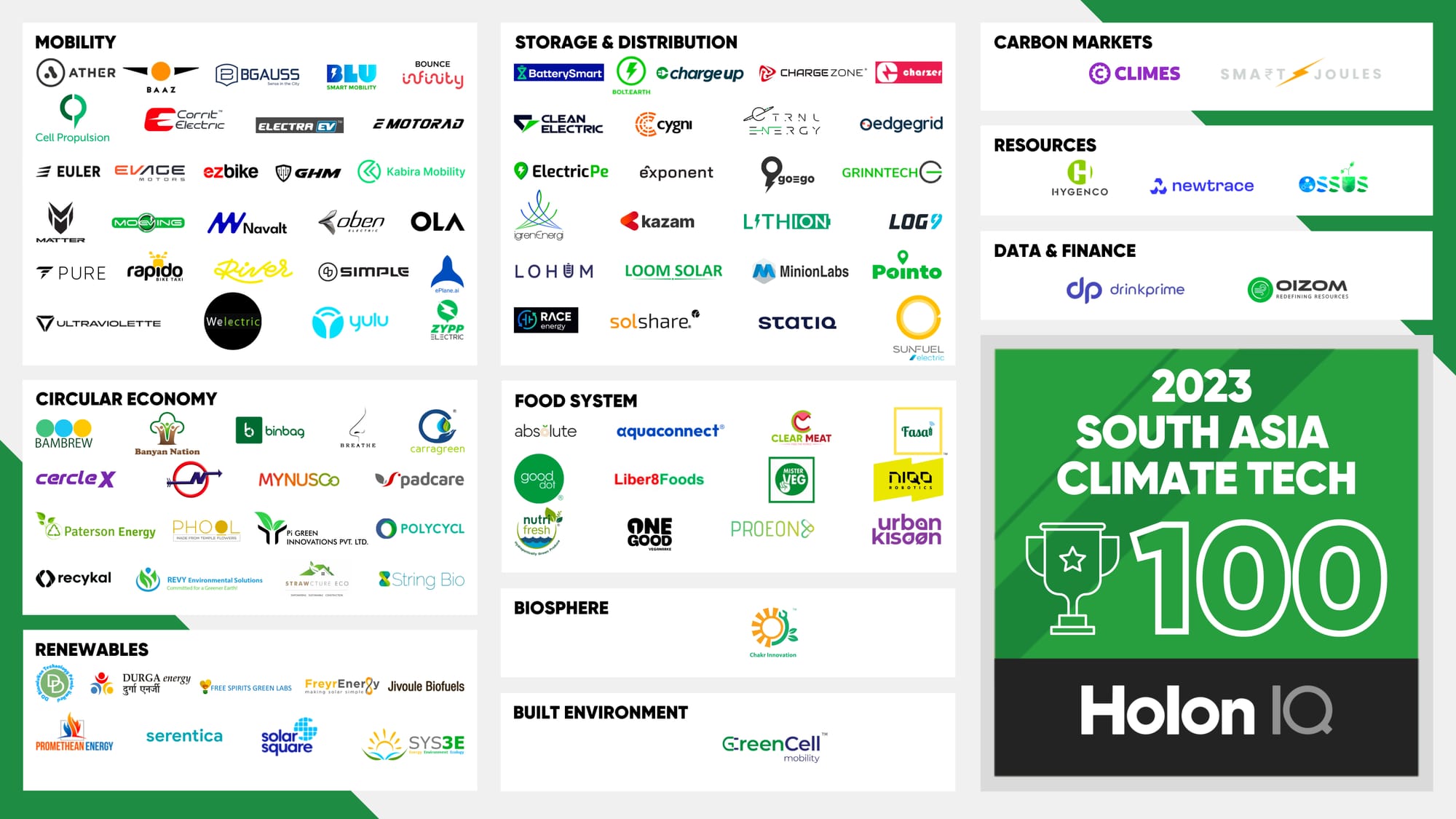

🏆 South Asia Climate Tech 100

The South Asia Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

India significantly dominated the South Asian region in the Climate Tech landscape, representing 98% of the South Asia Climate Tech 100. The remaining 2% consisted of startups from Bangladesh and Pakistan, signifying India’s dominant position in the region's startup ecosystem. Mobility, followed by Storage & Distribution & Circular Economy, was the largest sub-sector in the South Asia Climate Tech 100 list. At the same time, Recycling represented the majority of the Circular Economy sub-sector, followed by Sustainable Materials and Solid & Water Waste.

📊 2024 Global Climate Tech Outlook

2024 is a fresh start, and the stage is set for the next wave of Climate Technology. Just a few weeks ago, we launched the 2024 Global Climate Tech Outlook, HolonIQ's annual analysis of the new climate economy, presenting over 230 pages of detailed market data, investment & analysis, strategic shifts, and trends in energy, the environment, infrastructure, and mobility. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Health Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations worldwide as they navigate the challenges and opportunities ahead.

💰Climate Tech Top Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🌿 Koloma, a Denver-based company, raised a $245.7M Series B to advance its geologic hydrogen technology.

🪨 Lilac Solutions, a California-based lithium extraction technology company, raised a $145M Series C to expand its ion-exchange material production and global deployment.

🌱 Heura, a Barcelona-based Vegan meat brand raised $43M to accelerate innovations in plant-based cheese and boost Heura’s international presence.

✈️ Velocys, a Texas-based sustainable aviation fuel technology company, raised $40M to boost tech delivery, scale production, and enrich team expertise.

🌍 Rimere, a California-based company specializing in climate solutions, raised $10M in a corporate round from Clean Energy Fuels Corp. This funding will accelerate the deployment of Rimere’s two devices, the Reformer and the Mitigator.

IPOs

🌞 Alpex Solar, made its debut on the National Stock Exchange (NSE) of India, listing at $3.96 a share, recording a 186% increase from the issue price of $1.39.

M&A

⛽ Diamondback Energy, a Texas-based independent oil and natural gas company, and Endeavor Energy Resources, an exploration and production company in Texas, have entered into a definitive merger agreement. The transaction is valued at approximately $26B.

🔋 TRIG, a Guernsey-based leading renewable energy investment company, acquired Fig Power, a UK-based energy projects developer specializing in battery storage.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com