💻 Semiconductors Rise YoY 50%. $190M+ VC Funding.

Impact Capital Markets #120 looks at our Semiconductors Stock Index, major impact deals, M&A, and upcoming economic releases.

Dia dhuit ☘️

📈 Today's Global Economic Update: The Bank of England decided to hold its policy interest rate at 5.25% in June, with 2 of the nine-member monetary policy committee voting for a cut to 5%. The more accommodative tone in this month's meeting minutes compared to previous months has led financial markets to increase bets on a rate cut in August.

💉 Deal of the Day: iOnctura, an Amsterdam-based oncology biotech company, raised an $85.8M Series B to accelerate the development of its lead asset.

What's New?

💻 Semiconductors. Semiconductors rise YoY 50%

💰 Funding. Oncology biotech, warehouse automation, mental health solutions + more

💼 M&A. Solar tracking and education services

📅 Economics. Germany Ifo, US GDP data, inflation, + more

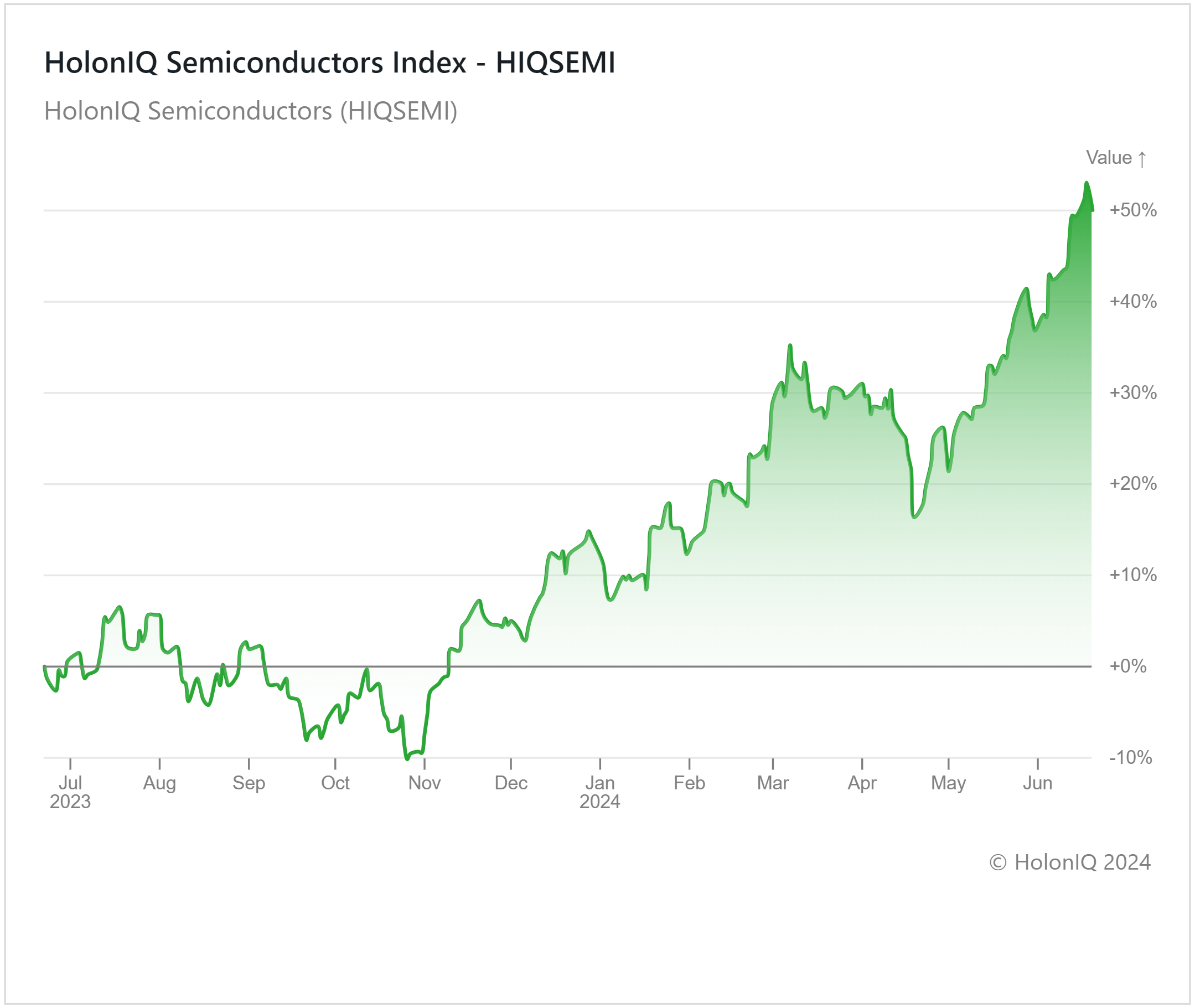

💻 Semiconductors Rise YoY 50%

HolonIQ’s semiconductor index has risen sharply in the last 2 months, to register a 50% yearly gain. While NVIDIA has seen a continued increase in its stock price since its earnings announcement in May, other semiconductor companies are also riding the wave. The rise of AI and soaring demand in EV and other tech industries has significantly boosted market confidence, while global funding for the semiconductor industry has further bolstered investor confidence. Apple's announcement of its first generative AI features for the iPhone is expected to increase semiconductor shipments from Taiwan Semiconductor Manufacturing Company (TSMC) ($785B MCap), as Apple is TSMC's biggest customer, accounting for 25% of its revenue. Investments in Europe are also increasing after NATO announced a $1.1 billion investment in AI and robotics, while Japan aims to boost its economy with a $27 billion investment in the semiconductor industry.

Global chip conflicts are creating some market uncertainty for semiconductor firms in the regions affected. The US is urging allies to curb China's access to advanced chip-making tools, and a bipartisan bill has been introduced to prevent recipients of CHIPS Act funds from using Chinese-made equipment. Malaysia's semiconductor industry is facing challenges due to accusations against Kuala Lumpur-based Jatronics for supplying parts for the conflict in Russia and Ukraine. Despite these conflicts, the semiconductor industry is poised for long-term growth.

💰 Funding

💉 iOnctura, an Amsterdam-based oncology biotech company, raised an $85.8M Series B from Syncona to accelerate the development of its lead asset.

🤖 Vecna Robotics, a warehouse automation technology company, raised a $40M Series C to expand operations.

🔥 Molten Industries, an Oakland-based energy startup, raised a $25M Series A to build its first modular reactor.

🚜 Balwaan Krishi, an Indian agri-tech e-commerce platform, raised a $4.8M Series A from JM Financial Private Equity to advance product development.

🧠 MEandMine, a California-based digital mental health platform for children, raised $4.5M to bring an AI-flagging mental health solution to schools.

💼 M&A

🔆 Nextracker, a California-based solar tracking systems company acquired Ojjo, for $119M, a California-based solar foundation manufacturer.

📚 The Salta Group, a Brazilian education conglomerate, acquired Colégio Ábaco, a Brazilian education services company.

📅 Economic Calendar

Germany Ifo, US GDP, Inflation, + More

Monday, June 24th 2024

🇩🇪 Germany Ifo Business Climate, June

Tuesday, June 25th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, June

🇨🇦 Canada Inflation Rate, May

Wednesday, June 26th 2024

🇩🇪 Germany GfK Consumer Confidence, July

Thursday, June 27th 2024

🇺🇸 US Durable Goods Orders, May

🇺🇸 US GDP Growth Rate, Q1

Friday, June 21st 2024

🇫🇷 France Inflation Rate (Preliminary), June

🇮🇹 Italy Inflation Rate (Preliminary), June

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending, May

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com