💊 Radiopharmaceuticals + Biosimilars & North America Health Tech 200

Happy Monday 👋

This week we are spotlighting two of our market maps on radiopharmaceuticals and biosimilars. Don't forget to check out the 2024 Global Health Outlook, and sign up for our new Daily Newsletters - 'Chart of the Day' and 'Impact Capital Markets'.

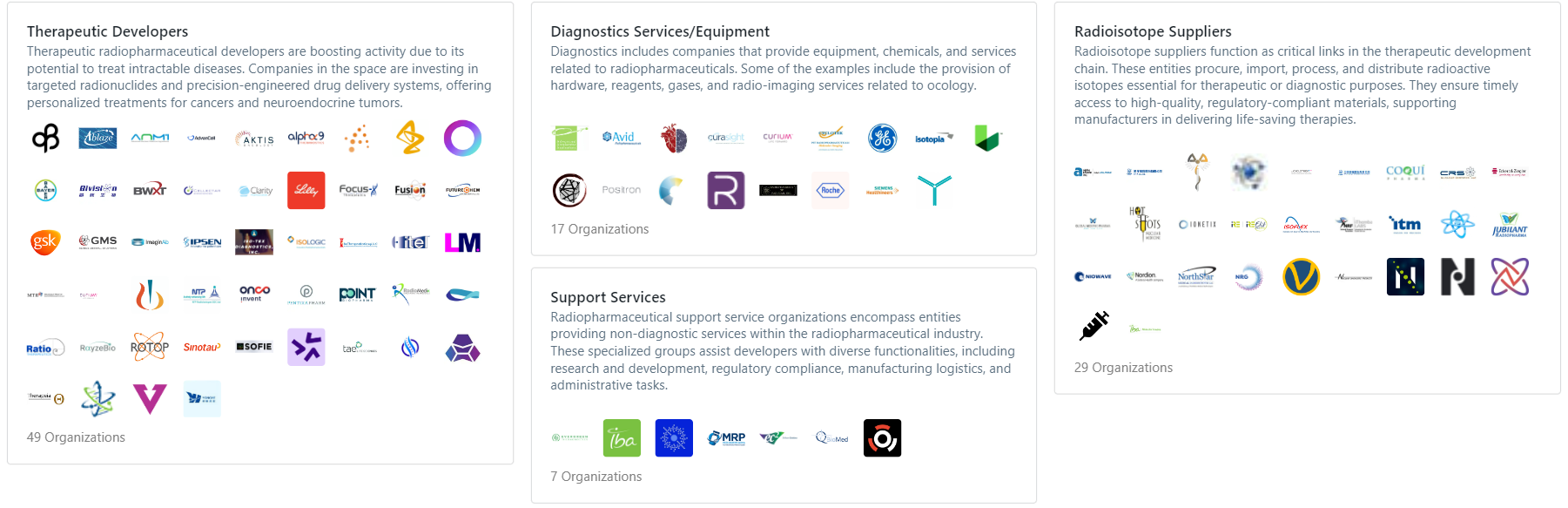

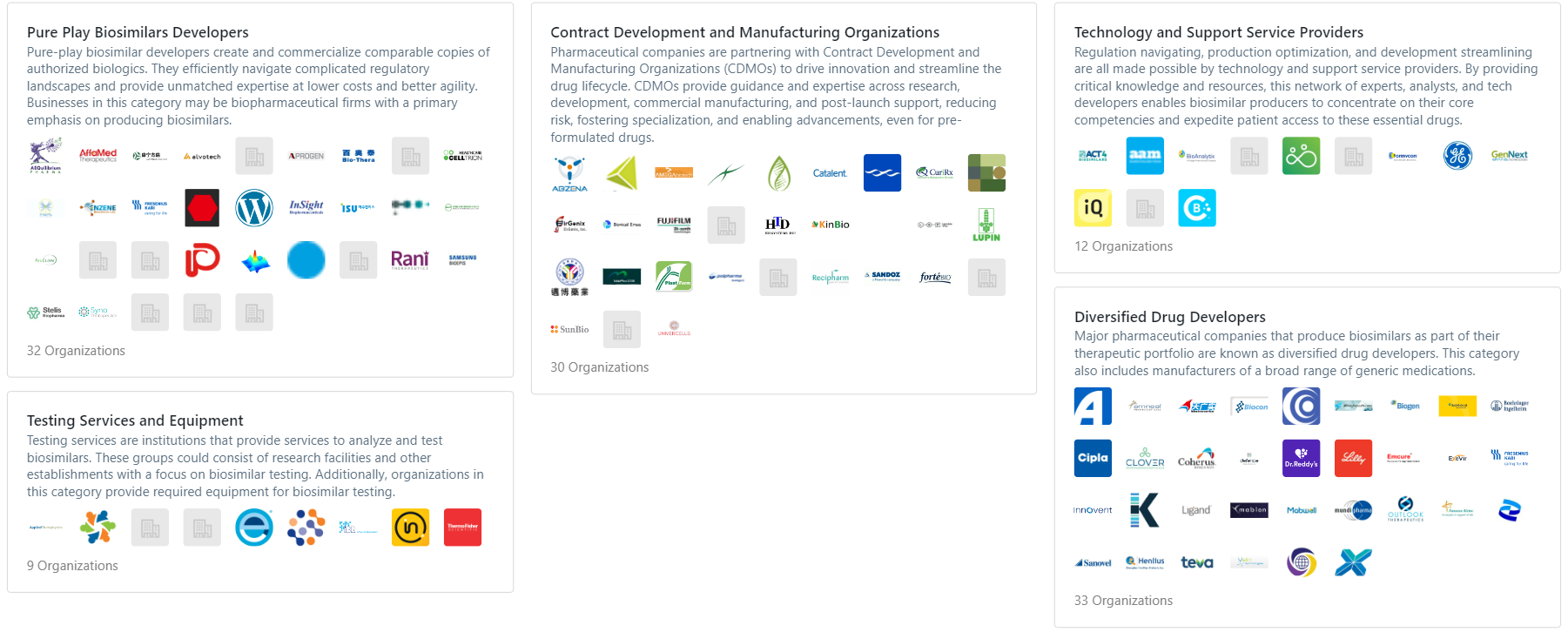

🧪 Radiopharmaceutical and Biosimilar Landscape

Cancer is the second leading cause of death globally, and radiopharmaceuticals seek to provide therapeutic and diagnostic solutions for cancer patients across the world. Biosimilars are copies of existing biologics, which are larger molecule medications synthesized from biological materials. These contrasting areas of the pharma market represent both the necessity of finding new cures and cutting the cost of existing medicines.

There is a considerable amount of industry activity surrounding these two topics. For biosimilars, CVS Caremark (one of the largest pharmacy benefits management firms in the US) sought to replace Humira with biosimilar options from January 08, 2024. Humira is a branded version of a biologic drug manufactured by AbbVie and the drug contributes to a considerable portion of the firm’s revenue. Concurrently, radiopharmaceuticals witnessed some recent activity with Novartis seeking to expand radiopharmaceutical production in China in December 2023.

HolonIQ is tracking hundreds of health companies in this area around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you. By region, revenue, age, category and more with sub categorization on any dimension in one click. Stay tuned for the launch…

📊 2024 Global Health Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Health Technology. Just a few weeks ago, we launched the 2024 Global Health Tech Outlook, HolonIQ's annual analysis of the health landscape, presenting over 190 pages of detailed market data, investment & analysis, strategic shifts and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Climate Tech Outlook or Global Education Outlook.

We have a jam packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward thinking institutions, governments and organizations worldwide as they navigate the challenges and opportunities ahead.

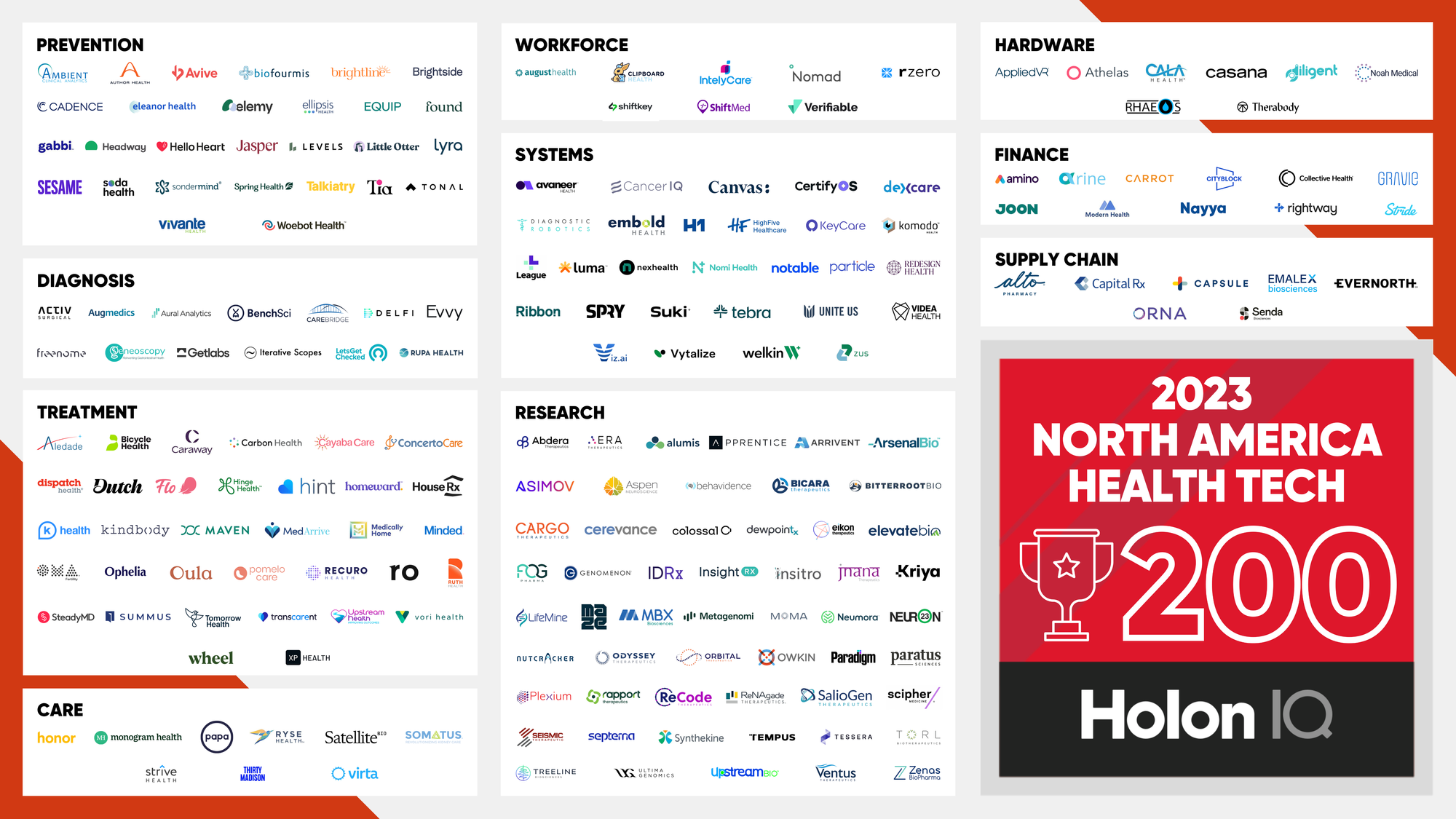

🏆 North America Health Tech 200

The North America Health Tech 200 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery and analytics.

📊 Charts, Charts and more Charts. Coming Soon.

Starting next week, HolonIQ is launching a new newsletter 'Chart of the Day'. A daily newsletter that helps explain the global impact economy - from health tech to education and climate tech. Subscribe to Chart of the Day for data-driven insights on sustainable and inclusive growth.

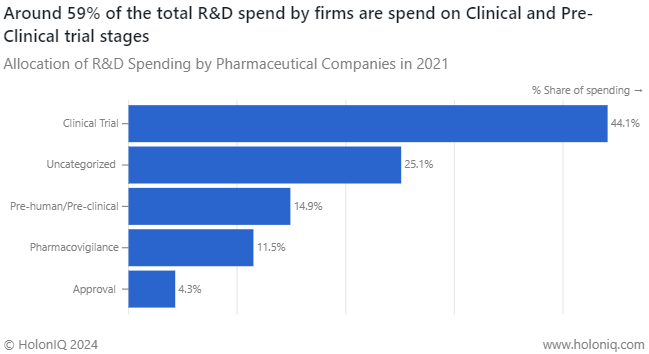

Roughly 59% of all R&D spending by pharmaceutical companies are spent on pre-trial and the clinical trial stage. Only 8% of all pharmaceutical drugs pass all stages of a clinical trial. Hence, most firms prioritize spending in these stages to ensure that their therapeutic passes the trial to obtain regulatory approval. Furthermore, the cost of developing a new drug ranges from less than $1 billion to over $2 billion. Government programs like Medicare influence private R&D spending, while policies like basic research and clinical trial regulations also impact supply and demand dynamics.

Source: HolonIQ, EFPIA

📈 Health Tech Capital Markets

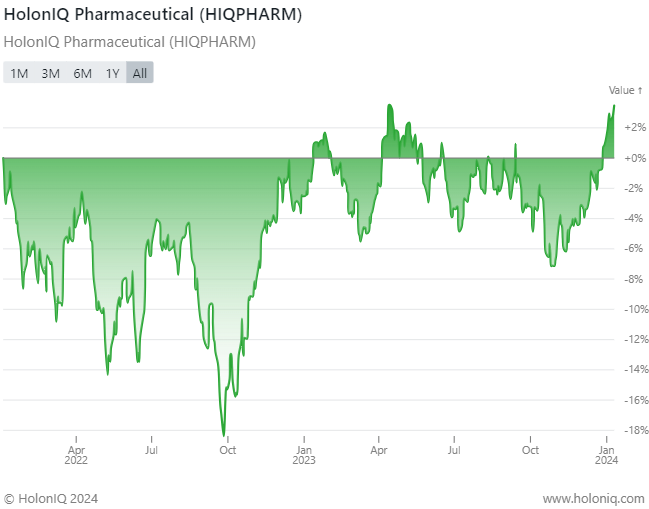

HolonIQ tracks over multiple listed companies in health around the world and thousands of acquisitions and investments each year. Soon we will launch a range of Stock Indices to track the daily performance of over 10 indices across Health Technology.

Our new Impact Capital Markets newsletter launches next week and will track over 60 impact stock indices, including climate tech, emerging economies and over 50 indices tracking education technology and healthcare innovation.

Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

Top Deals This Week:

Funding:

⚕️🔬 Lykos Therapeutics: secured $100M in Series A financing, targeting commercialization of MDMA-based therapy for PTSD, supported by positive late-stage trial results and psychological intervention.

🧬🔬 Vico Therapeutics: raised $60M in a Series B funding round led by Ackermans & van Haaren, with participation from Droia Ventures, EQT Life Sciences, Kurma Partners, Polaris Partners, Pureos Bioventures, and Eurazeo. The funding will support Vico Therapeutics' Phase 1/2a clinical trial.

👁️ Claris Bio: raised $70M in a Series B funding round, led by Novo Holdings A/S, to develop a recombinant human variant hepatocyte growth factor (dHGF) for corneal eye disease therapies. The lead program, CSB-001 Ophthalmic Solution 0.1%, is expected to complete enrolment in 2024.

Acquisitions:

🧠⚙️ Boston Scientific: plans to acquire Axonics for nearly $4B, aiming to strengthen its urology market position and enhance its sacral neuromodulation (SNM) product portfolio.

🧬🕊️ Johnson & Johnson: is set to acquire Ambrx Biopharma, a clinical-stage biopharmaceutical company specializing in next-generation antibody drug conjugates, valued at $2B.

🫁💔 GSK: acquires Aiolos Bio for $1.4B, bolstering its respiratory disease position. The acquisition targets 40% severe asthma patients with treatment options, a crucial move amid patent expiries and declining revenue.