⚛️ Nuclear Energy Resurgence. Europe Climate Tech 200.

This week we look at our new Market Maps, preview Nuclear Energy, and spotlight the 2023 Europe Climate Tech 200. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our new Daily Newsletters Chart of the Day and Impact Capital Markets.

📊 2024 Global Climate Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Climate Technology. Just a few weeks ago, we launched the 2024 Global Climate Tech Outlook, HolonIQ's annual analysis of the new climate economy, presenting over 230 pages of detailed market data, investment & analysis, strategic shifts, and trends in energy, the environment, infrastructure, and mobility. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Health Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations worldwide as they navigate the challenges and opportunities ahead.

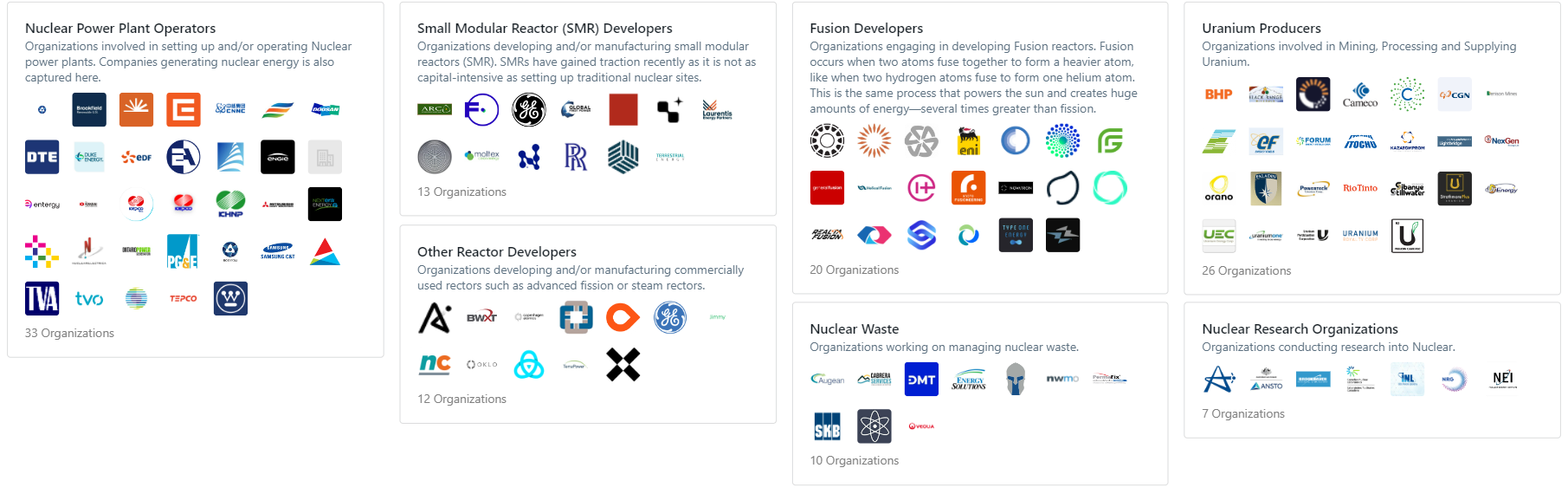

⚛️ Nuclear Energy Landscape

The nuclear energy sector is driven by a complex interplay of factors, ranging from geopolitical to technological, and environmental considerations. Governments worldwide have shown renewed interest in nuclear energy as a reliable, low-carbon energy source amidst the difficulties arising from climate change and energy security concerns. The landscape of nuclear energy is evolving with advancements such as small modular reactors (SMRs) and next-generation fuels that promise greater safety and efficiency. The last few years have also seen considerable advancements in Fusion reactors that are touted to revolutionize the sector. An increased amount of funding has been directed to companies developing fusion reactors, with the likes of Commonwealth Fusion, and Helion Energy achieving Unicorn Status. Decommissioning aging reactors and disposal of nuclear waste also remain costly and challenging which many startups are attempting to solve.

HolonIQ is tracking hundreds of players across the Nuclear landscape around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you, by region, revenue, age, category, and more with subcategorization on any dimension in one click. Stay tuned for the launch...

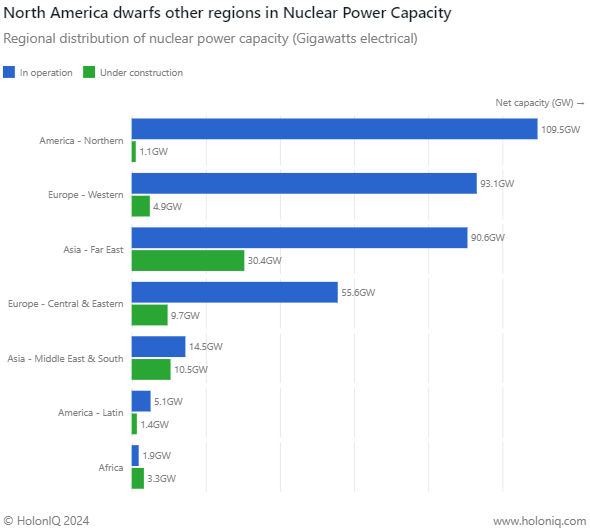

⚡Nuclear Share in Electricity Generation & Nuclear Power Capacity

HolonIQ launched a new newsletter 'Chart of the Day'. A daily newsletter that helps explain the global impact economy - from climate tech to education and healthcare. Subscribe to Chart of the Day for data-driven insights on sustainable and inclusive growth.

France tops the list in electricity generated from nuclear energy, with approximately 65%-70% of their electricity coming from their nuclear reactors in 2023. France has long backed nuclear energy as a clean energy source and has come into friction with its European peers such as Germany, Belgium, Spain, and Switzerland who are against nuclear energy due to its hazardous implications and challenges. In 2023, countries like Germany and Switzerland shut down their last reactors while the likes of China, Japan, and the US commissioned new nuclear power plants. Nuclear energy is set to play a larger role as the world transitions to clean and low-carbon energy sources and was a key point that was discussed at COP28 which took place in Dubai last year.

Despite France generating more electricity from nuclear energy, the US leads other regions in nuclear power capacity with over 100GW of capacity in operation. Constellation Energy, Duke Energy, and Tennesee Valley Authority account for the largest capacity in the US. A mixture of historical factors such as the partial meltdown of a reactor in Pennsylvania and the Chernobyl incidents have turned public sentiment away from Nuclear energy in the US, coupled with the country's reliance on fossil fuels has kept them from fully utilizing its nuclear fleet. East Asia, led by China has the largest nuclear capacity under construction with 21 reactors, looking to increase their total capacity to 45 reactors.

Source. HolonIQ, IAEA

🏆 Europe Climate Tech 200

The Europe Climate Tech 200 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

2024 Global Climate Tech Unicorn List

This week HolonIQ is updating the Global Climate Tech Unicorn List for 2024, with approximately 35 new companies joining the exclusive list of private companies valued at $1B or more. These companies combined are worth close to $320B.

This week saw Chinese company Qiyuan Green Power, a green energy solutions provider close a $211.2m funding round to reach the unicorn valuation of over $1b. Shanghai-based Qiyuan offers green energy solutions and services to help China build an eco-friendly logistics and transportation ecosystem.

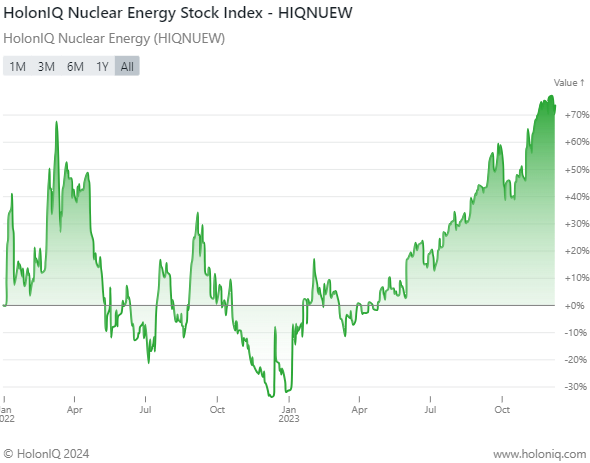

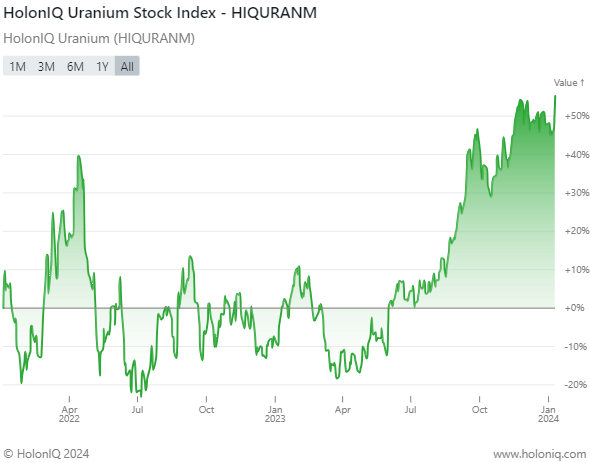

📈Capital Markets - Nuclear Stocks

HolonIQ's Nuclear and Uranium indices cover close to 100 of the best-performing stocks in the market and are actively monitoring the global economy and its impact on our indexes. The Nuclear and the Uranium Industries are closely interlinked and the performance of one has an immediate and direct impact on the other. Thus, we look at both parallelly to gauge how the market is performing.

Our new Impact Capital Markets newsletter launches next week and will track over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking education technology and healthcare innovation.

Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

💰Climate Tech Top Deals of the Week

Holon actively monitors and tracks deals that take place in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Top deals this week include,

💰 Funding

🌱 Perfect Day, a Berkeley, California-based company producing animal-free milk protein, raised a $90M Series D from international investors. The company aims to announce a 'major CPG (Consumer Packaged Goods) partner launch' in 2024.

🌊 120Water, an Indiana-based developer of a subscription-based water testing platform, raised $43M from Allos Ventures, to further expand the team, technology investments, and go-to-market efforts.

⚡ Vortexa, a UK-based energy analytics platform provider, raised $34M Series C from Morgan Stanley Expansion Capital to further accelerate its international expansion, technology, and quality of service to its clients and partners.

🚗 Burro, a Philadelphia-based autonomous mobility company, raised a $24M Series B from Catalyst Investors and Translink Capital. The funds are likely to support the company's growth in the autonomous mobility sector.

🌱 Enifer, a Finland-based biotech startup, secured a $13M Grant from NextGenerationEU, to build a first-of-its-kind mycoprotein ingredient factory.

💼 Acquisitions

🌾 Danstar Ferment, a Canadian-based food ingredient supplier, acquired Evolva, a Swiss-based producer of sustainably sourced natural flavors, sweeteners, and functional ingredients for $23.5M.

⚡ Energy Capital Partners (ECP), a New-Jersey-based leading infrastructure investor, acquired Triple Oak Power, an Oregon-based renewable project developer with a development pipeline exceeding 8 GW.

⛏️ Aterian Plc. (LSE: ATN), a UK-based miner has entered a share purchase agreement to acquire a 90% stake in Atlantis Metals, an Africa-based metal exploration company.