✨ Psychedelic Mental Health Treatments + South Asia Health Tech 100

Psychedelic drugs are emerging as a promising new approach to treating mental illness, offering unique mechanisms of action that may prove effective where traditional treatments like antidepressants have fallen short. In the Health Tech market, we revisit the 2023 South Asia Health Tech 100.

Happy Monday 👋

Psychedelic drugs are emerging as a promising new approach to treating mental illness, offering unique mechanisms of action that may prove effective where traditional treatments like antidepressants have fallen short. In the Health Tech market, we revisit the 2023 South Asia Health Tech 100, highlighting the region's most promising startups in the health technology sector.

This Week's Topics

✨ Psychedelic Mental Health Treatments. A shift to psychedelics to address mental health issues

📈 Medical Devices. Up 4% year-on-year

🏆 South Asia Health Tech 100. South Asia's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

✨ Psychedelic Mental Health Treatments

Psychedelic medications help to alter how the brain functions and improve mental health conditions like depression, anxiety, and posttraumatic stress disorder (PTSD). Medications for the treatment include ketamine, psilocybin, and MDMA. In a recent partnership, The University of Sydney's Brain and Mind Centre partnered with Psylo, a biotechnology startup developing non-hallucinogenic psychedelic drugs to create new treatments for mental health conditions using advanced artificial intelligence technologies. The joint effort aims to speed up the development of the treatments and offer cost-effective solutions. The biotech startup Psylo plans to carry out human trials in the coming year, focusing on addressing the limitations of conventional treatments, like SSRI antidepressants, and the barriers faced by traditional psychedelic therapies, highlighting the growing interest in university partnerships to address public health challenges.

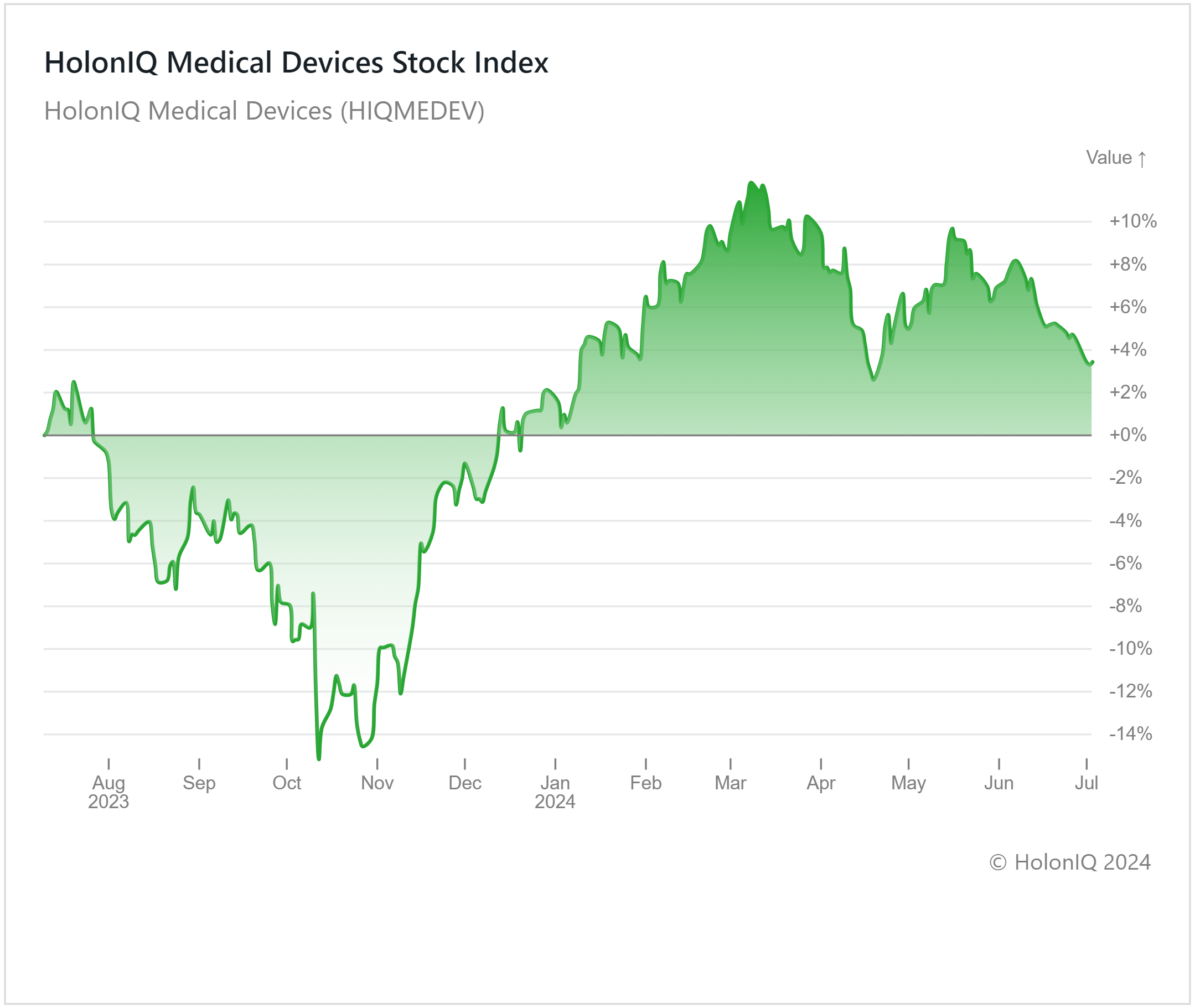

🛡️ Medical Devices by 4% YOY

The Medical Device Index has shown resilience, with a 4% increase over the past 12M, fueled by the accelerated adoption of wearable devices. This increase in demand, especially during the pandemic, for devices monitoring vital signs like temperature and oxygen levels contributed significantly to market growth, coupled with strong investment in R&D across the sector.

However, recent months have seen volatility, culminating in a 4% decline over the past quarter. This downturn stems from multiple pressures, such as governments worldwide pushing to lower healthcare costs and intensifying pricing pressures on medical devices, particularly in hospital settings. Regulatory hurdles, such as the European Medical Device Regulation and China's local innovation initiatives, have added complexity and uncertainty, impacting operational strategies. This has been reflected in key stocks within the index, with notable declines seen in significant players like Medtronic ($99B MCap), Abbott Laboratories ($178B MCap), and Stryker Corp ($126B MCap), showing decreases of 9%, 8%, and 5% respectively over the past quarter.

Supply chain disruptions, exacerbated by geopolitical tensions and healthcare workforce shortages, have further strained the sector's efficiency. Specific companies like Medtronic faced challenges, including stock decline due to lower-than-expected forecasts driven by soft demand for specific heart devices. Looking ahead, despite the current industry decline, there are promising signs of recovery and growth. Integration of data intelligence with devices continues to drive innovation, opening new revenue avenues and enhancing patient outcomes. Emerging Asian markets offer growth opportunities amid increasing healthcare demand. However, global challenges and regulatory pressures shape a cautious outlook.

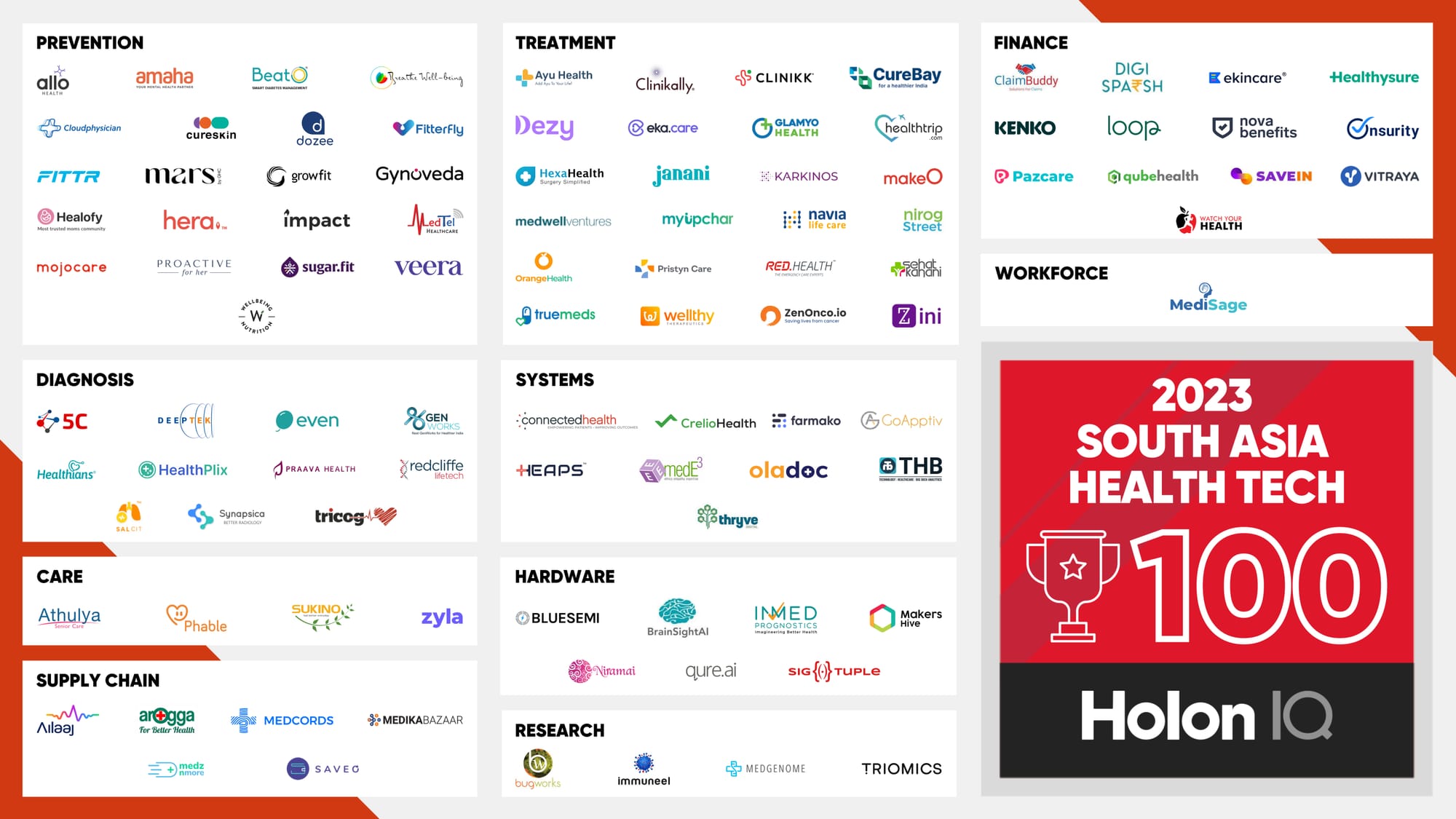

🏆 South Asia Health Tech 100

The 2023 South Asia Health Tech 100 is HolonIQ’s annual list of the region's most promising startups in digital health, biotech, drug discovery, and analytics.

A cohort member of 2023’s health tech list, Triomics, an AI company focused on oncology, raised $15M to help automate cancer providers' workflows. OncoLLM, a Tricomics technology, analyzes unstructured data in patient records to perform tasks like matching patients with clinical trials. Triomics is piloting this technology in several cancer centers, aligning with HolonIQ's most significant health trends, AI-led drug discovery, and AI-powered Diagnostics. AI in healthcare is primarily driven by the need to analyze and leverage large amounts of data.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to catch up on the top deals each day.

Funding

🧠 Beacon Therapeutics, a US-based biotech firm, raised a $170M Series B led by Forbion Capital Partners to advance the development of ophthalmic gene therapies.

📱 K Health, a NYC-based provider of an AI primary care platform, raised $50M in funding led by Claure Group to expand operations and development efforts.

🧪 Kanvas Biosciences, a US-based spatial biology company, raised $12.5M in a Seed round led by DCVC and Lions Capital LLC to further develop its spatial biology platform and advance two novel therapeutics.

M&A

👁️ Alcon, a Swiss eye care company, acquired Belkin Vision for $535M, a provider of laser devices to assist healthcare professionals in treating glaucoma.

🏥 UFP Technologies, a US-based pharmaceutical manufacturer, acquired AJR Enterprises for $110M, a medical device manufacturer that offers industrial sewing, cutting, printing, welding, and foam solutions.

Thank you for reading. Have a great week ahead!

Have some feedback suggestions? Let us know at hello@holoniq.com