💊 Nutrition and Supplements 6% Yearly Gain. $510M+ VC Funding.

Impact Capital Markets #80 looks at our Nutrition and Supplements index, major impact deals, M&A, and upcoming economic releases.

📉Today's Global Economic Update: US GDP data released yesterday showed a slowdown in economic growth, with the economy expanding by 1.6% in Q1 2024, compared to 3.4% in the previous quarter. The deceleration was driven by decreases in consumer spending and non-residential investment, while residential investment increased.

🤖 Deal of the Day: Augment, an AI coding assistant startup, raised a $227M Series B to accelerate product development.

What's New?

💊 Nutrition and Supplements. Nutrition and supplements steady past 3 months, up 6% YoY

💰 Funding. AI coding, neuro pharmaceutical, medical device + more

💼 M&A. Fintech and generative AI

📅 Economics. Euro Area GDP, US Fed interest rate, balance of trade + more

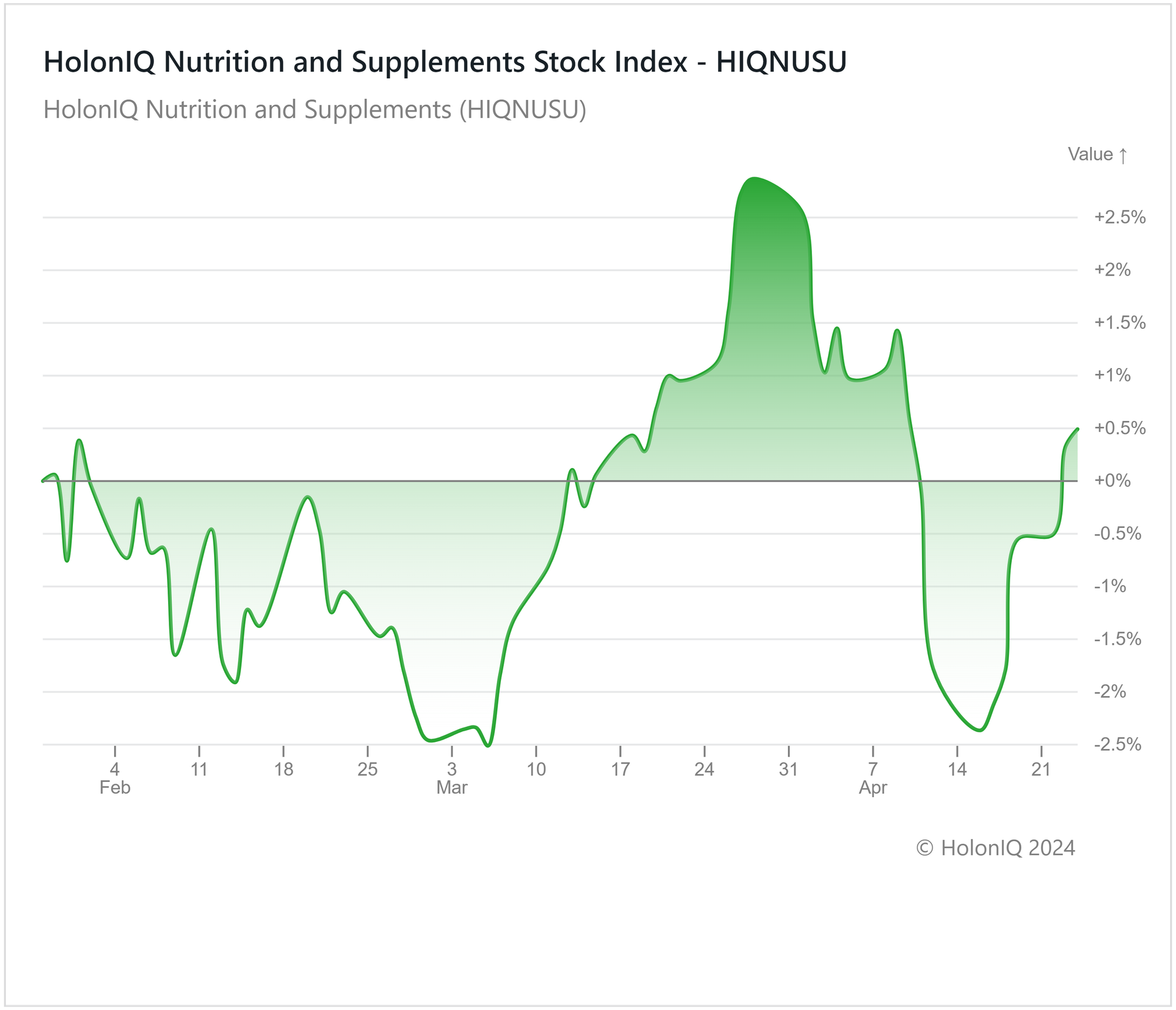

💊 Nutrition and Supplements Steady Past 3 months, Up 6% YoY

HolonIQ's Nutrition and Supplements index has climbed 6% over the last year, retracing a more than 10% drop in late 2023. This gain has largely held steady in the last three months despite with some fluctuations. The industry has been struggling with high prices for over two years, mainly due to increased input costs triggered by the pandemic and worsened by the Russia-Ukraine conflict. Alongside this, the prolonged period of high inflation has strained consumer budgets, leading many to opt for cheaper consumer goods. This trend is reflected in the index as well, where larger conglomerates like Nestle, Unilever, and Archer-Daniels-Midland saw price declines of 20%, 8%, and 21%, respectively. Conversely, smaller niche players, including Balchem Corp and BellRing Brands, made gains of 12% and 57% over the past year.

The trend is set to continue with larger companies, including Nestle, expecting only modest growth in sales amid ongoing challenges in other consumer segments. Unilever's stock price is, however, up 3% in the month following its announcement to spin off its ice cream business and focus on core segments, including health and wellness. Overall, the nutritional supplement industry appears poised for a gradual recovery. This could be fueled by easing inflation, growing demand from health-conscious consumers, and the aging population.

💰 Funding

🤖 Augment, a California-based AI coding assistant startup, raised a $227M Series B to accelerate product development.

💬 Parloa, a German conversational AI platform provider, raised a $66M Series B from Altimeter Capital to expand into new markets.

💊 Cerevance, a Massachusetts-based neuropharmaceutical company, raised a $47M Series B to advance its clinical pipeline.

👩⚕️ Pinkdx, a California-based biotechnology company, raised a $40M Series A to develop diagnostics and focus on gynecological cancers.

💉 AtaCor, a California-based medical device company, raised a $28M Series C from Arboretum Ventures to support FDA submission for its temporary pacing lead system.

🔋 Chemix, a California-based EV battery developer, raised a $20M Series A from Ibex Investors to expand its team.

🧬 RevOpsis Therapeutics, a California-based biopharmaceutical company, raised a $16.5M Seed to complete the Investigational New Drug (IND) enabling studies to secure FDA authorization.

💼 M&A

💰 Finsight, a New York-based fintech company acquired T-REX, a New York-based data analytics platform.

🌍 One Click LCA, a Finnish life cycle metrics software provider, acquired Buildrz, a French maker of generative AI software.

📅 Economic Calendar

Euro Area GDP data, US Fed Interest Rate, Balance of Trade + More

Friday, April 26th 2024

🇺🇸 US Core PCE Price Index, March

🇺🇸 US Personal Income & Spending, March

Monday, April 29th 2024

🇩🇪 Germany Inflation Data (Preliminary), April

🇨🇳 China NBS Manufacturing PMI, April

🇨🇳 China Caixin Manufacturing PMI, April

Tuesday, April 30th 2024

🇫🇷 France GDP Data (Preliminary), Q1

🇫🇷 France Inflation Data (Preliminary), April

🇩🇪 Germany GDP Data Flash, Q1

🇮🇹 Italy GDP Data, Q1

🇪🇦 Euro Area GDP Data Flash, Q1

🇪🇦 Euro Area Inflation Data Flash, April

🇮🇹 Italy Inflation Data (Preliminary), April

Wednesday, May 1st 2024

🇯🇵 Japan Consumer Confidence Index, April

🇺🇸 US ISM Manufacturing PMI, April

🇺🇸 US Job Openings, March

🇺🇸 US Fed Interest Decision

🇦🇺 Australia Balance of Trade Data, March

Thursday, May 2nd 2024

🇨🇦 Canada Balance of Trade Data, March

Friday, May 3rd 2024

🇺🇸 US Non-Farm Payrolls Data, April

🇺🇸 US Employment Data, April

🇺🇸 US ISM Services PMI, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com