💸 New US Tariffs Target Chinese Clean Tech + Puerto Rico Impact 50

Recently, the US has imposed significant tariffs on an extensive range of Chinese imports, including clean technology products like electric vehicles, solar panels, and batteries, along with essential healthcare items such as needles, surgical gloves, and other PPE equipment.

Happy Monday 👋

The US recently imposed heavy tariffs on a broad spectrum of Chinese imports, including clean technology products like electric vehicles, solar panels, and batteries. The tariffs extend to essential healthcare supplies such as needles, surgical gloves, and other PPE equipment. This week, we also feature HolonIQ's inaugural Puerto Rico Impact 50 list, identifying high-potential startups in the territory.

This Week's Topics

💸 US Tariffs. US raises taxes on Chinese clean energy tech & EVs

📉 Hydrogen Stock Index. Declines for most of the year

🏆 Puerto Rico Impact 50. High-potential startups and scale-ups driving positive change in education, health, and climate

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

💸 US Raises Taxes On Chinese Clean Energy Tech & EVs

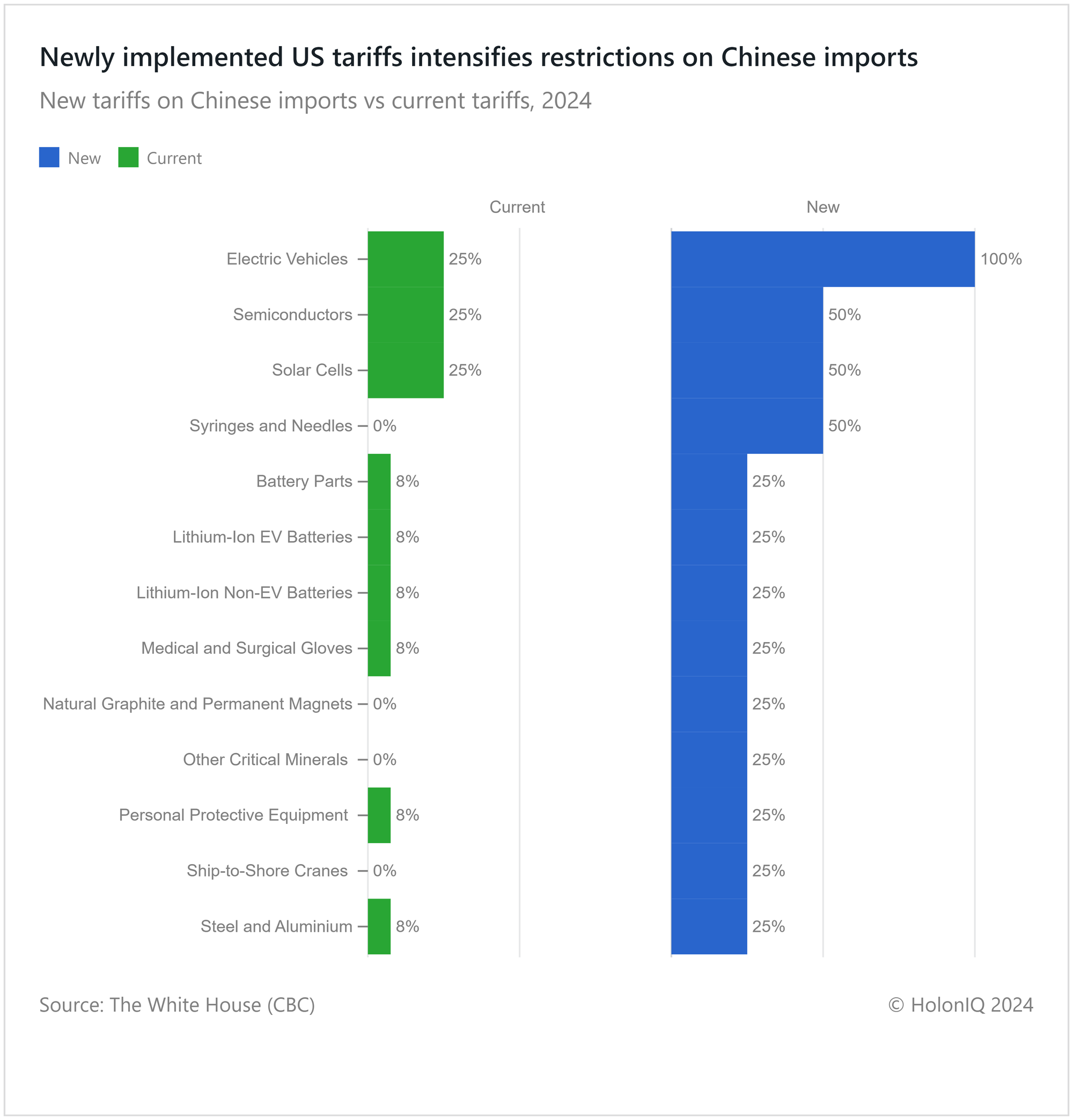

After months of deliberation, the US raised tariffs on Chinese imports worth $18 billion. Starting this year, the US is increasing the tariffs on imported Chinese electric vehicles from 25% to 100%. The import tax on Chinese solar cells doubles from 25% to 50%. And tariffs on certain Chinese steel and aluminum imports will increase more than three-fold, from 7.5% to 25%. While not yet officially announced, the tariff on lithium-ion batteries for EVs and lithium batteries meant for other uses, such as energy storage systems, is also expected to triple when it comes into effect.

New US tariffs on Chinese imports, including those for solar panels and electric vehicle batteries, could lead to temporary price increases, potentially hindering rapid adoption of these clean technologies in the near future until US clean tech manufacturers can ramp up production. However, it's important to note that China currently dominates the global production of solar panels and lithium-ion batteries, making the US heavily reliant on them.

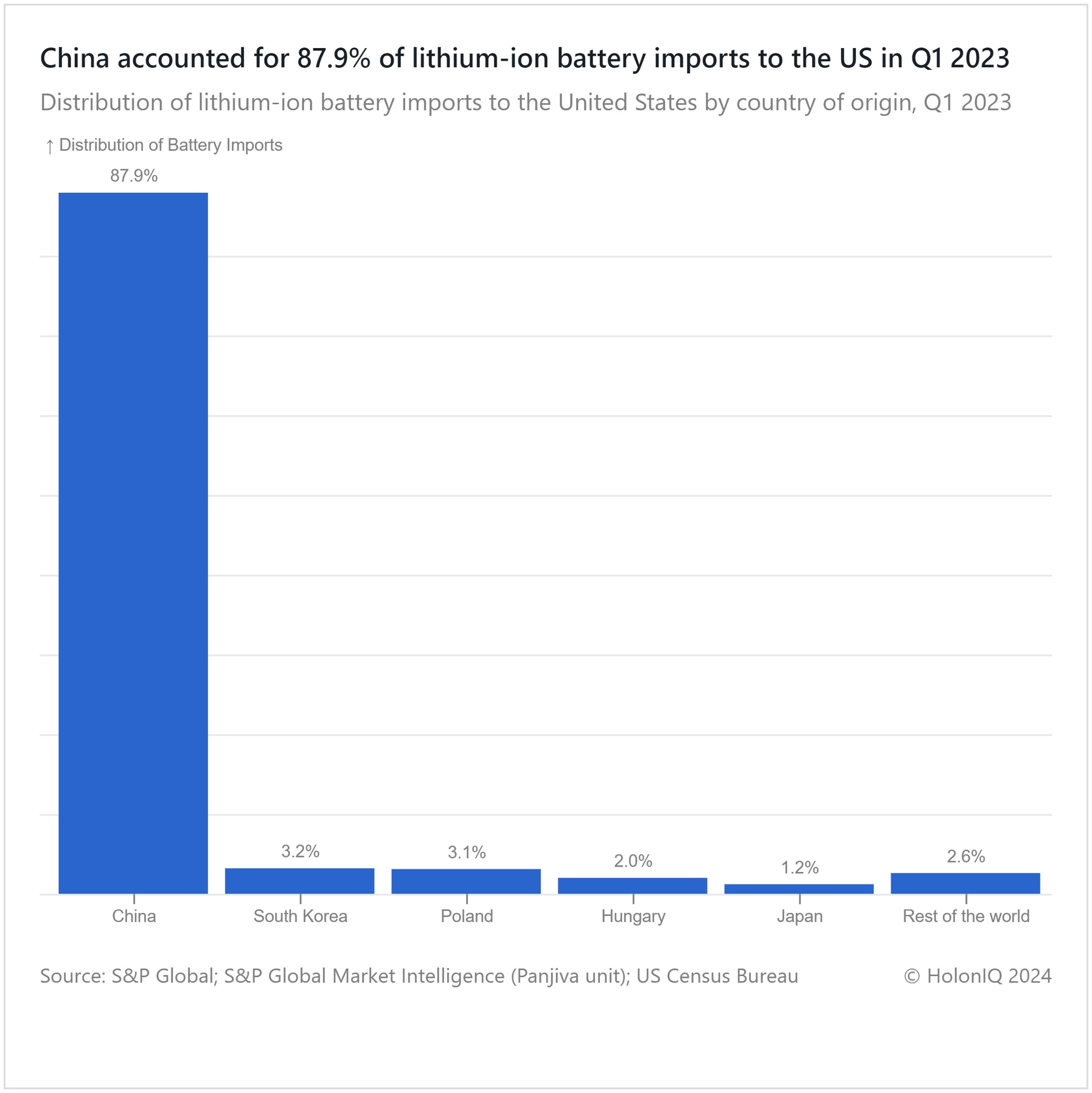

While Chinese electric vehicles haven't gained significant traction in the US yet, these tariffs could still impact the affordability and accessibility of clean energy solutions. For example, the US installed a record-breaking 33GW of solar capacity in 2023, with the utility sector alone adding 22.5 GW. Tariffs might disrupt this momentum, potentially impacting thousands of Americans who installed solar panels on their homes last year. The tariffs on lithium-ion batteries, a crucial component for electric vehicles, also raise concerns about achieving US net-zero goals. China remains the dominant supplier, accounting for 87.9% of US battery imports in March 2024, up from 77.5% in 2022.

Furthermore, the US is also ramping up the installation of battery storage systems, which is vital for integrating renewable energy projects into electricity generation. However, the new tariffs on Chinese imports, including those for batteries, threaten to disrupt this progress. Potential price hikes for American consumers could dampen the growth of clean energy sectors. This could further complicate the Federal Reserve's efforts to combat inflation, with high inflation and interest rates already having stalled some clean energy projects. The US government argues that the tariff structure minimizes inflation risks, allowing more time for US manufacturers to scale up their production. The overall impact on consumer costs and clean energy deployment remains to be seen.

📉 Hydrogen Index Declines For Most of the Year

HolonIQ tracks thousands of listed climate tech companies worldwide, as well as their acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ's Hydrogen Index declined most of the year as high production costs hindered growth in the sector. Despite providing an avenue to transition away from fossil fuels, the high energy prices in Europe and Asia have made hydrogen production and transportation a costly business. The cost of electrolyzers used to produce green hydrogen has increased by over 50% YoY in China, Europe, and the US, three of the largest markets for green hydrogen. Inflation in Europe and the US, affecting raw materials, energy, and labor costs, has made electrolyzers from the West four times more expensive than the equivalent from China.

Bloom Energy Corp ($2.8B MCap) missed revenue projections and saw its losses widen for the first quarter of 2024. Its stock price has declined by 17% over the last twelve months. Similarly, Plug Power ($2.4B MCap) reported a 43% year-on-year decline in first-quarter revenues, missing expectations, and its stock price declined by 63%. However, as inflation in the US decreases and interest rates begin to moderate, the outlook for the hydrogen industry is improving. Governments have also ramped up efforts to support the production of hydrogen. The Australian government introduced a Hydrogen Production Tax Incentive, which provides developers with A$2 (US$1.32) per kilogram of green hydrogen. In February, the UK government also announced £21 million government support for 7 projects.

🏆 Puerto Rico Impact 50

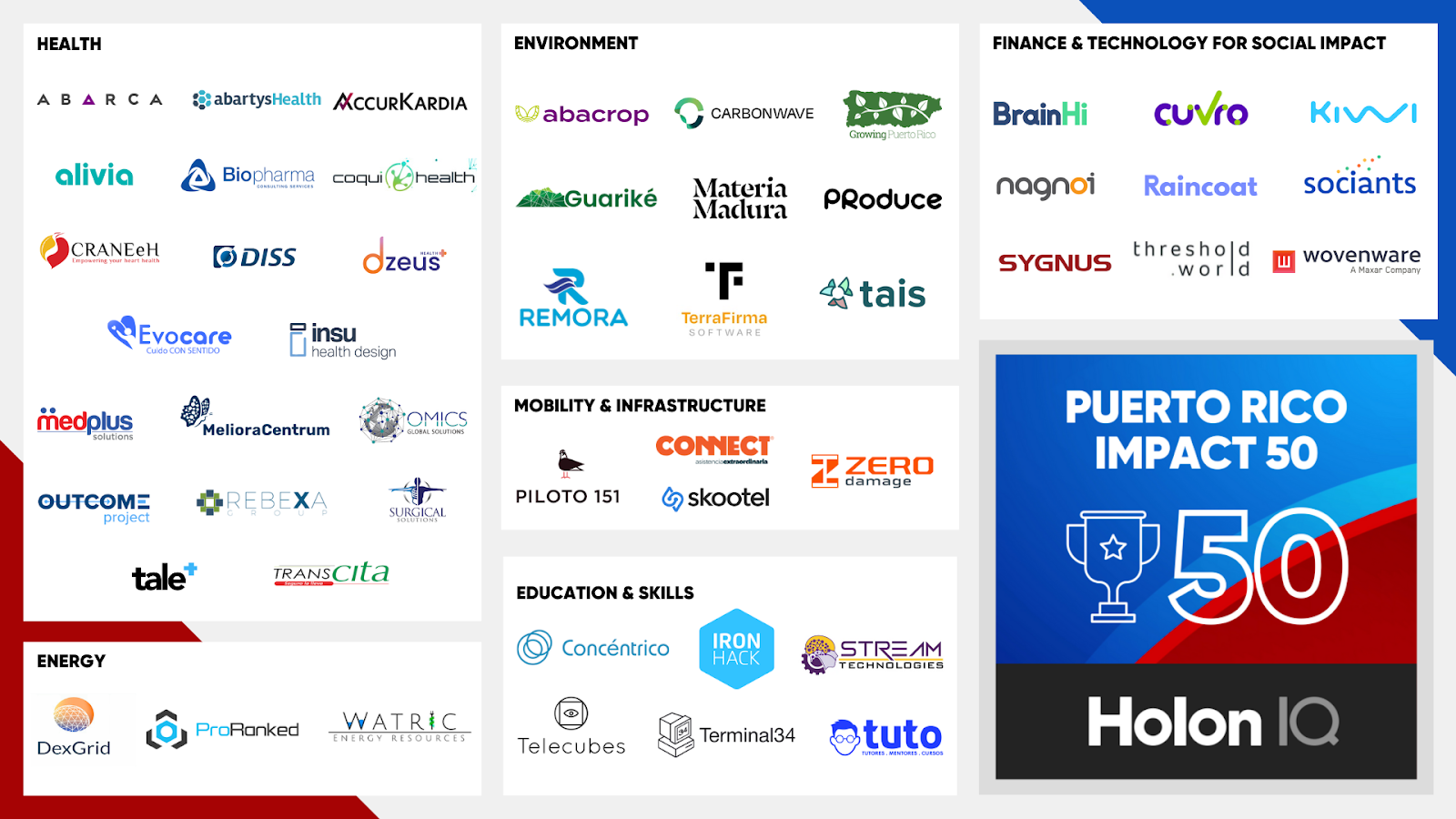

As part of Puerto Rico Impact Week, HolonIQ launched its inaugural Puerto Rico Impact 50 list. This list identifies high-potential startups and scale-ups in Puerto Rico driving positive change in education, health, and climate.

This year, the Puerto Rico Impact 50 reflects a strong emphasis on health innovation. Health tech companies comprise over a third of the cohort, followed by Finance & Technology for impact at 18%, Environment at 18%, and Education & Skills at 12%. The remaining startups tackle mobility and infrastructure.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

♻️ Circtec, a UK company specializing in pyrolysis for recycling end-of-life tires, raised $163 million in financing to support its sustainable recycling operations.

🌳 280 Earth, a California-based company that removes CO2 from the air, raised a $50M Series B from Builders VC to expand its DAC project development efforts.

🔋 Battery Smart, an Indian EV battery-swapping company, raised a $45M Series B from Acacia and MUFG.

🌐 Reactive Technologies, a UK-based grid stability company, raised a $31.4M Series D from M&G Investments to support global expansion.

⚡ Verse, a California-based renewable energy analytics company, raised a $20.5M Series A from Google Ventures to reduce corporate electricity costs and emissions.

🌋 XGS Energy, a California-based geothermal technology company, raised a $20M Series A from Valo Ventures and VoLo Earth Ventures to support its first commercial-scale project.

M&A

⚡ Veolia, a French energy and waste recycling management company, acquired MRC Consultants and Transaction Advisers, a Spanish energy consulting firm.

🌿 Superior Environmental Solutions, an Ohio-based industrial cleaning company, acquired Arrowhead Environmental Services, a Pennsylvania-based environmental solutions provider.

🔌 ABB, a Swiss electrification and automation provider, signed a definitive agreement to acquire Siemens' wiring accessories business in China.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com