⚽ Brazil Stock Index Up 15%. $185M+ VC Funding Day.

Impact Capital Markets #100 looks at our Brazil Stock Index, major impact deals, M&A, and upcoming economic releases.

Ayubowan 🐘

📉 Today's Global Economic Update: In April 2024, Japan's annual inflation rate decreased to 2.5%, with core inflation dropping to 2.2%, the lowest since January. While inflation is cooling as expected, the Japanese Yen has come under pressure, which is increasing bets on an early rate hike by the Bank of Japan.

🧬 Deal of the Day: Grey Wolf Therapeutics, a UK-based biotech company, raised a $50M Series B to support its clinical trials.

What's New?

⚽ Brazil. Brazil stock index up 15%

💰 Funding. Biotech, healthcare analytics, mycoprotein + more

💼 M&A. RNA therapeutics, labor analysis, vision care + more

📅 Economics. Euro Area inflation, US GDP, balance of trade + more

⚽ Brazil Index Up 15%

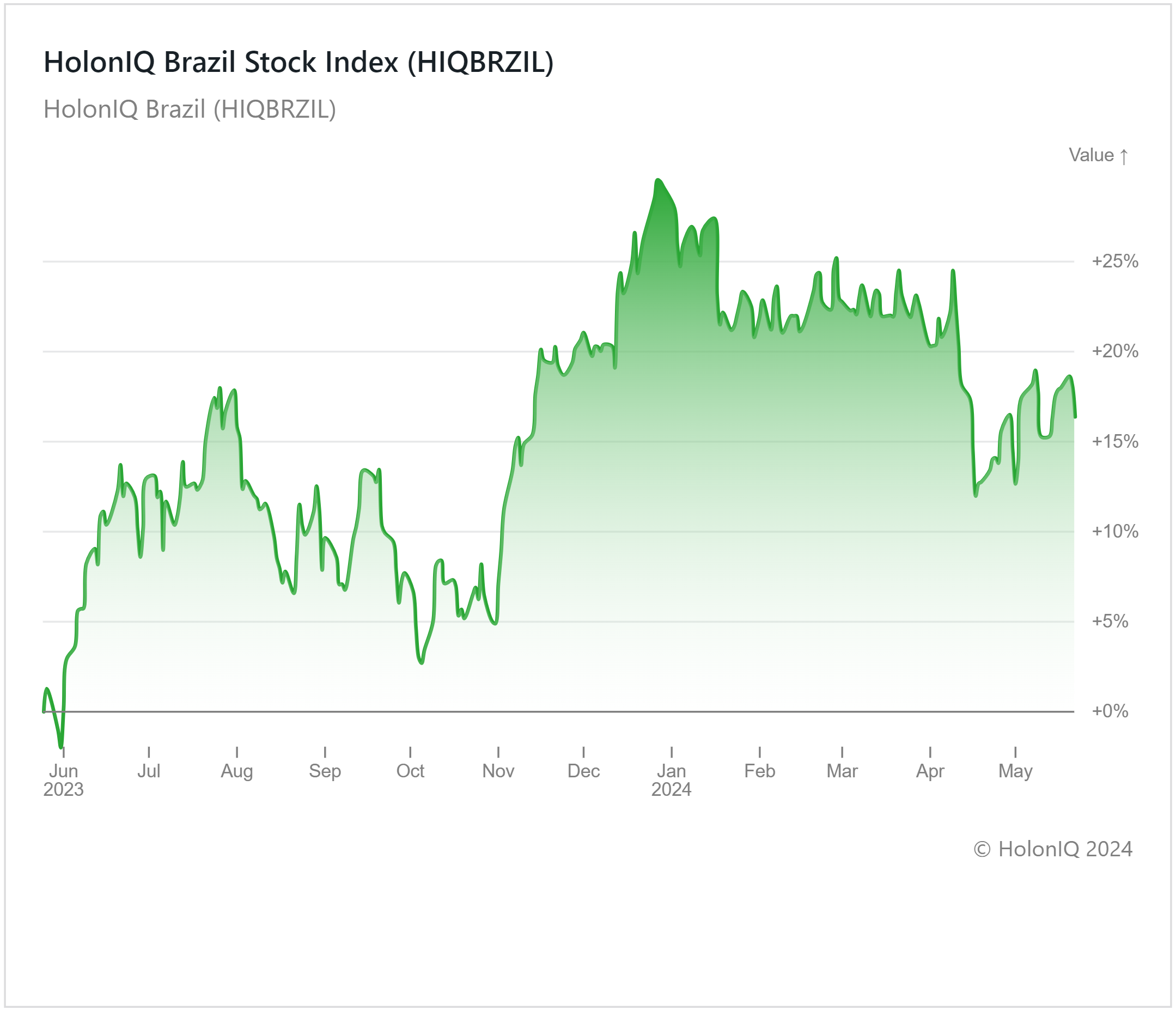

HolonIQ’s Brazil Index has increased by 16% over the past twelve months as the Brazilian Central Bank has been easing monetary policy, reducing interest rates seven times since August 2023, fostering an optimistic outlook for economic growth. Lower interest rates typically channel investment into the stock market, and Brazilian stocks in the index have been seeing positive growth over the past year. Despite a 38% fall in its 1Q 2024 net recurring profit from a year earlier, Petrobas ($95B MCap) recorded a 35% Year-on-Year growth in its stock price. Financial sector stocks also performed well underpinned by strong earnings reported in the first quarter. Itau Unibanco Holding ($57B MCap) recorded 15% growth over the past twelve months, while operating revenues rose 7.8% year over year and reported earnings per share beat analysts expectations. Banco do Brasil ($30B MCap) also increased by 17.3% in the past year.

The positive trajectory in the stock market reflects optimism in the Brazilian economy, with upward revisions in the GDP outlook for 2024 by international organizations and recent rating upgrades by rating agencies such as Moody’s. However, natural disasters, currency fluctuations and potential inflation pressure pose risks to the economy. Despite positive annual growth, HolonIQ’s Brazil stock index three-month return has seen a 6% decline, indicating the need for cautious optimism.

💰 Funding

🧬 Grey Wolf Therapeutics, a UK-based biotech company, raised a $50M Series B from the Intermediate Capital Group to support its clinical trials.

🩺 Atropos Health, a California-based personalized healthcare data analytics company, raised a $33M Series B from Valtrius to expand its operations.

🦠 Ygion Biomedical, an Austrian company developing personalized cancer vaccines, raised a $16.3M Series A to develop its platform.

🌱 Enifer, a Finnish mycoprotein company, raised a $16.3M Series B from Taaleri Bioindustry to construct a food-grade mycoprotein factory.

🍽️ OneOrder, an Egyptian food delivery company, raised a $16M Series A from Delivery Hero Ventures to scale its operations.

🏥 Radar Therapeutics, a California-based precision medicine biotech company, raised a $13.4M Seed from NfX Bio to advance its internal program.

📦 XSQUARE Technologies, a Singaporean warehousing automation company, raised a $7.8M Series A from Wavemaker Partners to accelerate regional growth.

🌐 ThinkLabs AI, a digital twin-powered grid planning startup, launched with a $5M Seed from Powerhouse Ventures and Active Impact Investments to develop its flagship product.

💼 M&A

🧬 Orna Therapeutics, a Massachusetts-based biotech company focused on circular RNA therapeutics, acquired ReNAgade Therapeutics.

🚀 Cornerstone OnDemand, a California-based talent management software company, acquired SkyHive, a California-based labor analytics company.

👓 Visibly, an Illinois-based digital vision care solutions company acquired Lensabl, a California-based lens replacement services company.

🖥️ CME, a California-based information technology company, acquired Augmental, a UAE-based EdTech company.

🏫 Raptor Technologies, a Texas-based school safety software company, acquired PublicSchoolWORKS, an Ohio-based K-12 school safety compliance provider.

📅 Economic Calendar

Euro Area Inflation, US GDP, Balance of Trade + More

Friday, May 24th 2024

🇬🇧 UK Retail Sales Data, April

🇺🇸 US Durable Goods Orders Data, April

Monday, May 27th 2024

🇩🇪 Germany Ifo Business Climate Index, May

Wednesday, May 29th 2024

🇯🇵 Japan Consumer Confidence Index, May

🇩🇪 Germany GfK Consumer Confidence, June

🇩🇪 Germany Inflation Data Preliminary, May

Thursday, May 30th 2024

🇺🇸 US GDP Growth Data, Q1

🇨🇳 China NBS Manufacturing PMI, May

Friday, May 31st 2024

🇫🇷 France Inflation Data Preliminary, May

🇪🇦 Euro Area Inflation Data (Flash), May

🇮🇹 Italy Inflation Data Preliminary, May

🇮🇳 India GDP Growth Data, Q1

🇨🇦 Canada GDP Growth Data, Q1

🇺🇸 US Core PCE Price Index, April

🇺🇸 US Personal Income & Spending, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com