🛵 Micro Mobility Drops 20%. $240M+ VC Funding Day.

Impact Capital Markets #42 looks at our Micro Mobility stock index, major impact deals, M&A, and upcoming economic releases.

Ayubowan 🙏

📉 Today's Global Economic Update: Italy's GDP Growth data reveals a 0.9% expansion in 2023, down from 4% the previous year, largely due to tighter financial conditions and reduced consumer spending. However, the Bank of Italy forecasts modest growth in the years to come, offering some optimism for the country's economic outlook.

💉 Deal of the Day: Phagenesis, a UK-based medical device company, raised a $42M Series D to support its expansion plans.

What's New?

- 🛵 Micro Mobility. Micro Mobility Index Drops 20%

- 💰 Funding. Medical devices, AI infrastructure, petcare & more

- 💼 M&A. Academic planner, daycare provider, biotech & more

- 📅 Economics. ECB interest rate decision, UK GDP, US inflation + more

For unlimited access to more deals and economic updates, request a demo

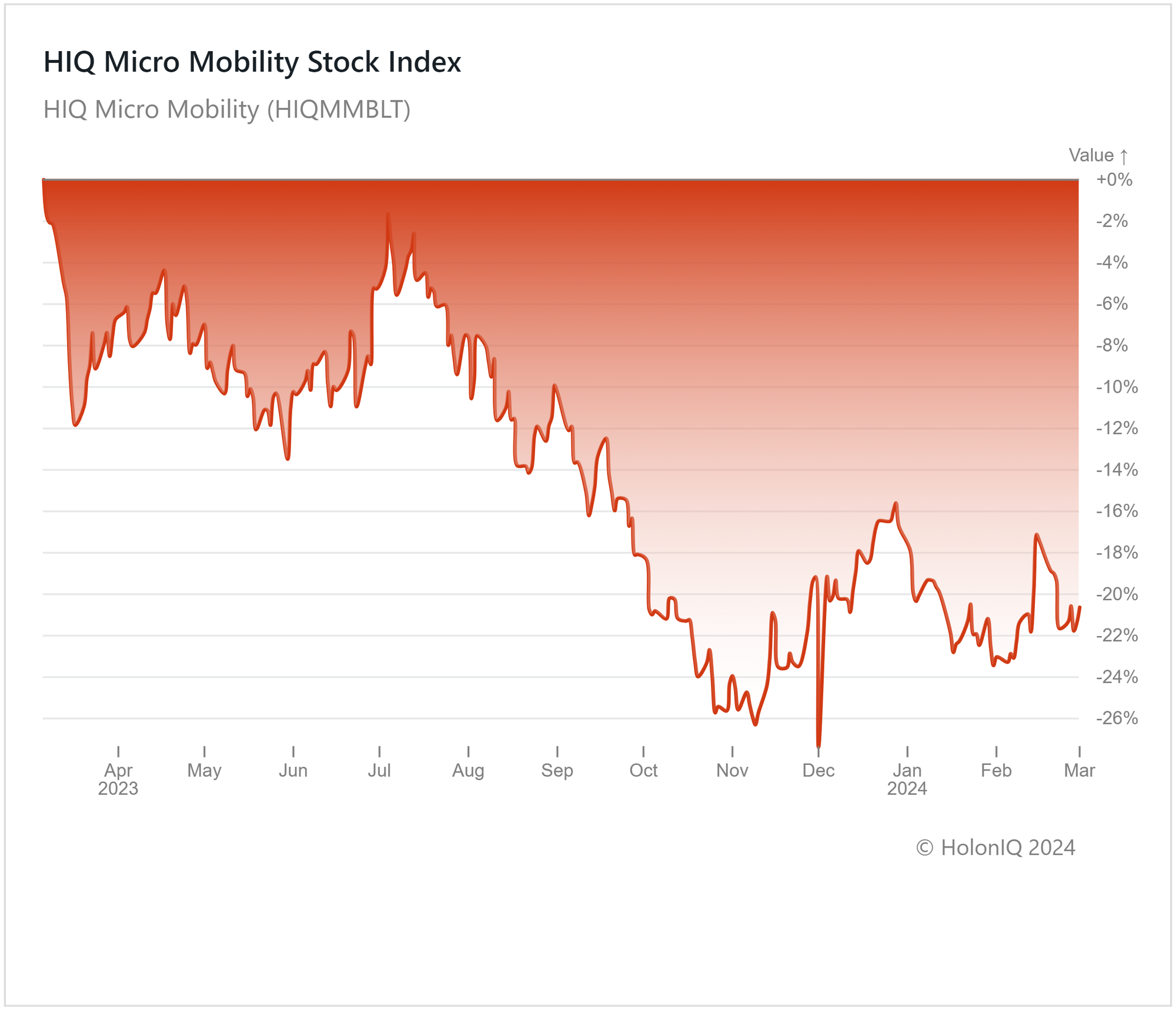

🛵 Micro Mobility Drops 20%

HolonIQ’s Micro-Mobility Index has declined over the past year, dropping by 20%. Major stocks in the index including Shimano, Inc. ($12B MCap) and Harley-Davidson, Inc. ($5B MCap), fell by 16% and 20% respectively.

Although the overall micro-mobility market has seen growth in sales from pre-pandemic levels, post-pandemic demand moderation and supply chain disruptions concerning batteries and other components have impacted the sector. Additionally, elevated interest rates have posed challenges for the industry, increasing the expense of auto loans. Bankruptcies of key players like Bird, the electric scooter pioneer, and the delisting of Micromobility.com from Nasdaq due to noncompliance with index requirements have further subdued investor confidence. Despite the current downturn, prospects for growth are emerging due to smart city initiatives and government backing.

💰 Funding

💉 Phagenesis, a UK-based medical device company, raised a $42M Series D from EQT Life Sciences and Sectoral Asset Management to expand its operations.

💻 Baseten, a California-based AI infrastructure company, raised a $40M Series B from IVP and Spark Capital to expand operations and development efforts.

🩺 Shape Memory Medical Inc, a California-based medical device company, raised a $38M Series C from Earlybird Venture Capital to accelerate market development of its shape memory polymers.

🏥 Healthee, a NYC-based healthcare platform which offers personalized treatment and coverage information, raised a $32M Series A. The fund will be used to scale operations & accelerate product development.

💊 Zeno Health, an Indian pharmaceutical company, raised a $25M Series C from STIC Investments to expand operations and reach.

🐾 MoeGo, a California-based payments platform provider for pet groomers, raised a $24M Series A from Base10 Partners to expand its business reach.

💼 M&A

💉 The Cicor Group, an integrated electronic solutions provider in Switzerland, acquired Evolution Medtec, a Romanian medical device development company.

📚 Ellucian, a Virginia-based higher education software provider, acquired Edunav, a California-based academic planning solutions provider.

👧 Kido Education, a UK-based early childhood education provider, acquired Amelio Early Education, an Indian corporate daycare provider.

🏥 Suntory Wellness Limited, a Japanese health and wellness business, acquired NBD Healthcare, a Thai health and personal care company.

👩⚕️ WindRose Health Investors, a New York-based healthcare private equity firm, acquired CardioOne, a Texas-based physician-focused consultancy.

🔬 Telix Pharmaceuticals, an Australian clinical-stage biotechnology company, entered into an agreement to acquire ARTMS, a Canada-based innovator in isotope imaging technology.

📅 Economic Calendar

ECB Interest Rate Decision, UK GDP, US Inflation + More

Wednesday, March 6th 2024

🇦🇺 Australia GDP Growth Data, Q4

🇩🇪 Germany Balance of Trade, January

🇨🇦 Canada BoC Interest Rate Decision

🇨🇦 Canada Ivey PMI, February

🇺🇸 US JOLTs Job Openings, January

Thursday, March 7th 2024

🇦🇺 Australia Balance of Trade, January

🇨🇳 China Balance of Trade, Jan-Feb

🇪🇦 ECB Interest Rate Decision

🇨🇦 Canada Balance of Trade, January

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

US Unemployment Data, February

Tuesday, March 12th 2024

🇦🇺 Australia NAB Business Confidence, February

🇬🇧 UK Unemployment Data, January

🇺🇸 US Core Inflation Data, February

🇺🇸 US Inflation Data, February

Wednesday, March 13th 2024

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment (Preliminary), March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com