💻 Health Practice Management + Africa Health Tech 50

Health Practice Management systems streamline healthcare service provision, easing administrative burdens. This may alleviate burnout among healthcare workers and help to combat the escalating problem of employee attrition, a pressing industry challenge.

Happy Monday 👋

Health Practice Management systems allow healthcare providers to efficiently provision healthcare services while reducing administrative burdens. In the health tech landscape, the spotlight is on Africa with its blossoming health startup space.

This Week's Topics

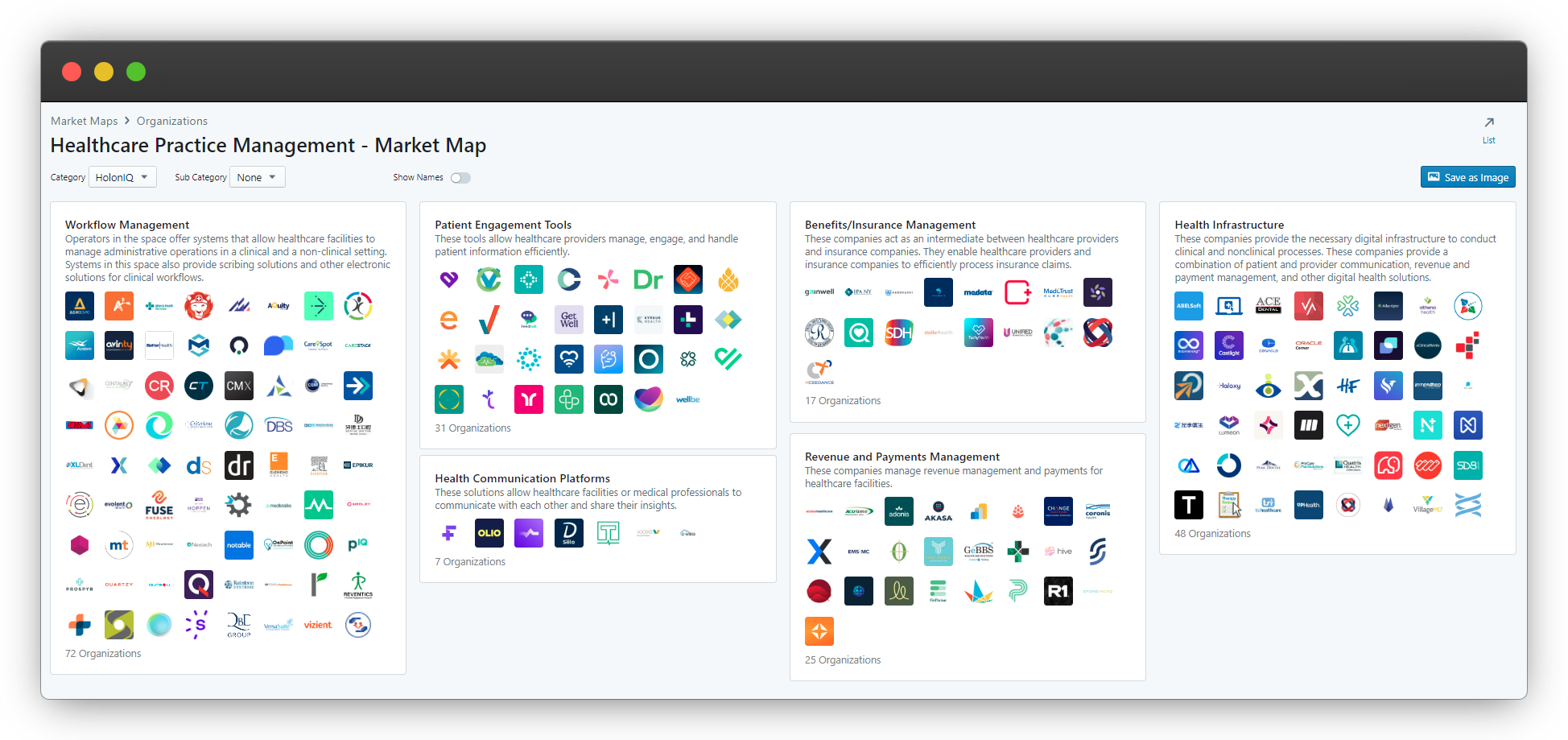

- 💻 Health Practice Management Market Map. 200+ companies across the health practice management

- 📊 Charts Spotlight. Access to EHR systems in Europe is mainly sponsored by governments

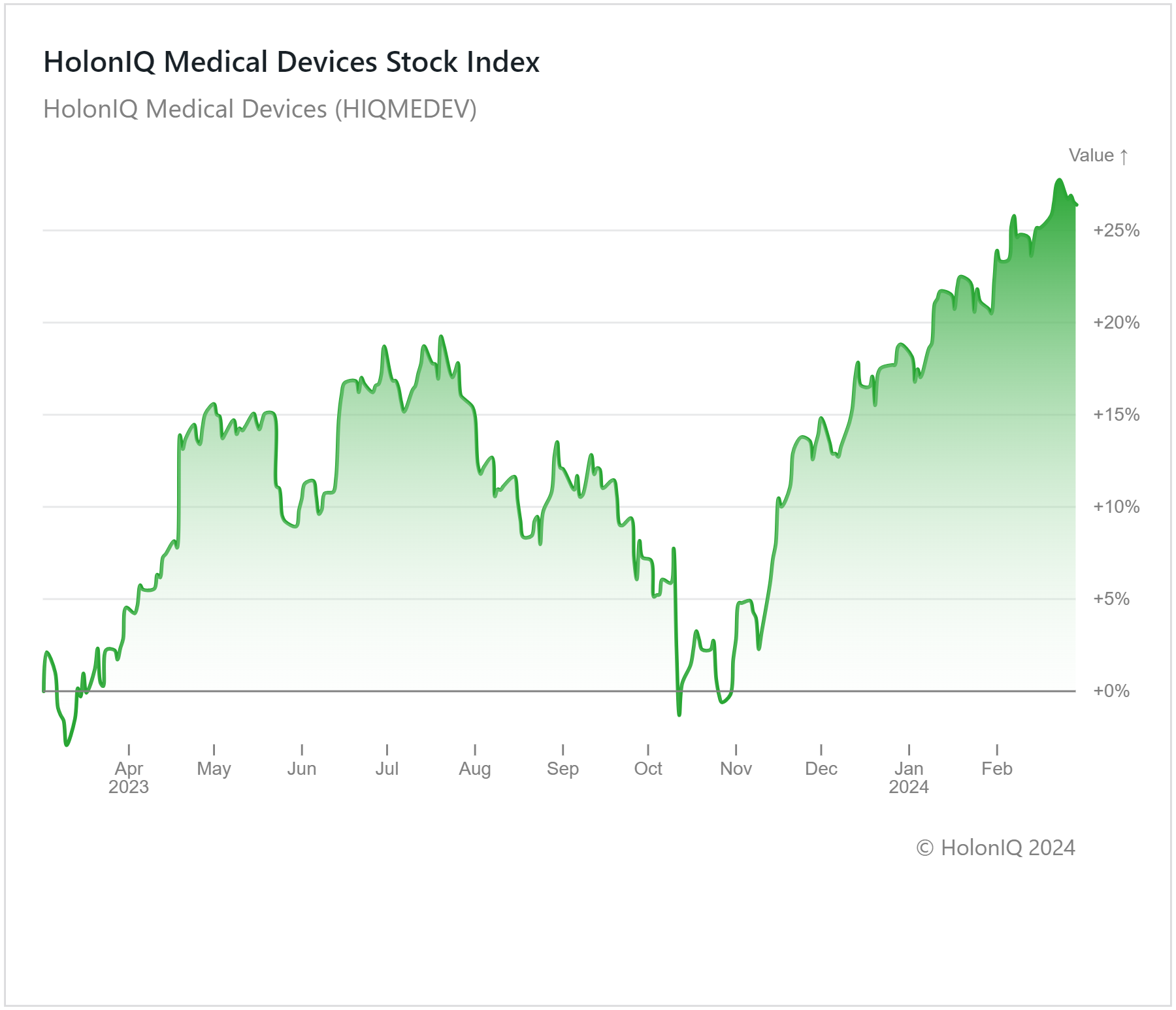

- 📈 Medical Devices. Up 27% over the past 12 months

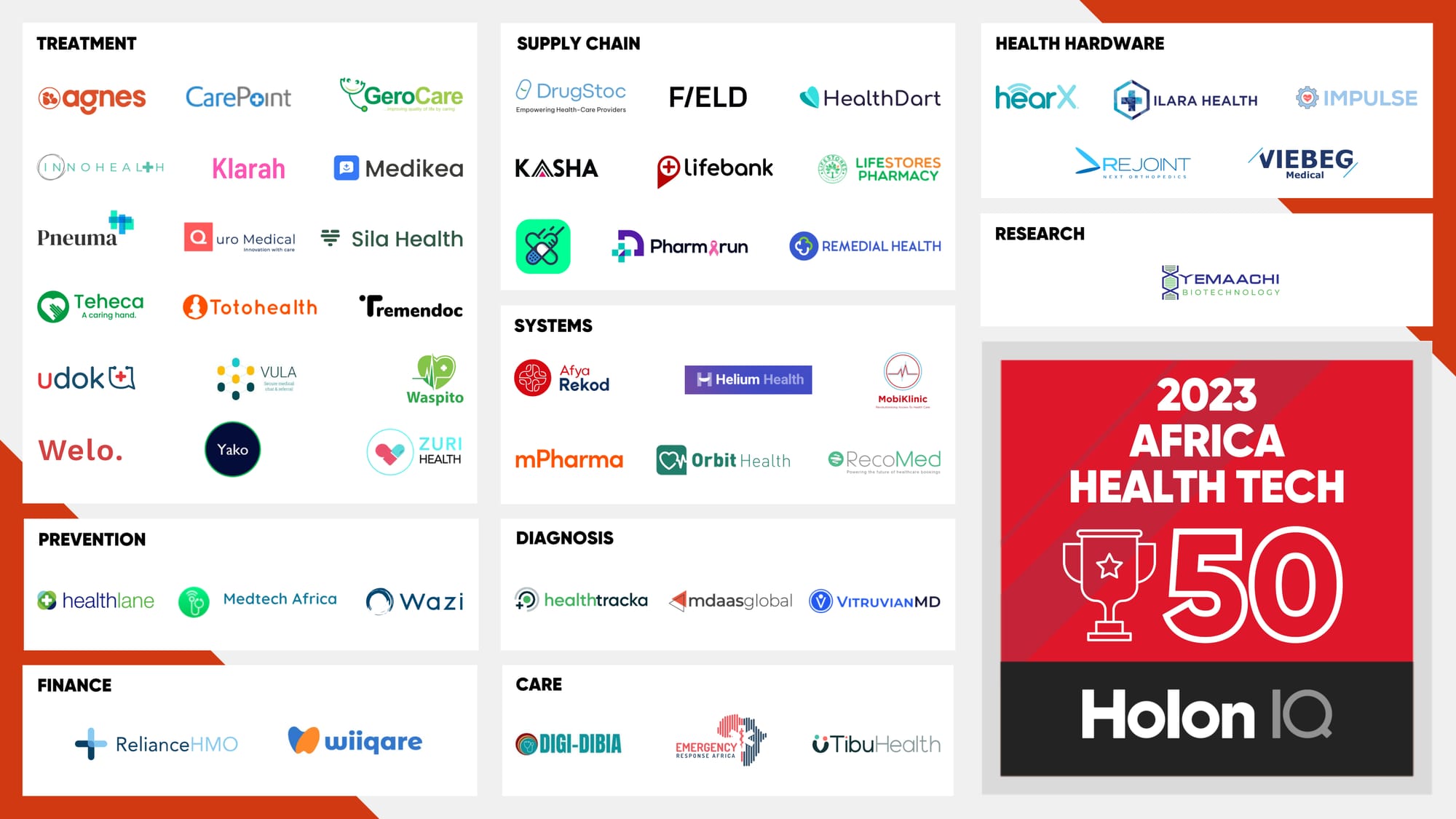

- 🏆 Africa Health Tech 50. Africa's most promising startups working in digital health, biotech, drug discovery, and analytics

- 📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

- 💰 Health Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Health Tech Outlook, and sign up for our Daily Newsletters, Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

💻 Health Practice Management Landscape

Administrative workload places an immense burden on the healthcare workforce and providers. Roughly 63% of all physicians are showing symptoms of burnout, and another 43% of clinicians are planning to leave their jobs. Furthermore, errors in healthcare can cause critical patient care concerns. Preventable medical errors cause harm to approximately 450,000 patients and cause more than 100,000 deaths, accounting for nearly $20B in costs in the US annually. A considerable portion of the non-clinical workflow stems from managing insurance-related workflows, where there are multiple layers of paperwork attached to a single approval. Hence, health practice management systems offer means for healthcare facilities to efficiently conduct their practices while reducing error rates.

However, several recent data breaches have targeted the IT infrastructure of major healthcare providers, underscoring the necessity for enhanced security for health management systems. For example, this month saw Change Healthcare (subsidiary of UnitedHealthcare) experienced a major cyber attack that disrupted a considerable proportion of pharmacies and healthcare systems across the US. In another example, Viamedis and Almerys (French health payment providers) encountered a data breach that has potentially impacted half of the French population.

💻 Health Practice Management Market Map

📊 Charts Spotlight - Access to EHR Systems Sponsored by Governments

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy - from climate tech to education and healthcare.

Governments sponsor electronic health record (EHR) systems in nearly two-thirds of European countries as part of the government-funded universal healthcare system. However, other digital health options are yet to be a government priority in the region, such as treatment programs (23.2%) and patient monitoring schemes (37.5%). Considering that the compulsory public scheme finances 73% of all European medical expenses, the public health system can benefit from increased adoption of digital methods that can reduce costs and enhance the overall service levels like reducing wait times.

📈 Capital Markets - Medical Devices Index

HolonIQ tracks thousands of listed health companies around the world and several acquisitions and investments each year. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Health Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

The HolonIQ's Medical Devices Index grew over 25% in the past year, reflecting rising demand for innovative devices fueled by growing chronic diseases and preventive healthcare awareness. Major stocks within the index including Abbott Laboratories, Intuitive Surgical, and Stryker Corp. also experienced significant gains. Regulatory developments like the MHRA roadmap for medical devices in the UK and MHRA-FDA collaboration aim to streamline medical device approval, potentially further propelling the industry. China's growing presence and India's efforts to improve product capabilities present additional opportunities. However, cost pressures from government efforts to reduce healthcare spending pose a challenge, potentially impacting company margins. Moving forward, innovation and technological integration will likely be crucial factors for success in the medical device sector.

🏆 Africa Health Tech 50

The Africa Health Tech 50 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery, and analytics in the region.

The cohort has seen some funding activity over the past few months with Ilara Health, a Kenyan primary care digital health startup, raising $4.2M in a re-series A funding round in February and Waspito, a Cameroon-based telehealth company, raising $2.5M in a seed funding in November 2023.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Health industry, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🧬 Alamar Bioscience, a US-based precision proteomics company, raised $100M through Series C funding to accelerate the commercialization of its Nulisa proteomic platform.

🧠 Denali Therapeutics, a US-based biotech company that specializes in neurodegenerative diseases, is raising $500M through private funding with current investors.

📊 Abridge, a Pennsylvania-based startup building AI-powered tools to document clinical conversations, raised a $150M Series C from Redpoint Ventures China and Lightspeed Venture Partners. The funding will be used to expand the team and develop AI models.

🤖 Medical Microinstruments, an Italian medical robotics company, raised a $110M Series C from Fidelity Management & Research Company to commercialize 'Symani Surgical System,' its surgical robotics platform.

🧪 Frontier Medicines, a US-based pre-clinical stage biopharmaceutical company, secured a $80M Series C to advance multiple pipeline programs into clinical studies.

Fund Formation

💼 ORI Capital, a Hong Kong-based biotech venture capital firm, closed a $260M fund that will focus on investing in early-stage biotech companies worldwide

💰 Scion, a biotech venture capital firm, has closed on a $310M fund to assist in pioneering new biotechnology companies that discover, develop, and commercialize medical innovations.

M&A

🏭 3M, a US-based multinational conglomerate operating in the fields of industry, worker safety, healthcare, and consumer goods, has filed to spin-off its healthcare business as an independent company, Solventum.

💡 Veradigm, a US-based integrated data systems & services company, has acquired ScienceIO, a healthcare AI solutions company, for $140M.

IPOs and Follow-On Offerings

💊 Simcere Zaiming Pharmaceutical, a China-based pharmaceutical company secured $134.8M in an equity offering to expand its working capital and enhance its attractiveness for future investors.

💉 Mainstay Medical, an Irish medical device company, announced that it priced an underwritten follow-on equity public offering worth $125M.

🩹 Alvotech, an integrated biopharmaceutical company, announced that it priced an underwritten public offering worth an amount totaling $166M.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com