🩺 Medical Devices Up 4% YOY. $15M+ VC Funding.

Impact Capital Markets #130 looks at our Medical Devices Stock Index, major impact deals, M&A, and upcoming economic releases.

📈 Today's Global Economic Update: US job openings increased to 8.14M from a revised 7.92M in April, exceeding expectations. However, the quits rate fell sharply, suggesting slower wage growth. This has increased anticipation of a rate cut at the September FOMC meeting amidst easing inflation concerns.

🧬 Deal of the Day: Granza Bio, a California-based cancer therapy developer, raised a $7M Seed to scale operations and advance development efforts.

What's New?

🩺Medical Devices. Medical devices up 4% YOY

💰 Funding. Biotherapeutic, software, and fintech

💼 M&A. Flexiss Group acquired Scott Storage

📅 Economics. US inflation, UK GDP, balance of trade + more

🩺 Medical Devices Up 4% YOY

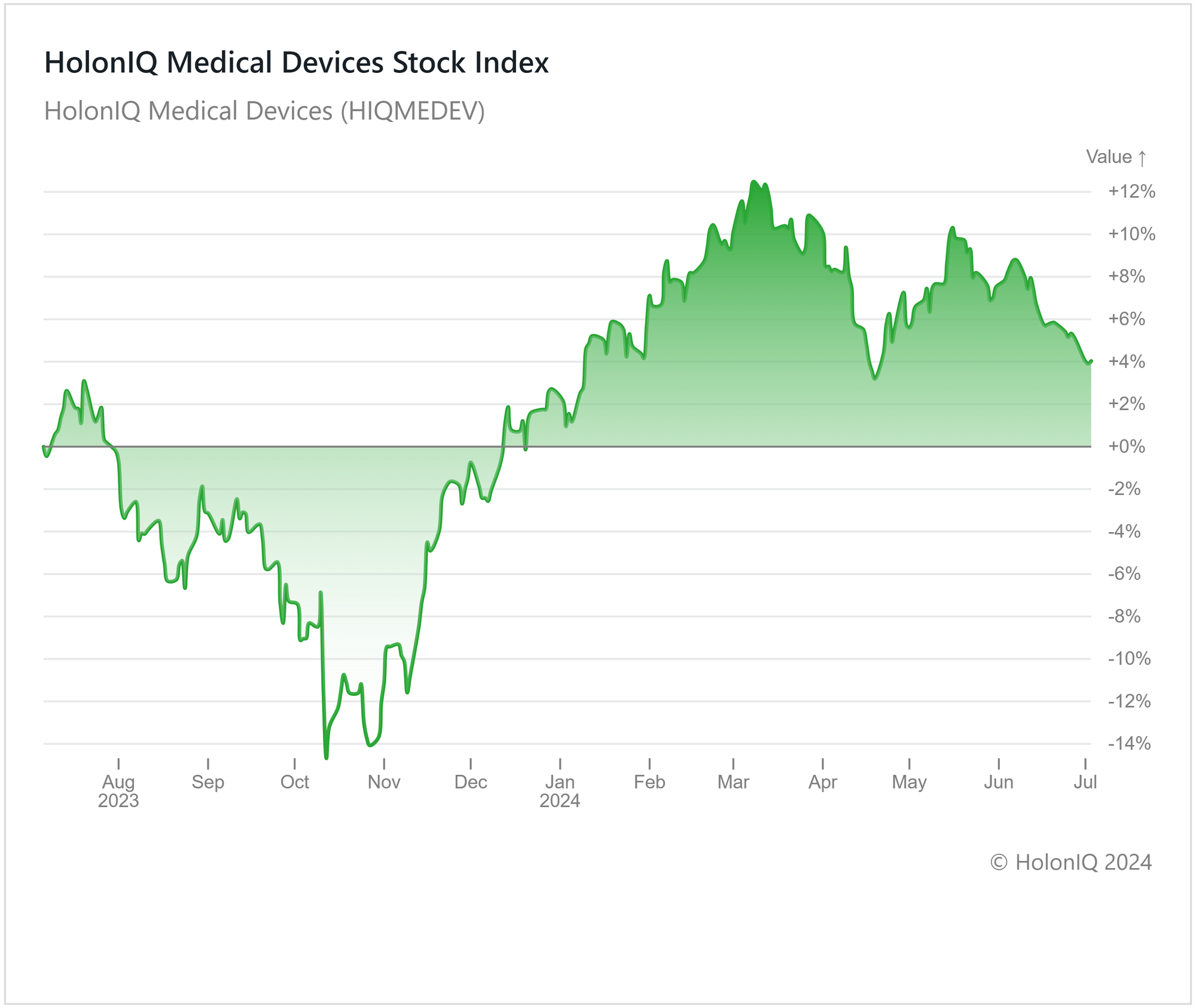

The Medical Device Index has shown a 4% increase over the past 12 months. The increase in demand for wearable devices that monitor vital signs like temperature and oxygen levels contributed significantly to market growth, coupled with strong investment in R&D across the sector.

However, recent months have seen volatility, culminating in a 4% decline over the past quarter. This downturn stems from multiple pressures such as governments worldwide pushing to lower healthcare costs and intensifying pricing pressures on medical devices, particularly in hospital settings. Regulatory hurdles, such as the European Medical Device Regulation and China's local innovation initiatives, have added complexity and uncertainty, impacting operational strategies. This has been reflected in key stocks within the index, with notable declines seen in significant players like Medtronic ($99B MCap), Abbott Laboratories ($178B MCap), and Stryker Corp ($126B MCap), showing decreases of 9%, 8%, and 5% respectively over the past quarter.

Despite the industry's current decline, there are promising signs of recovery and growth. The integration of data intelligence with devices continues to drive innovation, opening new revenue avenues and enhancing patient outcomes. Emerging Asian markets offer growth opportunities amid increasing healthcare demand. However, global challenges and regulatory pressures shape a cautious outlook.

💰 Funding

🧬 Granza Bio, a California-based cancer therapy developer, raised a $7M Seed from Felicis and Refactor to scale operations and advance development efforts.

💻 QED Protocol, a Hong Kong software company, raised $6M from Blockchain Capital to expand operations.

📈 FreeBnk, a Lithuanian fintech app, raised $3M to support ongoing R&D for an app tailored to enhance accessibility.

💼 M&A

🗄️ Flexiss Group, a UK-based self-storage development company, acquired Scott Storage, a UK-based storage solutions company.

📅 Economic Calendar

US Inflation, UK GDP, Balance of Trade + More

Friday, July 5th 2024

🇨🇦 Canada Employment Data, June

🇺🇸 US Employment Data, June

🇨🇦 Canada Ivey PMI s.a, June

Monday, July 8th 2024

🇩🇪 Germany Balance of Trade, May

🇦🇺 Australia Westpac Consumer Confidence Change, July

🇦🇺 Australia WNAB Business Confidence Index, June

Tuesday, July 9th 2024

Thursday, July 11th 2024

🇬🇧 UK GDP Data, May

🇺🇸 US Core Inflation Data, June

🇺🇸 US Inflation Data, June

Friday, July 12th 2024

🇺🇸 US PPI Data, June

🇺🇸 US Michigan Consumer Sentiment (Preliminary), July

🇨🇳 China Balance of Trade, June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com