🏥 Home Health Up 30%+. $460M+ VC Funding.

Impact Capital Markets #55 looks at our Home Health stock index, major impact deals, M&A, and upcoming economic releases.

Kaixo 🌲

📉 Today's Global Economic Update: Germany's Manufacturing PMI data declined to 41.6 in March 2024, reaching a five-month low. The Services PMI inched up slightly to 49.8 from 48.3 in February 2024. These indexes have continued to reflect contractions in both sectors since at least August of the previous year, highlighting ongoing economic challenges in Germany.

💉 Deal of the Day: Nouscom, a French immuno-oncology vaccine developer, raised a $82M Series C from Angelini Ventures to advance its pipeline of vaccines for cancer treatment.

What's New?

- 🏥 Home Health. Home health index up 30%+

- 💰 Funding. Immuno-oncology, AI/ML cloud provider, climate tech & more

- 💼 M&A. Water treatment, home health & medical centers

- 📅 Economics. Inflation data, retail sales, US GDP + more

For unlimited access to more deals and economic updates, request a demo

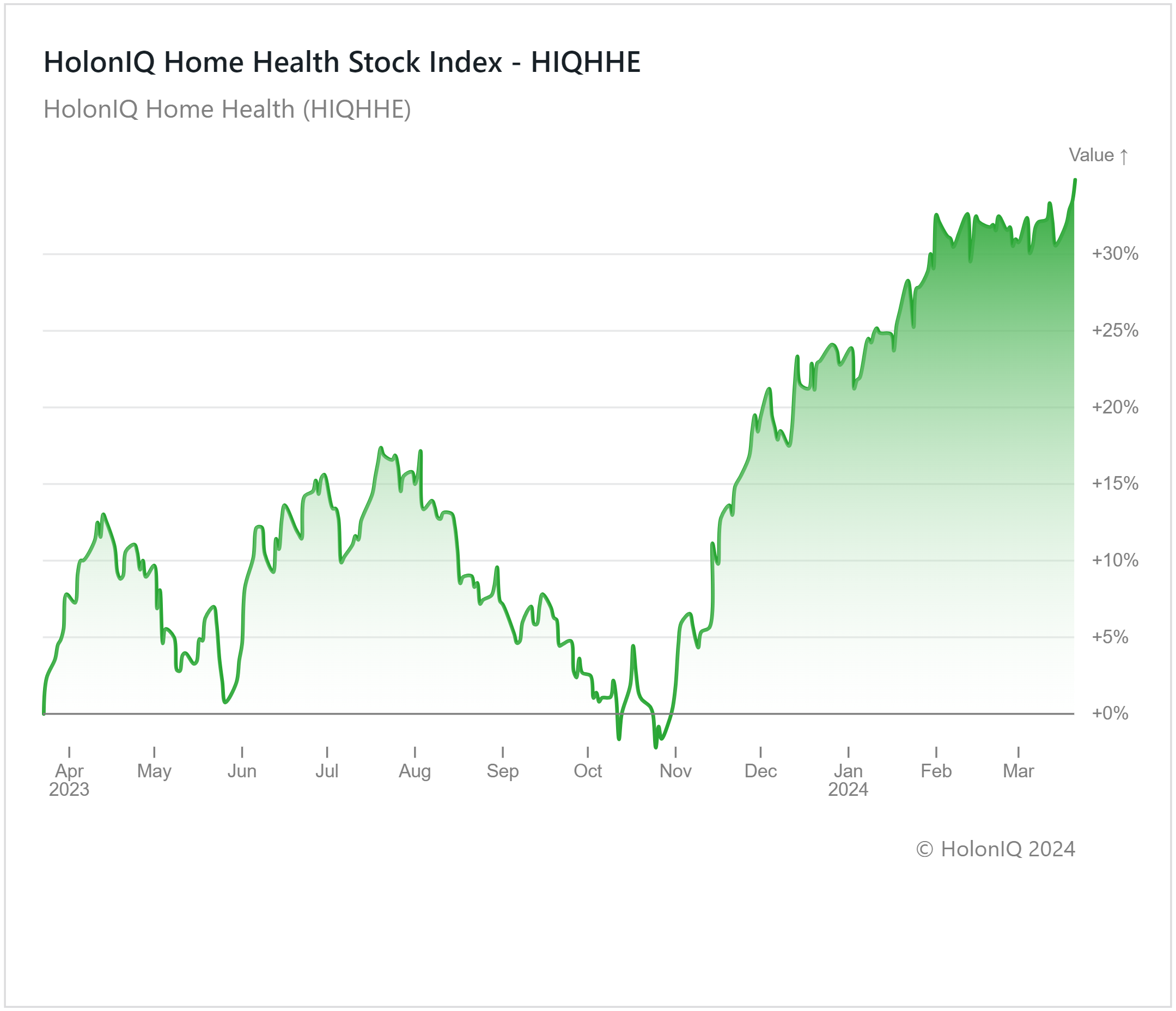

🏥 Home Health Index Up 30%+

Holon IQ’s Home Health Index has rebounded after a slight decline in the second half of 2023, rising by more than 30% YoY. The pandemic acted as a catalyst for the home health industry’s growth over the last few years, presenting safer and more convenient healthcare solutions than traditional healthcare settings. The relatively low cost of in-home healthcare services has prompted consumers to favor them over receiving care at medical facilities, further fueling the growth of the industry. The growing aging population is also projected to lead to increases in demand for home health. With a larger percentage of older individuals who are susceptible to chronic conditions, there arises a need for continuous monitoring and treatment. With most seniors preferring to receive treatment at home, the need for home health services is likely to rise.

The industry’s promising progress is evident in the increase of the index, with major stocks rising. Chemed Corp. ($10B MCap) witnessed returns of 24%, while Option Care Health ($6B MCap) increased 4%.

💰 Funding

🔬 Nouscom, a French immuno-oncology vaccine developer, raised a $82M Series C from Angelini Ventures to advance its pipeline of vaccines for cancer treatment.

☁️ Foundry, a California-based AI/ML Cloud Provider, raised a $80M Seed and Series A from Sequoia Capital and Lightspeed Venture Partners to scale operations and improve its product offerings.

🌍 Greenly, a Paris-based climate tech startup, raised a $52M Series B from Fidelity International Strategic Ventures to refine software solutions and increase market reach

🐕 Loyal, a California-based biotech company developing drugs for dogs, raised a $45M Series B from Bain Capital Ventures to support the development of their upcoming drugs designed to extend the healthy lifespan of large-breed dogs.

🚚 Pandion, a Washington-based e-commerce parcel delivery network, raised a $41.5M Series B from Revolution Growth to increase delivery speed and increase geographic reach.

🔬 Profluent, a California-based company designing functional proteins for disease treatment, raised $35M from Spark Capital to improve its product offerings.

📊 Ultrahuman, an Indian health monitoring company, raised a $35M Series B to expand health monitoring research and manufacturing.

👨💼 Borderless AI, a Canadian AI-based startup providing an HR platform for global firms, raised a $27M Seed from Susquehanna and Aglaé Ventures to grow its operations.

💰 NX Technologies, a German fintech company, raised a $23.9M Series B from PayPal Ventures to boost its presence in Germany and expand across Europe.

⛽️Fuel Me, a Chicago-based fuel procurement platform, raised a $18M Series A from Pritzker Group Venture Capital and Tribeca Venture Partners to fast-track tech development.

🔒 Sevco Security, a Texas-based cybersecurity company, raised $17M from SYN Ventures to scale operations and widen business reach.

🌍 Cemvision, a Swedish climate tech company, raised $10.9M from Polar Structure, BackingMinds, and Zacua Ventures to support its operations.

💼 M&A

💧 Flotilla Partners, a Florida-based water treatment services provider in the Southeast, acquired four water treatment companies: Guardian Water Services, Crystal Pump Repair Services, Peter's Water Treatment & Irrigation, and WaterTech239.

🏡 Waud Capital Partners, an Illinois-based private equity firm, acquired Senior Helpers, a home health provider for seniors.

🏥TriasMD, a California-based healthcare company, acquired Thousand Oaks Surgery Center, a medical facility that focuses on providing outpatient surgical procedures.

📅 Economic Calendar

Inflation Data, Retail Sales, US GDP + More

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Tuesday, March 26th 2024

🇦🇺 Australia Westpac Consumer Sentiment Index, March

🇩🇪 Germany GfK Consumer Confidence Index, April

🇺🇸 US Durable Goods Orders Data, February

Thursday, March 28th 2024

🇺🇸 US Core PCE Price Index Data, February

🇺🇸 US GDP Growth Data, Q4

Friday, March 29th 2024

🇫🇷 France Inflation Data (Preliminary), March

🇮🇹 Italy Inflation Data (Preliminary), March

🇺🇸 US Personal Income & Spending Data, February

Monday, April 01th 2024

🇯🇵 Japan Tankan Large Manufacturers Index, Q1

🇨🇳 China Caixin Manufacturing PMI, March

🇺🇸 US ISM Manufacturing PMI, March

Tuesday, April 02th 2024

🇦🇺 Australia RBA Meeting Minutes

🇩🇪 Germany Inflation Rate (Preliminary), March

🇺🇸 US JOLTs Job Openings, February

Wednesday, April 03th 2024

🇪🇦 Euro Area Inflation Data, March

🇺🇸 US ISM Services PMI, March

Friday, April 05th 2024

🇦🇺 Australia Balance of Trade, February

🇨🇦 Canada Balance of Trade Data, February

🇨🇦 Canada Employment Data, March

🇺🇸 US Employment Data, March

🇨🇦 Canada Ivey PMI, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com