💉 Global Diabetes Forecasts + ANZ Health Tech 100

The global diabetic patient population is projected to rise significantly, with expectations of a twofold increase in Africa from 2021 to 2045.

Happy Monday 👋

The number of patients with diabetes globally is projected to rise significantly, with numbers in Africa expected to double between 2021 and 2045. In the Health Tech landscape, we revisit the 2023 Australia and New Zealand Health Tech 100, which highlights the region's most promising startups in the health technology sector.

This Week's Topics

📊 Charts Spotlight. Increase in diabetes patients forecasted by 2045

📈 Digital and Telehealth Index. Up 20% over the past 12 months

🏆 Australia and New Zealand Health Tech 100. ANZ's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

📊 Charts Spotlight - Increase in diabetes patients forecasted by 2045

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

The total number of diabetes patients is expected to increase in every region, with expectations of a twofold increase in Africa from 2021 to 2045. With increasing life expectancy, a rise in sedentary lifestyles, and shifting dietary trends, individuals are more susceptible to developing diabetes as a chronic condition. Many countries within the African region also have inadequate resources dedicated to addressing gaps in diabetes care and management. South Africa, for instance, has a 77% aggregate unmet need for comprehensive diabetes care. Food insecurity and a lack of access to nutrition in poorer regions also puts people at a high risk of developing diabetes.

Given its population size and the proportion of the aging population in the region, the Western Pacific region is projected to continue having the highest number of diabetic patients in 2045. Governments will have to establish policies to address the future demand for diabetes care in this region.

GLP-1 agonists are being developed, similar to the drugs introduced by Novo Nordisk and Eli Lilly. Hangzhou Jiuyuan Gene Engineering (a Chinese biopharma company) developed a new biosimilar that has similar medical properties to Ozempic and announced that it would seek approval in the country on April 03, 2024. The introduction of these biosimilars will provide an alternative to the more expensive offerings by Eli Lilly and Novo Nordisk. More biosimilars/generics will likely be developed over the coming years, as the patent for Ozempic is set to expire in 2031.

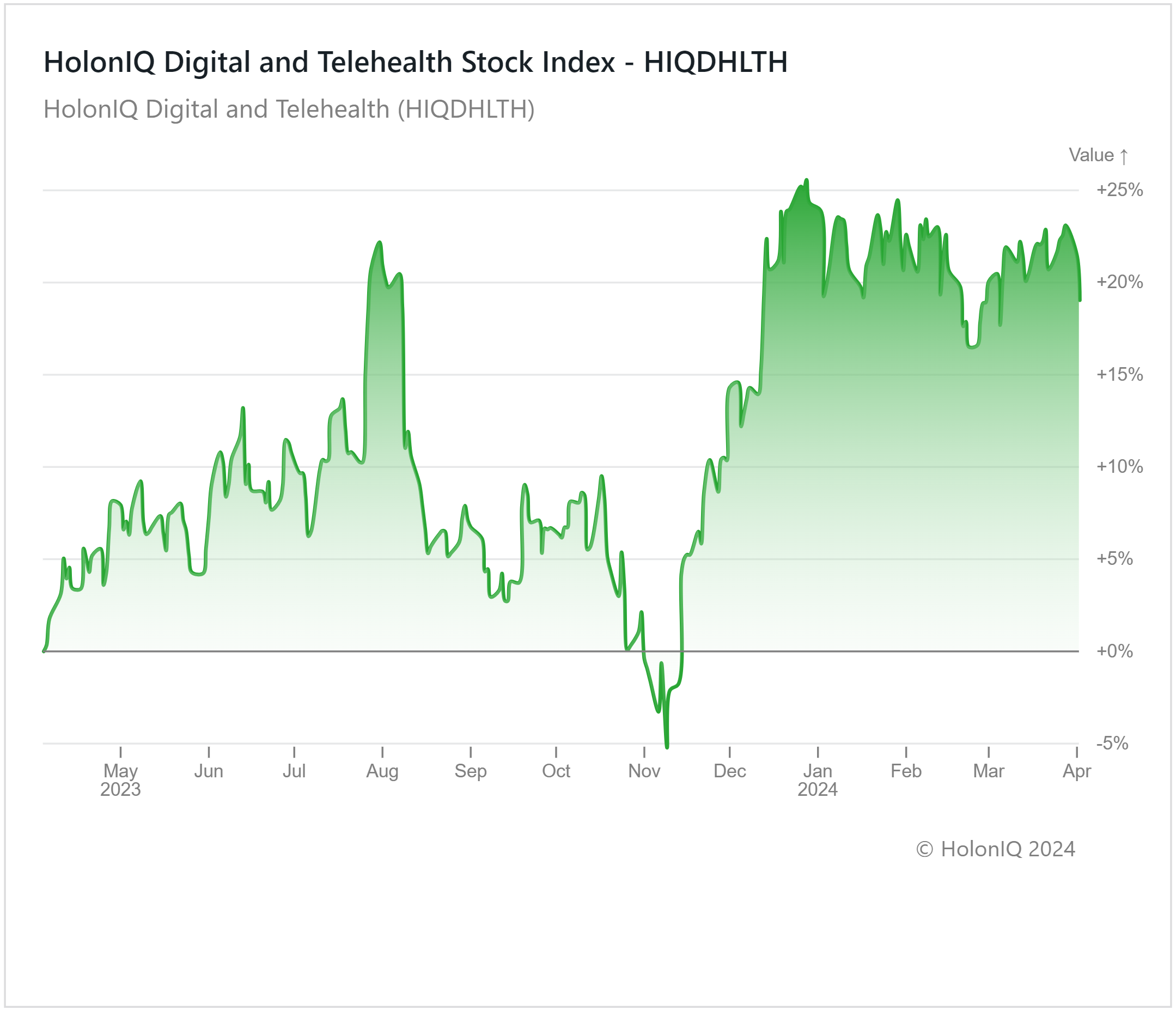

📈 Capital Markets - Digital and Telehealth

HolonIQ tracks thousands of listed health companies around the world, as well as acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten different sectors across Health Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ's Digital and Telehealth Index has seen a 20% increase, with the market experiencing significant growth due to rising demand for convenient healthcare services. Customers prefer digital solutions for remote monitoring, online medical advice, and medication purchases. The COVID pandemic fast-tracked industry expansion, witnessing an increase in online pharmacy usage and the adoption of virtual doctor appointments as a safe and convenient way of attending medical consultations.

Virtual Fertility and medication tracking apps are also becoming increasingly popular. Legislative support from governments, such as the Equal Access to Specialty Care Everywhere Act, also supports telehealth expansion. As digital technologies continue to advance, the market is poised for further growth and innovation, revolutionizing the way healthcare is delivered and experienced globally. However, concerns arise with decreasing employer contributions to worker health insurance schemes, which contribute to the revenues of select telehealth players.

🏆 Australia and New Zealand Health Tech 100

The Australia and New Zealand Health Tech 100 is HolonIQ’s annual list of the region's most promising startups in digital health, biotech, drug discovery, and analytics.

Among the cohort members, Kinoxis Therapeutics (An Australian neurology therapeutic developer) stood out with a grant it received. The US National Institute on Drug Abuse (NIDA) awarded Kinoxis Therapeutics a grant to fund Phase 1 clinical development of its lead molecule, KNX100, for treating opioid use disorder withdrawal symptoms. The grant is expected to provide around $3.6M over three years.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Health industry, spanning across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to peruse the top deals for each day.

Funding

🦷 Overjet, a US-based dental care AI platform provider, raised a $53.2M Series C led by March Capital to expand their platform operations.

🕰️ Aeovian Pharmaceuticals, a US-based biopharma that specializes in age-related conditions, closed a $50M Series A led by Hevolution to complete the Phase 1 clinical trial and prepare for a Phase 2 clinical trial.

🔪 ViaLase, a US-based laser surgical systems manufacturer, closed a $40M Series C led by a new investor to advance the ViaLase Laser, used for primary open-angle glaucoma treatment.

🔬 Selux Diagnostics, a US-based developer of a phenotyping platform, raised $48M in venture funding led by RA Capital Management to launch the Selux Next Generation Phenotyping (NGP) System in the US.

M&A

🩹 Gilead Sciences, a US biopharmaceutical company, has acquired CymaBay Therapeutics for $4.3B. The acquisition allows Gilead to integrate CymaBay's lead investigational product, Seladelpar, into its portfolio.

👃 Integra LifeSciences, a US-based medical device company, has acquired Acclarent for $275M to expand their sinuplasty and dilation offerings.

🦴 HIG Capital, a US-based private equity firm, has acquired ZimVie's spinal segment for $375M to make ZimVie a pure-play dental company.

💻 GE HealthCare, a US-based provider of medical technologies, has acquired MIM Software for an undisclosed amount to expand the company's digital health offerings.

IPOs & Follow-on Offerings

🩸 Invea Therapeutics, a US-based AI-based platform to understand inflammatory disorders, announced that it withdrew from a $75M IPO.

🍬 Movano Health, a US-based glucose monitor manufacturer, announced that it plans to raise $24M through a follow-on equity offering.

Spin-Offs

🏭 3M, a US-based manufacturing firm, has completed a spin-off to launch Solventum as an independent medical equipment company.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com