🪨 Australia Dominates Global Lithium Supply + ANZ Climate Tech 100

Australia accounts for 45% of global lithium supply, with Chile coming second, accounting for 28%. The landscape is undergoing a dynamic shift as efforts are made to diversify markets and lessen dependence on dominant suppliers.

Happy Monday 👋

Australia accounts for 45% of global lithium supply, with Chile coming second, accounting for 28%. The landscape is set to shift, and Argentina and North America are set to increase their market share post-2030. This week, we also spotlight the 2023 Australia & New Zealand Climate Tech 100, highlighting the region's most promising startups in the climate technology sector.

This Week's Topics

📊 Charts Spotlight. Australia And Chile hold more than half of the global lithium supply

📈 Shipping Index. Shipping index up 27%

🏆 Australia and New Zealand Climate Tech 100. $27.7M of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

📊 Charts Spotlight - Australia and Chile Hold More Than Half of the Global Lithium Supply

Subscribe to the HolonIQ newsletter 'Chart of the Day,' a daily newsletter that helps explain the global impact of the economy, from climate tech to education and healthcare.

Fueled by the global race towards clean energy technologies, demand for critical minerals has increased exponentially, creating a double-edged sword of opportunity and challenge. Between 2012 and 2022, the value of critical mineral trade saw a significant increase. Exports increased from $198.5 billion to $373.1 billion, and imports rose from $199.2 billion to $375.2 billion.

The landscape is undergoing a dynamic shift. Governments are increasingly asserting control, while new international partnerships are developing. These efforts aim to diversify markets and lessen dependence on dominant suppliers. Australia and Chile currently lead in lithium supply, with Australia's higher output attributed to the mining sector's shift from coal to battery minerals. China currently contributes only 10% to the global supply and projects a decline. It remains the largest consumer of lithium globally and is the global leader in lithium processing. Argentina is exploring mining partnerships with Europe and is expected to compensate for China's lower output in the coming years. The declines in Australia and Chile are expected to be offset by the increased output in North America and other parts of the world, such as Thailand.

These countries are strategically enhancing state involvement in critical mineral sectors, aiming to boost revenue and prevent exploitation. In 2023, Chile announced that it was nationalizing its lithium industry, while Indonesia nationalized its nickel industry in 2022. In 2023, the Australian government blocked acquisitions of mining land and companies by Chinese players due to China's dominant hold on the market.

📈 Capital Markets - Shipping Stock Index

HolonIQ tracks thousands of listed climate tech companies worldwide, along with acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ Shipping Stock Index (HIQSHIP) reflected a 27% increase over the past year, defying a turbulent year for the global transport industry. The shipping industry has seen a gradual recovery from the COVID-related downturn, with supply chain disruptions easing as port congestion and transport bottlenecks cleared out. Despite the subsequent drop in freight rates, optimism about a recovery in Chinese exports also improved sentiment.

More recently, the emergence of conflicts along Middle Eastern and European trade routes has started to undermine this trend, potentially triggering a reversal. Almost all major shipments coming through the Red Sea have had to be rerouted, which has led to higher costs for freight carriers, impacting profitability. Further challenges are expected in 2024, such as the strengthening of emission control regulations leading to increasing costs for shipping companies, forcing them to rethink strategies to maintain profitability.

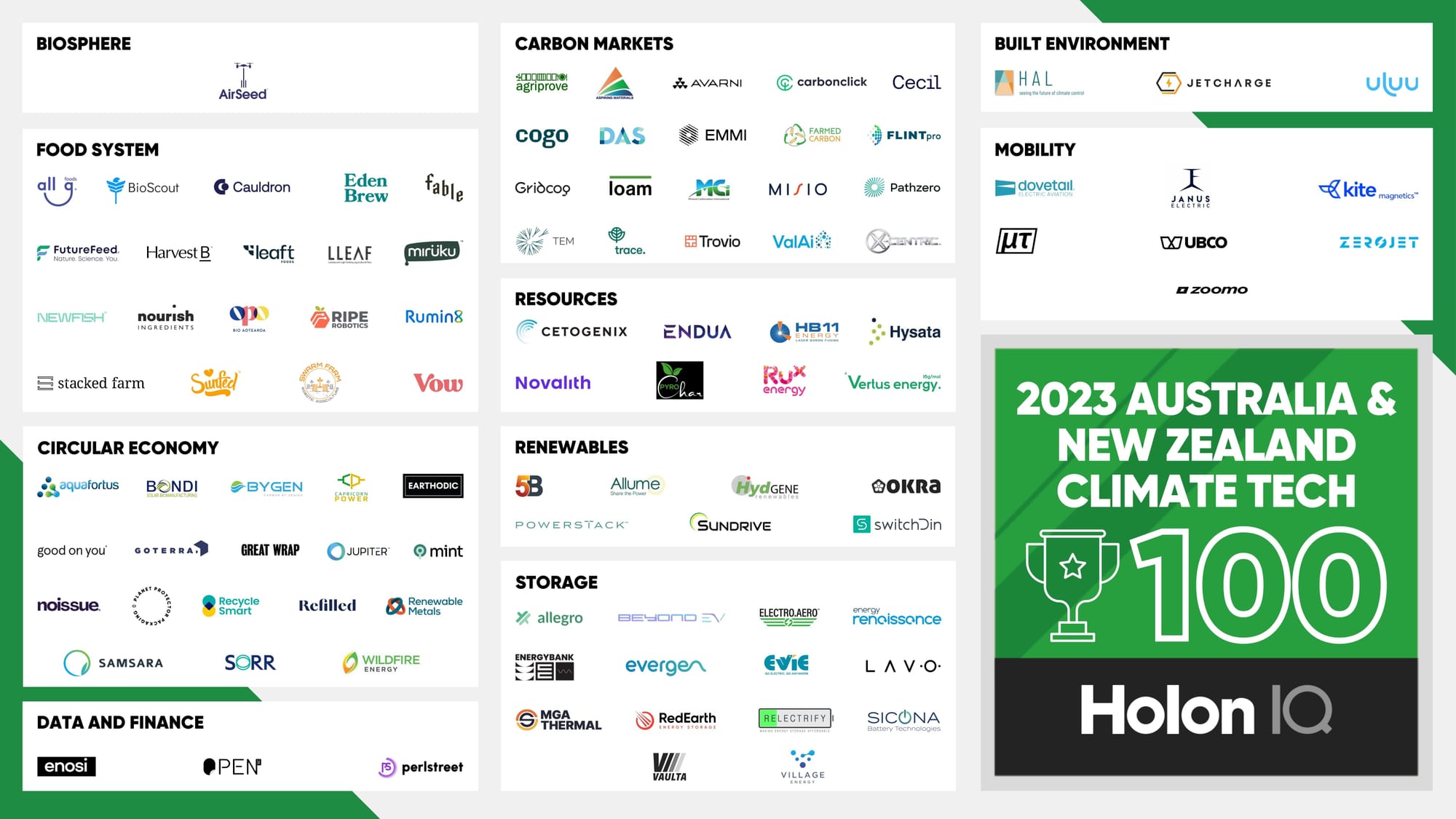

🏆 Australia & New Zealand Climate Tech 100

The Australia & New Zealand Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Australia and New Zealand's (ANZ) top climate tech companies have to date raised $27.7M in 2024. This is significantly lower than the $200M these companies raised in 2023. However, as inflation recedes and interest rates start normalizing, the region is poised to see increased fundraising volume. Juniper Ionics, an Australian startup, raised $9M and aims to scale up the development of carbon-neutral “green” ammonia for the agriculture sector. Cauldron Ferm raised a $6.3M Series A to build a large-scale facility to manufacture high-value ingredients through precision fermentation.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🔋 Alsym Energy, a Massachusetts-based rechargeable battery developer, raised $78M Series C from Tata Limited and General Catalyst to grow its team.

⚡ Torus, a Utah-based global energy solutions company that engineers and manufactures energy storage and management products, raised $67M from Origin Ventures to grow its team.

🧬 Onego Bio, a Finnish biotechnology company manufacturing animal-free egg white protein, raised a $29M Series A from NordicNinja VC to scale operations.

🌡️ Oros Labs, an Oregon-based thermal solutions company, raised a $22M Series B from Airbus Ventures to support its expansion in consumer, commercial, and government industries.

M&A

🚚 Sheer Logistics, a US-based Managed Logistics Company, acquired CargoBarn, a freight brokerage firm. The acquisition aims to strengthen the company’s ability to handle future cyclical market shifts.

🪵 Koppers Holdings, a US-based chemical and mineral company, acquired Brown Wood Preserving Company for $100M. The acquisition is to broaden its market reach and open up new geographic areas for business.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com