🧬 Genomics Index Dips 4%. $180M+ VC Funding.

Impact Capital Markets #65 looks at our Genomics stock index, major impact deals, M&A, and upcoming economic releases.

Sawasdee 🎏

📉 Today's Global Economic Update: Australia's Balance of Trade data for February 2024 revealed a decline in the trade surplus to $4.8B. Exports saw a 2.2% decline over the month, driven by lower metal ore and mineral exports, while imports increased by 4.8%.

💉 Deal of the Day: Biolinq, a healthcare technology company, raised $58M to support the completion of a clinical trial for its intradermal glucose sensor.

What's New?

🧬 Genomics. Genomics index declines 4%

💰 Funding. Health tech, clinical research + more

💼 M&A. SolarEdge Technologies acquires Wevo Energy

📅 Economics. Inflation, balance of trade, US employment data + more

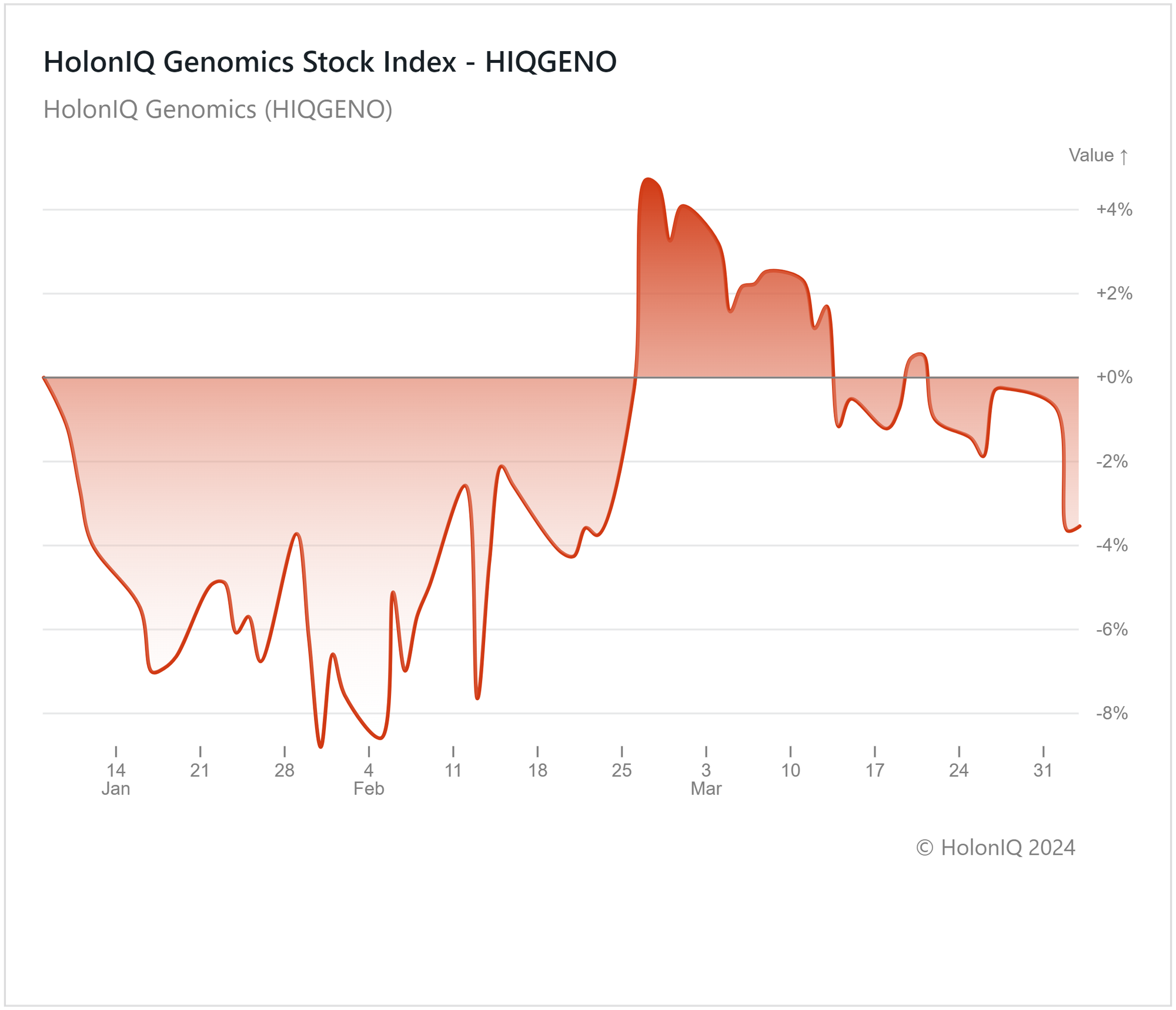

🧬 Genomics Index Declines 4%

HolonIQ's Genomics index witnessed a 4% dip in the last quarter. Despite a 25% decrease over the past year, the rate of decline has eased since reaching a low -35% in November. Key constituents in the index, including QIAGEN NV ($9B MCap), decreased 7% quarter-on-quarter, while Illumina, Inc ($20B MCap) and BioMarin Pharmaceutical, Inc ($16B MCap) declined 7% and 11%, respectively.

The genomics industry continues to recover from COVID-related disruptions, macroeconomic uncertainty, and supply chain challenges. Uncertainties related to regulatory ambiguities and technological challenges have also affected firms in the index. However, the recent approval of new cell-based gene therapy treatments like Casgevy and Lyfgenia has offered the potential for some recovery momentum, signifying a positive turn for the genomics industry and offering hope for further progress.

The growing desire for tailored medicine and treatments, alongside the progression of advanced genomic sequencing technologies, is also anticipated to present favorable prospects for the industry. The sector is poised to gain from enhancements in data analytics and AI, which will facilitate more efficient analysis of extensive genomic datasets.

💰 Funding

💉 Biolinq, a California-based healthcare technology company, raised $58M from Alpha Wave Ventures to support the completion of a clinical trial for its intradermal glucose sensor.

🌱 ION Clean Energy, a Colorado-based firm developing carbon dioxide capture technologies, raised $45M from Chavron New Energies & Carbon Direct Capital to expand operations.

🧬 EnteroBiotix, a UK-based clinical-stage biotechnology company, raised a $34M Series B to advance its lead product through a clinical trial and to progress its pipeline of therapeutics.

🤖 Manifold, a Massachusetts-based AI-powered clinical research platform eliminating administrative burdens for cancer centers, raised a $15M Series A from TQ Ventures to expand operations.

💼 M&A

🔌 SolarEdge Technologies, an Israeli smart energy technology company, acquired Wevo Energy, an EV charging optimization software startup.

📅 Economic Calendar

Inflation, Balance of Trade, US Employment Data + More

Friday, April 5th 2024

🇨🇦 Canada Balance of Trade Data, February

🇨🇦 Canada Employment Data, March

🇺🇸 US Employment Data, March

🇨🇦 Canada Ivey PMI, March

Monday, April 08th 2024

🇩🇪 Germany Balance of Trade Data, February

Tuesday, April 09th 2024

🇦🇺 Australia Westpac Consumer Sentiment Index, April

🇦🇺 Australia NAB Business Confidence Index, March

Wednesday, April 10th 2024

🇯🇵 Japan Consumer Confidence Index, March

🇺🇸 US Core Inflation Data, March

🇺🇸 US Inflation Data, March

🇨🇦 Canada BoC Interest Decision

Thursday, April 11th 2024

🇨🇳 China Inflation Data, March

🇪🇦 Euro Area ECB Interest Rate Decision

🇺🇸 US Producer Price Index, March

Friday, April 12th 2024

🇬🇧 UK GDP Data, February

🇺🇸 US United States Michigan Consumer Sentiment (Preliminary), April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com