🚗 Electric Vehicles Index Grows 15%. $180M+ VC Funding.

Impact Capital Markets #103 looks at our Electric Vehicles Stock Index, major impact deals, M&A, and upcoming economic releases.

📉 Today's Global Economic Update: The consumer confidence index in Japan fell to 36.2 in May 2024, the lowest since last November, down from 38.3 in April and below the forecast of 38.9. This persistent decline highlights growing concerns about Japan's economic stability and potential challenges.

⚡ Deal of the Day: Cloover, a German renewable energy finance provider, raised a $114M Seed to grow its platform and connect industry stakeholders.

What's New?

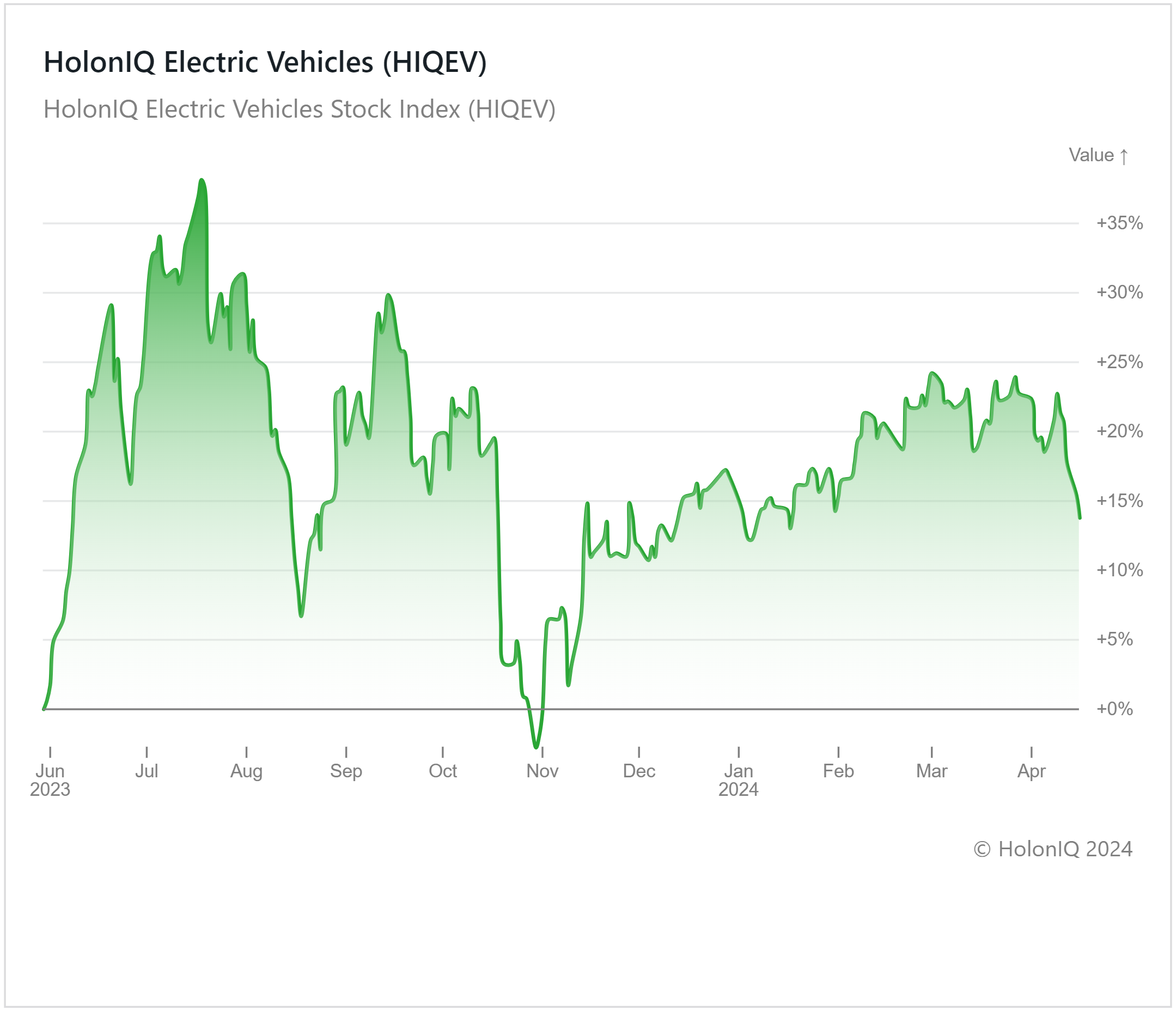

🚗 Electric Vehicles. Electric vehicles index grows 15%

💰 Funding. Renewable energy finance, sustainable materials, biotech + more

💼 M&A. OpenText acquired Pillr

📅 Economics. US GDP, Euro area inflation, balance of trade + more

🚗 Electric Vehicles Grows 15%

HolonIQ’s Electric Vehicle index has experienced a 15% Year-over-Year increase, gaining momentum since November 2023 and maintaining a consistent upward trend, albeit with minor fluctuations. EVs are rapidly growing as climate and pollution concerns drive consumer and industry adoption for a greener future, reducing carbon emissions. In the last year, sales of electric vehicles have increased by 35%, with over 14M new electric cars hitting the roads worldwide. Also, factors like technological advancements, government policies, and initiatives, such as tax changes in China and incentives for localized production in Europe and the US, are contributing to sustained growth in the EV market. This trend has been evident in key stocks such as Stellantis NV ($71B MCap), which gained 49% YOY. While the growth rate in global EV sales is moderating, declining costs, and the expansion of charging infrastructure are paving the way for further growth in the coming years.

💰 Funding

⚡ Cloover, a German renewable energy finance provider, raised a $114M Seed from Lowercarbon Capital to grow its platform.

♻️ Claros Technologies, a Minnesota-based sustainable material company raised a $22M Series B from the Ecosystem Integrity Fund and American Century Investments to advance R&D efforts.

🧬 Lucy Therapeutics, a Massachusetts-based biotech company, raised $12.5M from Engine Ventures and Safar Partners to support its research programs.

🌍 Vizcab, a French carbon impact reduction platform, raised a $4.9M Series A from KOMPAS VC to expand its operations.

🔋 Maxvolt Energy, an Indian electric vehicle battery manufacturer, raised $1.5M to support the company's research and development.

💼 M&A

🛡️ OpenText, a Canadian cybersecurity company acquired Pillr, a Kansas-based security operations software provider.

📅 Economic Calendar

US GDP, Euro Area Inflation, Balance of Trade + More

Thursday, May 30th 2024

🇺🇸 US GDP Growth Data, Q1

🇨🇳 China NBS Manufacturing PMI, May

Friday, May 31st 2024

🇫🇷 France Inflation Data Preliminary, May

🇪🇦 Euro Area Inflation Data (Flash), May

🇮🇹 Italy Inflation Data Preliminary, May

🇮🇳 India GDP Growth Data, Q1

🇨🇦 Canada GDP Growth Data, Q1

🇺🇸 US Core PCE Price Index, April

🇺🇸 US Personal Income & Spending, April

Monday, June 3rd 2024

🇺🇸 US ISM Manufacturing PMI, May

Tuesday, June 4th 2024

🇺🇸 US JOLTs Job Openings, April

🇦🇺 Australia GDP Growth Data, Q1

Wednesday, June 5th 2024

🇨🇦 Canada BoC Interest Rate Decision

🇺🇸 US ISM Services PMI, May

🇦🇺 Australia Balance of Trade Data, April

Thursday, June 6th 2024

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇪🇦 Euro Area ECB Press Conference

🇨🇦 Canada Ivey PMI s.a, May

🇨🇳 China Balance of Trade Data, May

Friday, June 7th 2024

🇩🇪 Germany Balance of Trade Data, April

🇨🇦 Canada Balance of Trade Data, April

🇨🇦 Canada Employment Data, May

🇺🇸 US Employment Data, May

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com