🖥️ EdTech's 12% Climb. $140M+ Funding Day.

Impact Capital Markets #12 looks at our EdTech Stock Index, major impact deals and acquisitions, and the upcoming big economic releases. For unlimited access to more deals and economic updates, request a demo.

Today's Topics

- 🖥️ EdTech. EdTech up 12%YoY, Sentiment Improving.

- 💰 Funding. $140M+ funding in Health Supplement, Ocean Carbon, Solar, Fitness & Neurodegeneration.

- 💼 Acquisitions. Pharmaceutical, K-12 education, Cotton Processing & More

- 📅 Economics. Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

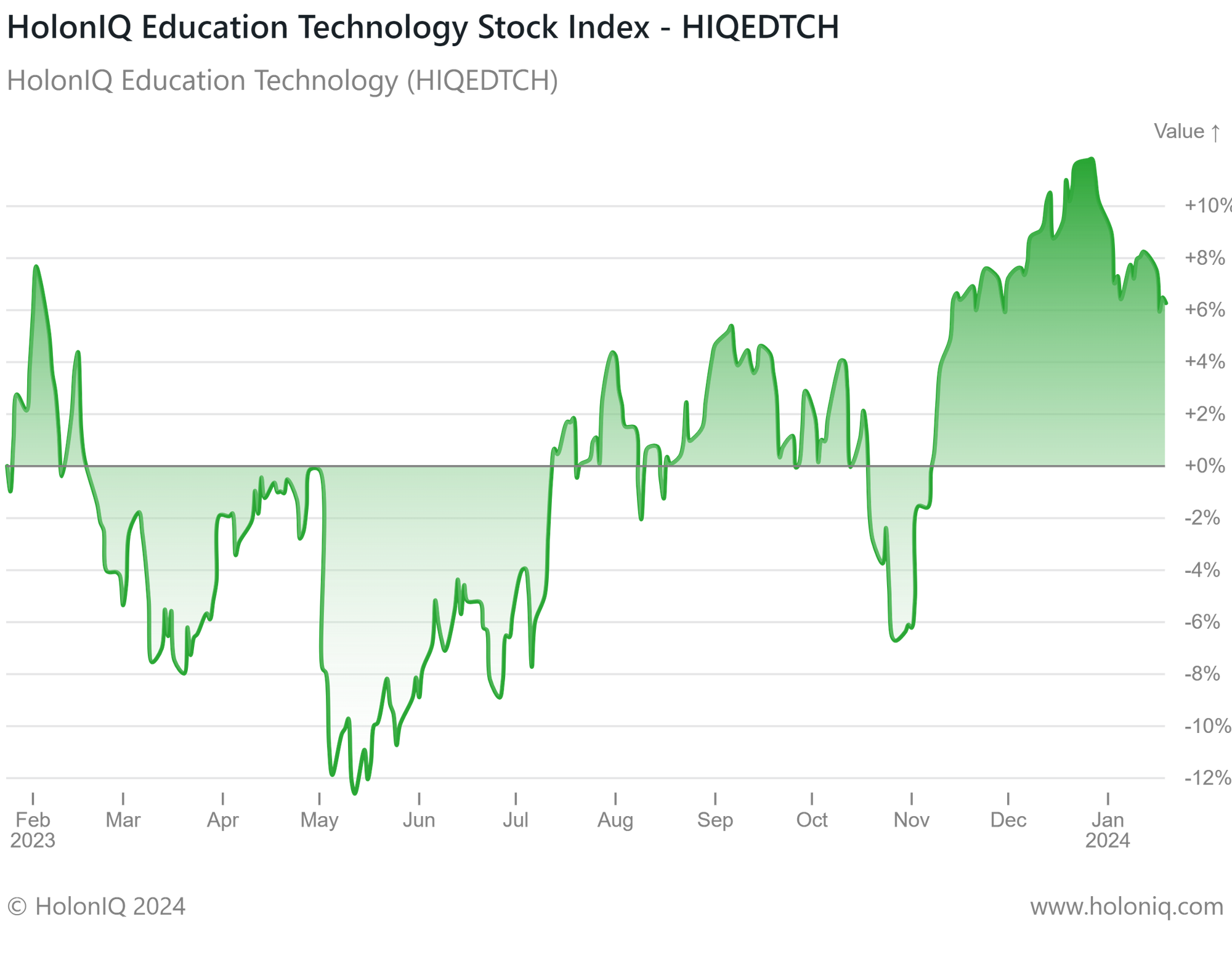

🖥️ EdTech Up 12%YoY, Sentiment Improving

HolonIQ Education Technology (HIQEDTCH). The index saw negative indexed returns (returns on the index relative to the level on 23rd Jan 2023) in the 1H of 2023, but it recovered in the 2H of the year. Year-on-Year annual returns were recorded at over 12% in January 2024.

Many EdTech companies face a new competitive threat posed by free and open generative AI in 2023. Market sentiment for providers like Coursera, Chegg, and even Duolingo has been challenged with the concern that students may shift away from traditional EdTech in favor of GenAI powered and potentially free solutions. As the long-term potential for AI in education technology is slowly recognized (or over-promises are blown out), sentiment is gradually improving. Meanwhile, many EdTech companies are launching AI and advanced immersive technologies to harness the potential of AI. Pearson (MarketCap: US$8.5B), a provider of content, assessment, and digital services to learners, announced the availability of generative AI study tools in its academic study material. Chegg (MarketCap: US$1.2B), a homework help and resource platform, revealed CheggMate, an AI-enhanced learning platform created on OpenAI's model, GPT-4, offering a conversational learning companion (an AI tutor). Duolingo (MarketCap: US$7B) also expanded its AI capabilities, launching DuolingoMax early last year, which offers customers role-play-based learning.

Government and school leaders’ focus on recovering from learning losses also contributes to increased EdTech adoption, especially for solutions that improve learning experiences and outcomes. Companies like Stride (NYSE:LRN), offer virtual schools and tutoring services that are growing in demand to help students recover academically.

💰 Funding

💊 Bloom Nutrition, a California-based provider of health supplements helping consumers achieve wellness goals, raised $90M from Nutrabolt. The funds will boost Bloom’s growth, driving demand, fostering product innovation, and expanding capabilities.

🌊 Captura, a California-based company that provides ocean carbon capturing technology, raised $21.5M Series A from Future Planet Capital. The funds will be used to commercialize its Direct Ocean Capture (DOC) technology, which harnesses the power of the ocean to absorb carbon dioxide (CO2) from the atmosphere.

🧬 Sano Genetics, a UK-based personalized medicine research platform, raised $11.4M from Plural Platform to advance precision medicine.

☀️ Dayao Green Energy, a China-based operator of solar photovoltaic power plants, raised $7M from Yunnan Energy International to fund the construction and operation of solar photovoltaic power stations.

🎮 Talofa Games, a California-based gaming studio developing social fitness games, reportedly raised $6.3M Seed from Chamaeleon to expand operations and its development efforts.

⚡️ Reel Energy, a Danish renewable energy sourcing solution, raised $5.4M Seed from Transition to scale its transformative model for B2B renewable electricity supply across Europe.

🧠 MitoSense, a Massachusetts-based research and development company focused on neurodegenerative disease treatments, raised $3.5M Seed from Caydan Capital Partners to advance its innovative work in Mitochondria Organelle Transplantation (MOT™️).

💼 Acquisitions

💊 StateServ, a Arizona-based company that understands the needs of hospice, acquired Delta Care Rx, a Pennsylvania-based national pharmaceutical care provider.

🎓 PowerSchool, a California-based prominent provider of cloud-based software for K-12 education, acquired Allovue, a Maryland-based software platform that helps school districts create and plan budgets and monitor spending to make financial.

🧑💼 Flores & Associates, a North Carolina-based human resources company specializing in health savings account administration services, acquired London Health Administrators, a Rhode Island-based third-party administrator of employee benefit programs.

🌾 Louis Dreyfus Company, a Netherlands-based Merchant Firm involved in agriculture goods, acquired Namoi Cotton , an Australian-based cotton processing and marketing organization.

🌐 Welcome to the Jungle, a France-based provider of a recruitment platform, acquired Otta, a UK-based provider of a candidate-first job search platform.

📅 Economic Calendar

Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

Tuesday January 23th 2024

🇦🇺 Australia - NAB Business Confidence, December

🇯🇵 Japan - BoJ Interest Rate Decision

Wednesday January 24th 2024

🇯🇵 Japan - Balance of trade, December

🇩🇪 Germany - HCOB Manufacturing PMI (Preliminary), January

🇨🇦 Canada - BoC Interest Rate Decision

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇪🇦 Euro Area - ECB Interest Rate Decision

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December

Tuesday January 30th 2024

🇫🇷 France - GDP Data, Q4

🇮🇹 Italy - GDP Data, Q4

🇪🇦 Euro Area - GDP Data, Q4

🇺🇸 US - Employment Data, December

Wednesday January 31st 2024

🇦🇺 Australia - Inflation Data, Q4

🇨🇳 Canada - NBS Manufacturing PMI, January

🇯🇵 Japan - Consumer Confidence, January

🇫🇷 France - Inflation Data, January

🇩🇪 Germany - GDP Data, Q4

🇩🇪 Germany - Inflation Data, January

Thursday February 1st 2024

🇺🇸 US - Fed Interest Rate Decision

🇺🇸 US - Fed Press Conference

🇨🇳 Canada - Caixin Manufacturing PMI, January

🇪🇦 Euro Area - Inflation Data, January

🇮🇹 Italy - Inflation Data, January

🇬🇧 UK - BoE Interest Rate Decision

🇺🇸 US - ISM Manufacturing PMI, January

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com