🧑🏫 Early Childhood 10% Climb Fizzles. $24M+ VC Funding.

Impact Capital Markets #81 looks at our Early Childhood stock index, major impact deals, M&A, and upcoming economic releases.

Ola 🌊

📉 Today's Global Economic Update: The Bank of Japan (BoJ) left its key interest rate unchanged at Friday's meeting as was expected. The Japanese Yen weakened against the Dollar and briefly reached a 34-year low following the announcement before sharply rebounding on Monday. The BoJ also raised its inflation forecast and continued to indicate that it would gradually raise interest rates.

📚 Deal of the Day: Edia Learning, a US-based math-tech solutions company, closed a $9.4M funding round to diversify operations.

What's New?

🧑🏫 Early Childhood. Early childhood -30% YoY, ends +4% in 3M

💰 Funding. Math-tech solutions, food-tech, workspace management

💼 M&A. Gig workforce & blockchain payment

📅 Economics. Euro Area GDP, US Fed interest rate, balance of trade + more

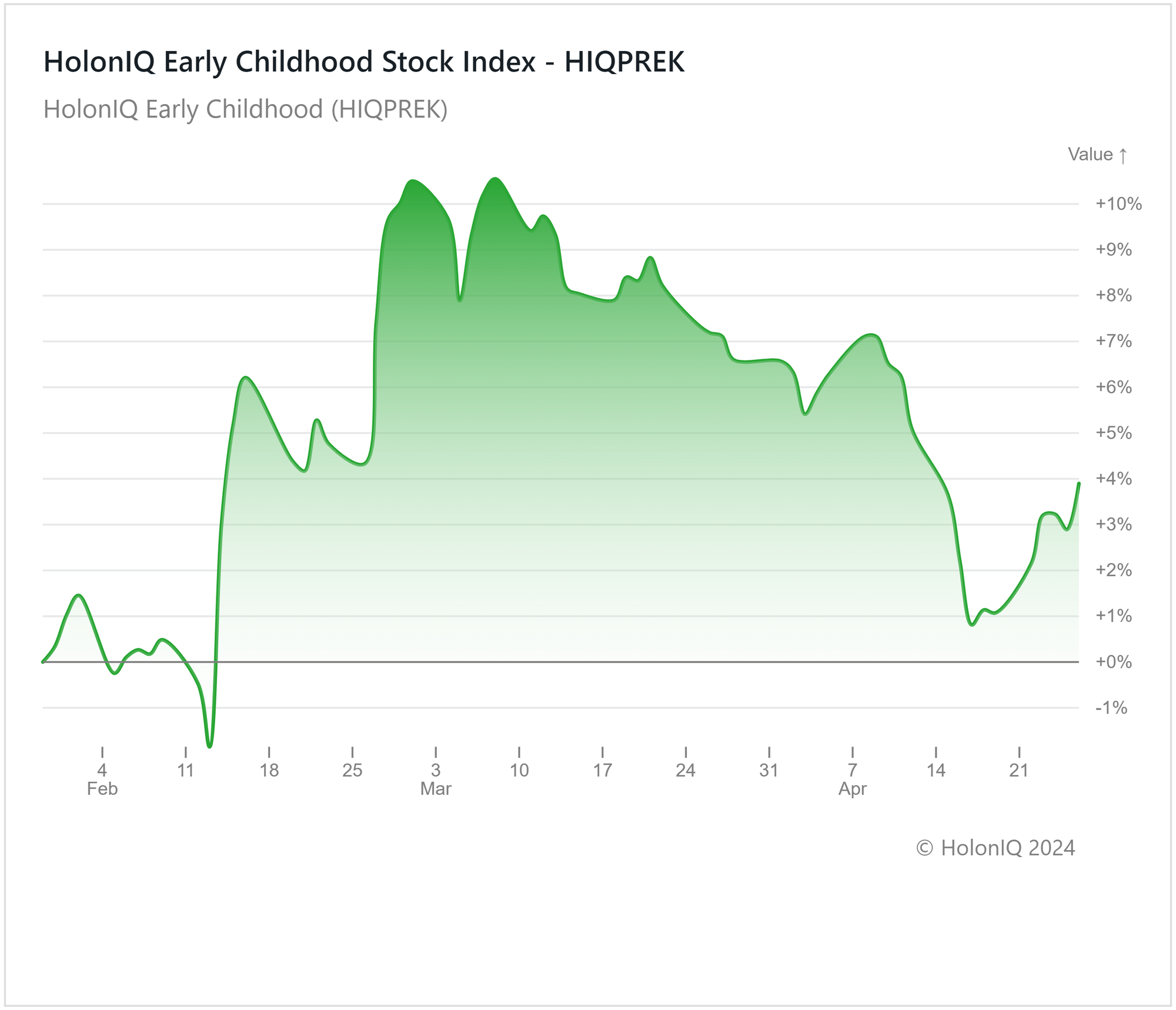

🧑🏫 Early Childhood -30% YoY, Ends +4% in 3M

HolonIQ's Early Childhood Index has experienced a significant decline of 30% over the past year. This decline was particularly sharp in November 2023, with the index dropping nearly 40%. However, there are signs of recovery in recent months. The index's 3-month return reflects this trend of a partial bounce back. Major stocks within the index, including Bright Horizons Family Solutions ($6.2B MCap) and G8 Education ($0.6B MCap), have seen positive returns in the last 3 months (5.62% and 16.67%, respectively). The US-based Bright Horizons Family Solutions has performed well in the last 12 months, helped by higher demand for child care as employees returned to offices after the pandemic. Bright Horizon's success can also be attributed to its Back-Up Care segment (which partners with corporations to offer employer-sponsored childcare solutions), which saw revenues grow by 24% YoY in the last quarter of 2023. G8 Education's performance in 2H 2023 improved compared to the first half of the year indicating an improved outlook.

Looking ahead, government initiatives amid current demographic shifts are expected to contribute to growth in the sector in the coming years. Government support for early childhood education is increasing in regions like Australia and the US while corporations are increasingly offering childcare as an employee benefit. Countries in East Asia with declining birth rates are also taking steps to improve access to childcare services, highlighting a global trend towards recognizing the importance of early childhood education.

💰 Funding

📚 Edia Learning, a US-based math-tech solutions company, closed a $9.4M funding round from Felicis to diversify operations.

🌱 Solar Foods, a Finnish food-tech startup raised a $8.6M Series B from Springvest to expand operations.

🏢 Neowrk, a Brazil-based provider of a workspace management platform, raised $2M in funding from Indicator Capital to scale operations.

💼 M&A

💻 Mynavi, a Japanese information services company acquired Awign, an Indian startup specializing in gig workforce and last-mile delivery services.

💳 Paystand, a California-based blockchain payment company, acquired Teampay, a New York-based expense management software provider.

📅 Economic Calendar

Euro Area GDP Data, US Fed Interest Rate, Balance of Trade + More

Monday, April 29th 2024

🇩🇪 Germany Inflation Data (Preliminary), April

🇨🇳 China NBS Manufacturing PMI, April

🇨🇳 China Caixin Manufacturing PMI, April

Tuesday, April 30th 2024

🇫🇷 France GDP Data (Preliminary), Q1

🇫🇷 France Inflation Data (Preliminary), April

🇩🇪 Germany GDP Data Flash, Q1

🇮🇹 Italy GDP Data, Q1

🇪🇦 Euro Area GDP Data Flash, Q1

🇪🇦 Euro Area Inflation Data Flash, April

🇮🇹 Italy Inflation Data (Preliminary), April

Wednesday, May 1st 2024

🇺🇸 US ISM Manufacturing PMI, April

🇺🇸 US Job Openings, March

🇺🇸 US Fed Interest Decision

🇦🇺 Australia Balance of Trade Data, March

Thursday, May 2nd 2024

🇨🇦 Canada Balance of Trade Data, March

🇯🇵 Japan Consumer Confidence Index, April

Friday, May 3rd 2024

🇺🇸 US Employment Data, April

🇺🇸 US ISM Services PMI, April

Tuesday, May 7th 2024

🇦🇺 Australia RBA Interest Decision

🇩🇪 Germany Balance of Trade Data, March

🇨🇦 Canada Ivey PMI s.a, April

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com