🌐 Digital Infrastructure Up 15%. $460M+ VC Funding.

Impact Capital Markets #108 looks at our Data Centers and Digital Infrastructure Stock Index, major impact deals, M&A, and upcoming economic releases.

Halló ❄️

📈 Today's Global Economic Update: US Job openings fell by 296,000 to 8.059M in April 2024, the lowest since February 2021, missing the 8.34M consensus. The labor market softness is strengthening expectations of a Fed rate cut in September.

🌐 Deal of the Day: Xcimer Energy, an inertial fusion company, raised a $100M Series A to expand its team and develop a prototype system.

What's New?

🌐 Data Centers & Digital Infrastructure. Digital Infrastructure 3M down 6%, YoY up 15%

💰 Funding. Fusion energy, content management, biotech + more

💼 M&A. Health management and biotherapeutics

📅 Economics. US employment data, euro area interest rate, balance of trade + more

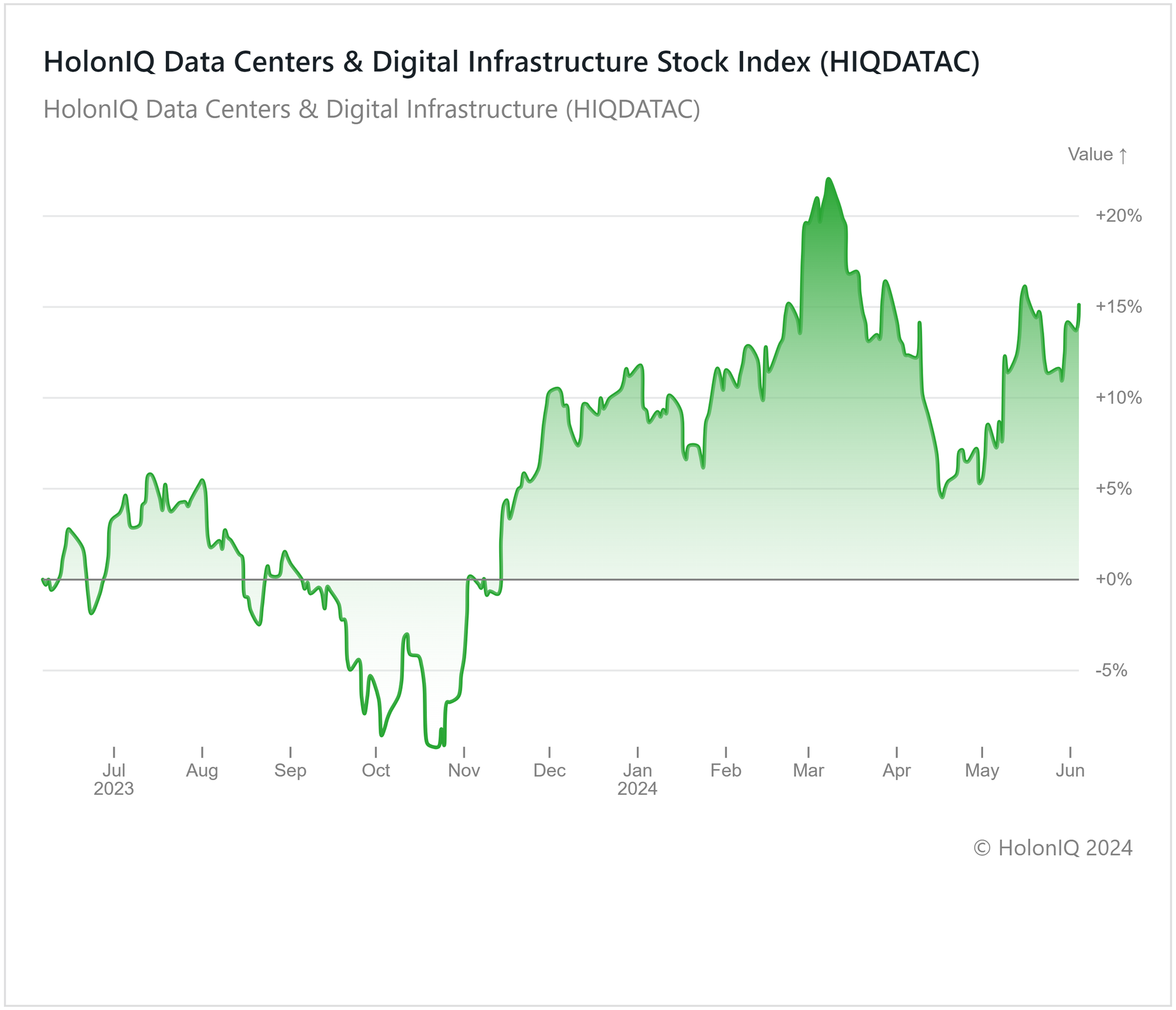

🌐 Digital Infrastructure 3M Down 6%, YoY Up 15%

HolonIQ's Data Centers and Digital Infrastructure Index has decreased by 6% over the past 3 months, while the index is up by 17% in the last 12 months. Key stocks in the index, such as American Tower ($93B MCap), Equinix ($72B MCap), and Digital Realty Trust ($47B MCap) have seen respective stock price declines of 4%, 16%, and 4%.

Despite the short-term fluctuations, the growing demand for data centers, driven by the surge in AI requirements and the increasing global demand for IT services, is sustaining the Year-on-Year growth in the index. The exponential increase in the need for data centers, as companies heavily invest in AI, emphasizes the critical importance of digital infrastructure in facilitating this technology, thereby providing the sector with significant opportunities. NVIDIA's data center revenue surged to $22.6 B, a 427% YoY increase in Q1 2024, while American Tower and Equinix have become notable data center hardware manufacturer partners to the company. Additionally, global 5G subscriptions are expected to double and surpass 1 billion this year. Gartner estimates that 5G infrastructure spending needed to support the change could increase 22% this year to more than $23 B worldwide, adding to the sector's growth opportunities.

💰 Funding

🌐 Xcimer Energy, a Colorado-based inertial fusion company, raised a $100M Series A from Hedosophia to expand its team and develop a prototype system.

📝 Storyblok, an Austrian content management system, raised a $80M Series C from Brighton Park Capital to provide smart content management for businesses.

🧬 Vilya, a Washington-based biotechnology company, raised a $71M Series A from ARCH Venture Partners to advance drug design and develop new medicines.

💻 ActuityMD, a Massachusetts-based technology partner for the MedTech industry, raised a $45M Series B from ICONIQ Growth to expand its platform and speed up medical technology adoption.

🔍 GetWhy, a Denmark-based research technology company, raised a $34.4 from PeakSpan Capital to continue reshaping consumer research.

🖥️ Imagino, a French marketing technology provider, raised a $27.2M Series A from Cathay Innovation and henQ to accelerate its growth in the UK.

🛠 Neural Concept, a Swiss engineering intelligence platform, raised a $27M Series B from Forestay Capital to strengthen its technology.

💼 M&A

🏥 OneTouch Health Group, an Irish health management platform, acquired OnePlan Software, a UK-based IT firm.

💊 Patheous Health, a Kansas-based biotherapeutics company, acquired DiagnosTEX, a Texas-based medical company.

📅 Economic Calendar

US Employment Data, Euro Area Interest Rate, Balance of Trade + More

Wednesday, June 5th 2024

🇨🇦 Canada BoC Interest Rate Decision

🇺🇸 US ISM Services PMI, May

🇦🇺 Australia Balance of Trade Data, April

Thursday, June 6th 2024

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇪🇦 Euro Area ECB Press Conference

🇨🇦 Canada Ivey PMI s.a, May

🇨🇳 China Balance of Trade Data, May

Friday, June 7th 2024

🇩🇪 Germany Balance of Trade Data, April

🇨🇦 Canada Balance of Trade Data, April

🇨🇦 Canada Employment Data, May

🇺🇸 US Employment Data, May

Monday, June 10th 2024

🇦🇺 NAB Business Confidence, May

Tuesday, June 11th 2024

🇬🇧 UK Employment Data, April

🇨🇳 China Inflation Data, May

Wednesday, June 12th 2024

🇬🇧 UK GDP, April

🇺🇸 US Core Inflation Data, May

🇺🇸 US Inflation Data, May

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

🇺🇸 US Fed Press Conference

Thursday, June 13th 2024

🇺🇸 US PPI, May

Friday, June 14th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇺🇸 Michigan Consumer Sentiment (Preliminary), June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com