⚡ China Renewable Energy Down 31%. $615M+ VC Funding.

Impact Capital Markets #107 looks at our China Renewable Energy Stock Index, major impact deals, M&A, and upcoming economic releases.

Marhaba 🐪

📈 Today's Global Economic Update: Annual inflation in the Euro Area increased to 2.6% in May 2024, surpassing forecasts, with energy prices rebounding and services rising faster. Inflation exceeded expectations in Germany, France, Spain, and Italy, indicating persistent inflationary pressures.

💊 Deal of the Day: Summit Therapeutics, a Florida-based biopharmaceutical company, raised $200M to advance clinical development of ivonescimab, a cancer-fighting antibody medication.

What's New?

⚡ China Renewable Energy: China renewable energy declines 31%

💰 Funding. Biopharmaceutical, EV charging, ed-tech + more

💼 M&A. Pharmaceuticals and medical technology

📅 Economics. US employment data, Euro Area Interest rate + more

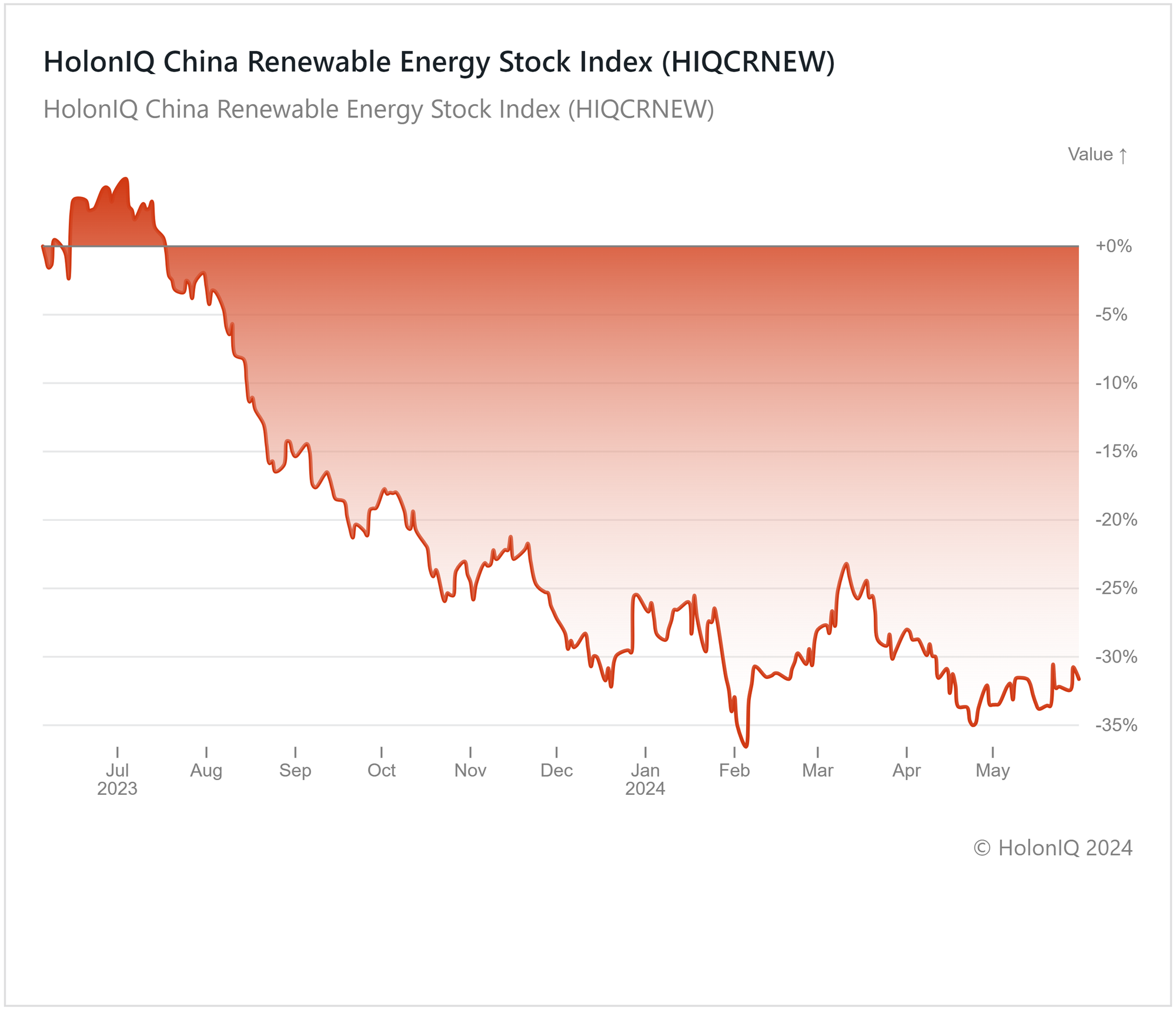

⚡ China Renewable Energy Declines 31%

China stands as the global leader in renewable energy investment and installations, yet the sector now faces significant hurdles, evidenced by a 31% decline in the index over the past year. While China broke records in solar and wind energy installations in 2023, heavy reliance on coal, accounting for 70% of electricity, limits full renewable capacity utilization. Geopolitical tensions and droughts intensify security concerns, heightening coal reliance, while slow hydropower generation due to droughts needs an energy mix reassessment.

The rapid expansion of Longi and other Chinese firms has led to oversupply, precipitating a crash in solar prices and profit margins. LONGi Green Energy Technology ($19B MCap) shares dropped 36% LTM due to supply and price concerns, impacting its growth trajectory. Layoffs at Longi signal a global shift in solar manufacturing, potentially challenging China's dominance. Subsequently, earnings results have declined, prompting analysts to revise their outlooks and resulting in negative market reactions. Jinko Solar Co ($1.5B MCap) saw a 34% decline in stock price over the past year, mirroring broader industry challenges. Despite these obstacles, solar manufacturers like Jinko Solar maintain optimism regarding global demand growth, anticipating a 20% rise in demand this year.

💰 Funding

💊 Summit Therapeutics, a Florida-based biopharmaceutical company, raised $200M to advance clinical development of ivonescimab, a cancer-fighting antibody medication.

⚗️ BioBTX, a Dutch chemical manufacturer, raised $86.8M to launch the first commercial renewable aromatics plant.

🌡️ Frore Systems, a California-based thermal technology company, raised a $80M Series C from Fidelity Management & Research Company to scale its operations.

🔌 Energy Park, a UK-based EV charging solutions company, raised a $44.6M Series A from Zouk Capital to accelerate residential charging facilities across the UK.

💼 Ashby, a California-based recruiting platform, raised a $30M Series C from Lachy Groom for product development.

⚡ Gireve, a French EV charging provider, raised $21.7M from Partech to expand business in Europe and globally.

📚 Bcas, a Spanish ed-tech platform, raised $18.4M from MyInvestor and Actyus to speed up its international growth.

🏢 Workbox, an Illinois-based national workspace operator, raised a $17.5M Series A from Chicago Atlantic to accelerate its expansion across the USA.

🌾 Iyris, a Saudi Arabian Agri-climate company, raised a $16M Series A from the Ecosystem Integrity Fund to increase its sales and deliver international orders.

💼 M&A

💊 Formosa Laboratories, a Taiwanese pharmaceutical company, acquired Synchem, an Illinois-based biopharmaceutical company.

🏥 Stryker, a medical technology company, acquired Artelon, a Georgia-based medical equipment supplier.

📅 Economic Calendar

US Employment Data, Euro Area Interest Rate, Balance of Trade + More

Tuesday, June 4th 2024

🇺🇸 US JOLTs Job Openings, April

🇦🇺 Australia GDP Growth Data, Q1

Wednesday, June 5th 2024

🇨🇦 Canada BoC Interest Rate Decision

🇺🇸 US ISM Services PMI, May

🇦🇺 Australia Balance of Trade Data, April

Thursday, June 6th 2024

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇪🇦 Euro Area ECB Press Conference

🇨🇦 Canada Ivey PMI s.a, May

🇨🇳 China Balance of Trade Data, May

Friday, June 7th 2024

🇩🇪 Germany Balance of Trade Data, April

🇨🇦 Canada Balance of Trade Data, April

🇨🇦 Canada Employment Data, May

🇺🇸 US Employment Data, May

Monday, June 10th 2024

🇦🇺 NAB Business Confidence, May

Tuesday, June 11th 2024

🇬🇧 UK Employment Data, April

🇨🇳 China Inflation Data, May

Wednesday, June 12th 2024

🇬🇧 UK GDP, April

🇺🇸 US Core Inflation Data, May

🇺🇸 US Inflation Data, May

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

🇺🇸 US Fed Press Conference

Thursday, June 13th 2024

🇺🇸 US PPI, May

Friday, June 14th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇺🇸 Michigan Consumer Sentiment (Preliminary), June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com