🔒 Cybersecurity Up 60%. $740M+ VC Funding.

Impact Capital Markets #125 looks at our Cybersecurity Stock Index, major impact deals, M&A, and upcoming economic releases.

Ma'alin 🌴

📈 Today's Global Economic Update: The U.S. economy expanded at an annualized 1.4% rate in Q1 2024, a slowdown from 3.4% in the previous quarter, revised figures showed. The upward revision was expected but is a significant slowdown from the 3.4% growth in the previous quarter.

🔋 Deal of the Day: Sila, a California-based battery materials company, raised a $375M Series G to scale its operations.

What's New?

🔒 Cybersecurity. Cybersecurity index up 60%

💰 Funding. Battery materials, AI hardware, energy storage + more

💼 M&A. Biotechnology and tech research and advisory

📅 Economics. Euro area inflation, employment data, balance of trade + more

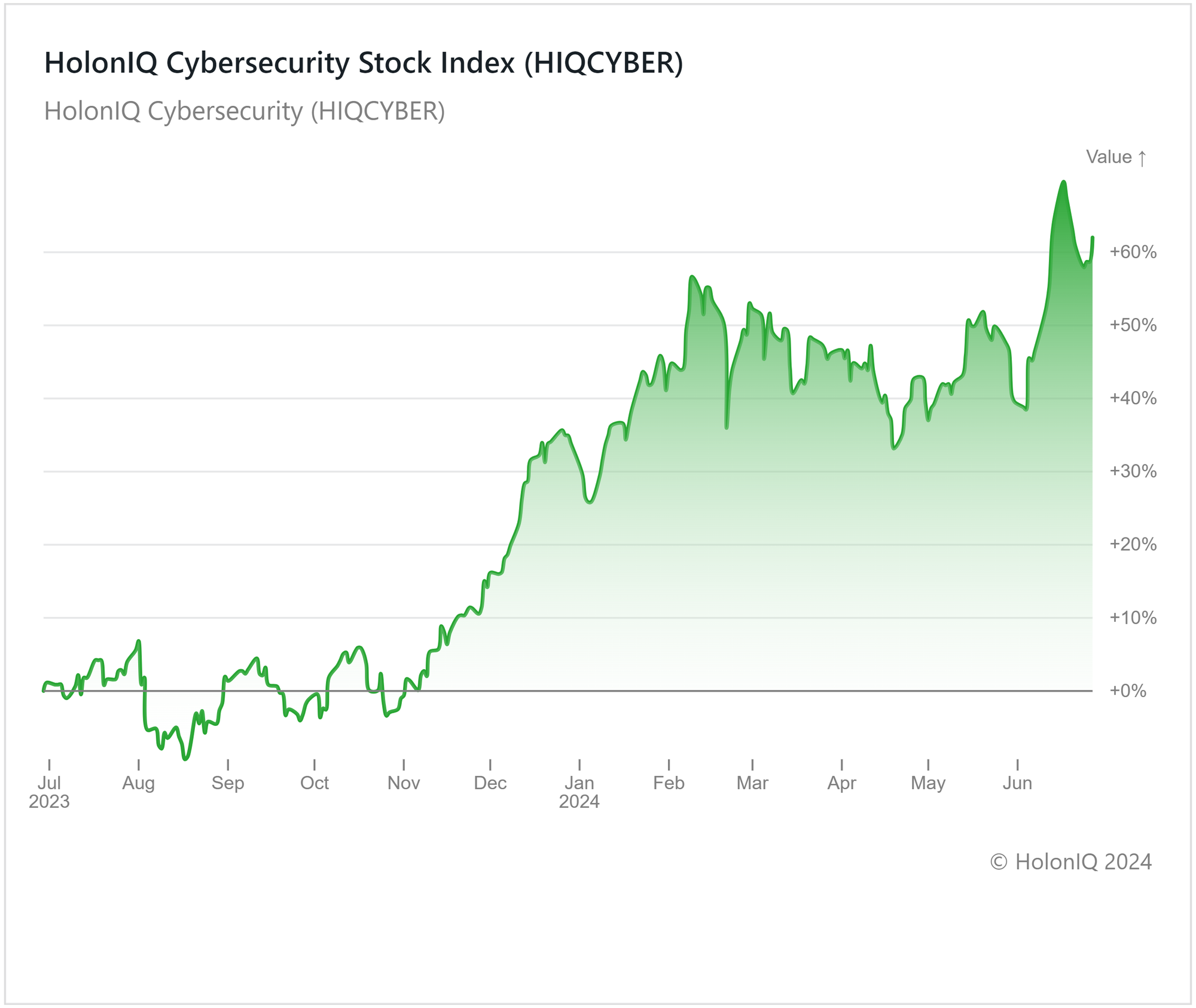

🔒 Cybersecurity Index Up 60%

HolonIQ’s Cybersecurity index increased 60% in the past year, rebounding sharply from a nearly 40% decline in January 2023. This growth reflects escalating cyberattacks, prompting heightened business prioritization globally. The average US data breach cost of about US$ 9.5M underscores the related financial risks for organizations.

CrowdStrike Holdings ($96B MCap), Broadcom ($733B MCap), and Palo Alto Networks ($109B MCap) have mirrored this growth trend, showing stock price increases of 17%, 20%, and 21%, respectively, over the past three months. These companies have capitalized on rising cybersecurity demands, with Palo Alto Networks reporting strong earnings of US$1.7 B in the second quarter of fiscal year 2024. Broadcom's strategic acquisitions and focus on AI innovations have driven its stock to new highs, with AI initiatives contributing significantly to its $12.49 billion 2Q revenue. CrowdStrike's recent inclusion in the S&P 500 underscores its profitability and pivotal role in addressing cybersecurity challenges. The outlook for the sector remains positive, with increasing AI integration and rising demand for cybersecurity solutions driving future prospects.

💰 Funding

🔋 Sila, a California-based battery materials company, raised a $375M Series G from Sutter Hill Ventures to scale its operations.

🛠️ Axelera AI, a Dutch provider of AI hardware, raised a $68M Series B from invest-NL Deep Tech Fund to expand operations and its business reach.

🔐 Odaseva, a California-based data security platform, raised a $54M Series C from Silver Lake Waterman to support growth and invest in data security.

📱 KarmaCheck, a California-based software company, raised a $45M Series B from Parameter Ventures to accelerate tech development and expand into new industries.

⚡ e-Zinc, a Canadian energy storage company, raised a $31M Series A from Evok Innovations to start commercial pilot projects for its long-duration energy storage system.

💻 Orby AI, a California-based technology company, raised $30M from New Enterprise Associates to accelerate the development and commercialization of the AI process automation platform.

🎓 MagicSchool AI, a Colorado-based EdTech platform, raised a $15M Series A from Bain Capital Ventures to expand tools for teachers and students.

💼 M&A

🔍 Ecosystm, a Singaporean technology research and advisory firm, acquired CoVentured, an Australian technology discovery cooperation.

💊 AbbVie, an Illinois-based biopharmaceutical company, acquired Celsius Therapeutics, a Massachusetts-based biotechnology company.

📅 Economic Calendar

Euro Area Inflation, Employment Data, Balance of Trade + More

Friday, June 28th 2024

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending Data, May

Monday, July 1st 2024

🇯🇵 Japan Consumer Confidence, June

🇩🇪 Germany Inflation Data (Preliminary), June

🇺🇸 US ISM Manufacturing PMI, June

Tuesday, July 2nd 2024

🇪🇦 Euro Area Inflation Data, June

🇺🇸 US JOLTs Job Openings, May

Wednesday, July 3rd 2024

🇨🇦 Canada Balance of Trade, May

🇺🇸 US ISM Services PMI, June

🇦🇺 Australia Balance of Trade, May

Friday, July 5th 2024

🇨🇦 Canada Employment Data, June

🇺🇸 US Employment Data, June

🇨🇦 Canada Ivey PMI s.a, June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com