🔒 Cybersecurity surges 90%. $175M+ Funding across impact sectors.

Impact Capital Markets #10

For over 5 years, HolonIQ has been tracking and analyzing Impact Capital Markets, Foundations and Philanthropies, Venture and Growth Capital, Private Equity and Public Markets.

Now, with more than 50 stock indices being tracked, we're kicking off 2024 with a new daily newsletter for data-driven global leaders looking to understand trends in strategic industries.

Today's Topics

- 🔒 Cybersecurity. Records impressive 90% year-on-year returns.

- 💰 Funding. $175M+ funding in Labs, Power, Agriculture, Telehealth & more.

- 💼 Acquisitions. Drug delivery, clinical research, and learning platforms.

- 📅 Economics. Consumer, GDP, and inflation data + Japan and Canada interest rates next week.

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

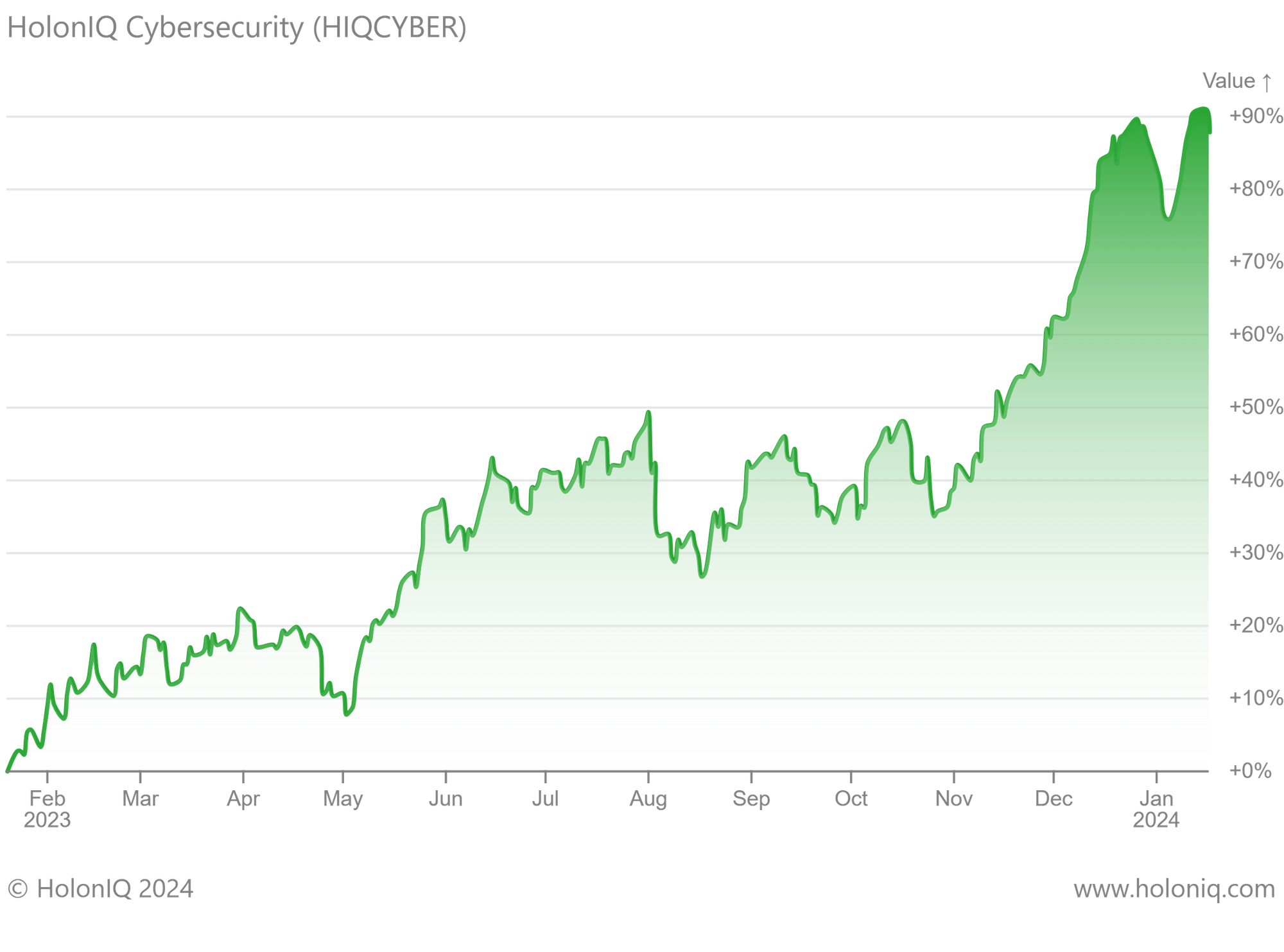

🔒 Cybersecurity Index - Recording Impressive 90% Year-on-Year Returns

HolonIQ Cybersecurity (HIQCYBER). In 2023, 12-month returns peaked in December (returns on the index relative to the level on January 20, 2023), increasing by almost 90%.

Palo Alto Networks, Inc. (MarketCap: US$104B), a global cybersecurity leader, announced their generative AI initiatives to improve efficiency across sales and marketing and their G&A functions. Additionally they are leveraging AI to resolve customer issues faster in an effort to improve overall customer experience. With AI enabled in product support, they plan to reduce the time to resolve complaints by over 65%.

SentinelOne (MarketCap: US$6.1B), an autonomous cybersecurity platform company, announced a partnership with Wiz, a leader in cloud security, to provide a best-of-breed cloud security solution with enhanced detection, prevention, investigation, and response capabilities, enabling them to significantly lower the risk to businesses of all sizes and allow access to it.

💰 Funding

🧪 SmartLabs, a Massachusetts-based provider of flexible laboratory infrastructure and resourcing solutions, raised $48M Series C from ArrowMark Partners, Winslow Capital Management, and Conversion Venture Capital. The funds will be used to broaden SmartLabs' operational model, delivering cost-efficient solutions to drive innovation in the biopharma industry.

🔋 International Battery Company, a California-based Battery cell manufacturer raised $35M Seed from RTP Global. The funds will be used to expand its manufacturing plant, improve its batteries, and add a layer of AI/ML technologies to enhance its products.

💡 Intelligent Growth Solutions, a UK-based power, lighting, and communications platform, raised $28.47M Series C from existing institutional investors to support significant global expansion as the business deploys its vertical farming technology to customers worldwide.

🌐 TrusTrace, a Sweden-based Software-as-a-Service (SaaS) company specializing in product traceability and compliance, raised $24M Series B from Circularity Capital. The funds will be utilized to strengthen market presence, drive product innovation, and foster collaborations.

🔬 Kinvent, a France-based biomechanics and training solutions provider, raised $17.4M from Eurazeo to accelerate research and external growth activities.

🌾 Farm-ng, a California-based robotics firm specializing in agricultural automation, raised $10M Series A from Xplorer Capital & HawkTower to deploy more of its modular robotics for small- and mid-sized farms.

🤖 Sky Engine AI, a UK-based provider of a simulation and learning platform for tech companies raised $7M Series A from Cogito Capital Partners to use the funds to expand operations and its business reach.

👶 Nest Collaborative, a Connecticut-based telehealth platform specializing in lactation support, raised $6M Series A from Altitude Ventures to scale operations, expand into new markets, and continue advancing its offering.

💼 Acquisitions

🧪 Iuvo BioScience, a NYC-based contract research organization, acquired Promedica International, a California-based clinical research organization.

💊 Kindeva Drug Delivery, a Minnesota-based global contract development and manufacturing organization, acquired Summit Biosciences, a Kentucky-based drug-delivery company.

🧑💼 Ceridian, a Minnesota-based human capital management (HCM) company, entered into a definitive agreement to acquire Eloomi, a Danish learning experience platform software provider.

🌎 ELIQUENT Life Sciences, a Columbia-based regulatory consulting firm for the life sciences industry, acquired RApport Global Strategic Services, a UK-based international regulatory consultancy.

📅 Economic Calendar

Anticipate key economic indicators focusing on Balance of Trade, GDP, and Inflation. Japan, Canada Interest rate decisions next week.

Friday January 19th 2024

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Tuesday January 23th 2024

🇦🇺 Australia - NAB Business Confidence, December

🇯🇵 Japan - BoJ Interest Rate Decision

Wednesday January 24th 2024

🇯🇵 Japan - Balance of trade, December

🇩🇪 Germany - HCOB Manufacturing PMI (Preliminary), January

🇨🇦 Canada - BoC Interest Rate Decision

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December