📈 Clean Energy Investments to Reach $2T in 2024 + Indo-Pacific Climate Tech 100

Global energy investment is set to exceed $2 trillion for the first time in 2024, exceeding fossil fuel investments. Investment in clean energy has been on an accelerated trend since 2020. This week, we also highlight the Indo-Pacific Climate Tech 100.

Happy Monday 👋

Global energy investment is set to exceed $2 trillion for the first time in 2024, surpassing fossil fuel investments, with funding to clean energy accelerating since 2020. This week, we also highlight our Indo-Pacific Climate Tech 100, showcasing the region's most promising start-ups across the energy and storage, food systems, and mobility sectors.

This Week's Topics

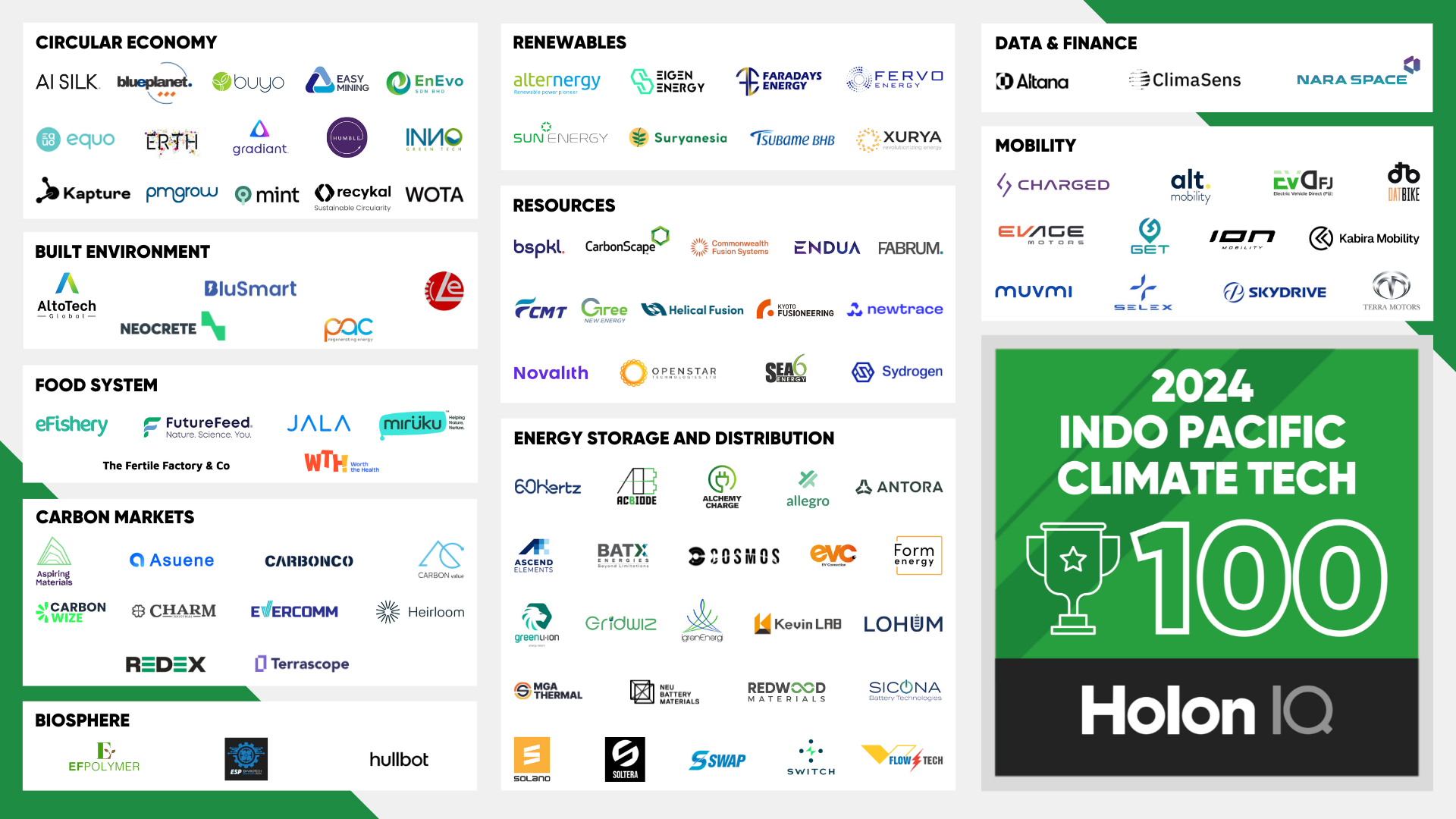

🏆 Indo-Pacific Climate Tech 100. HolonIQ's inaugural list of the most promising Climate Tech start-ups from 14 IPEF partner countries

📈 Clean energy investments. To exceed $3T in 2024

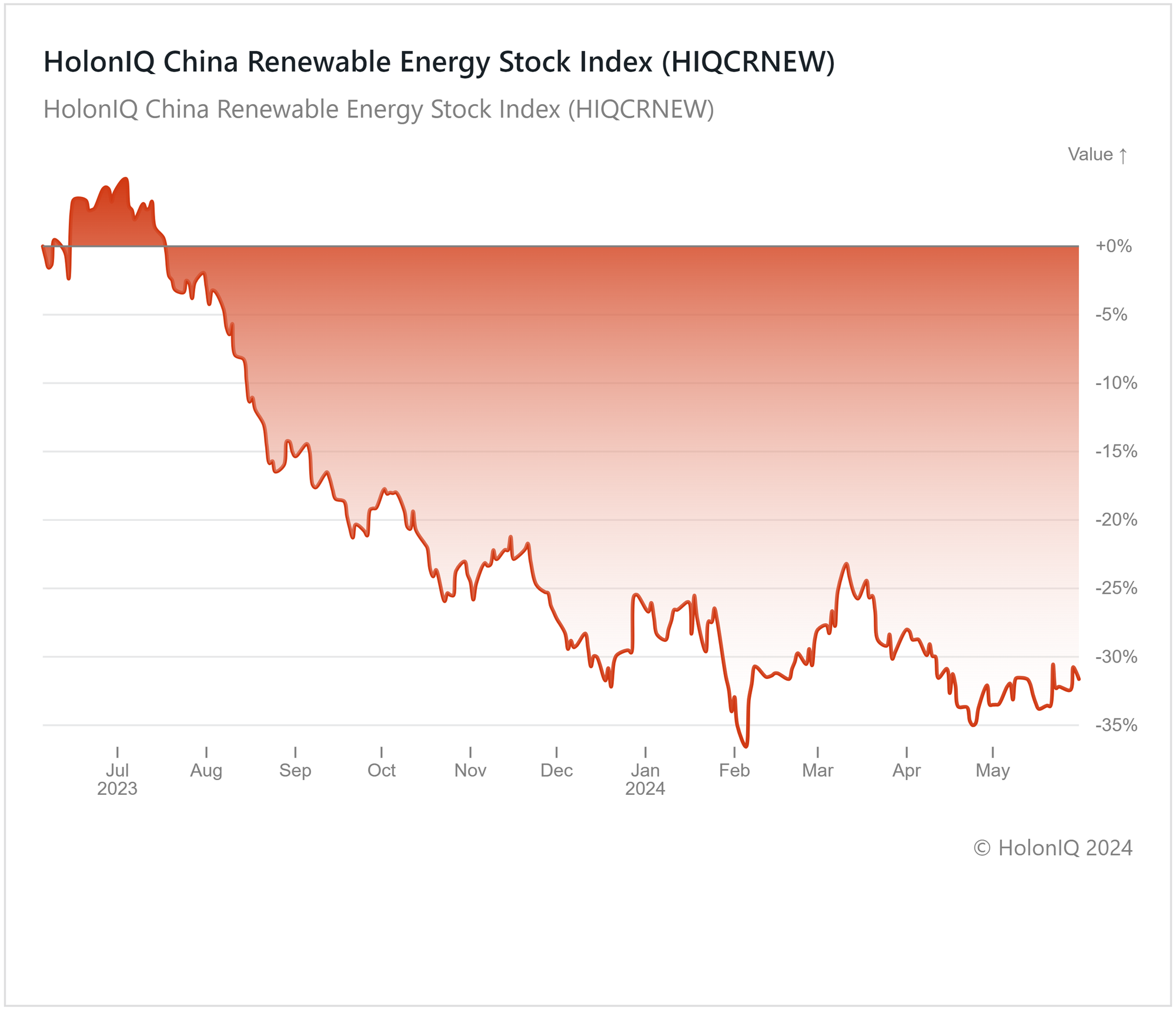

📊 China Renewable Energy Stock Index. 31% decline as oversupply causes price volatility

📝 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🏆 Indo-Pacific Climate Tech 100

The Indo-Pacific Climate Tech 100 includes companies from all 14 IPEF partner countries, representing the region's most innovative and promising climate tech companies. The cohort represents companies with a combined total valuation of over $20B, employing over 12,000 people in green jobs in IPEF economies. The Indo-Pacific Climate Tech 100 cohort attracts total aggregate revenue of $1.5B, growing at more than 20% year over year, and has raised over $12B in total funding to date.

In partnership with the Indo-Pacific Partnership for Prosperity (IP3), this ambitious climate tech initiative is designed to accelerate clean economy investment and climate impact in one of the world's largest and fastest-growing regions, the Indo-Pacific. 50 companies representing the Indo-Pacific Climate Tech 100 traveled from across the 14 IPEF partner countries to meet in person in Singapore last week with over 150 leading investors, philanthropies, and financial institutions seeking to raise $1-2B in fresh funding at the Forum.

📈 Global Clean Energy Investments to Exceed $3 trillion in 2024

Global energy investments are projected to surpass $3 trillion in 2024, with $2 trillion dedicated to clean energy technologies and infrastructure. This increase is driven by nations worldwide accelerating their shift towards a sustainable energy future. Favorable factors like decreasing costs and easing supply chain pressures support the clean energy transition. Notably, spending on renewable energy, grids, and storage has now eclipsed total investment in oil, gas, and coal. While rising interest rates may have posed a temporary financing challenge, the market is expected to normalize in 2024, paving the way for a significant boost in clean energy capacity deployment, especially in the latter half of the year. Solar and wind continue to be the primary recipients of these investments and are expected to dominate clean energy deployments in 2024. Last year, the world added approximately 510GW of clean energy capacity, two-thirds of which were solar additions.

In 2023, global clean energy investments exceeded $1.8 trillion. Notably, investments in electric vehicles have experienced remarkable growth, starting from negligible funding in 2014 and reaching almost $130 billion in 2023. This uptick in EV investments has triggered increased investments into batteries, supporting the expanding EV market. Additionally, nuclear and low-emission fuels are gaining traction with significant private-sector investments, indicating a promising future. Despite the skepticism surrounding renewable power, investments in this sector continue to grow steadily, reflecting confidence in clean energy generation.

⚡ China Renewable Energy Declines 31%

China is the global leader in renewable energy investment and installations, yet the sector faces significant hurdles, evidenced by a 31% decline in the index over the past year. While China broke records in solar and wind energy installations in 2023, heavy reliance on coal, accounting for 70% of electricity, limits full renewable capacity utilization. Geopolitical tensions and droughts intensify security concerns, heightening coal reliance, while slow hydropower generation due to droughts needs an energy mix reassessment.

The rapid expansion of Longi and other Chinese firms has led to oversupply, precipitating a crash in solar prices and profit margins. LONGi Green Energy Technology ($19B MCap) shares dropped 36% LTM due to supply and price concerns, impacting its growth trajectory. Layoffs at Longi signal a global shift in solar manufacturing, potentially challenging China's dominance. Subsequently, earnings results have declined, prompting analysts to revise their outlooks and resulting in negative market reactions. Jinko Solar Co ($1.5B MCap) saw a 34% decline in stock price over the past year, mirroring broader industry challenges. Despite these obstacles, solar manufacturers like Jinko Solar maintain optimism regarding global demand growth, anticipating a 20% rise in demand this year.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all world regions. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🌐 Xcimer Energy, a Colorado-based inertial fusion company, raised a $100M Series A from Hedosophia to expand its team and develop a prototype system.

⚗️ BioBTX, a Dutch chemical manufacturer, raised $86.8M to launch the first commercial renewable aromatics plant.

🌡️ Frore Systems, a California-based thermal technology company, raised a $80M Series C from Fidelity Management & Research Company to scale its operations.

🔌 Energy Park, a UK-based EV charging solutions company, raised a $44.6M Series A from Zouk Capital to accelerate residential charging facilities across the UK.

💻 ActuityMD, a Massachusetts-based technology partner for the MedTech industry, raised a $45M Series B from ICONIQ Growth to expand its platform and speed up medical technology adoption.

⚡ Gireve, a French EV charging provider, raised $21.7M from Partech to expand business in Europe and globally.

M&A

🏗️ JSW Steel, an Indian distributor of steel products, acquired Minas de Revuboè Limitada, a Mozambique-based coal mining company.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com