♻️ Circular Economy Index Grows 35%. $735M+ VC Funding.

Impact Capital Markets #92 looks at our Circular Economy Index, major impact deals, M&A, and upcoming economic releases.

Sawasdee 🎏

📈 Today's Global Economic Update: In April 2024, Canada's unemployment rate remained at 6.1%, matching the previous month's level. Net employment increased by 90,400, coming in surprisingly strong, leading to increasingly diverging views on whether the Bank of Canada will deliver a rate cut in June.

⛽ Deal of the Day: HIF Global, an e-fuels company, raised $164M to expand the e-fuels market in Japan and establish CO2 supply chains.

What's New?

♻️ Circular Economy. Circular economy index grows 35%

💰 Funding. EFuels, biotechnology, infant nutrition + more

💼 M&A. Insurance broker and risk manager

📅 Economics. US inflation data, retail sales, balance of trade + more

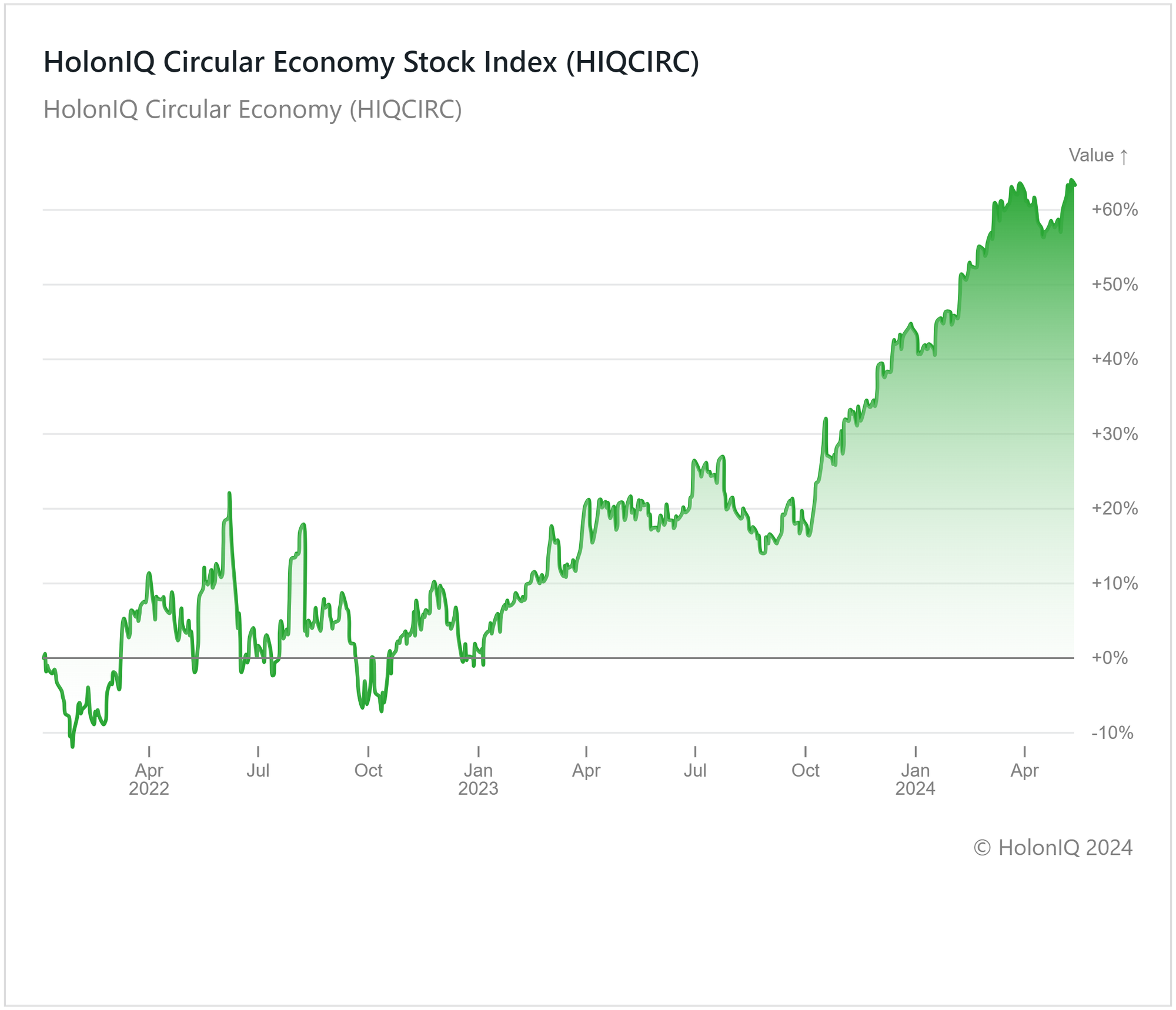

♻️ Circular Economy Index Grows 35%

HolonIQ’s Circular Economy Index has maintained its momentum, increasing by 35% over the past 12 months, while over the last 6 months, the index has experienced a growth of 25%. The rise in waste generation, heightened focus on corporate social responsibility, and growing environmental concerns have cultivated a promising landscape for stocks in waste management, water distribution, and recyclable packaging within the index. As a result, the stock prices of major constituents have been rising over the last year, with the fundamentals of the stocks beating expectations. Waste Management Inc ($85B MCap) and Ecolab ($66B MCap) recently reported their first-quarter earnings results. Earnings per share for both stocks surpassed estimates, while EcoLab reported a significant rise in net income, up 77% year-over-year. Both stocks' prices have risen by 25% and 33% over the last year. Waste Connection ($42B MCap) also saw its price increase by 16% YoY and recently closed an acquisition of 30 energy waste treatment and disposal facilities in Western Canada.

As governments increasingly commit to managing waste more effectively and higher environmental protection laws come into play, the companies in the index are set to benefit. In March, the EU voted to impose stricter restrictions on the export of waste to non-EU countries, indicating higher recycling opportunities for the region. The increased integration of AI into waste management also allows firms to improve sorting technology and adopt cost-cutting measures to improve their operational efficiency.

💰 Funding

⛽ HIF Global, a Chilean e-fuels company, raised $164M to expand the e-fuels market in Japan and establish CO2 supply chains.

🧬 Lycia Therapeutics, a California-based biotechnology company, raised a $106.6M Series C from Venrock Healthcare Capital Partners to advance lead programs treating autoimmune and inflammatory diseases into clinical stages.

👶 ByHeart, a New York-based infant nutrition company, raised $95M to develop its pipeline of products.

💊 Ajax Therapeutics, a New York-based biopharmaceutical company, raised a $95M Series C from Goldman Sachs Alternatives to support its ongoing clinical trials.

🔬 CereVasc, a Massachusetts-based medical device company, raised a $70M Series B from Perceptive Advisors and Bain Capital Life Sciences to assist in the clinical and regulatory development of its medical systems.

🚚 Pepper, a New York-based digital logistics company, raised a $30M Series B from ICONIQ Growth to advance product innovation.

💎 Nivoda, a UK-based diamond and gemstone marketplace, raised a $30M Series B from Avenir Growth Capital to boost its customer base, expand markets, and grow its team.

💉 May Health, a French clinical-stage medical device company, raised a $25M Series B from Bpifrance and Trill Impact to support its growth and develop its Ovarian Rebalancing therapy which addresses PCOS-related infertility.

💼 M&A

👩💼 Gallagher, an Illinois-based global insurance broker and risk manager, acquired Acumen, a Florida-based employee benefits consulting firm.

📅 Economic Calendar

US Inflation Data, Retail Sales, Balance of Trade + More

Tuesday, May 14th 2024

🇬🇧 UK Employment Data, March

🇩🇪 Germany ZEW Economic Sentiment Index, May

🇺🇸 US PPI, April

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits Data (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Monday, May 20th 2024

🇦🇺 Australia Westpac Consumer Confidence Index, May

🇦🇺 Australia RBA Meeting Minutes

Tuesday, May 21st 2024

🇨🇦 Canada Inflation Data, April

🇯🇵 Japan Balance of Trade, April

Wednesday, May 22nd 2024

🇬🇧 UK Inflation Data, April

🇺🇸 US FOMC Minutes

Thursday, May 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), May

🇯🇵 Japan Inflation Data, April

Friday, May 24th 2024

🇬🇧 UK Retail Sales Data, April

🇺🇸 US Durable Goods Orders Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com