⚡ China Renewable Energy Down 35%. $210M+ VC Funding.

Impact Capital Markets #47 looks at our China renewable energy stock index, major impact deals, M&A, and upcoming economic releases.

Annyeonghaseyo 🍜

📉 Today's Global Economic Update: Canada's February 2024 employment data showed a slight uptick in the unemployment rate to 5.8%, from January's 5.7%. The economy added 42,000 jobs, but strong population growth continues to outweigh employment gains.

🥤 Deal of the Day: Liquid Death, a California-based beverage platform, raised $67M for product innovation.

What's New?

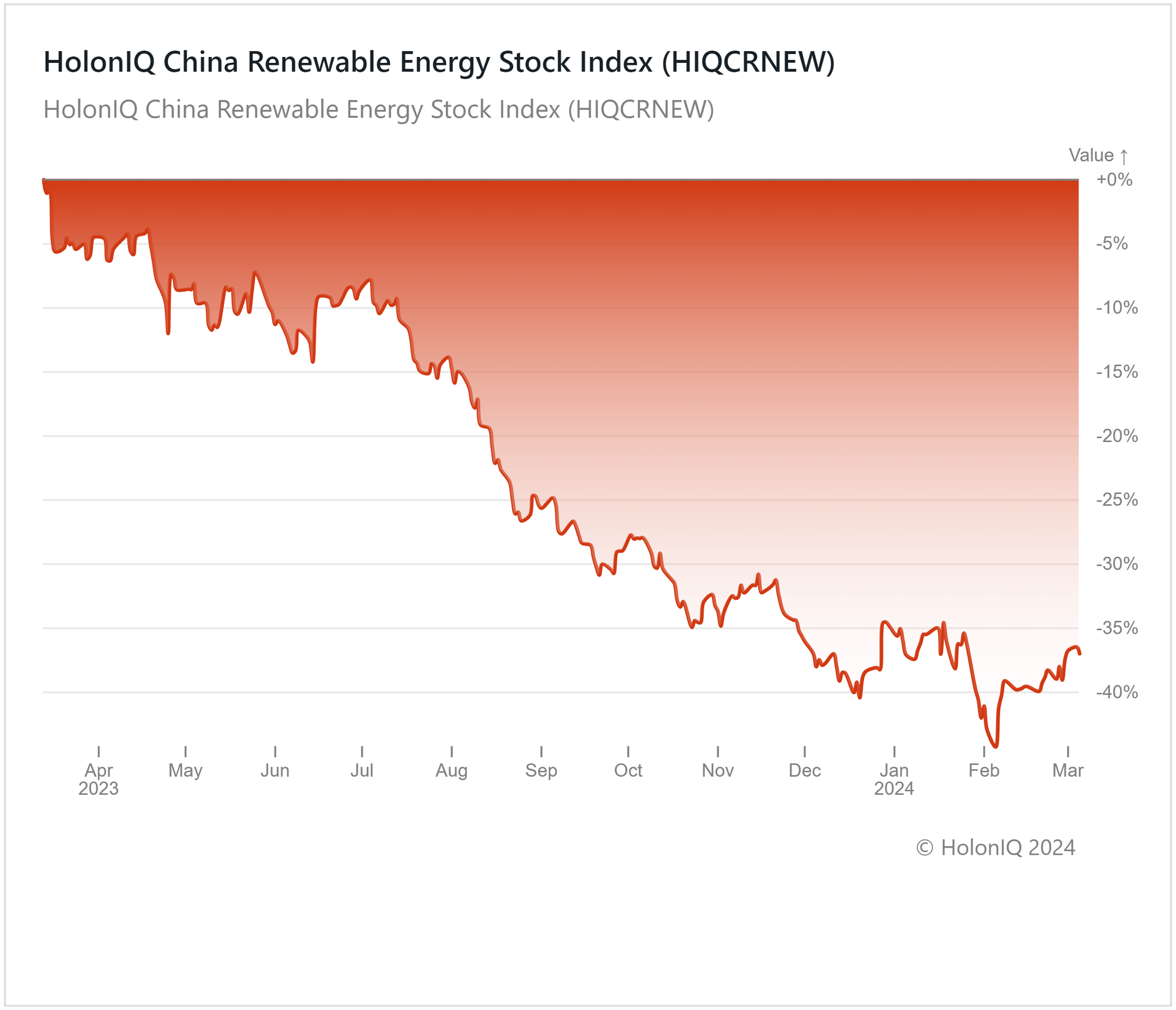

- ⚡ China Renewable Energy. China renewable energy index down 35%

- 💰 Funding. Beverages, biogas, drug discovery & more

- 💼 M&A. PAR Technology acquires Stuzo & Task

- 📅 Economics. Employment data, UK GDP, US inflation + more

For unlimited access to more deals and economic updates, request a demo

⚡ China Renewable Energy Down 35%

HolonIQ's China Renewable Energy Index has experienced a notable decline, dropping 35% over the past year, with a particularly sharp decrease of 46% in February 2024. Prominent stocks within the index, including LONGi Green Energy Technology Co. Ltd. ($22B MCap), China Three Gorges Renewables (Group) Co. Ltd ($19B MCap), and Sungrow Power Supply Co. Ltd ($21B MCap), have shown significant declines of 49%, 18%, and 6%, respectively.

China led global renewable energy expansion in 2023, doubling solar capacity and increasing wind power by 66%. With over 50% of its total installed capacity coming from renewables, China aims to derive nearly half of its electricity from clean sources by 2028.

Despite China's significant role in the renewable energy sector, renewable energy stocks have declined due to macroeconomic challenges including rising interest rates, reduced tax credits, and project delays, which have increased costs and dampened profitability. Uncertainties in government projects and policies haven't done any favors for investor sentiment. An anticipated increase in demand suggests a potential revival in 2024, which may present investors with promising early-stage opportunities. However, the outlook for the sector's recovery in the coming months is cautiously optimistic.

💰 Funding

🥤 Liquid Death, a California-based beverage platform, raised $67M for product innovation.

🍼 Serenity Kids, a Texas-based baby food company, raised a $52M Series B from Stride Consumer Partners to accelerate retail distribution and drive innovation.

🛡️ Vouch, a California-based insurance company, raised a $25M Series C from Ribbit Capital to expand operations.

🌱 SUBLIME Energy, a French startup specializing in biogas processing technologies, raised $12.5M from The Révolution to recruit staff and launch a project aiming to produce green fuel by 2025.

💊 Ability Pharmaceuticals, a Spanish drug discovery company, raised $7.7M to finance the clinical study of a targeted therapy for pancreatic cancer.

🤖 Guardrails AI, a California-based AI assurance company, raised a $7.5M Seed from Zetta Venture Partners to expand its engineering and product teams.

🔬 HawkCell, a French medical research company, raised a $5.5M Series A from MIG to scale operations.

💼 M&A

🍽️ PAR Technology, a New York-based food technology company, acquired Stuzo, a Pennsylvania-based digital product innovation company. The firm also entered into an agreement to acquire Task, an Australian global food service transaction platform.

📅 Economic Calendar

Employment Data, UK GDP, US Inflation + More

Tuesday, March 12th 2024

🇬🇧 UK Unemployment Data, January

🇺🇸 US Core Inflation Data, February

🇺🇸 US Inflation Data, February

Wednesday, March 13th 2024

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment Data (Preliminary), March

Monday, March 18th 2024

🇨🇳 China Industrial Production Data, Jan-Feb

🇨🇳 China Retail Sales Data, Jan-Feb

Tuesday, March 19th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, March

🇺🇸 US Building Permits (Preliminary), February

🇨🇦 Canada Inflation Data, February

Wednesday, March 20th 2024

🇬🇧 UK Inflation Data, February

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade Data, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com