🩺 China Health Care Declines 45%. $100M Sustainability Funding ++

Impact Capital Markets #20 looks at our China Healthcare Index, major impact deals and acquisitions, and the upcoming economic releases.

Thursday's Eurozone inflation report revealed a slight dip in the headline rate to 2.8%, sparking speculation about a European Central Bank rate cut. However, the persistence of core inflation and a robust job market suggests any move might be delayed until June.

Today's Topics

- 🩺 China Healthcare. China Healthcare Index Down ~45%

- 💰 Funding. Watershed raises $100M + Other deals in climate & health

- 💼 Acquisitions. Fitness & School Transport

- 📅 Economics. Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo.

🩺 China Healthcare Index Down ~45%

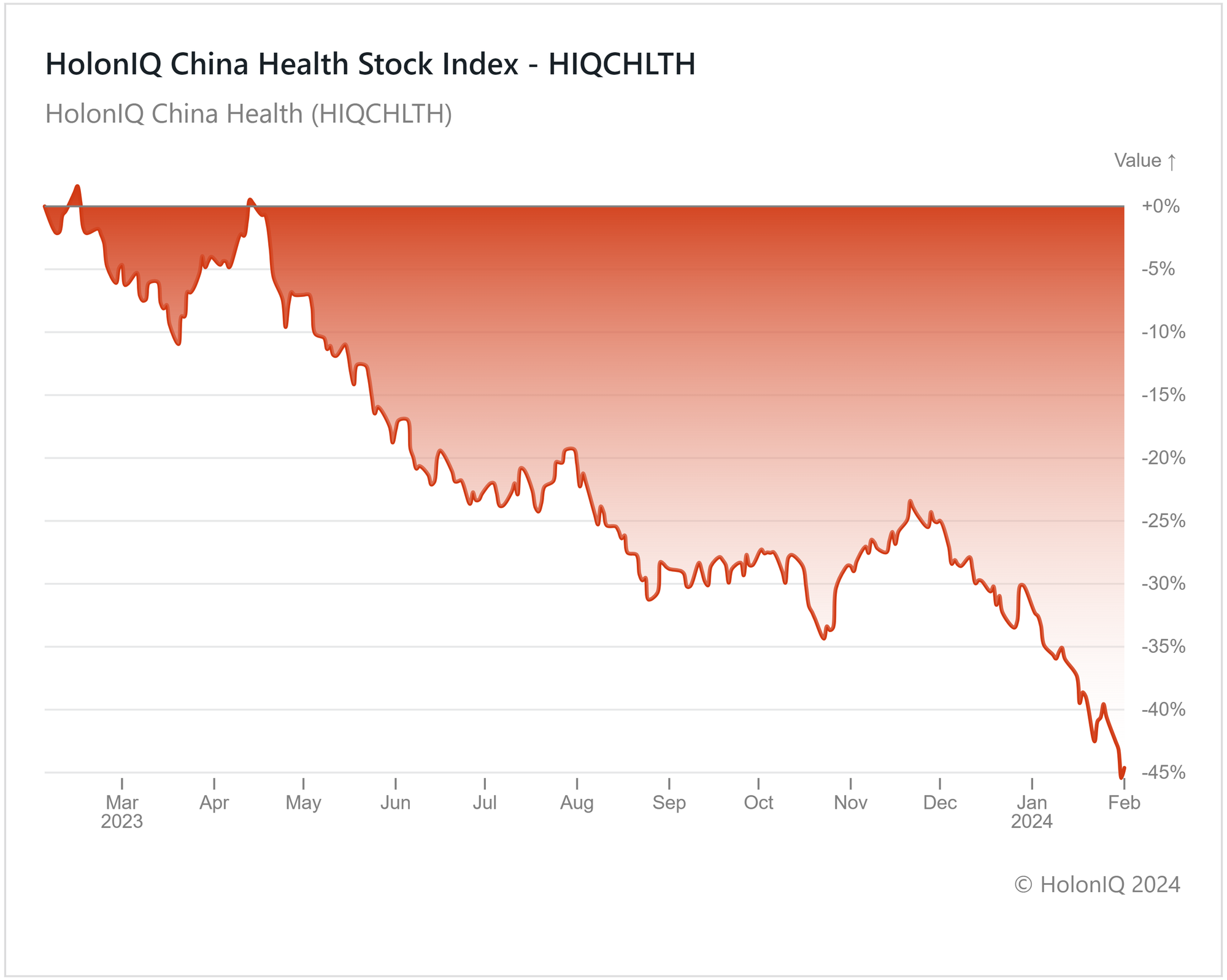

HolonIQ China Health (HIQCHLTH).12-month Indexed returns (returns on the index relative to the level on February 03, 2023) have been on a downward trend, decreasing to 45% YoY in January 2024.

China's recent anti-corruption measures may have prompted short-term investor aversion to healthcare stocks, contributing to a decline in the index's performance. Simultaneously, the nation confronts a demographic challenge with consecutive yearly population declines and a record-low birth rate. Despite these issues, there is potential for a reversal of this trend. In response to an aging population, China is leveraging digital technology to innovate healthcare, particularly in smart medicine. Moreover, there is a concerted effort to improve medical care for critical pregnant women, emphasizing a commitment to maternal health. In a broader health context, China has unveiled a comprehensive plan targeting heart and brain diseases, outlining long-term strategies for improved public health outcomes. These initiatives demonstrate China's proactive approach to addressing healthcare challenges.

💰 Funding

🌍 Watershed, a California-based enterprise sustainability platform provider, raised a $100M Series C from Greenoaks to expand operations and its business reach.

⚕️ SPR Therapeutics, an Ohio-based private medical device company, raised a $85M Series D from Revelation Partners. The funds will leverage commercial momentum, customer demand, and market opportunities to expand sales representation in more U.S. territories.

🧬 Basking Biosciences, an Ohio-based clinical-stage biopharmaceutical company specializing in stroke treatment, raised $55M from ARCH Venture Partners. The funds will be used to fast-track the development of a novel RNA aptamer targeting von Willebrand Factor (vWF) for rapid, short-term effects.

🏥 Cohere Health, a Massachusetts-based patient-centric SaaS solution provider, raised a $50M Series C from Deerfield Management. The funds will be used for the company's expansion to meet the increasing demand for Cohere's intelligent prior authorization platform.

🩺 Avation Medical, an Ohio-based neuromodulation and digital health company, raised a $22M Series Can from ShangBay Capital and Asahi Kasei to launch its Vivally System.

🔬 ArteraAI, a California-based health tech company specializing in personalized cancer treatments, raised $20M. The funds will be used for the company's international expansion and commercial growth and its test.

⚡️ Greenerwave, a French electromagnetic wave control technology company, raised a $16.2M Series A to advance breakthrough tech in electromagnetic wave control through reconfigurable intelligent surfaces (RIS) and algorithms.

🌿 Planet A Foods, a Germany-based B2B sustainable ingredients company, raised a $15.4M Series A from World Fund to take its cocoa-free chocolate global.

🧬 NeoPhore, a UK-based small molecule neoantigen immuno-oncology company, raised a $12.2M Series B from its existing investors to progress NeoPhore's lead oral program, through early pre-clinical development.

🩻 Carpl, a California-based radiology tech startup, raised $6M from Stellaris Venture Partners to expand operations and continue building its tech stack.

💊 Perelel, a California-based vitamin company, raised a $6M Series A to grow its team to develop new products.

🩺 Proniras, a Washington-based clinical-stage biotechnology company, raised a $4.65M Series B from Accelerator Life Science Partners and ARCH Venture Partners to back a phase 1 clinical study for a novel treatment.

👶 Harbor, a Texas-based infant care technology company, raised a $3.7M Seed from Trust Ventures to expand operations and its business reach.

🧪 LimmaTech Biologics, a Swiss clinical-stage biopharmaceutical company, raised a $3M Series A from Tenmile. The funds will be used to advance proprietary vaccine tech and expedite the development of a pipeline addressing global antimicrobial resistance.

💼 Acquisitions

🏋️ Xplor Technologies, a West Sussex-based global platform combining SaaS solutions, acquired Membr, a Salford-based fitness platform that connects the fitness industry with its members.

🚌 Zeelo, a London-based TransitTech company that provides a mobility platform for transportation services, acquired Kura, a UK-based company that specializes in school transportation and transport safeguarding software.

📅 Economic Calendar

Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Monday February 5th 2024

🇦🇺 Australia - Balance of Trade, December

🇩🇪 Germany - Balance of Trade, December

🇺🇸 US - SM Services PMI, January

Tuesday February 6th 2024

🇦🇺 Australia - RBA Interest Rate Decision

🇨🇦 Canada - Ivey PMI s.a , January

Wednesday February 7th 2024

🇨🇦 Canada - Balance of Trade , December

Thursday February 8th 2024

🇨🇳 China - Inflation Data, January

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com