🔋Battery Tech/Lithium up 10%. $75M+ Funding.

Impact Capital Markets #7

For over 5 years, HolonIQ has been tracking and analyzing Impact Capital Markets, Foundations and Philanthropies, Venture and Growth Capital, Private Equity and Public Markets.

Now, with more than 50 stock indices being tracked, we're kicking off 2024 with a new daily newsletter for data-driven global leaders looking to understand trends in strategic industries.

Today's Topics

- 🔋 Lithium and Battery Tech. Lithium and Battery Tech: 1Y returns peak at 25% mid 2023

- 💰 Funding. $75M+ for Investment Tech, RevOps Software, and Solar

- 💼 Acquisitions. Juniper Education and Alamos Gold acquisitions

- 📅 Economics. Consumer, GDP and Inflation data + Japan, Canada Interest rates next week.

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

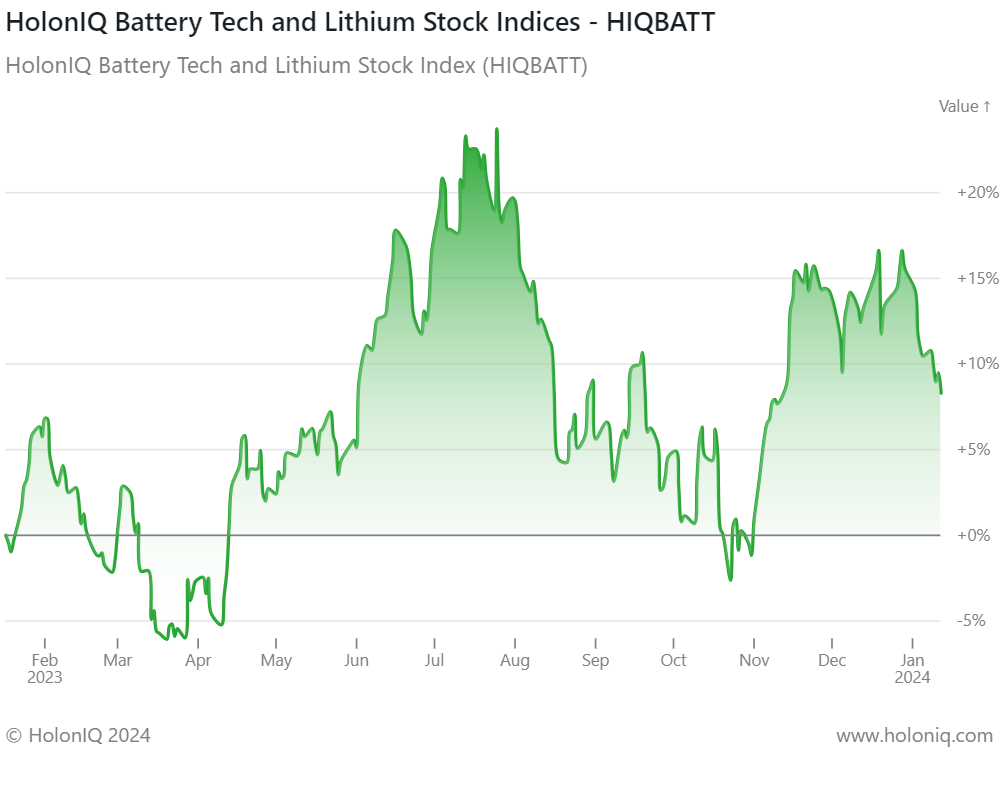

🔋Lithium and Battery Tech: 1Y returns peak at 25% mid 2023

HolonIQ Battery Tech And Lithium Index. During 2023, 12-month returns peaked in August, with the Lithium and Battery Tech index increasing by almost 25%. Index performance declined in 1H 2023 due to a slowdown in China after companies were hit by sluggish demand conditions alongside an increase in raw materials stockpiles.

CATL (Market Cap: US$ 95B) and LG Energy Solutions (Market Cap: US$ 74B), two prominent players in the battery manufacturing industry from China and South Korea, respectively, experienced significant developments over the past year. The index rose steadily amid CATL’s announcement in July 2023 of a development of new materials for lithium ion batteries that would improve the efficiency of electric vehicle charging. In addition, CATL saw a surge in revenue after it secured a new deal to supply 950 containerised liquid-cooling battery systems and 232 inverters to the government of Western Australia for a AUD 1B energy storage project. In August 2023, LG Energy Solutions produced its first battery recycling joint venture in order to oversee the construction of two new battery recycling plants in China.

💰Funding

📈 Grip Invest , a Delhi, India-based provider of a D2C, investor-first, SEBI regulated, digital investment platform, raised a $10m Series B from Stride Ventures to streamline product development, improve distribution, expand consumer reach, and bolster brand and tech capabilities.

💻 Fullcast, a Redmond, WA based RevOps software platform, raised a $34M Seed from Epic Ventures to broaden operations and business reach.

☀️ Soly bags, a Groningen, Netherlands-based solar energy company, raised $32.8M from ArcTern Ventures to expand operations into Italy, Spain, France, Scandinavia, offering innovative energy services.

📦Acquisitions

📚 Juniper Education a UK based educational software and services provider, acquired Bulgarian educational management platform Shkolo to contribute to modern education management for improved learning outcomes.

🪙 Alamos Gold (NYSE: AGI), a Canadian based intermediate gold producer, entered into a definitive agreement to acquire Toronto-based junior miner Orford Mining (TSXV: ORM).

📅 Economic Calendar

Anticipate key economic indicators focusing on Balance of Trade, GDP, and Inflation.

Tuesday January 16th 2024

🇦🇺 Australia - Westpac Consumer Confidence Change, January

🇬🇧 UK - Unemployment Rate, November

🇩🇪 Germany - ZEW Economic Sentiment Index, January

🇨🇦 Canada - Inflation Rate YoY, December

Wednesday January 17th 2024

🇨🇳 China - GDP Growth Rate YoY, Q4

🇨🇳 China - Industrial Production YoY, December

🇬🇧 UK - Inflation Rate YoY, December🇺🇸

🇺🇸 US - Retail Sales MoM, December

Thursday January 18th 2024

🇺🇸 US - Building Permits Prel, December

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Friday January 19th 2024

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Tuesday January 23th 2024

🇦🇺 Australia - NAB Business Confidence, December

🇯🇵 Japan - BoJ Interest Rate Decision

Wednesday January 24th 2024

🇯🇵 Japan - Balance of trade, December

🇩🇪 Germany - HCOB Manufacturing PMI (Preliminary), January

🇨🇦 Canada - BoC Interest Rate Decision

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December