🛫 Aviation Declines By 9%. $480M+ VC Funding.

Impact Capital Markets #122 looks at our Aviation Stock Index, major impact deals, M&A, and upcoming economic releases.

Helo 🏴

📈 Today's Global Economic Update: Australia's Westpac-Melbourne Institute Consumer Sentiment index increased by 1.7% month-on-month to 83.6 in June 2024, the highest since February, but remains below the neutral 100 level due to persistent inflation and high interest rates.

⚕️ Deal of the Day: SkyCell, a Swiss pharmaceutical supply chain technology company, raised a $116M Series D for global expansion, focusing on US and Asia growth.

What's New?

🛫 Aviation. Aviation declines by 9%

💰 Funding. Pharmaceuticals, carbon removal, supply chain management + more

💼 M&A. Mining and fertility benefits management

📅 Economics. US GDP, Euro area inflation, balance of trade + more

🛫 Aviation Declines By 9%

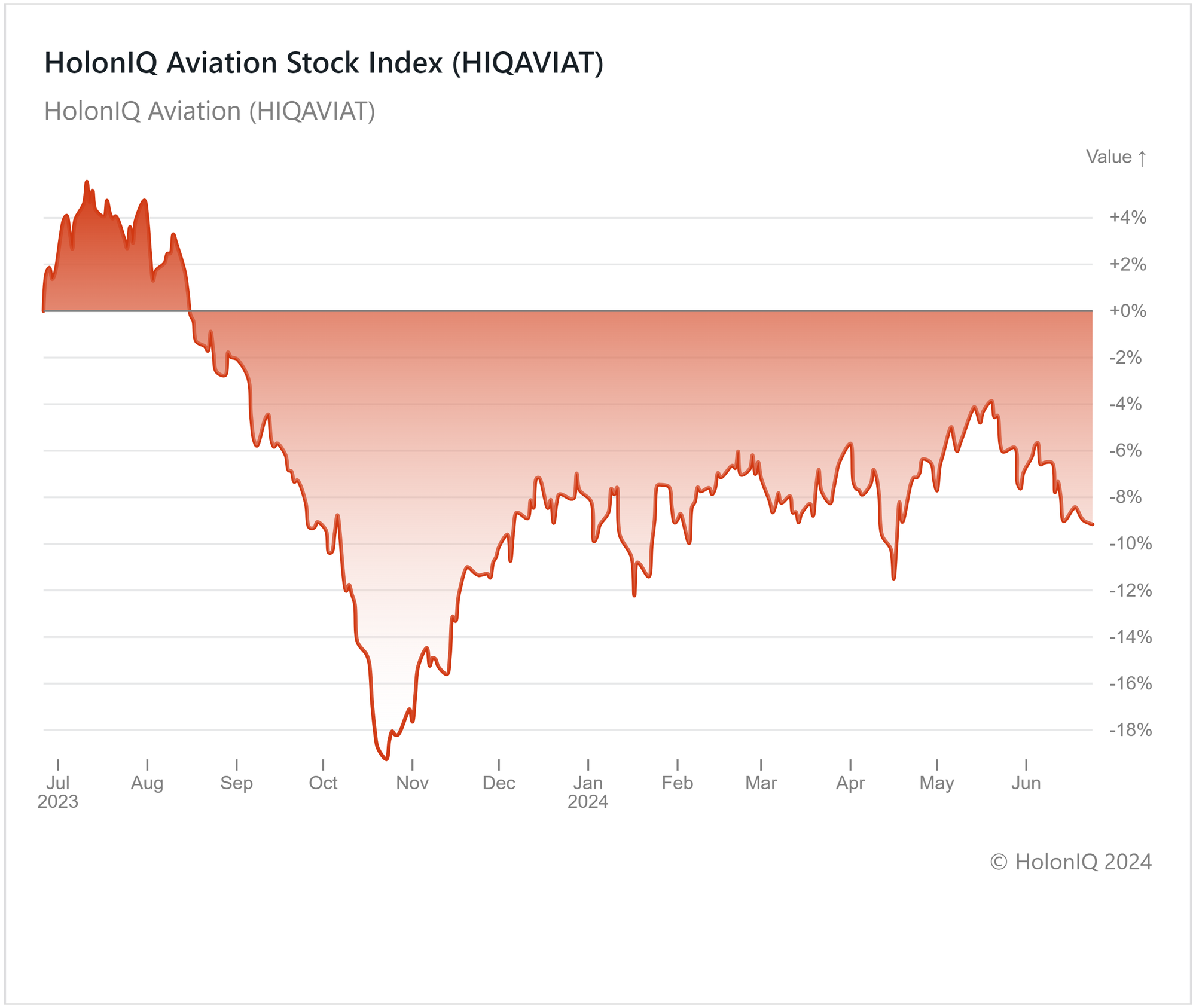

HolonIQ’s aviation index has seen a 9% decline in the past 12 months, with the 3-month performance remaining stagnant amid volatile movements. Despite increased air travel post-COVID, market sentiment and investor confidence are down due to factors including fluctuating fuel prices, mixed earnings forecasts, and geopolitical issues. Recent malfunctions and quality concerns involving Boeing have affected stocks in the index as well.

Investors are also likely worried about possible increases in oil prices due to conflicts in the Red Sea. A report released by the US Department of Transportation in May indicated that the cost of aviation fuel in March decreased by 2.2%, while aviation fuel consumption increased by 4.9%. This has led to a 5.9% decrease in airfares in May compared to a year ago. This has also made investors cautious about the potential impact on airline revenue, further affecting the index. However, the negative trend could moderate in the near future, driven by increasing demand.

💰 Funding

⚕️ SkyCell, a Swiss pharmaceutical supply chain technology company, raised a $116M Series D from Tybourne Capital Management and CCI for global expansion, focusing on US and Asia growth.

🌍 Neustark, a Swiss carbon removal provider, raised $69M from decarbonization partners to scale operations and extend market reach.

🛠️ Prewave, an Austrian AI-based supply chain company, raised a $67.5M Series B from Hedosophia to enhance its AI-driven platform for supply chain risk and compliance management.

🤖 TechWolf, a Belgian AI company, raised a $42.75M Series B from Felix Capital to expand in the US and advance AI innovation.

🌾 Oatside, a Singaporean oat milk startup, raised a $35.3M Series B to support its expansion into new markets and to enhance its production capabilities.

🚢 Hive, a German storage and shipping company, raised a $30.2M Series A from Earlybird to enhance brand operations throughout Europe.

💊 Rapafusyn Pharmaceuticals, a Maryland-based drug discovery company, raised a $28M Series A from 3E Bioventures Capital and Proxima Ventures Ltd to advance their drug pipeline and capabilities.

🩹 Vico Therapeutics, a Dutch clinical-stage genetic medicines company, raised a $12.3M Series B from Seroba and Kurma Partners to treat neurological disorders.

💼 M&A

⛏️ Paladin Energy, an Australian mining company, signed a definitive agreement to acquire Fission Uranium Corp for $833M, a Canadian uranium mining company.

🍼 Progyny Inc., a New York-based fertility benefits management company, acquired Apryl, a German fertility benefits platform.

📅 Economic Calendar

US GDP, Euro Area Inflation, Balance of Trade + More

Tuesday, June 25th 2024

Wednesday, June 26th 2024

🇩🇪 Germany GfK Consumer Confidence, July

Thursday, June 27th 2024

🇺🇸 US Durable Goods Orders, May

🇺🇸 US GDP Growth Data, Q1

Friday, June 28th 2024

🇫🇷 France Inflation Data (Preliminary), June

🇮🇹 Italy Inflation Data (Preliminary), June

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending Data, May

Monday, July 1st 2024

🇯🇵 Japan Consumer Confidence, June

🇩🇪 Germany Inflation Data (Preliminary), June

🇺🇸 US ISM Manufacturing PMI, June

Tuesday, July 2nd 2024

🇪🇦 Euro Area Inflation Data, June

🇺🇸 US JOLTs Job Openings, May

Wednesday, July 3rd 2024

🇨🇦 Canada Balance of Trade, May

🇺🇸 US ISM Services PMI, June

🇦🇺 Australia Balance of Trade, May

Friday, July 5th 2024

🇨🇦 Canada Employment Data, June

🇺🇸 US Employment Data, June

🇨🇦 Canada Ivey PMI s.a, June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com